|

IN BRIEF

|

Questions related to prices mutual insurance is essential for companies concerned about the health of their employees. There AXA mutual insurance for businesses offers tailored solutions with various guarantees and competitive rates. In an environment where healthcare costs can take a toll on business finances, knowing the options available is crucial. This article guides you through what you need to know about AXA mutual insurance rates and the benefits it offers to your employees.

THE AXA mutual insurance rates for businesses presents itself as an essential option for HR managers and business leaders wishing to offer solid health coverage to their employees. With prices accessible from €8.48 per month, AXA offers packages adapted to various professional profiles, combining reasonable costs and attractive guarantees. This article highlights the benefits and the disadvantages of this mutual in order to help you make an informed choice.

Benefits

First of all, the AXA mutual insurance is distinguished by its principle of no remaining charge on routine care, in effect since January 1, 2020. This allows employees to benefit from comprehensive health coverage without unforeseen costs, thus making medical care more accessible.

Another major advantage lies in the various guarantees offered by AXA. Whether for dental, optical or hospital care, the mutual covers a wide range of needs. For example, coverage for hospitalization costs in a private room can reach €49.66 per day, ensuring additional comfort for employees.

AXA also positions itself as a flexible player thanks to its customizable formulas, allowing companies to select the options that best suit their employees. This ensures that each employee finds health coverage suited to their profile, thus increasing overall satisfaction.

Mutual insurance for foreigners: everything you need to know

IN BRIEF Mutual insurance: essential to cover care abroad. Reimbursement of healthcare expenses incurred abroad. Different levels of healthcare coverage for expatriates. The rules vary depending on the country of origin and the status of the expatriate. Anticipate health risks…

Disadvantages

potential disadvantages associated with AXA mutual rates. First, some businesses might find that prices are relatively high compared to other insurers, particularly for similar levels of guarantees. This could be a hindrance for small or budget-conscious businesses.

To learn more about the refunds and the different formulas offered by AXA, you can consult the information available on their official website, in particular on the healthcare reimbursements and the additional guarantees.

In the dynamic world of business, ensuring the health of your employees is a priority. There AXA company mutual insurance stands out for its adapted offers and competitive prices. This article provides you with a comprehensive overview of prices, of the guarantees offered and conditions to know to make the best choice for your business.

Health insurance at 1st euro: understanding and advantages

IN BRIEF 1st euro insurance : coverage of health costs from the first euro spent. Reimbursement to 100% amounts actually committed. A solution for expatriates, without the need to join the CFE. Difference between international insurance at 1st euro and…

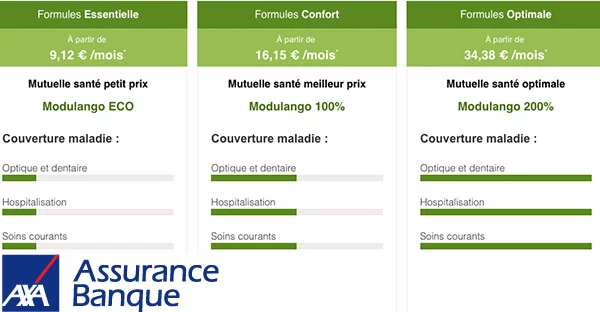

Prices for AXA company mutual insurance

The price of the AXA mutual insurance for businesses starts from €8.48 per month, making it an affordable option for your employees’ health coverage. THE prices may vary depending on the level of guarantees chosen, the specific needs of your company and the number of employees to be covered. Therefore, it is essential to analyze the different options offered in order to determine what best suits your situation.

Criteria influencing prices

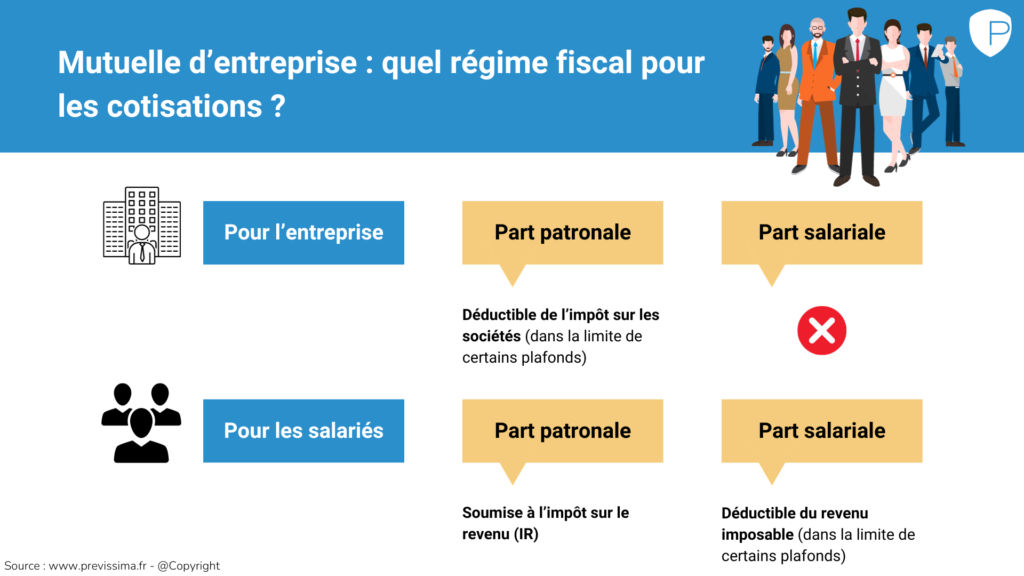

Several criteria are taken into account in calculating the price of your complementary health. For example, the profile of your employees, their age range, and management fees can significantly influence the cost. An in-depth study of these elements will allow you to optimize your choice of mutual insurance and respect your budget.

Axa supplementary health insurance: everything you need to know

IN BRIEF Free online quote for tailor-made health insurance from €9.04 per month. Reimbursement to €0 out-of-pocket costs for eligible medical equipment. Tips for choose wisely your complementary health insurance according to your budget. Clear understanding of guarantees offered by…

Guarantees offered by AXA

There AXA company mutual insurance stands out in particular for the diversity of its guarantees. It offers reimbursements for routine care, such as consultations with approved general practitioners and specialists. For example, for a general practitioner, reimbursement amounts to €17.50 and for a specialist to €25.

Additional options

To meet different needs, AXA also offers options for more expensive care, such as optical care or the dental care. In addition, for healthcare establishments, AXA offers the possibility of being in a single room, with a reimbursed amount of up to €49.66 per day.

How to contact axa for your complementary health insurance

IN BRIEF Phone number: Call 36 41, available 24/7. 24/7 Support: Contact AXA on 01 55 92 26 92 in case of emergency. Contact form: Complete the form on the AXA website for any request. Contact by email: Use the…

How to subscribe to AXA company mutual insurance?

To join the AXA company mutual insurance, it is possible to make a free quote online. This process allows you to evaluate the different formulas suitable for your business. In addition, AXA makes subscription easier by providing you with customer area online, allowing you to manage your contracts simply and efficiently.

Do not hesitate to consult additional resources to compare offers from AXA and other insurers. To do this, visit sites like this site, which offers relevant comparisons and advice to help you in your choice.

In a constantly changing world, it is essential for companies to choose their mutual health insurance. AXA offers a range of solutions adapted to the needs of each company. This article will provide you with essential information about prices, THE guarantees, and reimbursement possibilities to help you make the best choice for your employees.

Axa global: understanding the challenges of insurance on an international scale

IN BRIEF AXA EssentiALL : inclusive insurance for vulnerable customers. Objective ofgreen investments of 26 billion euros by 2023. International health insurance with adjustable monthly premiums. Internationalization : expansion in Asia, after Europe and the United States. World leader in…

Understanding AXA mutual insurance rates

THE prices AXA mutual insurance companies may vary depending on several criteria such as the number of employees, their age, and the level of coverage chosen. In general, prices for complementary health insurance can start from €8.48 per month for managers and independents. This makes it an accessible option for businesses of all sizes.

AXA supplementary health insurance: everything you need to know

IN BRIEF Free online quote for personalized health insurance Offers from €9.04/month Refunds for routine care, hospitalization, dental, optical and hearing expenses Easy understanding of health coverage Charts of guarantees And refunds available for download Opinion on the quality of…

Guarantees offered by AXA

AXA company mutual insurance offers different formulas which include guarantees varied. For example, you can benefit from reimbursement of consultations with approved general practitioners up to €17.50 or for specialists to €17. In addition, dental and optical care are covered by basic guarantees, which reduces the out-of-pocket costs for your employees.

Axa mutual insurance: understanding the advantages of mutual health insurance

IN BRIEF Supplementary health customizable from €9.04/month. Choice of level health guarantees adapted to your needs. Effective reimbursements for health expenses. Intervention in addition to Social security. Analysis of the criteria influencing the price of your mutual insurance. Benefits of…

Reimbursements and out-of-pocket costs

Thanks to AXA’s collective health supplement, your employees can benefit from 0 € remaining charge for many treatments from January 1, 2020. This means that routine, often expensive care becomes more accessible and can be managed with less financial stress.

Axa mutual contract: everything you need to know

IN BRIEF Supplementary health AXA: adapted protection from €7.39/month Reimbursements on health expenses not covered by theHealth insurance Choice of modules to personalize your CONTRACT Options third party payer with many health professionals Care support dental And optical, including refractive…

Assessing your business needs

Before choosing a mutual insurance company, it is crucial to carry out a personalized quote. AXA provides an online tool to help you calculate the price of your complementary health insurance. It is important to take into account the specificities of your company, the profile of your employees and the management costs which can influence the final price of contributions.

Why choose AXA for your company mutual insurance?

AXA is recognized for its seriousness and expertise in the field of company mutual insurance. By choosing AXA, you are choosing a trusted partner who offers competitive rates and a wide range of guarantees. Additionally, businesses can benefit from attractive discounts of up to -32% off for life.

Ease of access and contact

Finally, interested companies can easily access the necessary information regarding the AXA mutual insurance companies thanks to their online customer area. For more information, do not hesitate to visit their official website or contact their customer service.

AXA business mutual rate

| Criteria | Details |

| Price from | €8.48 per month |

| General practitioner reimbursement | 100% of the reimbursement base |

| Reimbursement of dental care | Basic care support |

| Private room | €49.66/day |

| Optical care | Refractive surgery included |

| Access to specialists | 200% refund |

| Average cost of complementary insurance | Varies depending on profile |

| Flexible contract duration | Customizable according to needs |

Testimonials on AXA Enterprise Mutual Prices

Many HR managers and business leaders have questions about prices of the mutual AXA company. Listen to what some of them have to say:

“After comparing several options of complementary health for my employees, I finally chose AXA. Not only were the prices competitive, but the variety of guarantees offered really made the difference. From just €8.48 per month, my employees can benefit from coverage adapted to their needs.”

“It was important to me to ensure health coverage that offers remains responsible zero, and AXA did so in January 2020. This means my employees don’t have to worry about the cost of their daily care, which increases their satisfaction and productivity.”

“The specific reimbursements are really interesting. For an approved general practitioner, for example, there is a fairly high direct reimbursement. This helped my employees realize the importance of mutual company without fear of large costs ahead.”

“The possibility of adjusting the level of guarantees according to our needs is a big plus. The different levels of coverage, with options such as coverage for dental and optical care, allowed me to personalize the contract. It was essential for me to offer the best to my team.”

“I was pleasantly surprised to find that the formulas offered by AXA also include attractive rates for private rooms during hospitalizations, demonstrating a real concern for the well-being of employees. This strengthens the image of my company among employees.”

These testimonies show to what extent the rates for AXA business mutual insurance are advantageous and adapted to the realities on the ground. The feedback is positive and highlights practical and effective solutions for team health.

AXA mutual insurance rates for businesses: introduction

In a context where employee health is a priority for companies, choosing the right mutual insurance is crucial. There AXA mutual insurance for businesses offers varied guarantees and attractive prices to meet the needs of managers and employees. This article tells you everything you need to know about the rates and options available for your business.

Amount of contributions

The price of the mutual AXA company is flexible and can accommodate various budgets. Monthly contributions start from €7.39 for basic options, reaching approximately €8.48 for more complete guarantees. This system allows companies to choose a plan that meets their specific needs while ensuring adequate health coverage for all employees.

Cost Analysis

The cost of a company mutual insurance depends on several factors, such as the employee profile, the desired level of coverage and the associated management costs. It is therefore essential to assess the needs of your team so that each employee can benefit from coverage that suits them. An analysis of employee profiles will help you define the appropriate level of guarantee without having to pay excessive amounts.

The guarantees offered by AXA

There AXA mutual insurance offers a wide range of guarantees for its policyholders. Among the most important, we find:

- Medical reimbursements : General practitioners and specialists under agreement are reimbursed efficiently, with amounts of up to 200% of the Reimbursement Base (BR).

- Optical care : Costs related to refractive surgery (myopia, etc.) are also covered, with a basic guarantee for glasses and lenses.

- Dental care : Reimbursement covers various procedures, including periodontology, often poorly reimbursed by Social Security.

The advantages of AXA mutual insurance for businesses

In addition to competitive prices, AXA mutual insurance for businesses has several significant advantages:

- No remaining charges : Since January 1, 2020, AXA has offered the possibility of reimbursing 0 € remaining charge for routine care, allowing employees to better manage their healthcare expenses.

- Responsive customer support : AXA has a customer area to facilitate administrative procedures and the submission of reimbursement requests.

- Adapted formulas : With à la carte options, each company can personalize its guarantees according to its needs.

Conclusion and advice

For a company, the choice of a collective mutual is essential. The prices of the AXA mutual insurance, with varied options, guarantee adequate coverage for employees. Do not hesitate to make a personalized quote to find the formula best suited to your structure. This will allow you to ensure the health and well-being of your team while controlling your budget.

There AXA company mutual insurance is a strategic choice for business leaders and human resources managers wishing to offer their employees access to quality healthcare. From €8.48 per month, this investment represents an affordable solution, adapted to the needs of businesses of all sizes.

THE AXA mutual insurance rates are transparent and come with various guarantees. For example, reimbursements for care among general practitioners and specialists approved can reach up to 100% of the amount of the reimbursement base. This ensures employees almost total coverage of their health costs, thus significantly reducing the remaining costs.

The different support options available make AXA mutual insurance a wise choice. Whether for the optical care, THE dental care, or even hospitalization, AXA provides flexible options. For example, the cost for a single room can be up to €49.66 per day, thus guaranteeing optimal comfort during a hospital stay.

In addition, AXA facilitates contract management thanks to a dedicated customer area and online quote tools. This allows companies to adjust and personalize their contract according to their specific needs, while benefiting from attractive discounts, particularly for self-employed workers. This means that each company can find a formula that perfectly matches its profile and financial priorities.

In short, choose the AXA company mutual insurance is a wise investment to ensure the well-being of your employees while controlling your budget. Adapted and accessible health coverage is an essential asset for attracting and retaining talent in an increasingly competitive job market.