|

IN BRIEF

|

In an increasingly globalized world, understanding international insurance has become essential for companies wishing to expand their activities beyond borders. Each country has varied regulations and specific risks which require particular attention. Well-adapted insurance not only protects the company’s assets, but also guarantees peace of mind ensuring legal and financial compliance. Businesses need to know the different options available to choose an insurance program that meets their needs. specific needs, while taking into account global issues and local requirements.

In an increasingly globalized world, understand international insurance for businesses is an essential element for the sustainability and security of commercial activities. Businesses venturing across national borders must navigate a maze of regulations, market-specific risks and varying insurance needs. This article highlights the benefits and the disadvantages of international insurance, to help you make informed choices.

Advantage

One of the main benefits of international insurance is the global coverage. With tailored insurance programs, businesses can protect themselves against specific risks in each country where they operate. This provides peace of mind when unforeseen situations arise.

Furthermore, a risk management centralized is facilitated by the integration of these insurances. A company can thus anticipate and manage risks in a standardized manner, ensuring legal compliance with local and international regulations. This significantly reduces potential legal issues and associated costs.

Finally, the establishment of an International Insurance Program can offer competitive rates, especially when companies combine their different coverages into a single program. It can also offer more personalized coverage options based on the specific insurance needs of each company.

Mutual health insurance in Algeria: everything you need to know

IN BRIEF Mutual insurance : understand its importance in Algeria. Benefits mutual health insurance: savings and additional coverage. Blankets offered: medical care, hospitalization, dental. Underwriting process : simple steps to join. Practical tips : optimize your health protection. Comparative offers…

Disadvantages

Despite its many advantages, international insurance also presents disadvantages. First of all, the complexity of regulations in each country can be confusing. Each jurisdiction has its own requirements, which can make it difficult to put together a suitable insurance program.

Another disadvantage lies in the cost. Although grouped together, some international insurance policies can be expensive. Businesses should weigh the potential benefits against the costs involved, and determine whether it is worth it compared to local insurance.

Finally, processing times may take longer for international claims. Businesses may have difficulty obtaining compensation quickly, which may affect the continuity of their operations.

When companies enter the scene international, the need for a adapted insurance becomes essential. With different regulations and country-specific risks, making the right choice is crucial. This article explores the essential steps to follow to ensure adequate coverage, thereby ensuring the sustainability of overseas business operations.

Vital insurance quote: everything you need to know to choose the right insurance

IN BRIEF Analysis of your health needs. Evaluation of your health budget. Comparison of offers on the market. Importance of guarantees proposed. Consideration of waiting periods. Evaluation of your profile (age, state of health). Advice to optimize your quote.When the…

The challenges of international insurance

Companies that operate globally must navigate through various risks and often unpredictable. Whether these are issues related to human resources, material goods or even civil liability, each aspect requires particular attention. In addition, each country has its own regulations which can significantly influence the type of blanket necessary.

Mutual insurance in Algeria: everything you need to know

IN BRIEF Mutual insurance in Algeria: an important choice for your health. Coverage of medical expenses basic and complementary. Process of subscription simplified for policyholders. Advantages and guarantees of the different mutual insurance companies available. Tips for optimize your health…

Cost, coverage and benefits

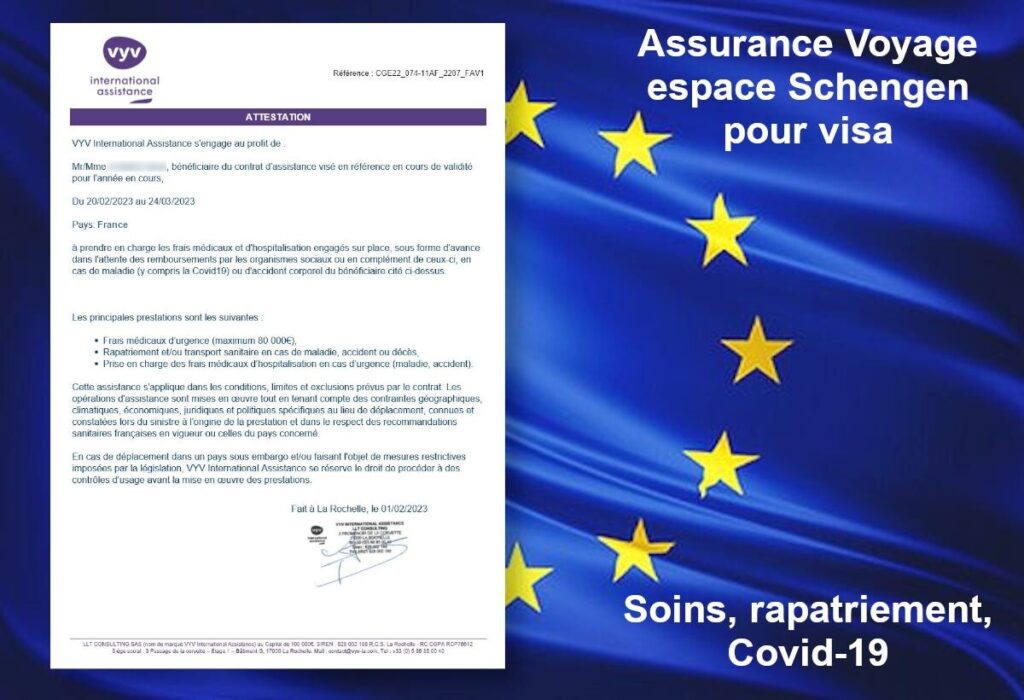

Understand the cost International health insurance is fundamental for businesses. Each insurance plan offers coverage options varied which can include services such as medical care, hospitalization, and even repatriation assistance. In comparing the different plans, companies can choose the best option to protect their employees abroad.

Tips for preserving your mental health during an expatriation

Expatriation can be an enriching but also stressful experience. Adapting to a new culture, far from one’s family references, can affect one’s mental health. To navigate this context, several strategies can be effective. From preparation in advance to managing daily…

Development of an international insurance program

Create a international insurance program effective goes through several key stages. First, it is crucial to precisely identify the specific needs of the company according to the countries of intervention. Then, the establishment of a integrated insurance strategy allows risks to be managed in a uniform manner while respecting local requirements.

Axa insurance products: complete guide to choosing the best option

IN BRIEF Car insurance : different formulas and guarantees. Home insurance : options and protections. Health insurance : coverage for individuals and expatriates. Life insurance : comparison of Axa contracts. Competitive rates for young drivers. Assistance : services available at…

Adapted insurance solutions

There are many international insurance solutions. Businesses may choose to opt for tailor-made insurance programs, which guarantee appropriate coverage depending on the different international issues that they encounter. An analysis of options available can prove decisive for optimal risk management.

Mutual insurance for residents abroad: everything you need to know

IN BRIEF Mutual insurance: importance for residents abroad. Supplement to the CFE for optimal protection. Rights to health insurance according to the country of residence. Steps to follow to benefit from health insuranceabroad. Differences between EU and non-EUcountries. Need for…

International health insurance for expats

For employees sent abroad, a international health insurance is essential. It not only protects employees, but also the company against unexpected medical costs. It is crucial to choose coverage that offers the best benefits, in order to guarantee the well-being of expatriates. Find out more about this at the following link: International health insurance.

How to contact Axa mutual health: telephone number and useful information

IN BRIEF Phone number to contact AXA: 0 970 808 088. Support available 24/7 via chat in your customer area. For the teleconsultations, dial 📞 36 33. Contact by email: service.orientation.santeentreprise@axa.fr. Opening hours: from Monday to Friday from 8 a.m.…

Resources to deepen your knowledge

For those who want to learn more about international insurance, there are many resources available. Consult in particular the white paper on international insurance programs which provides a detailed overview of the issues and best practices to follow.

You can also find out more specifically about the cost ofinternational insurance in Morocco by visiting this link: Cost of international insurance in Morocco.

Finally, for expatriates, find out everything you need to know aboutinternational expat insurance which will help you secure your mobility abroad.

In an increasingly interconnected world, understand international insurance is essential for businesses looking to expand beyond their local market. This article presents the necessary avenues for navigating the different regulations, evaluating the risks internationally and choose suitable insurance solutions. Of the importance of blanket to the analysis of costs, each element plays a crucial role in protecting the company and its employees abroad.

Mutual foreign stay: what you need to know before leaving

EN BREF Vérifiez les garanties de votre mutuelle avant de partir. Pour courts séjours, les mutuelles classiques peuvent suffire. Prévoyez une garantie supplémentaire pour une meilleure couverture. Informez-vous sur les remboursements des soins selon votre destination. Pensez à souscrire une…

The challenges of international insurance

Access to new markets necessarily entails risks increased. Each country has its own regulations, and companies need to understand these specificities to avoid legal complications. International insurance helps manage these risks by offering protection tailored to local requirements.

Specific Risk Assessment

Before choosing an insurance solution, it is crucial to assess the specific risks that the company could encounter abroad. This assessment helps identify the main threats, whether they are related to legislation, employee health, or natural disasters. In addition, it is useful to consult industry experts who can provide in-depth analyses.

International Insurance Options

There are different insurance options for companies operating internationally. Among the most common is international health insurance, which covers employees working abroad. It is essential to compare the available plans to determine which one best meets the specific needs of your team.

Coverage tailored to expatriate employees

For companies with expatriate employees, offering suitable coverage is essential. This can include services such as medical care, emergencies, and sick pay. Choosing the right international health insurance policy will ensure that employees are protected no matter what country they are in. More information on this topic can be found in resources such as this link.

Building an International Insurance Program

To ensure adequate coverage, it is recommended to set up an international insurance program. This process involves several key steps, such as identifying specific business needs, finding reliable insurance providers, and establishing mechanisms for compliance with local requirements. Working with insurance specialists can also provide valuable insights.

The advantages of an integrated approach

Take an approach integrated for international insurance allows companies to better control their risks and ensure that different insurance policies work well together. This also simplifies the management of the same and increases the legal compliance in each country of operation. For examples of insurance solutions, see this resource.

Conclusion on international insurance

In short, understanding the nuances of international insurance is essential for any business looking to expand beyond its borders. Choosing the right options and building a solid insurance program are essential steps to ensure the sustainability and security of operations in a complex international environment.

Comparison of Types of International Insurance

| Type of Insurance | Description |

| International Health Insurance | Protects employees abroad, covering medical care, hospitalization and preventative care. |

| Civil Liability Insurance | Covers damages caused to third parties, essential for cross-border activities. |

| Political Risk Insurance | Protect against losses due to unforeseen political events in the country of operation. |

| International Fleet Insurance | For companies with vehicles abroad, ensuring material and bodily liability. |

| Property Insurance | Covers loss or damage to physical property in international operations. |

| Multinational Insurance | Integrated program to centralize insurance coverage across markets. |

| Cyber Risk Insurance | Protection against data breaches and cybercrime internationally. |

Testimonials on understanding international insurance for businesses

In an ever-changing business environment, having a good understanding of international insurance has become a necessity for businesses looking to expand abroad. A business owner of an SME testifies: “When we decided to set up in Europe, we realized how much risk coverage varied from one country to another. Thanks to expert support, we were able to navigate the specific regulations and find the best solution to secure our activities.”

A human resources manager also shares her experience: “Before choosing an international health insurance plan for our expatriate employees, we took the time to compare the available options. We found that tailor-made plans not only protected our teams, but also promoted their well-being abroad. The peace of mind this provides is invaluable!”

A technology company executive notes: “Setting up the right insurance for our international business was a real challenge. We followed a structured, step-by-step process to ensure that each country we operated in was covered. This not only reduced our financial risksbut also increased our credibility with our customers.”

A former expat entrepreneur shares her journey: “Getting insured internationally seemed like a daunting task. However, I quickly learned that choosing the right insurance plan is the key to feeling safe abroad. I was able to meet experts who enlightened me on the different solutions adapted to my specific problems.”

Finally, a risk management consultant concludes: “Companies must take the time to understand the importance of international insurance. By mastering the various issues, we can develop robust insurance strategies that not only meet local requirements, but also ensure that the business can prosper in the long term.”

In an increasingly globalized world, it is essential for businesses to have a thorough understanding ofinternational insurance. Each country has its own specific regulations and risks, making having an effective insurance program in place absolutely essential. This article explores the different steps and considerations needed to ensure optimal coverage, as well as the undeniable benefits of insurance tailored to the needs of businesses operating internationally.

The challenges of international insurance

One of the main issues of theinternational insurance lies in the diversity of regulations. Depending on the country, insurance requirements will vary and may involve specific standards to be met. Businesses must therefore familiarize themselves with local laws to ensure compliance and avoid penalties. Furthermore, each territory presents unique risks, whether linked to the environment, security or health. Understanding these particularities is crucial to assessing the insurance needs of each country.

Risk assessment

Before choosing an insurance program, it is imperative to carry out a risk assessment complete which could weigh on the company’s activity. This involves careful analysis of potential threats in each region where the company operates. This assessment should take into account local market characteristics, economic risks and cultural challenges. By having a clear view of threats, businesses can select appropriate and effective insurance policies.

Choosing the right type of coverage

Once the risk assessment has been carried out, the next step is to choose the right type of insurance coverage. The options available on the market vary widely and can include liability insurance, property insurance, or international employee health insurance. It is imperative to select fonts that precisely meet the specific needs of the business and local regulations.

Comparison of insurance plans

To make the right choice regarding insurance, it is also wise to compare insurance plans. Businesses should look at the different deals available to get the best value for money. This includes analyzing coverage levels, exclusions, and associated costs. Insurance comparison platforms can be very useful in facilitating this step.

The advantages of international insurance

Opting for international insurance offers many benefits to businesses. Firstly, it allows for better risk control, because policies can be designed to provide global coverage while respecting local specificities. In addition, well-designed insurance guarantees the legal compliance and tax, thus reducing the risk of financial sanctions.

Assistance in the event of a disaster

Having international insurance also allows companies to benefit from disaster assistance globally. Whether it is for an accident, a theft or a natural disaster, companies can count on immediate and adapted support. International coverage greatly facilitates the management of claims, as it offers resources and a network of experts all over the world.

In short, understanding international insurance is an essential process for any company wishing to develop on a global scale. By carefully addressing the issues, assessing risks and choosing the right coverage, entrepreneurs can boost their confidence in their operations, even in complex foreign contexts.

In a constantly changing business world, international insurance plays a vital role for companies expanding abroad. Navigating the different regulations and specific risks of each country may seem complex, but understanding these challenges is vital to ensuring the sustainability of operations. Adequate insurance coverage

not only protects assets, but also provides the peace of mind needed to focus on growth. It is crucial for companies to analyze the available insurance options and choose tailor-made solutions that meet their specific needs. This includes the cost, the guarantees offered and the benefits associated with each plan. International health insurance has also become essential to protect employees during their assignment abroad. It is imperative to look at integrated insurance programs

that ensure legal compliance in the countries of establishment while meeting the requirements of the home country. Businesses should also consider the importance of working with insurance experts who can guide them in implementing an effective program. These professionals can provide an informed vision on the construction of ainternational insurance program

, ensuring that all necessary mechanisms are in place to cover international activities.

Finally, risk management through well-structured international insurance is an undeniable asset for any company wishing to establish itself in foreign markets. Understanding these issues is the first step towards successful and sustainable international development.

FAQ – Understanding International Insurance for Business What is international business insurance?

International business insurance is a set of insurance policies that cover risks related to business operations abroad, taking into account the specific regulations of each country. Why is it important to take out international insurance?

Purchasing international insurance is essential to protect your business against the unforeseen events of doing business abroad, such as property damage, legal disputes and business interruptions. What are the main coverages offered by international insurance?

Main coverages include civil liability, property protection, employee health insurance, and international transportation risk coverage. What factors should be considered when choosing international insurance?

It is important to consider the specific needs of your business, the types of risks you face, local regulations, and the cost and extent of coverage offered. How to compare different international insurance policies?

To compare insurance policies, it is advisable to examine the guarantees offered, the exclusions of each contract, the limits of compensation and the costs associated with each option to choose the one that best meets your needs. What are the advantages of an internationally integrated insurance program?

An integrated insurance program allows you to have an overview of your coverages, ensure regulatory compliance in different countries, and better control risks on a global scale. How can businesses determine their international insurance needs?

Companies can conduct an in-depth analysis of the risks specific to their international operations, consult with insurance experts, and take into account the advice of their legal and financial teams. What challenges do businesses face when it comes to international insurance?