|

IN BRIEF

|

Are you looking for a mutual health insurance that adapts to your needs while offering

full guarantees

? There

AXA mutual insurance

positions itself as a major player in the field, with varied options to meet different profiles. By exploring the

estimate

and the

guarantees

offered, you will discover how to obtain the ideal coverage, adjusted to your budget and your health expectations. Let’s dive together into the specifics of the AXA offer to help you make the best choice.

Axa mutual health: everything you need to know about quotes and guarantees

In a world where health costs can quickly add up, it is essential to fully understand your health insurance. There AXA mutual health insurance stands out for its varied options adapted to each profile. In this article, we will explore the advantages and disadvantages of this mutual, as well as key information on the quotes and guarantees it offers.

Mutual hospitalization insurance: why choose AXA?

IN BRIEF Importance of a hospitalization guarantee in your complementary health. Reimbursements of up to 400% for hospital costs. Support for pre and post-operative costs at 150%. Options for home hospitalization And medical transport at 150%. Formulas flexible adapted to…

Benefits

A wide range of guarantees

AXA offers several options complementary health, ranging from simple reimbursements to more comprehensive coverage. This allows each individual to choose a level of guarantee that perfectly suits their needs and budget.

Personalized support

One of AXA’s major assets lies in its network of local advisors. These professionals are available to help policyholders adjust their coverage levels according to their healthcare expenses, thus making reimbursement management simpler and more efficient.

Get a free, easily accessible quote

AXA allows you to make a free simulation of your online health supplement. This offers future policyholders the opportunity to compare different options and choose the one that suits them best. For more information, you can visit the website AXA.

Axa mutual insurance: everything you need to know before subscribing

IN BRIEF Needs assessment : Analyze your current treatments and your health expenses. Diversified offers : AXA offers 7 customizable formulas to adapt to each profile. Selection criteria : Consider the guarantees, services, and options available. Exclusive advantages : Discover…

Disadvantages

High management fees

Despite the many advantages of AXA mutual insurance, some users report scandalously high management fees. This situation has sparked criticism, particularly from organizations like UFC-Que Choisir, which ensure consumer protection.

Complexity of choices

With such a diversity of plans and options, it can be difficult for policyholders to make the right choice. It is therefore advisable to carefully study the guarantee tables offered before making a decision. A lack of clarity in the information could be confusing for some users.

Insurance comparison

The mutual market is very competitive, and although AXA offers many attractive features, it is wise to compare with other companies. For an overview, you can consult rankings like those of best mutual health insurance.

In short, the AXA mutual insurance has many advantages, but also some challenges to overcome. By carefully analyzing the options, you can find the perfect solution for your health needs.

Mutual and travel insurance: what you need to know before you leave

IN BRIEF Essential preparation before a trip: don’t neglect insurance. Difference between travel insurance And mutual. Importance of guarantees to leave peacefully. Consider the destination to choose the right coverage. Check the options And services available. Understand the risks related…

Axa mutual health: everything you need to know about quotes and guarantees

There AXA mutual health insurance stands out for its varied offers adapted to different needs and profiles. In this article, we will explore in detail the processes of estimate, the options guarantee and the advantages of choosing AXA for your complementary health insurance.

Understanding Axa mutual health quotes

When you are considering subscribing to a complementary health, it is essential to start by requesting a quote. AXA offers a simple and accessible process for obtaining a quote online. You can simulate your needs in a few clicks and discover the different plans available, including the options ECO, Comfort and others.

AXA quotes allow you to clearly visualize the prices as well as the guarantees included in each formula. By studying this information, you will be able to choose an offer that perfectly meets your expectations and your budget.

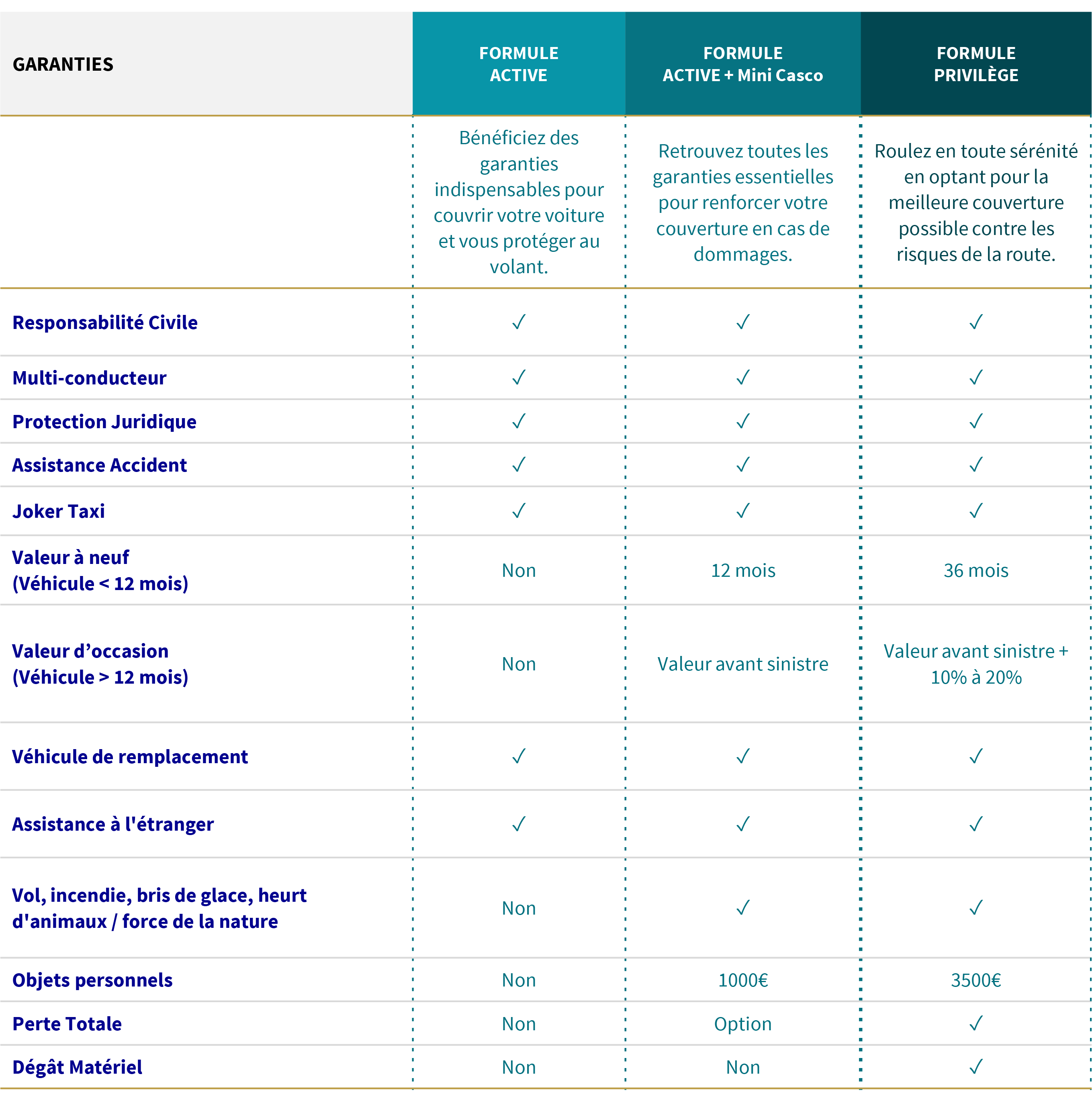

The guarantees offered by AXA

AXA focuses on three main pillars: pay the right price, take care of yourself And get better reimbursements. Mutual health insurance plans include guarantees that cover your health expenses, whether for medical consultations, hospitalization or dental care.

The tables of guarantees proposed by AXA detail the reimbursement levels according to health benefits. It is therefore important to consult them carefully to ensure that the coverage chosen meets your specific needs.

How to adjust your guarantees with AXA

One of the great advantages of AXA mutual insurance is the flexibility offered by the possibility of adjusting your guarantees according to the evolution of your needs. Every 5 to 10 years, it is advisable to re-examine your guarantees to ensure that they still correspond to your personal and professional situation.

Whether you are a student, a young worker or a family member, AXA will guide you in choosing the complementary health the most suitable. Thanks to a local advisor, you will be able to easily navigate between the different options and adapt your coverage accordingly.

Get advice for your complementary health insurance

To choose your mutual health insurance, do not hesitate to contact the AXA teams to benefit from personalized advice. You can contact them by telephone or email to ask all your questions regarding your estimate or the guarantees available. This will allow you to make an informed decision and choose the plan that suits you best.

To learn more about the offers available, you can consult the official AXA website: AXA complementary health. Also discover other online resources, such as AXA quote simulation or even the guarantee options.

Axa: complete guide to choosing the right insurance

IN BRIEF Understanding Axa offers Analysis of guarantees proposed Comparison of prices available Customer reviews on AXA and its services Criteria for choosing blanket adequate Guide to subscribing online easily Information on claims and declarations In a world where protecting…

Axa mutual health: everything you need to know about quotes and guarantees

AXA mutual health insurance stands out for its flexibility and the diversity of its offers, allowing everyone to find the coverage that suits them. Whether you are young active or retired, it is essential to understand the different estimate And guarantees offered by AXA in order to choose the formula best suited to your health needs. Let’s find out together everything you need to know about it.

Understanding AXA mutual health quotes

To obtain a estimate personalized with AXA, simply complete a simple online simulation. This process will allow you to explore the various options and prices adapted to your personal situation. Thanks to this tool, you can adjust your guarantee levels according to your needs without paying for services that you do not benefit from.

The guarantees offered by AXA

AXA provides you with several options: complementary health, ranging from covering current expenses to specific guarantees for more advanced care. Each plan is designed to meet different profiles and budgets, allowing you to find the ideal coverage. It is advisable to compare the guarantees offered in order to identify those that best protect you.

Reimbursements: what you need to know

Another crucial aspect to consider is the level of reimbursement offered by different plans. AXA offers several reimbursement scales of up to 400%. By becoming aware of the guarantee tables from AXA, you can assess what each plan actually covers and to what extent. This helps you avoid unpleasant surprises when billing your medical care.

Help your efforts with a local advisor

AXA offers a large network of advisors ready to support you in all your efforts. By contacting your advisor, you benefit from personalized assistance to adjust your guarantees according to your specific needs. Do not hesitate to contact them for any questions or clarifications regarding your estimate And guarantees health.

Why review your mutual insurance regularly?

It is advisable to re-evaluate your guarantees every 5 to 10 years. Your life situation is changing and so are your health needs. Whether you are a student, young professional, or retired, expectations are changing. Hence the importance of staying up to date to maximize your reimbursements and adjust your coverage accordingly.

Get personalized advice

If you aspire to know more about thesubscription offer of AXA health or for a free quote, there are various ways to contact AXA. Whether by telephone or via their website, advisors are available to guide you in choosing the best formula suited to your situation.

Axa mutual health insurance: everything you need to know to choose the right one

IN BRIEF AXA offers personalized health insurance. Analyze your behavior in terms of care is crucial. There exists 7 formulas of AXA mutual insurance companies adapted to different needs. THE benefits include quality customer service and competitive prices. Consider the…

Comparison of AXA mutual guarantees

| Type of Warranty | Description |

|---|---|

| Hospitalization | Reimbursement of up to 400% of hospitalization costs depending on the chosen formula. |

| Consultations | Varied reimbursement depending on the type of practitioner, with an attractive base rate. |

| Optical | Enhanced coverage for glasses and lenses, with annual ceilings. |

| Dental | High reimbursements for common procedures, such as crowns and prostheses. |

| Medications | Valuable reimbursement on medications not reimbursed by social security. |

| Prevention | Coverage for preventive visits, such as health checks. |

| Quotes | Possibility of making a quote online, fast and without obligation. |

| Proximity Advisor | Access to an advisor for personalized support in choosing guarantees. |

Axa mutual health insurance: everything you need to know about its formulas

IN BRIEF AXA Mutual Health offers a varied range of formulas. Reimbursement options ranging from 100% has 400%. Customizable formulas with modules additional. Offers adapted to seniors and specific health needs. Process of subscription simple and transparent. Guaranteed health insurance…

Testimonials on AXA Mutuelle Santé: Quotes and Guarantees

After exploring various options, I decided to subscribe to the AXA mutual health insurance. What really appealed to me was the ability to easily compare free quotes online. In just a few clicks, I was able to get a clear idea of the guarantees available and the associated rates. This allowed me to select the plan that really suited my needs.

As a young professional, I was looking for a mutual insurance company that offered me reimbursements that fit my budget. I discovered that AXA offers a variety of plans such as 100% health or 200% health; it was reassuring to see how easy it is to adjust the levels of guarantee according to my health expenses. Thanks to my local advisor, I received personalized advice that was very valuable to me.

I am a mother and I needed health coverage for my entire family. What I liked about AXA was their transparency regarding the guarantees and the options additional. Each option was clearly detailed in the tables. guarantees, which allowed me to understand how refunds were going to work. In a short time, I had all the information I needed to make an informed decision.

For my part, AXA’s customer service was also a major asset. THE advisors were always available to answer my questions, which made me feel confident throughout the process. When I needed to adjust my coverage, the change was made quickly and without hassle. Knowing that I had support every step of the way really reassured me.

Finally, I highly recommend AXA for their mutual health insurance. THE options that they offer are not only varied but also adapted to various profiles. Whether you are a student, a young worker or a family with children, you will inevitably find a formula which will allow you to take care of your health while controlling your budget.

Axa France mutual life: contact and assistance guide

IN BRIEF Contact methods : Email, telephone, online form. Assistance : 24/7 availability for customer service. Claim declaration : Simplified process via telephone or online. Customer feedback : Complaint form available on the AXA website. Main number of customer service…

Axa Mutuelle Santé: Everything you need to know about quotes and guarantees

In a constantly changing world, it is crucial to choose the right complementary health. There AXA mutual insurance presents itself as an effective solution adapted to a wide range of needs. This article guides you to understand quotes, guarantees and how to take advantage of the best options offered by AXA for your health.

Axa mutual guarantee: everything you need to know

IN BRIEF Coverage of routine care: consultations, medications, medical analyses. Hospitalization : accommodation costs, surgery, daily fee. Optical and dental: reimbursement for glasses, lenses and dental care. Choosing the right mutual insurance: evaluation of your budget and your specific needs.…

Understanding AXA mutual quotes

One of the first elements to consider when subscribing to a complementary health is the estimate. AXA stands out for the possibility of carrying out an online simulation to obtain a free quote. This allows you to quickly evaluate the rates and options available to you.

Online simulation process

The simulation is simple and quick. In just a few clicks, you can personalize your contract according to your specific needs. All you need to do is provide information about your state of health, your projected expenses and your expectations in terms of coverage. Once this data is provided, you will receive an estimate of the rates and guarantees that apply to your situation.

The different levels of reimbursement

AXA offers a diverse range of reimbursement options, ranging from 100% to 400% depending on medical services. This means that you can choose a formula which suits you best, whether you are looking for basic coverage or more comprehensive guarantees. Be sure to check the warranty tables carefully to understand what is covered.

The guarantees offered by the AXA mutual insurance company

AXA focuses on three main pillars: paying the right price, taking care of you and getting better reimbursements. Here is a detailed overview of the guarantees you can expect.

Hospitalization guarantee

Hospitalization coverage is crucial, because hospitalization costs can quickly reach high sums. AXA offers you plans that cover a hospital decision, private room costs and doctors’ fees. This financial security is essential to approach hospitalization with peace of mind.

Routine care guarantee

Routine care includes primary care, specialist consultations, medical tests and more. AXA guarantees high reimbursement for these types of procedures, which can significantly reduce your daily healthcare costs. Be sure to analyze the reimbursement percentages and caps associated with each plan.

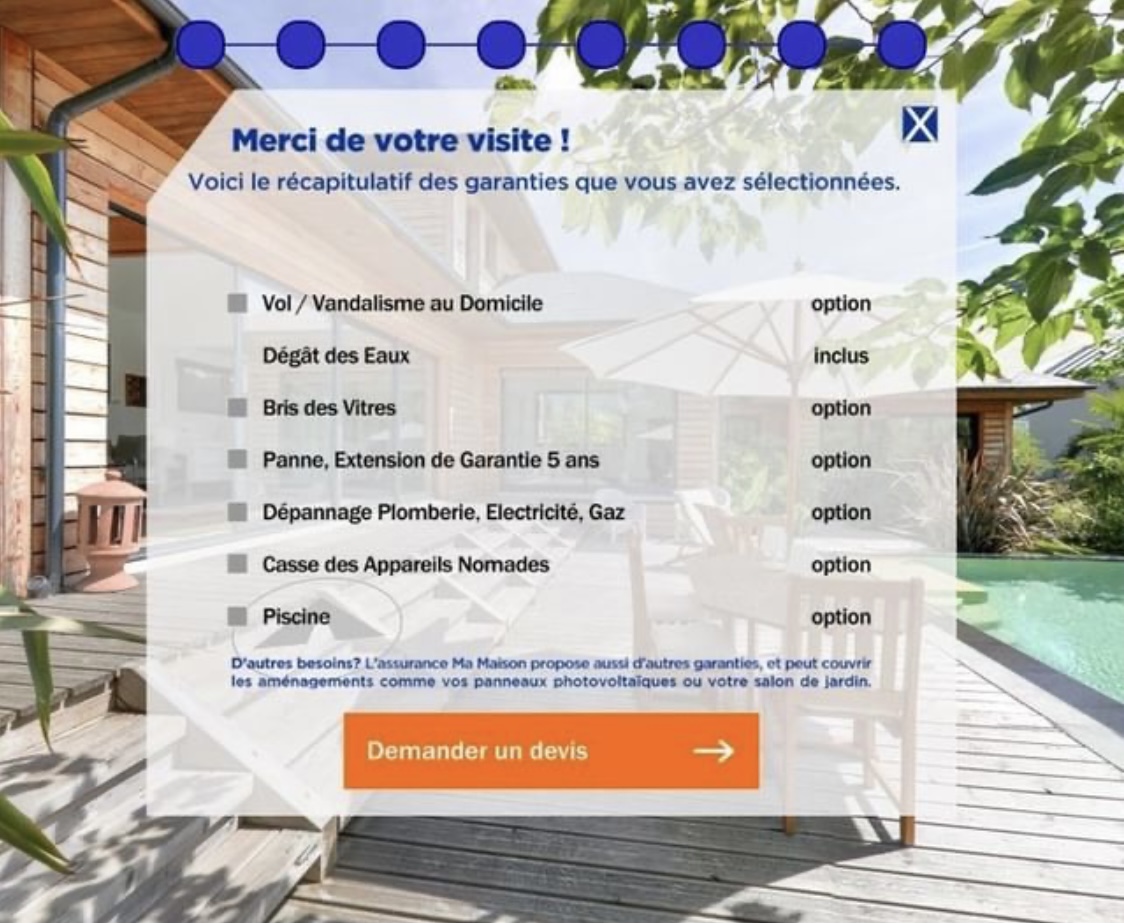

Additional services

AXA is not just limited to reimbursements. With certain plans, you can also benefit from additional services such as teleconsultation, home assistance and even prevention programs. These options make AXA mutual an adjustable choice according to the unique needs of each individual.

How to choose the right formula?

Choose the right formula complementary health requires careful consideration of your needs and expectations. Every 5 to 10 years, it is advisable to reassess your guarantees, especially if your personal situation changes (change of profession, addition of a family member, etc.).

Taking advice from your AXA advisor can be a major asset. He will be able to personalize your offer according to your profile and your health expenses. Furthermore, the availability of local advisors provides valuable support throughout your health journey.

Ultimately, AXA mutual insurance positions itself as a solid ally in covering your health costs. Follow these recommendations to choose with full knowledge of the facts and make the best choice for your health coverage.

Axa mutual health: everything you need to know about quotes and guarantees

When we talk about the mutual health insurance, AXA stands out for its wide range of services and options adapted to each profile. With its varied formulas, AXA offers guarantees which meet the specific needs of each person. Whether you are a student, young worker or senior, AXA has a solution that suits you. The important thing is to identify your health needs in order to choose the most appropriate formula.

One of AXA’s major assets is the possibility of obtaining a free online quote. This allows you to analyze the available options without commitment. Thanks to this tool, you can adjust your guarantees according to your health expenses. THE guarantee tables will help you visualize and compare reimbursements according to the different formulas. This is a real plus for all policyholders who wish to make an informed choice.

AXA also provides you with a network of local advisors, ready to support you in all your efforts. This offers a human dimension to your experience, essential when addressing issues as personal as health. These advisors will guide you so that you can understand all aspects of the contracts and find the best level of refunds.

In summary, AXA positions itself as a major player in the complementary health, with flexible options, pricing transparency and responsive customer service. With AXA, you are sure to benefit from suitable cover, while having the opportunity to control your health choices in an informed manner.

FAQ about Axa mutual health: everything you need to know about quotes and guarantees

What is the procedure for obtaining a quote for Axa mutual health insurance? You can request a free quote online via the AXA website or contact your local advisor.

What guarantees are offered by Axa mutual health? Axa offers different plans with a wide range of guarantees adapted to everyone’s needs, such as hospitalization, routine care and dental care.

How is reimbursement carried out with Axa mutual insurance? Reimbursements are made according to the guarantees chosen and the guarantee tables available, allowing specific health costs to be covered.

What guarantee options are available at AXA? AXA offers several options, including varied reimbursement levels of up to 400%, depending on the plan chosen.

Can you adjust your guarantees during your contract with Axa? Yes, AXA allows you to adjust the guarantee levels according to changes in your healthcare expenses.

What are the prices charged by Axa for its health insurance? Prices vary depending on the formulas and options chosen; it is recommended to carry out a simulation to obtain a precise estimate.

Do you have a health assistance service at AXA? Yes, AXA offers health assistance to answer your questions and facilitate your procedures.

What is the recommended frequency for reviewing your health benefits? It is advisable to re-evaluate your guarantees every 5 to 10 years or after an important stage in your life.