|

IN BRIEF

|

There mutual health insurance in Algeria is proving to be a subject of great importance for everyone, whether expatriate or resident. It constitutes a real safety net, allowing access to medical care without worrying about the exorbitant costs that may arise. Although there is no established private health insurance system in the country yet, it is crucial to familiarize yourself with the various options available. This exploration will guide you through the specifics and benefits of mutual health insurance, while shedding light on the issues to guarantee your well-being and that of your loved ones.

Mutual health insurance in Algeria represents a crucial issue for many people, whether employees, expatriates or residents. Although there is not yet a fully developed private health insurance system, understanding the characteristics of mutual health insurance can make all the difference in access to medical care. This guide looks at the advantages and disadvantages of mutual health insurance in Algeria, in order to inform readers about their choice in terms of health coverage.

Benefits

THE mutual health insurance offer several significant benefits for their members in Algeria. First of all, they allow a reimbursement of up to 80% medical expenses, an essential aspect to relieve the budget of families in the event of unforeseen health expenses. In addition, in the event of chronic illness, reimbursement is full, which constitutes invaluable support for people in need of extensive and continuous care.

Then, for expatriates residing in Algeria, the international health insurance offer the possibility of choosing a type of intervention according to their needs. This includes options such as first euro insurance or packages adapted to travel abroad, thus guaranteeing optimal coverage in all circumstances. It is also good to know that mutual health insurance can serve as a complement to Algerian security, guaranteeing better coverage of medical costs.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its advantages, mutual health insurance in Algeria also has certain disadvantages. The absence of a well-established private health insurance system limits choices for users. In addition, although the costs are reimbursed up to 80%, this means that part of the expenses remains the responsibility of the insured, which can lead to financial difficulties, especially for households with modest incomes.

Also, expatriates must be vigilant about the coverage offered by their mutual insurance companies, because not all treatments are necessarily covered. It is also possible to encounter problems with refund, which can add a layer of stress to the process of accessing care. For more information, it is recommended to turn to external resources such as those offered by the health insurance site for expatriates or consult guides available on health coverage in Algeria.

Finally, it is essential to keep in mind that mutual health insurance does not completely replace good health coverage. Gathering information and evaluating different offers are crucial to making the best possible decision. Online platforms like AGF mutual health Or Travel insurance in Algeria provide valuable details.

There mutual health insurance is a crucial subject for any resident in Algeria, whether employed or expatriate. Understanding how it works and its benefits is essential to benefit from the best possible coverage. This article guides you through the different options available, reimbursements, as well as the specificities of the Algerian health system.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The health system in Algeria

The Algerian health system is mainly based on social security. According to the provisions in force, each person, whatever their nationality, must be affiliated to social security, in particular to the CNAS (National Social Insurance Fund) or to the CASNOS (National Social Security Fund for Non-Employees). This framework guarantees access to health care, but it is important to note that reimbursed services do not always cover all costs incurred.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Reimbursements for health benefits

As a general rule, health care is reimbursed at 80% of the prices charged, except for chronic illnesses where reimbursement is full. This mixed reimbursement option may push policyholders to consider a complementary mutual insurance to cover the remainder. It is advisable to explore the different options offered by mutual insurance companies in order to choose the one that best meets your needs.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Insurance Options for Expats in Algeria

For expatriates, choose a international health insurance may prove wise. Several companies offer insurance contracts that specifically cover the needs of expatriates, such as the possibility of selecting the type of intervention, whether first euro insurance or other suitable formulas. This is particularly important in the context of a medical inflation increasing which can influence the costs of care.

Coverage options are also available, including expenses for urgent care and repatriation service if needed. For more details, you can check out resources such as Health Insurance in Algeria Or the insurance comparator for expatriates.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Importance of private health insurance

Although there is not yet a private health insurance system in Algeria, subscribing to a private mutual health insurance can provide more comprehensive coverage. The terms and conditions may vary, as well as the prices, and it is recommended to take the time to analyze the different offers available such as those proposed by private health mutuals.

How to choose the right health insurance?

The process of selecting a suitable health insurance plan requires a careful assessment of your potential medical needs, your care habits and your budget. To guide you, resources such as this guide on choosing the ideal mutual health insurance for expatriates can be very useful.

In summary, the landscape of mutual health insurance in Algeria presents many opportunities to ensure adequate coverage. Understanding how the system works and exploring the options available will allow you to benefit from the protection you need for your health and financial security.

There mutual health insurance in Algeria is an essential subject for everyone, whether employees, expatriates or non-residents. It plays a crucial role in guaranteeing access to health care, complementing social security and insurance systems. This article presents the key elements to know about mutual health insurance, its advantages, as well as the options available to choose your coverage.

Understanding the mutual insurance system in Algeria

In Algeria, the health system is mainly based on social security, involving the National Social Insurance Fund (CNAS) and the National Social Security Fund for Non-Employees (CASNOS). Mutual health insurance complements these systems, thus offering broader and more effective coverage. Although there is not yet a widespread private health insurance system, expatriates and the self-employed can seek private insurance to benefit from coverage tailored to their needs.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Mutual health insurance benefits

The services offered by mutual health insurance companies in Algeria can vary considerably. In general, health care is reimbursed up to 80% of the agreed rate, except in the case of chronic illness, where reimbursement is full. It is crucial to find out about the types of care and reimbursement options available before joining a mutual insurance company.

Choosing the right health insurance

To choose the ideal health insurance, it is essential to evaluate several elements: your medical needs, your budget, as well as the guarantees offered. Some mutuals offer specific options for expatriates and those who travel regularly. For example, you can opt for insurance from the 1st Euro, which reimburses from the first euro of health expenses, or choose more comprehensive formulas.

Options for expatriates

Expatriates in Algeria have the possibility of subscribing to international health insurance adapted to their situation. These compacts can include broader coverage, such as repatriation and protection against exorbitant medical expenses. To learn more about the best international health insurance options, consult resources like Allianz or the UFE.

Travel insurance: a necessity

If you are traveling, it is important to subscribe to travel insurance that covers medical expenses as well as unforeseen events related to cancellation or repatriation. Sign up for protection tailored to local conditions, and check for specific coverages related to Covid-19. Companies like AXA Assistance offer excellent options.

Useful resources

To navigate the complex world of health insurance in Algeria, consult specialized sites that offer advice and comparisons. Platforms like Mutuelle santé pour voyager or the Caisse des Français de l’Etranger provide useful information for all your questions regarding health coverage in Algeria.

| Criteria | Details |

| Type of insurance | Basic health insurance and additional options available. |

| Reimbursement | 80% of expenses, except for chronic diseases which are fully reimbursed. |

| Protection for expatriates | Possibility of taking out adapted international insurance. Affiliation |

| Obligation to affiliation to social security (CNAS or CASNOS). | Costs |

| Contributions vary depending on the coverage chosen. | Access to care |

| Services available in public and private establishments. | Travel insurance |

| Traveler health insurance options, including Covid-19 coverage. | Duration of coverage |

| Renewable annual contracts for expatriates. | Medical assistance |

| Access to emergency assistance and repatriation services. | discover our mutual health solutions in Algeria, adapted to all your needs. benefit from comprehensive medical coverage, personalized services and quality support to guarantee your well-being and that of your loved ones. |

The system of

mutual health insurance in Algeria is a subject that generates many opinions, particularly among those who benefit from this type of coverage. Many individuals have legitimate questions about the reimbursement levels and the protection offered by these mutual insurance companies. For some, the fact of being able to be reimbursed at 80% of benefits, except in the event of chronic disease where reimbursement is full, is a significant advantage. This helps relieve some of the medical costs, making care more accessible. Many expatriates also testify to the importance of subscribing to

international health insurance . It is crucial to choose the type of intervention that corresponds to your needs. Options like insurance1st Euro are very popular. This choice ensures optimal coverage during travel or extended stays outside the country. Furthermore, the

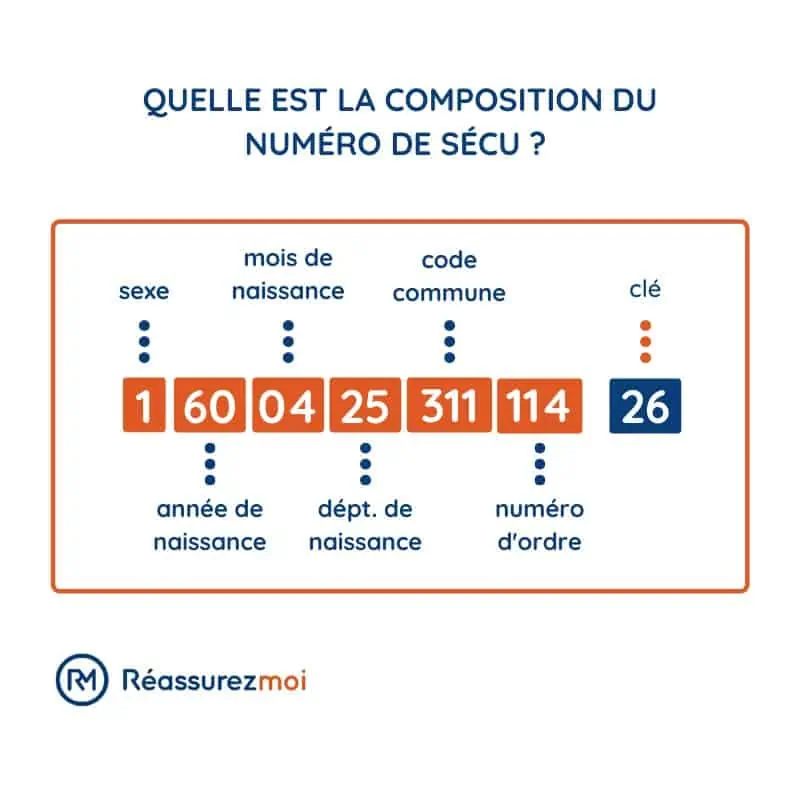

economic situation current situation and medical inflation in Algeria mean that many are turning to Fund for French people abroad (CFE) which offers 67% coverage for hospitalizations. This alternative is particularly appreciated for its ability to adapt to the needs of expatriates wishing to seek treatment in Algeria or abroad. Let us also bear witness to the obligations of affiliation to the

social security , which affect all people, whether they are employees or not. Be affiliated with theCNAS or to the CASNOS is fundamental to benefit from a form of social protection, even if many feel slightly lost in the twists and turns of administrative procedures. Finally, for those who plan to use their health coverage by providing treatment abroad, it is essential to fully understand the steps to follow. Receive authorization from the

National Social Insurance Fund (CNAS) before leaving is essential if you want to avoid surprises. This process, although a little tedious, is a step that many policyholders take seriously to benefit from quality care with complete peace of mind. Introduction to mutual health insurance in Algeria

There

mutual health insurance in Algeria represents a crucial issue for individuals seeking to optimize their medical coverage. With a health system that may have certain limitations, it is essential to understand how mutual insurance companies work to benefit from better financial protection against health expenses. This article will guide you through the fundamental aspects of mutual health insurance in Algeria, allowing you to make an informed choice. What is mutual health insurance?

A

mutual health insurance is an organization that offers reimbursements for medical expenses not covered by the social security system. In Algeria, this type of coverage is particularly relevant in a context where health care is sometimes limited by waiting times or insufficient resources. Mutual insurance companies make it possible to complete reimbursements of social security , thus offering greater peace of mind to policyholders.The characteristics of mutual health insurance in Algeria

In Algeria, the

mutual health insurance do not yet have a developed private health insurance system. However, they exist and offer varying levels of coverage. Mutual insurance companies can offer benefits covering part of the costs of medical consultations, hospitalization, medications, as well as dental and optical care. Coverage varies depending on the contract, and it is crucial to carefully consider the options available. Services reimbursed by mutual insurance companies

In general, health benefits are reimbursed up to

80% of the social security rate . This means that for routine care, the insured person can benefit from partial reimbursement, while for chronic illnesses, reimbursement is full. It is essential to check the specifics of the mutual insurance contract concerning the types of care covered.The importance of international health insurance

For expatriates living in Algeria, take out a

international health insurance can be an advantageous solution. This allows access to care abroad or in private establishments in Algeria. International insurance companies can offer coverage from the first euro, which ensures protection from the start of care. Services can include medical repatriation, medical expenses, and more. Choosing the right health insurance

To choose the

mutual health insurance which suits you best, it is advisable to take several factors into account. Start by assessing your needs based on your health, medical habits and financial situation. Compare the different offers available, this includes reimbursement levels, waiting periods and warranty exclusions. Organizations like the National Social Insurance Fund (CNAS) and the National social security fund for non-employees (CASNOS) can provide valuable information about the options available. It is essential to become familiar with the world of

mutual health insurance in Algeria to ensure adequate coverage. Making informed decisions when choosing mutual insurance not only allows you to better manage medical expenses, but also to benefit from the peace of mind necessary to face life’s unexpected events. Do not hesitate to inform yourself and ask questions to choose the solution best suited to your needs. discover the advantages of Algerian mutual health insurance, an effective way to guarantee your financial security and your access to health care in Algeria. Find out about the different offers, services and protections adapted to your needs.

mutual health insurance in Algeria is a crucial subject for all citizens and expatriates wishing to benefit from adequate protection in terms of medical expenses. Although the national health system offers many services, it is essential to be informed about the coverage options available to provide financial security when needed. Currently, health services are generally reimbursed at 80% of the price, except for chronic illnesses which benefit from full reimbursement. This information should encourage careful assessment of the type of

health protection necessary, whether it is an employee or non-employee status. The social security system requires workers to be affiliated to the CNAS or to the CASNOS , guaranteeing coverage adapted to their needs.For expatriates, the choice of a

international health insurance turns out to be a good investment. Different formulas are offered, allowing medical interventions to be carried out in the best conditions. This flexibility is essential for those who frequently move from one country to another and want to remain covered abroad. It is also important to note that access to quality care can vary, making it all the more necessary to take a

additional insurance adequate. Evaluating multiple offers and understanding the details of insurance contracts will allow you to be better prepared when you face unforeseen medical situations. FAQ about mutual health insurance in Algeria

What is the reimbursement rate for health services in Algeria?

Most health benefits are reimbursed up to 80% of the established rate, except in the case of chronic illness where reimbursement is full. Can expatriates in Algeria take out health insurance?

Yes, expatriates have the possibility to subscribe to a international health insurance which allows them to benefit from medical care adapted to their needs. What is the role of the Algerian social security system for employees?

The Algerian social security system provides health care coverage for employees, with a guaranteed national minimum wage (SNMG) fixed, for example, at 20,000 DZD .Is healthcare free in Algeria?

In principle, healthcare is not completely free in Algeria. Patients usually have to pay part of the cost, even if some services are covered by Social Security. What is the medical coverage for foreign residents in Algeria?

Foreign residents must verify that they have a adequate health insurance , because medical costs may not be covered by Algerian social security.What travel insurance options are available in Algeria?

There are several solutions for travel insurancein Algeria, including coverage of medical expenses, repatriation and cancellations linked to the Covid-19 pandemic. How does the health system work in Algeria for expatriates?

Expatriates should find out about the social protection in Algeria and ensure their affiliation to the CNAS or to the CASNOS , depending on their status.What information should I provide to subscribe to mutual health insurance in Algeria?

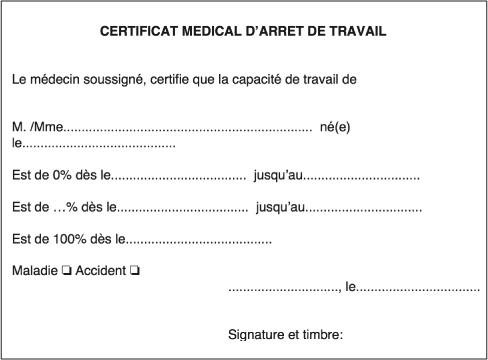

To take out mutual health insurance, it is necessary to provide documents such as identification, proof of residence and possibly medical check-ups according to the requirements of the chosen mutual health insurance.