|

IN BRIEF

|

In a world where health is paramount, it is essential to have health insurance reliable to protect your well-being and that of your family. L’Allianz Health insurance stands out for its varied options and customizable guarantees which meet the specific needs of each insured person. Whether you are looking for a complementary health to complete the reimbursements of your compulsory scheme, a mutual health insurance business for your employees, or even a international health insurance for your travels, Allianz has what you need. Let’s explore everything you need to know about the health solutions offered by Allianz and the benefits they can offer.

In a world where health is a priority, choose the right one health insurance is essential. Allianz Health Insurance offers a multitude of options to meet your personal or professional needs. This article reviews the main advantages and disadvantages of this coverage to help you make an informed choice.

Benefits

One of Allianz’s strengths is its offering of 100% Health guarantees in essential fields such as optics, dental and audiology. Thanks to these guarantees, policyholders can benefit from full refunds with no out-of-pocket costs, thereby alleviating financial concerns related to health care.

Furthermore, the company health insurance offered by Allianz is a valuable tool for employers. It protects not only employees, but also their families, helping to reduce out-of-pocket health costs. This promotes a climate of trust and well-being within teams.

Policyholders can also manage their contract online, with the possibility of easily tracking their health reimbursements, download statements and obtain third-party payment certificates, thus facilitating all administrative procedures.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Prices for different ranges may be perceived as high compared to other companies. This can pose a problem for people looking for low-cost coverage.

Furthermore, the termination of your complementary health insurance can sometimes seem complex for some policyholders. In fact, you must terminate your contract when it expires, which requires some organization. To find out more about the termination conditions, you can consult the information available here.

Finally, despite the numerous options and coverages offered, some policyholders may find that reimbursements in certain specific areas, such as osteopathy, remain insufficient. For details on dental reimbursements, consult the following link here.

Health insurance is an essential component of social protection, and with Allianz, you can benefit from solutions tailored to your needs. This article offers you a complete overview of Allianz Health insurance, discussing its different options, its advantages, and what sets it apart in the market. Whether you are looking for complementary health insurance or professional mutual insurance, Allianz offers products that could meet your expectations.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The different Allianz Health Insurance plans

Allianz offers a personalized health insurance that adapts to your specific needs. Whether you are an individual looking for a health solution for yourself or your family, or a professional looking to ensure the protection of your employees, there is an Allianz plan that will suit you perfectly. In addition to basic guarantees, Allianz offers options such as 100% Health guarantees in optical, dental And audiology which supplement social security reimbursements.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The role of company health insurance

In a professional context, the company health insurance is mandatory and constitutes a major asset for your employees. By including this type of coverage in your group health contract, you allow your employees to reduce their out-of-pocket costs for health costs, while improving their satisfaction and well-being. This commitment to the health of your employees also reflects a positive image of your company.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The advantages of complementary health insurance

There complementary health has the main role of supplementing the often insufficient reimbursements of your compulsory scheme. For self-employed workers (TNS), taking out supplementary insurance can be essential to ensure adequate coverage. Allianz Santé offers specific solutions for TNS, allowing them to benefit from improved reimbursements adapted to their needs.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Peace of mind with international health insurance

For those who travel often or live abroad, theinternational health insurance of Allianz presents itself as a necessity. It guarantees your emergency care coverage anywhere in the world, giving you invaluable peace of mind. Whether for diagnostics or post-treatment care, Allianz has you covered, whether you are at home or abroad, including within the Benelux.

Online tools for easy monitoring

Allianz makes managing your health easier with intuitive online tools. You can view and track your health reimbursements, download your statements and your third-party payment certificate in just a few clicks. This ease of access to information is a major asset for better managing your healthcare expenses.

Understanding the third-party payment system

THE third party payer simplifies your procedures. To benefit from it, simply present your Vitale card, accompanied by your third-party payment certificate. This solution reduces the need to advance costs, thus making access to care easier and faster.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Choose Allianz for your health insurance

Choosing Allianz means ensuring you benefit from recognized and accessible mutual insurance. With numerous favorable opinions, Allianz mutual health insurance has a competitive offer adapted to contemporary needs. Do not hesitate to visit their customer area to consult the details of their offers and get personalized quotes.

Allianz Health Insurance is a wise choice to guarantee optimal well-being for you and your family. With a varied range of health products, Allianz allows you to personalize your coverage and benefit from reimbursements tailored to your needs. In this article, we will explore the different health insurance options and the benefits they offer.

The advantages of complementary health insurance

Opt for one complementary health is essential to fill the reimbursement gaps in your basic plan. Thanks to Allianz, you can benefit from guarantees such as 100% Health which fully covers optical, dental and audiology costs. This solution represents a real asset for limiting unforeseen expenses and preserving your health budget.

Online reimbursement tracking

With Allianz, easily view and track your health reimbursements online. You also have the possibility to download your health counts and your third party payment certificate. This simplifies the management of your healthcare expenses and allows you to quickly access all the necessary information.

Corporate health insurance

Subscribing to company health insurance is often mandatory to protect employees and their families. With a collective health contract, you reduce your employees’ remaining medical expenses. This reassuring coverage is a real plus for retaining your employees.

Personalized health insurance for self-employed workers (TNS)

Self-employed workers can also benefit from personalized health insurance that meets their specific needs. Subscribing to complementary health insurance makes it possible to supplement the sometimes insufficient reimbursements of their compulsory plan, thus ensuring more complete coverage for themselves and their family.

International health insurance

For those who travel often or live abroad, theinternational health insurance is an essential option. Allianz offers tailored solutions that cover your medical costs in the event of emergency care, and support necessary diagnosis and treatment wherever you are. For more details on these offers, visit the Allianz website on this subject here.

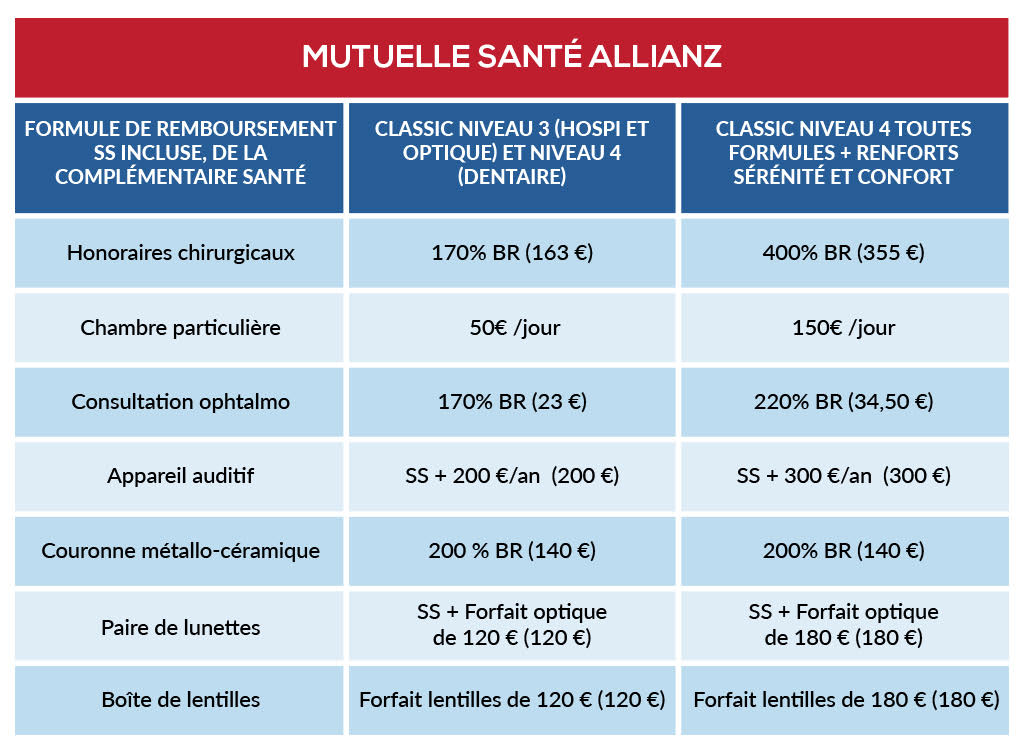

Reimbursements and health services

It is important to know the details of refunds offered by your mutual insurance company. Allianz offers attractive reimbursements for various treatments, including those related to optical and dental care, thus guaranteeing significant financial support in your health journey. You can view the details of health services of Allianz on their site.

Termination of complementary health insurance

If you wish to change mutual insurance, please note that you can cancel your complementary health each year when it expires. Take the anniversary date of your contract into account for a simple transition.

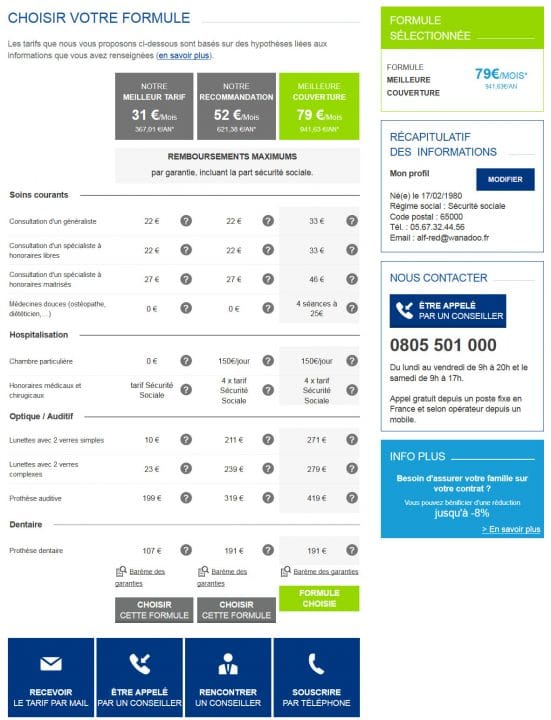

Get reviews and prices

Before choosing health insurance, it may be wise to consult the notice And prices different offers. Allianz offers comparison tools that allow you to find the product that best meets your expectations. For complete transparency, do not hesitate to consult comparative articles online.

To learn more about Allianz health insurance and all your options, visit the following pages: Third-party payment FAQ, Allianz health insurance prices, And international health insurance certificate.

Comparison of Allianz Santé Offers

| Criteria | Description |

| Types of coverage | Classic complementary health insurance, company mutual insurance, international health insurance. |

| Refunds | 100% Health guarantees available for optical, dental and audiology. |

| Online services | Consultation of reimbursements, downloading of statements and third-party payment certificate. |

| Company mutual insurance | Protection of employees and their families, reduction of out-of-pocket expenses. |

| Personalized health insurance | Coverage options tailored to individual and family needs. |

| Termination | Possibility of canceling annually at the end of the contract. |

| Reimbursement of dental care | Full refund with a responsible supplement. |

| Third party payment | Simple to use, just present your vital card and the certificate. |

| International health insurance | Coverage of medical expenses in the event of an emergency, abroad and in France. |

Testimonials on Allianz Health Insurance

Marie, 45 years old: “Since I subscribed to Allianz health insurance, I feel much more peaceful. It is so easy to consult my health reimbursements online. I particularly appreciate the fact of being able to download my statements and access my certificate of third party payer in just a few clicks. This greatly simplifies my administrative procedures.”

Jean, entrepreneur: “As a business manager, I opted for a company health insurance OBLIGATORY. This is a real benefit for my employees and their families. Thanks to this contract, their health costs are greatly reduced, which contributes to a more peaceful working environment and general well-being.”

Sophie, freelance: “As a self-employed worker, I understood the importance of complementary health. Allianz allows me to supplement my compulsory plan reimbursements, which is crucial, especially when I need dental or optical care. The guarantees offered give me great peace of mind.”

Luc, expatriate: “With Allianz international health insurance, I have peace of mind wherever I am in the world. In the event of emergency care or diagnostics, I know I will be covered. This allows me to concentrate on my work at abroad, without worrying about medical unforeseen circumstances.”

Claire, retired: “I recently subscribed to the Allianz senior mutual insurance and I am impressed by the refunds and the options offered. I compared several contracts and Allianz proved to be the best option for my specific health needs. I feel completely comforted.”

Marc, young parent: “When our child was born, we signed up for Allianz health insurance. The reimbursements for pediatric care are excellent, and we were pleasantly surprised to discover many online resources to help us. C “is truly a valuable support for new families.”

Introduction to Allianz Health Insurance

Faced with the vagaries of life and medical unforeseen events, theAllianz Health Insurance stands out as an essential option to guarantee quality care without financial worries. This article presents the main aspects to know about this insurance, its advantages, and how it can meet your specific health needs.

The advantages of health insurance

Choose one health insurance like that of Allianz, it means opting for effective coverage in terms of healthcare reimbursements. Thanks to appropriate guarantees, you can benefit from optimized reimbursements for a wide range of care, including optical, dental and audio. This insurance makes it possible to supplement the sometimes insufficient reimbursements of your compulsory plan, thus ensuring optimal protection.

Customization of Contracts

One of the great assets of theAllianz Health Insurance is the possibility of personalizing your contract. You have the freedom to choose the guarantees that suit you best, based on your needs and those of your family. This allows you to have tailor-made coverage and adjust your health budget accordingly.

Company Health Mutual

For businesses, the company health insurance is now an unavoidable imperative. By subscribing to a collective contract, you can protect your employees and their families while reducing their remaining health costs. This not only ensures health coverage, but also promotes well-being within your team.

International Health Insurance

If you are an expatriate or travel often, theinternational health insurance from Allianz offers you essential security. This coverage not only supports urgent Care, but also the diagnoses and treatments necessary after an accident or illness. This allows you to travel with peace of mind, knowing that you are well protected should the need arise.

Third Party Payer to Simplify Your Reimbursements

THE third party payer is an option that significantly simplifies the reimbursement process. By presenting your vital card and your third-party payer certificate to a healthcare professional, you do not have to pay up front, thus making your medical visits more stress-free. This feature is particularly appreciated by policyholders who want to make their daily lives easier.

Termination of your Mutual Health Insurance

It is essential to know that you can cancel your complementary health each year, at the end of your contract. This allows you to reassess your health needs and choose another solution if necessary. Keep in mind that the cancellation date generally corresponds to the anniversary of the subscription of your contract.

Conclusion on Allianz Health Insurance

Choose theAllianz Health Insurance is a decision that can greatly secure your daily life, giving you peace of mind in the face of unexpected healthcare expenses. With a multitude of tailored offers, you are able to find the coverage that brightens your health future.

L’Allianz Health insurance stands out for its numerous options and tailor-made guarantees, thus meeting the varied needs of its policyholders. With optimized reimbursements for routine care, health expenses can be controlled. Whether for optics, dental, or even audiology, you will find suitable solutions that guarantee your well-being while respecting your budget.

One of the great advantages of Allianz health insurance is the possibility of consulting and monitoring your online health reimbursements. In one click, policyholders can access their statements and certificates, thus offering them simplified management of their contract. Additionally, the third party payer is at the heart of the services, allowing easier payments, thus reducing the balance payable by policyholders to health professionals.

THE complementary health for companies, in particular collective contracts, represent an excellent initiative for employers wishing to protect their teams. By covering part of medical costs, this insurance improves the quality of life at work while building employee loyalty.

For those considering broader coverage, international health insurance is an option to seriously consider. It allows you to be protected even abroad, whether for vacations or professional missions. Emergency care is provided there, guaranteeing peace of mind beyond borders.

Finally, whether it is contract terminations or the evaluation of the necessary guarantees, Allianz provides tools and assistance so that each policyholder feels supported in their choices. The rating system and customer reviews are there to guide you in your search for the ideal solution.

FAQs about Allianz Health Insurance

What is Allianz health insurance? Allianz health insurance is coverage that allows you to benefit from reimbursements on your medical expenses, in addition to your compulsory plan.

What types of refunds are included? Allianz offers reimbursements for various treatments, including optical, dental and audiology, thanks to its 100% Health guarantees.

How can I track my health reimbursements online? You can view and track your health reimbursements online by logging into your Allianz customer area, where you can also download your health statements.

What are the characteristics of a company health insurance? Company health insurance is mandatory and helps protect your employees and their families, while reducing their out-of-pocket health costs.

Can I cancel my health insurance? Yes, you can cancel your complementary health insurance each year when it expires, which generally corresponds to the anniversary date of your contract.

Why is it important to take out complementary health insurance? Supplementary health insurance is crucial to supplement the often insufficient reimbursements from your compulsory plan, thus ensuring more complete coverage of your medical costs.

Does international health insurance cover treatment abroad? Yes, Allianz international health insurance covers your medical expenses, including emergency care, both in France and abroad.

What are the conditions to benefit from third-party payment? To benefit from third-party payment, simply present your vital card and the third-party payment certificate to the healthcare professional.

What are the advantages of Allianz senior mutual insurance? The Allianz senior mutual offers advantageous reimbursements adapted to the needs of retirees, including specific services for the well-being of seniors.

Does Allianz reimburse excess fees? Yes, Allianz offers guarantees that can cover fee overruns, depending on the terms of your contract.