|

IN BRIEF

|

Living abroad is an exciting adventure that offers many opportunities, but it also has its share of challenges, particularly when it comes to health. It is essential to ensure adequate protection to deal with possible medical emergencies. A mutual health insurance adapted is the key to ensuring optimal coverage, even when away from home. In this article, we’ll explore everything you need to know about choosing the mutual which will meet your needs and allow you to travel peacefully and with complete confidence.

Living or traveling abroad can be an enriching experience, but it also comes with challenges, particularly when it comes to health. Subscribe to a mutual insurance abroad is essential to ensure adequate care. In this article we will examine the benefits and the disadvantages mutual insurance companies abroad, to help you make an informed choice.

Benefits

One of the greatest qualities of a mutual insurance abroad is the peace of mind it provides. In the event of a health problem, you will be reassured to know that your medical expenses will be taken care of, which is crucial when you find yourself in a health environment different from your own.

Furthermore, a international mutual health insurance can offer a variety of coverages based on your specific needs, from hospital reimbursement to outpatient care coverage. This allows you to choose a contract that truly meets your profile as a traveler or expatriate.

Finally, many health insurance contracts abroad also offer 24/7 telephone assistance, facilitating access to expert medical advice and help in the event of an emergency, no matter where you are. This responsiveness is an undeniable asset for anyone living abroad.

Mutual insurance for foreign residents: what you need to know

IN BRIEF Health insurance options for foreigners in France. Eligibility requirements to access coverage. Steps to follow to benefit from health protection. CMU, AME, PUMA : schemes for non-residents. Health insurance adapted to expatriates and foreign students. Importance of choosing…

Disadvantages

Despite its many advantages, subscribing to a health insurance abroad also has some disadvantages. One of the main points to consider is the cost. Insurance premiums can vary considerably depending on the guarantees chosen and the countries in which you are located, which can weigh on your budget, especially if you are traveling for an extended period.

In addition, some health insurance may have coverage exclusions. For example, pre-existing conditions or specific care may not be reimbursed. It is crucial to read the general conditions carefully in order to avoid inconveniences in the event of a need for medical care.

Finally, the coverage of care abroad by your mutual insurance can differ considerably from one country to another. So make sure you understand how reimbursement works in the country where you are traveling or residing. This is not always self-evident and often requires a real effort of research.

Overall, subscribing to mutual health insurance abroad can be the key to guaranteeing your safety and peace of mind during your travels or during your expatriation. Always find out more to choose the solution best suited to your needs.

When you decide to live or travel abroad, you must ensure that your health protection is adequate. Taking out expatriate health insurance or international health insurance is essential to cover your medical expenses. This article provides you with all the information you need to choose the right health insurance and stay calm during your stay abroad.

AXA mutual guarantees: what you need to know

IN BRIEF Formulas offered : 7 customizable options according to your needs. Hospitalization guarantee : coverage of costs not reimbursed by Social Security. Refunds : consult the tables to evaluate the reimbursement rates. Additional support and services : varied options…

Why take out health insurance abroad?

Health should not be a concern when you are far from home. Indeed, medical care can be expensive and vary from one country to another. Taking out health insurance abroad will give you peace of mind in the event of illness, accidents or unforeseen events. With suitable coverage, you will be able to access the best care without financial stress.

Inter mutual assistance and health coverage in the face of Covid

IN BRIEF Inter Mutuelle Assistance: key player in thehealth assistance facing the Covid-19. Services available: travel assistance, medical assistance, teleconsultation, repatriation. Availability: 24/7 to meet the needs of beneficiaries. Rapid adaptation: adjustment of services in the face of the global…

What does expatriate health insurance cover?

An expatriate health insurance is designed specifically for people living outside their home country. It generally covers medical expenses such as consultations, hospitalization, and certain specialized treatments. In addition, you will be able to benefit from a rapid reimbursement for your health expenses

Mutual insurance for foreigners: everything you need to know

IN BRIEF Mutual health insurance for expatriates: essential additional coverage. Comparison of mutual insurance companies: find a suitable and affordable solution. Reimbursement of care: information on support abroad. Health protection: insured even outside the national territory. Medical assistance: conditions for…

in the country where you are, which is essential to avoid inopportune advances of costs.

How to choose the right mutual insurance? The choice of a suitable mutual insurance depends on several factors. It is important to consider your destination, the length of your stay, as well as your specific medical needs. Take the time to compare the comprehensions of guarantees

How to send a quote to AXA Mutuelle efficiently

IN BRIEF Request a written quote before treatment to avoid excessive excesses. Use the Hospiway service of AXA to analyze hospitalization costs. Prepare your quote to find out the amount of coverage by your mutual insurance company. Send your quote…

offered by different companies and check the scope of their network of health establishments. You can consult specialized sites to help you find the best option adapted to your situation.

Reimbursement of care abroad One of the essential aspects of a mutual insurance abroad is its reimbursement process care. When subscribing, make sure you understand the reimbursement terms. Please note that these terms and conditions may vary depending on the agreement between your country of origin and the country where you are located. In general, it is possible to be reimbursed upon presentation of receipts and invoices, or to benefit from an exemption from advance fees in certain health establishments.

April unveils its new health insurance offer for expatriates

In response to the significant increase in the number of people living abroad, APRIL is launching “Ma Santé International”, a flexible health insurance offer designed specifically for the varied needs of expatriates. Faced with strict regulations and often high healthcare…

The right steps to take

Before leaving, take the time to finalize your mutual contract. Check that all information is up to date and that you have received your insurance documents. In addition, note down the emergency numbers and health assistance contact details that will help you manage a medical emergency abroad. Do not hesitate to seek advice from professionals to have complete peace of mind.

Everything you need to know about AXA mutual insurance

IN BRIEF AXA : world leader in health insurance Formulas customizable adapted to each profile Reimbursements vary depending on the options chosen Guarantee full support Competitive rates for all types of coverage Availability a network of local advisors Coverage options…

Prepare for the international

Finally, find out about the health practices in the country and specific recommendations related to your destination. For example, some countries may require proof of vaccination or preventive treatments. Good preparation will allow you to fully enjoy your experience abroad without worry.

Living or traveling abroad can be an enriching experience, but it is crucial to ensure adequate health coverage. Subscribe to a expatriate health insurance is an essential step that guarantees your protection against unforeseen medical emergencies. Find out here everything you need to know to navigate the world of mutual insurance abroad and stay safe wherever you are.

AXA Mutual: understanding option 1 and its advantages

IN BRIEF Option 1 of the AXA mutual : key details Analysis of guarantees and refunds proposed Customer reviews onstandard option Comparison with others mutual of the market Benefits of a optimal health coverage Third party payment : avoid expense…

Why take out mutual health insurance abroad?

When you go abroad, healthcare systems and costs of care can vary significantly from your home country. A mutual health insurance allows you to benefit from reimbursement of medical expenses, thus avoiding unexpected expenses. As financial losses can be rapid in the event of illness or accident, it is prudent to protect yourself with appropriate insurance.

How to choose the right mutual insurance for abroad?

Choosing the right health insurance can seem confusing with the multitude of options available. Take the time to evaluate your specific coverage needs. Ask yourself the right questions: What types of care do you want to cover?, In which country are you going to stay?, What is your medical history? For more information on the criteria to take into account, consult the guide available on the UFE website here.

The different guarantees offered

Mutual health insurance companies abroad generally offer different guarantees ranging from basic care to more comprehensive coverage. It is essential to check out these options and choose the ones that best suit your needs. For example, good coverage should include medical visits, hospitalizations, medications, and possibly preventative medicine. The mutual must also anticipate your needs depending on the destination, such as covering specific care depending on the country.

Reimbursement of care abroad

A fundamental aspect to consider is the refund medical expenses abroad. Make sure that your mutual insurance company provides reimbursement up to the level of guarantee you have subscribed to. Also remember to check the way in which reimbursements are made, whether it is an advance of costs or direct payment. For more details on this process, you can read this article here.

Steps to follow if necessary

When you need medical care, it is important to know the steps to follow to benefit from effective coverage. Before leaving, make sure you keep your mutual insurance contact information and your insurance card. If necessary, do not hesitate to contact them quickly to find out the procedure to follow and optimize your support.

In short, good preparation is the key to remaining calm during your travels or stays abroad. By carefully choosing your health insurance and informing yourself about your rights and procedures, you will be able to take full advantage of your international experiences. For any questions or need for a quote, do not hesitate to consult online resources such as those provided by AXA Mutual.

| Criteria | Details |

| Type of coverage | International health insurance for medical expenses |

| Refunds | Coverage according to the level of guarantee subscribed |

| EMERGENCIES | Immediate coverage for urgent care |

| International agreements | Variability by country and bilateral agreements |

| Common exclusions | Aesthetic treatments, undeclared pre-existing treatments |

| Duration of coverage | Options for temporary stays or long expatriation |

| Repatriation assistance | Repatriation services in the event of a serious incident |

| Claims management | Simplified procedures for rapid reimbursement |

Testimonials about Mutual Insurance Abroad: Everything you need to know to be well covered

My expatriation to Sydney was an extraordinary adventure, but I had concerns about my health. By subscribing to a expatriate health insurance, I was able to benefit from suitable coverage. When I needed to see a doctor, the reimbursement process was smooth and quick. I never felt alone when it came to medical expenses, and it really made my stay better.

Going to live abroad is a great opportunity, but I know that health is essential. During my trip to Asia, I chose a mutual travel insurance which offered specific guarantees. I was able to enjoy peace of mind while discovering new horizons. In the event of a medical need, I knew I was well protected without having to worry about costs.

I always believed that the process of obtaining health coverage abroad would be complicated. To my astonishment, I found that choosing the right mutual health insurance was quick and simple. I took the time to compare the available offers and finally opted for the one that offered the best reimbursement for my treatment abroad. Having easy access to medical care allows me to travel more peacefully.

As an expat in New Zealand, I can confirm the importance of mutual health insurance abroad. It is crucial to look at the different types of coverage offered and ensure that any possible care is included. Thanks to my mutual insurance, I was able to have an operation without financial worries. The treatment was quick and efficient, allowing me to concentrate on my rehabilitation.

Before leaving for Europe, I knew I needed a international health insurance. I discovered that some insurance companies even cover hospitalization costs without advance payment, which is essential in the event of an emergency. This kind of coverage allowed me to travel with confidence, knowing that I would be taken care of no matter the situation.

One aspect that I had not considered before leaving was the variability of reimbursements depending on the country. During a stay in South America, I was surprised by the effectiveness of my mutual insurance. Medical expenses were covered up to my guarantee level, which saved me from unforeseen expenses. Being well informed about these particularities really helps to prepare for all eventualities.

Going abroad, whether for a short period or for a prolonged expatriation, requires being well prepared, especially with regard to your health coverage. A mutual health insurance adapted is essential to ensure access to care in the best conditions. This article guides you through the different options available to stay well covered during your stay abroad.

Which mutual fund to choose?

Before leaving, it is crucial to ask yourself which mutual insurance company is best suited to your situation. Depending on your destination and the length of your stay, health coverage needs can vary considerably. Expatriate mutual insurance companies often offer specific guarantees, adapted to living conditions abroad. You will need to assess your personal needs, such as predictable medical care, chronic treatments, or even additional services like prevention.

The different types of mutual health insurance abroad

There are several types of mutual insurance for travel or expatriations. THE international health insurance offer extensive coverage, often on a global scale, while travel mutuals offer more limited protections, often reserved for temporary stays. Take the time to compare the different offers, their guarantees and their exclusions in order to choose the one that suits you best.

Essential guarantees

When choosing a mutual, pay attention to the guarantees included. Make sure it covers:

- Hospitalization costs in case of medical emergency.

- Medical consultations and routine care.

- Medical repatriation, which can prove vital in times of urgent need.

- Prescribed medications as well as dental and optical care, if necessary.

It is also important to check the reimbursement limits, as they can vary from one mutual fund to another.

Reimbursement terms

Understanding how reimbursement works is essential to avoid unpleasant surprises. Generally, mutual insurance companies abroad reimburse part or all of the costs incurred, depending on the guarantees taken out. It is recommended to keep all receipts and medical documents up to date, to facilitate reimbursement procedures. Some mutual insurance companies even offer direct payment, which means that you do not have to advance the costs at the time of the consultation or hospitalization.

Preliminary steps before leaving

Before leaving your country of origin, make sure you find out about the administrative formalities related to your health coverage. Some mutual insurance companies require specific documents or pre-registrations. Do not hesitate to contact your insurer to clarify any unclear points and ensure that you are well prepared for your stay abroad.

Having suitable health insurance for your stays abroad is a key element for living peacefully. By taking the time to choose your coverage carefully and assess your needs, you give yourself every chance to fully benefit from your experience abroad, while remaining protected in the event of a medical need. Be proactive and informed to ensure your safety and well-being internationally.

When you plan to go abroad, whether it is a permanent expatriation or a simple trip, it is essential to find out about your mutual health insurance. Indeed, access to health care and coverage of your medical expenses can vary considerably from one country to another. As such, it is essential to opt for mutual insurance that will protect you, regardless of where you stay.

Before leaving, it is wise to choose a expatriate mutual insurance which adapts to your needs and your destination. This coverage must include adequate reimbursement for medical care, whether emergency or not. Also remember to check the guarantees offered, such as covering hospitalization costs, medical consultations and medications.

It is often recommended to subscribe to a international health insurance which will allow you to benefit from extensive coverage, even in less accessible regions. This will ensure reimbursement up to your actual expenses while reassuring you about your health protection. In addition, the management of formalities remains a crucial aspect. Find out about the steps to follow for reimbursement of your care and the validity of your coverage according to existing bilateral agreements.

Finally, keep in mind that health should never be neglected during your adventures abroad. By choosing the right mutual, you give yourself the means to enjoy every moment of your experience, with complete peace of mind.

FAQ about mutual insurance abroad

What is the importance of mutual health insurance abroad? Subscribe to a mutual health insurance abroad is essential to guarantee that your medical expenses are covered. This allows you to travel with peace of mind, knowing that you are protected against possible unforeseen events.

What are the differences between expatriate mutual insurance and travel insurance? A expatriate mutual insurance covers you for an extended period and often includes more comprehensive care, while a travel insurance is generally temporary and suitable for short stays.

How to choose the right mutual insurance when you go to live abroad? To select the correct mutual, it is crucial to compare the guarantees offered, the reimbursement levels, as well as the exclusions of each contract.

Does the mutual fund cover specific care abroad? Yes, in principle, the mutual health insurance covers specific treatments, but this depends on the conditions of your contract and the destination of your trip.

Are dental and optical care reimbursed abroad? Most of mutual health insurance offer reimbursement for dental and vision care, but it is important to check the terms before you go.

How to get reimbursed for medical expenses abroad? To be reimbursed, it is generally sufficient to keep all invoices and submit them to your mutual with the necessary documents for your return.

Can I take out mutual health insurance once abroad? Yes, some mutual offer the possibility of registering from abroad, although it is recommended to take care of this before your departure to avoid unpleasant surprises.

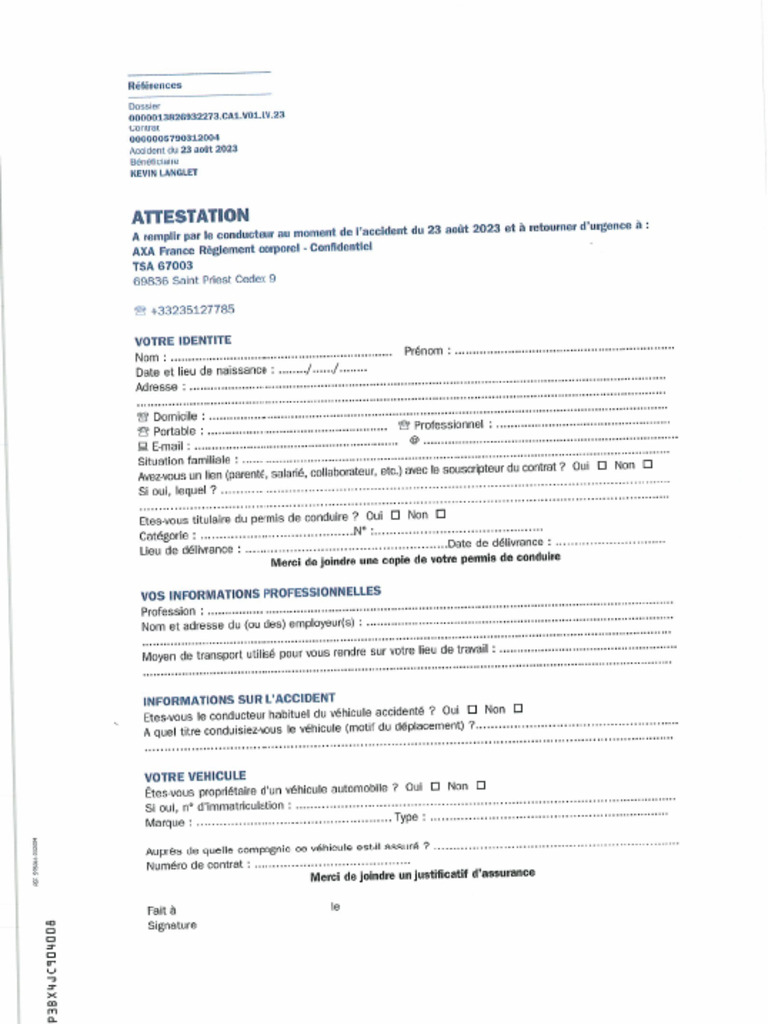

What documents must I provide to my mutual for reimbursement? For reimbursement, you will need to provide medical bills, your expense statements and sometimes a specific reimbursement request form from your mutual.

Does mutual insurance work in all countries? The operation of the mutual may vary depending on the agreements between France and the host country. It is therefore advisable to find out in advance to avoid inconvenience.

What practical advice to prepare for your departure abroad? Before you leave, make sure you have all the information on your mutual health insurance, including your rights, emergency contacts, and procedures to follow in the event of a medical need.