|

IN BRIEF

|

In a world where protecting your property and your health has become essential, choosing the right

insurance

is essential. Axa positions itself as a key player in the market, offering a diversity of options adapted to each need. This complete guide helps you understand the different

guarantees

, compare the

prices

and choose the most relevant coverage for you and your loved ones. Let’s dive into the world of Axa and discover how to optimize your security while benefiting from practical advice for an informed decision.

Axa: complete guide to choosing the right insurance

In a world where the security of your property and your family is paramount, choosing the right insurance is essential. Axa positions itself as a major player in the insurance market, offering a wide range of options to meet various needs. In this article, we will provide you with a comparison of the advantages and disadvantages of Axa, to help you make an informed choice regarding your coverage.

Travel and mutual insurance: how to choose the best health coverage for your vacation

IN BRIEF Understand the importance of mutual travel insurance. Evaluate the medical expenses abroad. Compare the guarantees and the options available. Choose according to your destination. Take into account the duration of your stay. Consider the risks related to your…

Benefits

Wide range of products

Axa offers a variety of insurance products ranging from car insurance to home and health insurance. This diversity allows policyholders to easily find coverage that meets their specific needs.

Convenient online services

Axa’s platform offers powerful online services, including the ability to take out insurance or manage your contract easily. Access to your customer area is a real asset for following your procedures at any time.

Positive customer reviews

Customer reviews generally highlight the reactivity and the efficiency of Axa’s customer service, which is essential when you need to report a claim or request information.

Customizable options

Axa allows customization of contracts with different options and guarantees. Whether for auto or home insurance, you can adjust your coverage according to your personal situation.

Taking out private insurance: what you need to know

IN BRIEF Subscription private insurance: key steps Importance of evaluating your personal situation Understand the guarantees proposed Terms membership and eligibility criteria Compare the price and offers from different insurers Right to retraction 14 days for certain contracts Tips for…

Disadvantages

Sometimes high prices

Although Axa’s products are quality, some offers may seem more expensive compared to those of other insurers. It is recommended to compare prices and warranties to determine if you’re getting the best value for your money.

Complexity of contracts

The multiplicity of options and formulas can make the choice of Axa somewhat complex. It is crucial to read contract details carefully to avoid any unpleasant surprises when you need coverage.

Customer service varies depending on the agency

Customer service feedback sometimes differs from one agency to another. Although some agencies provide exceptional service, others may have gaps in terms of availability or competence, which can complicate the management of your insurance.

Warranty Exclusions

As with any insurance company, it is essential to read the exclusions guarantees in Axa contracts. Certain situations or types of losses are not covered, which can lead policyholders to feel disadvantaged if necessary.

Mutual hospitalization insurance: why choose AXA?

IN BRIEF Importance of a hospitalization guarantee in your complementary health. Reimbursements of up to 400% for hospital costs. Support for pre and post-operative costs at 150%. Options for home hospitalization And medical transport at 150%. Formulas flexible adapted to…

Axa: Complete Guide to Choosing the Right Insurance

Choosing the right insurance is essential to protect your future and that of your loved ones. Axa, a major player in the insurance field, offers a variety of products adapted to your specific needs. In this guide, we’ll explore the insurance options offered by Axa, as well as practical advice for making an informed choice.

Axa mutual insurance: everything you need to know before subscribing

IN BRIEF Needs assessment : Analyze your current treatments and your health expenses. Diversified offers : AXA offers 7 customizable formulas to adapt to each profile. Selection criteria : Consider the guarantees, services, and options available. Exclusive advantages : Discover…

The Different Types of Insurance Offered by Axa

Axa offers a wide range of insurance, ranging from car insurance to health insurance, including home insurance and pension solutions. Each product is designed to meet varying needs, ensuring the protection needed depending on your situation.

Auto Insurance

Axa car insurance is available in several options, ranging from third-party insurance to all-risk coverage. It is crucial to evaluate your type of vehicle and your driving habits to choose the most suitable plan. To find out more about subscribing to a car insurance online with Axa, consult our complete guide.

Home Insurance

Axa home insurance covers damage related to your house or apartment, including theft, fire and water damage. Evaluating the value of your assets and the potential risks is the key to optimal coverage. Axa also offers customization options to meet your specific needs.

Health Insurance

With Axa health insurance, you can benefit from a wide range of guarantees to cover your medical expenses. This includes routine care, but also specific guarantees for alternative medicine or dental care. Find out about the different options to choose the one that suits you best. To learn more about health insurance, explore this link: Everything you need to know about mutual medical insurance.

Mutual and travel insurance: what you need to know before you leave

IN BRIEF Essential preparation before a trip: don’t neglect insurance. Difference between travel insurance And mutual. Importance of guarantees to leave peacefully. Consider the destination to choose the right coverage. Check the options And services available. Understand the risks related…

How to Compare Axa Offers

Before making a decision, it is essential to compare the different Axa offers. This includes prices, guarantee levels, and deductibles. Use insurance comparators to identify the offer that best suits your situation. Don’t forget to take into account customer reviews to get an overview of policyholder satisfaction.

Axa mutual health insurance: everything you need to know to choose the right one

IN BRIEF AXA offers personalized health insurance. Analyze your behavior in terms of care is crucial. There exists 7 formulas of AXA mutual insurance companies adapted to different needs. THE benefits include quality customer service and competitive prices. Consider the…

Steps to Subscribe to Insurance with Axa

To take out Axa insurance, the first step is to obtain a quote online. Fill in the required details regarding your situation and needs. Once you have obtained the quote, review the guarantees offered and adjust them if necessary. For practical advice, check out this ranking of insurers.

Axa mutual health insurance: everything you need to know about its formulas

IN BRIEF AXA Mutual Health offers a varied range of formulas. Reimbursement options ranging from 100% has 400%. Customizable formulas with modules additional. Offers adapted to seniors and specific health needs. Process of subscription simple and transparent. Guaranteed health insurance…

The Advantages of Choosing Axa

Choosing Axa means choosing peace of mind and complete coverage. Axa is recognized for its claims management and efficient customer service. The different customer reviews are a good way to assess the quality of the service offered by the insurer. For a more in-depth look, read our analysis of review of Axa Bank.

Axa France mutual life: contact and assistance guide

IN BRIEF Contact methods : Email, telephone, online form. Assistance : 24/7 availability for customer service. Claim declaration : Simplified process via telephone or online. Customer feedback : Complaint form available on the AXA website. Main number of customer service…

Conclusion

In summary, choosing insurance with Axa gives you access to a multitude of products and services adapted to your needs. Don’t hesitate to research and compare options to find the coverage that will give you the peace of mind you’re looking for.

Axa: complete guide to choosing the right insurance

In a world where protecting your assets and your future is essential, Axa presents itself as a key player in the field of insurance. This comprehensive guide offers you tips and tricks for selecting the best coverage for your specific needs. Whether you’re looking for auto, home, or health insurance, we help you navigate the available options and make an informed choice.

Understanding the different Axa insurance formulas

Before subscribing to an insurance contract, it is essential to understand the different formulas offered by Axa. Whether for car, home or health insurance, Axa offers a variety of options ranging from basic coverage to more extensive guarantees. Be sure to review each plan in detail to choose the one that best suits your needs.

Compare prices and guarantees

Another essential point when making your choice is the comparison of prices and guarantees. Axa offers a range of options at varying prices, so it’s crucial to use comparison tools to assess what’s on offer in the market. Platforms like the insurance comparator can be useful in visualizing the differences and making an informed choice.

Consult customer reviews

Before finalizing your decision, do not hesitate to consult the customer reviews. Many platforms, including UFC-Que Choisir, publish detailed reviews that can give you insight into policyholder satisfaction. This feedback can greatly influence your choice and alert you to the points to watch out for.

Subscribe online with Axa

Purchasing insurance online has become a common practice thanks to its convenience. Axa makes the process easy with clear steps and a comprehensive guide. For more information on the process to follow, consult their official website which offers practical advice to finalize your contract quickly and efficiently. You can find this information on the Axa website.

Choose the appropriate guarantees

You must also define which guarantees are essential for you. Whether you want protection against theft, accidental damage, or natural disasters, Axa offers various options that can be customized. It may be useful to consult insurance experts or online comparison sites to assess your needs.

Ask an expert for advice

Finally, do not hesitate to seek assistance from a expert in insurance. These professionals are trained to guide you towards the solutions best suited to your personal situation. Whether for a car, home or borrower insurance project, their know-how can make the difference.

Comparison of Axa Insurance Options

| Type of Insurance | Description |

|---|---|

| Auto Insurance | Protect your vehicle with suitable packages, ranging from third-party insurance to all risks. Personalized warranty options. |

| Home Insurance | Covers property in the event of damage, with several levels of protection. Includes options for tenants and owners. |

| Life Insurance | Protect your loved ones with suitable contracts. Configuration of payments and beneficiaries possible. |

| Health Insurance | Varied options for medical and hospital costs, with rapid reimbursement and choice of practitioners. |

| Travel Insurance | Covers unforeseen travel-related events, including cancellations and medical treatment abroad. |

| Real Estate Loan Insurance | Protection in the event of death or incapacity, obligation to guarantee loans between individuals and establishments. |

| Civil Liability Insurance | Protection against damage to others, essential for individuals and businesses. |

| Pet Insurance | Covers veterinary costs for your companions with plans adapted to their needs and ages. |

Testimonials on Axa: Complete Guide to Choosing the Right Insurance

“I was lost in choosing the different insurance options. Thanks to the complete guide to Axa, I was able to compare the guarantees and the prices according to my specific needs. I finally found a blanket that fits me perfectly! »

“As a new driver, choosing my car insurance seemed complicated to me. THE Axa guide helped me understand the different formulas and to select the one that offered me the best value for money. I now feel confident on the road. »

“I subscribed to a health insurance with Axa following reading their advice. Their clear explanations of guarantees offered and the additional options allowed me to choose coverage that meets my needs. I am very satisfied with my choice! »

“The online process for opening a Axa Bank account was very simple, and the customer reviews I consulted really reassured me. I highly recommend reading the testimonials before making a choice. »

“In looking for a car insurance, I came across the comparison offered by Axa. This not only allowed me to see the best offers, but also to inform me about the coverage options available. This is a great starting point for any insurance search. »

“I am delighted to have chosen Axa for my borrower insurance. Their guide was essential in understanding the details and specifics of the contracts. I was able to make an informed decision and I feel secure in my real estate project. »

Introduction

Choosing the right insurance can seem like a complex task, but it’s essential to have coverage that meets your specific needs. This article guides you through the different steps to select the most suitable Axa insurance. We will discuss the types of contracts, the guarantees available, as well as advice on making the best decision. With a thorough understanding of the options, you can effectively protect your future and that of your loved ones.

The different types of insurance at Axa

Axa offers a wide range of productsinsurance which meet the diverse needs of its customers. Among the most common are:

Car insurance

Car insurance is a necessity for every vehicle owner. Axa offers different formulas ranging from third-party insurance to all risks, through intermediate options. It is advisable to evaluate your personal situation, in particular the value of your vehicle and your driving history, to choose the most appropriate plan.

Home insurance

Homeowners insurance is crucial to protecting your home and personal property. Axa provides tailored solutions, including property warranty, civil liability and legal protection. Remember to analyze your assets and your security needs to determine the most suitable coverage.

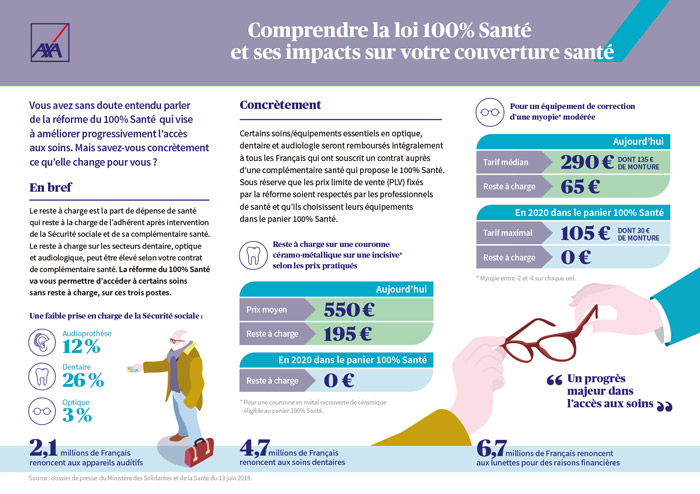

Health and mutual insurance

Have a health coverage reliable is fundamental. Axa offers mutual health insurance options that supplement Social Security reimbursements. Think about your specific medical needs, such as frequent use of specific care or treatments, to choose a mutual insurance company that suits you.

Analyze guarantees and options

To choose Axa insurance, it is crucial to understand the guarantees and options offered. Each contract may include various coverage options which can be added, according to your requirements.

Civil liability

Civil liability is often included in most insurance guarantees. This coverage protects against damage you may cause to others, whether as a driver or as a property owner. It is essential to check the limits of this guarantee to be well protected.

Deductibles and bonuses

When making your choice, find out about the franchises applied and the amount of premiums. A high excess means you will have to pay more in the event of a claim, while a low premium could mean fewer guarantees. So compare quotes taking these elements into account.

Check customer reviews

Testimonials from other customers can provide you with a unique perspective on the quality of Axa customer service. Evaluate them customer reviews regarding claims handling, customer service responsiveness and general satisfaction. This will give you valuable insight to make your decision.

Use comparison tools

In order not to feel overwhelmed by the options, it is advisable to use comparison tools. These tools allow you to juxtapose the different Axa offers with those of other insurance companies. This makes it easier to select the insurance that best suits your needs and budget.

Conclusion

Although selecting the right insurance from Axa can seem overwhelming, careful consideration of the different products and options, combined with a careful assessment of your needs, will help you make the right choice. Remember that protecting your future largely depends on the quality of the insurance you choose.

Axa: Complete Guide to Choosing the Right Insurance

Choose one insurance adequate can seem complex given the multitude of options available on the market. However, with a complete guide such as that offered by Axa, you can approach this process in a calm and informed manner. Axa stands out for its desire to support its customers in choosing their blanket, offering solutions adapted to each personal situation.

An important first step is to assess your specific needs. Whether you are looking for a car insurance, of a home insurance or a health insurance, it is essential to analyze your requirements based on your lifestyle, family and assets. Axa offers a diverse range of guarantees which allows everyone to find the formula that suits them best.

In addition, Axa encourages you to compare the different offers available. By taking the time to examine not only the prices, but also the guarantees and the services included, you can make an informed choice. Customer reviews of various Axa products also provide valuable insight. This will allow you to better understand the reputation and reliability of the insurer you are considering choosing.

Finally, don’t hesitate to ask questions and request clarification regarding contracts. Axa customer service is here to help you clarify any points that may seem unclear to you. Opting for Axa means choosing a trusted partner for your safety and that of your loved ones.

FAQ: Complete Guide to Choosing the Right AXA Insurance

How important is good insurance?

Good insurance is essential to protect your property, your health, and your future. It gives you peace of mind in the event of a disaster and allows you to deal with unforeseen events.

How do I choose the right insurance for my needs?

To choose the insurance that is right for you, it is important to compare the available options, assess your specific needs and consider the guarantees included in each contract.

What guarantees are offered by AXA?

AXA offers a wide range of guarantees, from car, home, health insurance, to specific coverages such as borrower insurance. It is important to read the general conditions carefully to understand each guarantee.

How does the subscription process work at AXA?

The subscription process at AXA is simple and transparent. You can start with an online quote, then finalize your contract online or in agency, according to your preference.

What are customer opinions on AXA?

Customer opinions on AXA vary, but they generally highlight the quality of customer service and the ease of claims management. It is advisable to read several feedbacks to form a complete opinion.

Does AXA offer family insurance options?

Yes, AXA offers family insurance options that allow you to group several insurance policies, often with discounts on premiums.

How to report a claim with AXA?

To report a claim with AXA, you can do so online, by phone, or by visiting an agency. Supporting documents may be required to process your claim.

Are there any discounts available on first insurance contracts?

AXA often offers discounts for new customers or for multi-insurance contracts. Ask your AXA advisor to find out about current offers.

How can I cancel my insurance contract?

You can cancel your insurance contract by complying with the conditions specified in your contract. Written notification is generally required to cancel.

What are the payment terms for insurance premiums at AXA?

AXA offers different payment terms for premiums, including monthly, quarterly or annual payment, which allows you to choose the one that best suits your budget.