|

IN BRIEF

|

The selection of a mutual health insurance tailored to your needs is essential, especially for expats or anyone looking for effective cover abroad. There 1st euro mutual insurance stands out for its ability to reimburse health costs from the first euro spent, thus offering a real advantage in avoiding excessively high out-of-pocket costs. In this quest, it is crucial to understand the specificities of this option, its comparative advantages compared to other formulas such as “additional insurance to the CFE”, and above all, how to choose the coverage that best suits you. Let’s discover together the keys to making the right choice when it comes to mutual health insurance!

Choose one mutual health insurance adapted to your needs is essential, especially when you are an expatriate or not affiliated with the Fund for French People Abroad (CFE). There 1st euro mutual insurance is an option worth exploring. It offers reimbursement of medical expenses from first euro spent, thus offering many advantages, but also some disadvantages. This article details these points to help you make an informed choice.

Benefits

There 1st euro mutual insurance presents several advantages which make it attractive for many policyholders. First of all, it guarantees immediate reimbursement, as soon as health expenses are incurred. Unlike other plans, it is not necessary to wait for reimbursement of the CFE. This guarantee constitutes a major advantage for those who want rapid and efficient coverage of their medical expenses.

Additionally, the absence of out-of-pocket costs is another significant advantage. With a 1st euro mutual insurance, you are reimbursed 100% of the costs incurred, eliminating the anxiety associated with unexpected costs. Reimbursement times are also reduced, allowing you to quickly benefit from money for your care. For more information on health insurance options for expats, you can check out resources such as International Health.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many advantages, the 1st euro mutual insurance also poses certain limits. First of all, there may be higher contributions compared to other traditional health insurance. This can become a deterrent, especially for those on a tight budget. It is therefore important to compare the different offers available to check whether the quality-price ratio suits you.

Furthermore, some 1st euro mutual insurance may have warranty exclusions, meaning certain health benefits may not be covered. It is essential to read the insurance terms and conditions carefully to familiarize yourself with which services are covered and which are not. To help navigate these choices, you can consult online comparison sites that highlight the different options, such as AXA mutual insurance rates.

In short, the 1st euro mutual insurance represents an attractive solution for many policyholders thanks to its immediate care and full reimbursement. However, it is crucial to examine the prices and check the guarantees in order to make an informed choice adapted to your personal situation. Feel free to explore different online resources for an in-depth comparison and advice on the best approaches.

Are you considering subscribing to a 1st euro mutual insurance ? This type of health insurance has become a popular option for those looking for quick and complete reimbursement of their healthcare costs. In this article, we will explore in detail what 1st euro mutual insurance is, its advantages compared to other insurances, and how to choose the one that suits you best.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

What is a 1st euro mutual?

A 1st euro mutual insurance stands out for its ability to intervene from the first euro spent. This means that you are reimbursed in full and immediately, without needing to go through a primary fund like the CFE. This operation offers simplicity and transparency particularly appreciated by policyholders, especially during unforeseen health expenses.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The advantages of mutual insurance at the 1st euro

Choosing a 1st euro mutual has several advantages:

- Fast refunds: By opting for this type of insurance, you benefit from reduced reimbursement times.

- Reduction of the remainder payable: Being reimbursed from the first euro, your out-of-pocket costs will be minimal, which is essential for your health budget.

- Global Accessibility: Many 1st euro mutual funds are designed to be valid worldwide, which is ideal for expats.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

How to choose your 1st euro mutual insurance?

The choice of your 1st euro mutual insurance must be made taking into account several criteria:

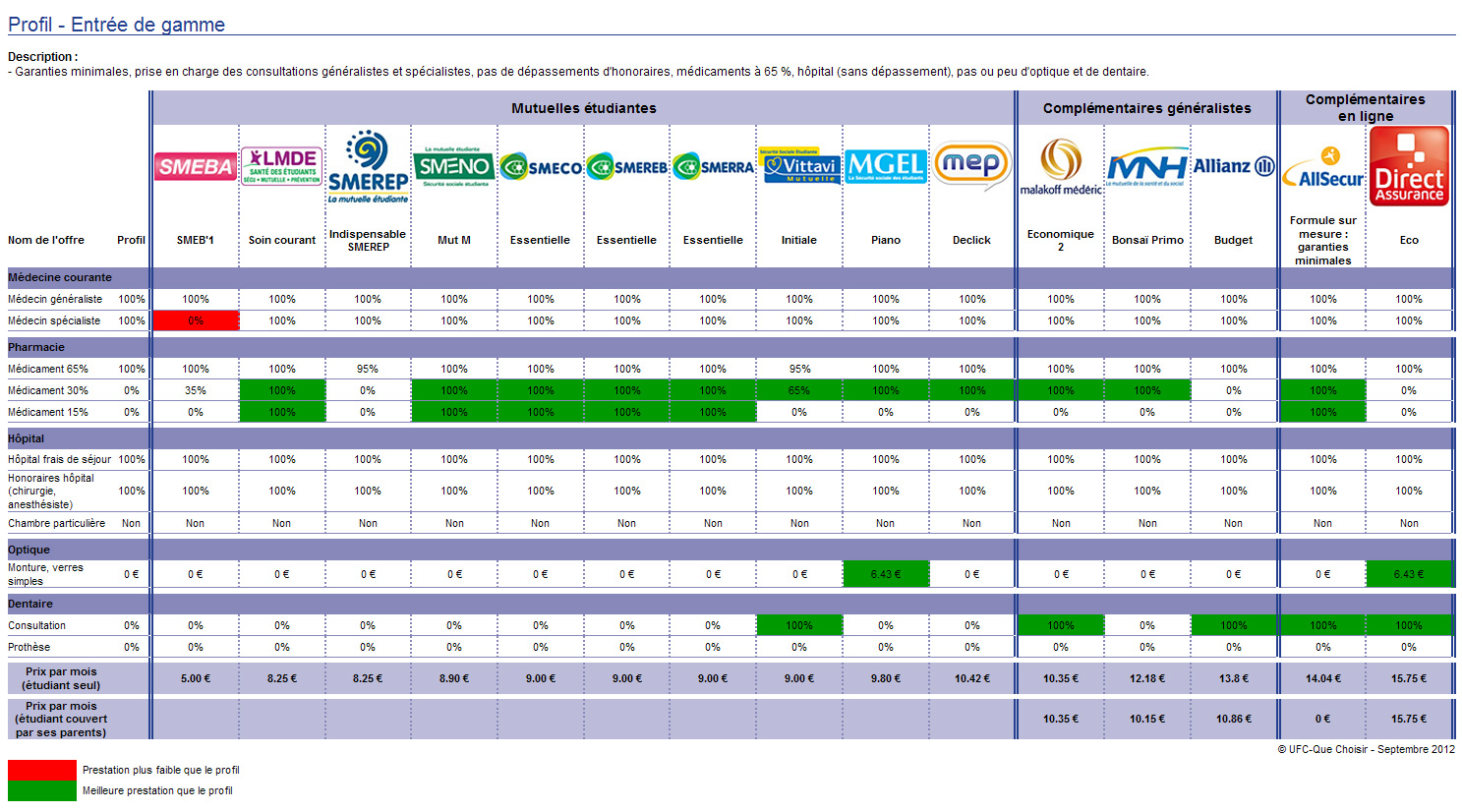

- Comparison of guarantees: Check the guarantees covered by the mutual insurance company, in particular routine care, hospitalization, and dentistry.

- Prices: Contributions vary from one insurer to another. It is therefore essential to compare prices to find the most advantageous option for you.

- Additional services: Find out about the services offered such as assistance, teleconsultation, or even support for specific treatments.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

1st euro mutual or CFE complementary health insurance?

If you are an expatriate, you are probably wondering whether it is better to opt for a 1st euro mutual insurance or a complementary health CFE. The main difference is in the support. While the CFE reimburses only after declaration, the 1st euro mutual intervenes from the start, without requiring complex administrative procedures.

To learn more about the differences between these two types of insurance, check out this article: International insurance at 1st euro or complementary health CFE.

Consult an online comparator

To make your choice easier, do not hesitate to use a online comparator. These tools will allow you to quickly view the different offers and make an informed choice based on your needs and your budget. You will often find advice to help you in your approach.

If you would like to explore concrete examples of 1st euro mutual insurance companies, consult this link: First euro individual expat pack at Malakoff Humanis.

Choose one 1st euro mutual insurance is essential to guarantee optimal health coverage, especially if you are an expatriate or travel regularly. This type of insurance offers you the possibility of being reimbursed from the first euro spent, without going through a social security fund. In this article, we offer you practical advice to make the right choice and better understand the issues of this health coverage.

What is a 1st euro mutual?

There 1st euro mutual insurance stands out for its ability to reimburse health costs from the first euro incurred. Unlike a traditional mutual insurance company, it is not necessary to go through a social security organization such as the CFE. This means that you can obtain rapid and simplified reimbursement for your healthcare expenses, whether for medical consultations, surgeries or medications.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

The advantages of a 1st euro mutual fund

Opt for one mutual health insurance to the 1st euro has several notable advantages. First of all, it makes it possible to considerably reduce the remains responsible for the insured, which is particularly useful in the event of a medical emergency. In addition, reimbursement times are often shorter, allowing you to quickly access care without worrying about administrative formalities.

How to choose the right 1st euro mutual fund?

To make the right choice regarding 1st euro mutual insurance, it is essential to assess your specific health needs. Take into account the types of care you may require and check the guarantees offered by each insurer. Do not hesitate to compare the prices and the levels of coverage offered by several insurance companies.

Criteria to take into account

When making your selection, pay particular attention to the following criteria: price contributions, services additional benefits in terms of insurance and retirement, as well as the reputation of the insurer. Also make sure that the mutual covers your health costs abroad if you are an expatriate. Some companies, such as AXA, offer solutions adapted to French people living outside France.

Where to find reliable information?

To keep you well informed about the 1st euro mutual insurance, several online resources are useful. Consult insurance comparators to clearly visualize the options available. You can also go to specialized sites to get advice and feedback from other users. For example, you can discover detailed advice on choosing a good expat health insurance here or find out about the rates of AXA mutual insurance here.

Finally, for a thorough understanding of the subject and to take into account all the available options, it may be beneficial to read expert articles on the comparison between CFE health insurance and that of the 1st euro, as proposed here.

The advantages of the 1st euro mutual

| Criteria | Details |

| Reimbursement from the 1st euro | Immediate support without excess. |

| Without CFE affiliation | No need to be attached to the CFE to benefit from it. |

| Reimbursement deadlines | Fast process, usually within a few days. |

| Competitive rates | Contributions accessible from 47 euros per month. |

| Pension options | Coverage for health and retirement risks. |

| Access to a healthcare network | Possibility of choosing partner health professionals. |

| International network | Coverage of care outside France. |

Testimonials on Mutuelle 1er Euro: Everything you need to know to choose well

The choice of a mutual health insurance at 1st euro can sometimes seem confusing, especially when it comes to expatriation. Several policyholders share their experience in order to enlighten those who find themselves in this situation.

Anne, an expatriate in Australia, says: “When I left France, I didn’t know what type of insurance to choose.international insurance at 1st euro allowed me to benefit from immediate coverage. Every euro spent was reimbursed without any preconditions. This considerably alleviated my financial worries and let me enjoy my new life peacefully.”

Jean, who arrived in Canada, explains why he opted for complementary health CFE : “I had initially thought about a 1st euro mutual fund, but I realized that the CFE could offer significant advantages, particularly for specific care. However, I recognize that the guaranteed from the 1st euro are very attractive, especially for those who want a quick refund.”

Sophie, based in Portugal, takes stock of her subscription: “Subscribe to a mutual insurance at 1st euro was the best decision. The system works perfectly and I have never had to pay up front. Additionally, I appreciate the fact that this coverage allows me to freely choose my healthcare providers.”

For those wondering about the cost, Lucas shares: “After comparing several offers, I found a 1st euro health insurance at a very affordable price. THE reduced repayment periods and the absence of any remaining charges also convinced me. It’s clear that for an expatriate, this is an option that should not be overlooked.”

Finally, Claire testifies to the advantages linked to the absence of a link with the CFE: “It really relieved me not to have to adhere to a system that I did not fully understand. With my expatriate mutual insurance at 1st euro, I only pay the contribution due to my insurer, which simplifies things enormously.”

Introduction to Mutuelle 1er Euro

The mutual 1st euro is a health coverage option that is attracting more and more people, especially those looking to optimize their health expenses. This type of insurance allows reimbursement of health costs from the first euro spent, without having to go through a primary fund such as the CFE. In this article, we will explore the essential aspects to consider when choosing the 1st euro mutual that will best meet your needs.

Understand how 1st euro mutual insurance works

The mutual 1st euro stands out for its simple and straightforward operation. Unlike other forms of insurance where a minimum amount must be reached before reimbursement, this mutual covers medical costs from the first expense. This allows immediate reimbursement without preconditions.

The advantages of 1st euro mutual insurance

Choose one 1st euro mutual insurance has several advantages. Firstly, it offers 100% reimbursement of costs incurred, which considerably reduces the remainder payable by the insured. In addition, it guarantees reduced reimbursement times, thus allowing smoother financial management in the event of medical expenses.

The guarantees offered

When considering a 1st euro mutual, it is crucial to examine the guarantees it offers. Many mutual insurance companies include various benefits such as reimbursement of medical consultations, hospitalization costs, alternative medicine, and even dental and optical care. Make sure you choose coverage that meets your specific needs.

Criteria for choosing a 1st euro mutual insurance company

To choose your mutual health insurance at 1st euro, several criteria must be taken into account. Here are the main elements to evaluate:

The mutual rate

Price is often a deciding factor. Compare the prices of the different mutual insurance companies and make sure you understand what is included in each offer. Be careful of insurance companies offering services at very low prices, as they may neglect certain essential guarantees.

Opinions of policyholders

Consulting feedback from other policyholders can provide you with a clear picture of the quality of customer service and reimbursements. Insurance comparison sites or forums can help you gather valuable opinions.

Reimbursement deadlines

Another criterion not to be underestimated is the repayment period. Find out how quickly the mutual reimburses its policyholders. A mutual fund that takes time to repay can cause financial difficulties in the event of unexpected expenses.

By choosing your 1st euro mutual insurance, you ensure appropriate health protection and financial support if necessary. Take the time to evaluate your options, taking into account the criteria mentioned, to make an informed choice that will meet your expectations and those of your family. Remember that your health and your budget deserve your full attention to ensure adequate coverage.

There mutual insurance at 1st euro stands out for its unique operation which guarantees full reimbursement of health costs from the first euro spent. This type of insurance is particularly suitable for people wishing to avoid complex administrative procedures linked to reimbursements, because it does not require the intervention of a primary fund. This makes it an ideal solution for expatriates, self-employed workers, or anyone wanting simple and effective health coverage.

When looking for a 1st euro mutual insurance, it is crucial to assess your specific needs. Consider the frequency of your medical expenses, the nature of the medical care you may require, and the network of healthcare professionals available to you. A good mutual insurance company must not only cover current costs, but also offer guarantees adapted to your personal situation, such as pension options or specific coverage for particular care.

THE varied prices 1st euro mutuals should also be considered. Contributions may differ from one company to another, so it is useful to carry out a comparison offers available on the market. Remember that price should not be the only determining factor. The quality of customer service, reimbursement times, and warranty exclusions must also be taken into account in your choice.

Finally, take the time to read the reviews of other policyholders and consult online comparison sites to gain an overview of the different options available to you. By following these tips, you will be able to make an informed choice for your mutual health insurance to the 1st euro, and thus protect your health optimally.

FAQ about Mutuelle 1er Euro

What is a 1st euro mutual? There 1st euro mutual insurance is health insurance that reimburses health costs from the first euro spent, without needing to go through a primary fund like the CFE.

What are the advantages of a 1st euro mutual insurance company? The main advantages include a immediate refund health costs, reduced remaining cost, and generally shorter repayment periods.

How does a 1st euro mutual fund work? This mutual covers the medical expenses from the first euro committed, thus allowing optimal coverage without advance costs.

Who is the 1st euro mutual insurance for? It is mainly aimed at expatriates or to people without affiliation with the CFE, looking for complete coverage for their health care.

What types of costs are covered by a 1st euro mutual fund? This mutual insurance generally covers medical expenses, consultations, hospitalization, and sometimes even drugs and preventive care.

Do you have to be affiliated to the CFE to benefit from 1st euro mutual insurance? No, the 1st euro mutual insurance operates independently of CFE affiliation, allowing policyholders to only pay the contribution due to their insurer.

What criteria should you take into account when choosing your 1st euro mutual insurance company? It is important to consider the guarantees offered, THE contribution rate, and the repayment period, as well as the opinions of policyholders.