|

IN BRIEF

|

There AXA mutual insurance is positioned as one of the leaders in the health insurance market, offering a variety of packages adapted to everyone’s needs. Whether you are an individual, a family or a professional, AXA offers guarantees and refunds personalized to ensure your well-being. In a world where health is paramount, it is essential to understand the benefits, the disadvantages and the feedback from policyholders regarding this mutual insurance company. This article aims to clarify the different options available, in order to help you make an informed decision.

AXA mutual insurance presents itself as a complementary health solution for those who wish to benefit from optimal coverage. As a global leader in insurance, AXA offers various services tailored to the needs of its clients. This article explores the benefits and the disadvantages of this mutual, to help you determine if it is right for you.

Benefits

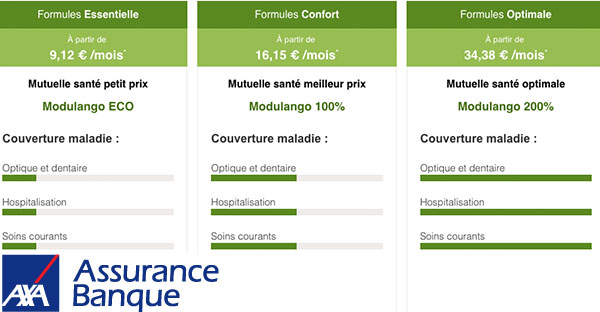

AXA mutual insurance has several advantages that make it attractive for policyholders. First of all, one of its main strengths lies in the diversity of formulas proposed. With a panel of seven customizable plans, each user can choose coverage that suits them according to their health needs.

Next, AXA focuses on the idea of optimal reimbursements, ensuring effective coverage of medical costs. Policyholders can benefit from support guarantees that add even more value to their contract, particularly in terms of support during hospitalizations or surgical procedures.

In addition, AXA provides a large network of advisors to support customers in all their procedures, thus facilitating the understanding of contracts and coverage. A real plus for people who want to be well informed before making a decision.

Mutual insurance for foreign residents: what you need to know

IN BRIEF Health insurance options for foreigners in France. Eligibility requirements to access coverage. Steps to follow to benefit from health protection. CMU, AME, PUMA : schemes for non-residents. Health insurance adapted to expatriates and foreign students. Importance of choosing…

Disadvantages

Although AXA mutual insurance has many advantages, it is not free ofdisadvantages that can discourage some potential subscribers. Sometimes, the rates applied can be considered high compared to other insurers. It is therefore essential to compare offers and carefully evaluate the services offered in relation to the cost.

Another point to consider is the complexity of the options. With a multitude of choices available, some policyholders may feel lost or have difficulty choosing the health coverage that will perfectly meet their needs.

Finally, it should be noted that reimbursement times may vary depending on the contract, which could be a source of dissatisfaction for some policyholders. It is therefore recommended to read the conditions and discuss with an advisor carefully before committing.

AXA mutual insurance is recognized for its ability to adapt to the varied needs of its policyholders. With a customizable offer, it offers solutions that meet the expectations of families, young workers and seniors. In this article, we will explore the different aspects of AXA health insurance, including the guarantees offered, prices, and customer feedback, in order to help you make an informed decision.AXA mutual insurance formulas

AXA mutual guarantees: what you need to know

IN BRIEF Formulas offered : 7 customizable options according to your needs. Hospitalization guarantee : coverage of costs not reimbursed by Social Security. Refunds : consult the tables to evaluate the reimbursement rates. Additional support and services : varied options…

AXA offers a varied range of

health insurance with no less than seven customizable formulas. Each of them has been designed to meet specific needs, whether it is improved reimbursement for routine care, more extensive coverage for alternative medicines, or guarantees adapted to particular situations. Let yourself be seduced by formulas that fit your lifestyle. The advantages of AXA mutual insurance

The main strengths of AXA mutual insurance lie in its

assistance guarantees and its competitive prices. It is committed to facilitating access to care by offering rapid and efficient reimbursements. In addition, the large network of local advisors is a real added value, making it possible to support each insured person in their health procedures. Thus, AXA positions itself as a mutual insurance company of choice for optimal health protection. Disadvantages to consider

Like any insurance product, AXA mutual insurance is not without its drawbacks. Some customers report that

prices can vary considerably depending on the options chosen, and it is important to read the contract conditions carefully to avoid unpleasant surprises. It is also essential to compare with other offers on the market to ensure that you are making the best choice for your personal needs. Reimbursements and guarantees

Inter mutual assistance and health coverage in the face of Covid

IN BRIEF Inter Mutuelle Assistance: key player in thehealth assistance facing the Covid-19. Services available: travel assistance, medical assistance, teleconsultation, repatriation. Availability: 24/7 to meet the needs of beneficiaries. Rapid adaptation: adjustment of services in the face of the global…

The AXA mutual is also distinguished by a system of

refunds attractive. Coverage levels are designed to supplement Social Security reimbursements, giving policyholders peace of mind in the event of medical needs. AXA is committed to paying attention to every detail to ensure that their customers receive the best possible health protection. How to subscribe to AXA mutual insurance

Mutual insurance for foreigners: everything you need to know

IN BRIEF Mutual health insurance for expatriates: essential additional coverage. Comparison of mutual insurance companies: find a suitable and affordable solution. Reimbursement of care: information on support abroad. Health protection: insured even outside the national territory. Medical assistance: conditions for…

To join the AXA family, subscribing to mutual insurance is simple and quick. Simply fill out an online form on their official website or contact an advisor for details on the different options. Do not hesitate to consult

this link for more information on the steps to follow. Opinions of policyholders

Mutual insurance abroad: everything you need to know to be well covered

IN BRIEF Expatriate mutual insurance : essential to stay covered abroad. Choice of mutual insurance : adapt according to your destination. Reimbursement of care : check the agreements with your destination country. Guarantees and coverages : know the care included…

It is always good to refer to the

customer returns before making a decision. According to opinions shared on specialized platforms, the majority of policyholders express general satisfaction with the services offered by AXA. Do not hesitate to read testimonials on sites like JeChange to gather varied opinions. In the world of

mutual health insurance , AXA stands out for its diversity of formulas and its commitment to its policyholders. Whether you are looking for coverage adapted to your personal or professional situation, AXA will provide you with complete and personalized solutions. For informed choices, it is essential to be well informed and compare the various options available on the market.Discover the offers from Axa mutual insurance, designed to guarantee your safety and that of your family. enjoy health coverage tailored to your needs, attentive customer service and customizable options for optimal well-being. join axa and optimize your health protection today!

The different formulas offered

How to send a quote to AXA Mutuelle efficiently

IN BRIEF Request a written quote before treatment to avoid excessive excesses. Use the Hospiway service of AXA to analyze hospitalization costs. Prepare your quote to find out the amount of coverage by your mutual insurance company. Send your quote…

AXA puts at your disposal

seven customizable formulas , each designed to meet a variety of profiles. Whether you are a student, working or retired, there is bound to be an option that perfectly meets your requirements. It is essential to examine each formula to determine which one offers the bestreimbursements based on your specific needs. The advantages of AXA mutual insurance

April unveils its new health insurance offer for expatriates

In response to the significant increase in the number of people living abroad, APRIL is launching “Ma Santé International”, a flexible health insurance offer designed specifically for the varied needs of expatriates. Faced with strict regulations and often high healthcare…

Opting for AXA mutual insurance means benefiting from many advantages. First of all, AXA focuses on

financial accessibility and quality of care. In addition, their commitment to providing optimal reimbursements is a significant asset for policyholders. Another element to highlight is the availability of a network of local advisors , ready to support you in all your health procedures.Potential disadvantages

AXA Mutual: understanding option 1 and its advantages

IN BRIEF Option 1 of the AXA mutual : key details Analysis of guarantees and refunds proposed Customer reviews onstandard option Comparison with others mutual of the market Benefits of a optimal health coverage Third party payment : avoid expense…

Although AXA mutual insurance has many advantages, it is crucial to take into account certain disadvantages. Sometimes,

rates can vary considerably from one formula to another, making comparison essential. In addition, some guarantees may not be as competitive as those of other insurers. So take the time to analyze the offers to choose the one that suits you best. How to subscribe to AXA mutual insurance

To join AXA mutual insurance, you have several options. You can go directly to the official AXA website to explore the different

formulas and rates , but also start the subscription process online. Do not hesitate to contact an advisor if you have questions or need clarification regarding the offers.Policyholders’ opinions

Policyholders’ feedback on AXA mutual insurance is generally positive. Many emphasize the efficiency and speed of

reimbursements, as well as the quality of customer service. However, some customers express reservations about the costs of contributions, making a thorough comparison essential before making your choice. Points to check before subscribingBefore you decide, take the time to read the general conditions carefully. Check in particular the

assistance guarantees

offered and warranty exclusions that could reduce your protection. It is also recommended to consult the social media reviews and forums to gather diverse experiences and inform your decision. For more information, do not hesitate to visit the following links: AXA – Good mutual

, Mutual document for abroad, Prices for AXA company mutual insurance, AXA supplementary health insurance 2024. Comparison of the characteristics of AXA mutual insuranceFeatures

Details

| Formulas offered | 7 customizable formulas adapted to all needs. |

| Refunds | Diversified reimbursements, with extensive coverage options. |

| Prices | Competitive rates based on the coverage levels chosen. |

| Assistance | Assistance guarantees for support when needed. |

| Accessibility | A large network of local advisors for personalized support. |

| Customer benefits | Overall positive reviews highlighting the satisfaction of policyholders. |

| Flexibility | Customization options to adjust the coverage. |

| International coverage | Possibility of suitable cover for stays abroad. |

| Contact | Support via digital platforms and online services. |

| discover the offers from axa mutual insurance company, designed to meet your health and welfare needs. benefit from comprehensive coverage and customer service available to assist you in your health choices. | View this post on Instagram |

AXA mutual insurance

. Opinions from policyholders vary, but many agree that it offers excellent value for money. For Pierre, 34, “subscribing to AXA mutual insurance was one of the best decisions for my health and that of my family. THE refundsare fast and the guarantees adapted to our daily needs. » Marie, a young mother, emphasizes the importance of health coverage

: “With AXA mutual insurance, I was able to benefit from incredible assistance during my medical visits. The advisors who were always available made my procedures easier, and I was pleasantly surprised by the quality of services proposed. » On the other hand, Jean, a fifty-year-old, shares a nuanced experience: “Although I am satisfied with the services of AXA mutual insurance, I would have liked to know in more detail the options offered

at the time of my subscription. Sometimes the scales of refund in percentage can be confusing, but overall, I don’t regret my choice. » Lucie, an elderly person, highlights the network of advisors available: “What I really liked was the personalized support. I have always had an advisor available to answer my questions about my guarantees

and my options. It gave me a real feeling of security. » Finally, Maxime, a student, appreciates the flexibility of the offer: “AXA mutual offers several customizable plans, which allowed me to choose the one that best suited my budget and my expectations. The report price/guarantee

is very competitive compared to other insurers. » Presentation of AXA mutual insurance AXA mutual insurance company positions itself as a key player in the field of health insurance. With a diversified offering adapted to all profiles, it offers complete solutions to meet everyone’s health needs. In this article, we will explore the different formulas, reimbursements, benefits and opinions of policyholders to help you determine if AXA mutual insurance is right for you.

AXA mutual insurance plans

There

AXA mutual insurance

offers a varied range of formulas, totaling seven customizable options. Each formula is designed to adapt to the specific needs of policyholders. Whether you are looking for basic coverage or more comprehensive guarantees, AXA offers flexible solutions that meet everyone’s expectations. Adapted guarantees AXA mutual guarantees are available at several levels, ranging from reimbursements for medical consultations to hospital care, including those linked to alternative medicine. This wide range ensures that each policyholder finds the protection they need.

Reimbursements offered

One of the strong points of AXA mutual insurance lies in its

refunds

. Depending on the formula chosen, policyholders can benefit from advantageous reimbursements, often higher than those offered by the Social Security. This includes attractive reimbursement rates on routine care, hospitalization costs and specialist consultations. Support and servicesIn addition to reimbursements, AXA offers various

support services

to support its clients in their health initiatives. This includes expert advice, access to a network of healthcare professionals and online tools for simplified management of your contract. AXA mutual insurance prices THE

price

of AXA mutual insurance depends on several factors, such as age, the level of coverage chosen and the profile of the insured. In general, prices are competitive on the market, making it an attractive option for those looking for quality health insurance. Opinions of policyholders Customer feedback on AXA mutual insurance is generally positive. Many policyholders appreciate the quality of reimbursements and the accessibility of services. However, as with any product, there are also some critical opinions regarding claims management or processing times. This feedback allows us to have a clear vision of the advantages and possible disadvantages of AXA coverage.

How to subscribe to AXA mutual insurance

For those considering

subscribe

, the procedure is simple. You can contact an AXA advisor, who will help you choose the most relevant plan for your needs. It is also possible to carry out online simulations to evaluate the cost and guarantees of the different options offered. Contact and supportAXA stands out for the presence of a large network of advisors available to guide you and answer your questions. This local support ensures peace of mind when subscribing and throughout the contract.

Choosing a mutual insurance company may seem complex, but AXA mutual insurance company positions itself as a reliable solution adapted to your needs. With its diversified offers, its advantageous reimbursements and its personalized support, it deserves to be considered for the protection of your health and that of your family.

discover axa mutual, a complete health solution adapted to your needs. take advantage of varied guarantees, attentive customer service and a network of privileged partners to protect your well-being and that of your family.

AXA mutual insurance company positions itself as a key player in the field of

. With a variety of offers adapted to different needs, this mutual aims to meet the expectations of each of you. Whether you are a student, working, or retired, AXA offers customizable plans that will allow you to find the right coverage. The advantages of AXA mutual insurance are numerous. First of all, its network oflocal advisors

is a major asset. These experts are there to support you in your choice and enlighten you on the different guarantees available. In addition, AXA is committed to providing optimal reimbursements , thus guaranteeing better coverage of your health expenses. Another strong point of the AXA offer lies in its transparency. The mutual focuses on three main pillars: paying the right price, taking care of you, and offering you the best reimbursements. This approach helps build a relationship of trust with policyholders, who can count on a service that meets their expectations.Regarding the

prices

, AXA offers a varied range that fits every budget. Thus, it is possible to find complementary health insurance that will not burden your finances while ensuring solid coverage. This flexibility is essential in a context where each individual has their own needs. In order to subscribe to AXA mutual insurance, several options are available to you. You can choose to do this online, by telephone or by going directly to one of the AXA agencies. Whatever subscription method you choose, you will benefit from comprehensive assistance to guide you throughout this process. Investing in mutual health insurance such as that of AXA means choosing security for yourself and your family.FAQ about AXA mutual insurance