|

IN BRIEF

|

In a constantly evolving professional environment, offering your employees a optimal health coverage is a crucial issue to preserve their well-being and strengthen your attractiveness as an employer. AXA healthcare enterprise positions itself as a partner of choice, offering solutions adapted to each structure. This comprehensive guide will allow you to explore the various options of complementary health, essential guarantees and the advantages of effective coverage, while facilitating your decision-making when choosing a contract that meets the specific needs of your team. Together, let’s take the first step towards reinforced health protection for all your employees.

For managers concerned about the well-being of their employees, choosing the right complementary health insurance is essential. AXA corporate health positions itself as a key player, offering solutions adapted to the size and specific needs of each company. This article explores in detail the benefits and the disadvantages from AXA for optimal health coverage.

Benefits

Complete and adapted protection

AXA offers flexible supplementary health contracts, allowing companies to choose the guarantees best suited to their employees. Whether for hospitalization costs, orthodontics or other specific care, AXA ensures that each employee can benefit from solid coverage.

Varied choice of formulas

The different coverage options offered by AXA allow companies to configure their contract according to their specific needs. This includes tailor-made solutions that can adapt to particular situations and the requirements of each employee.

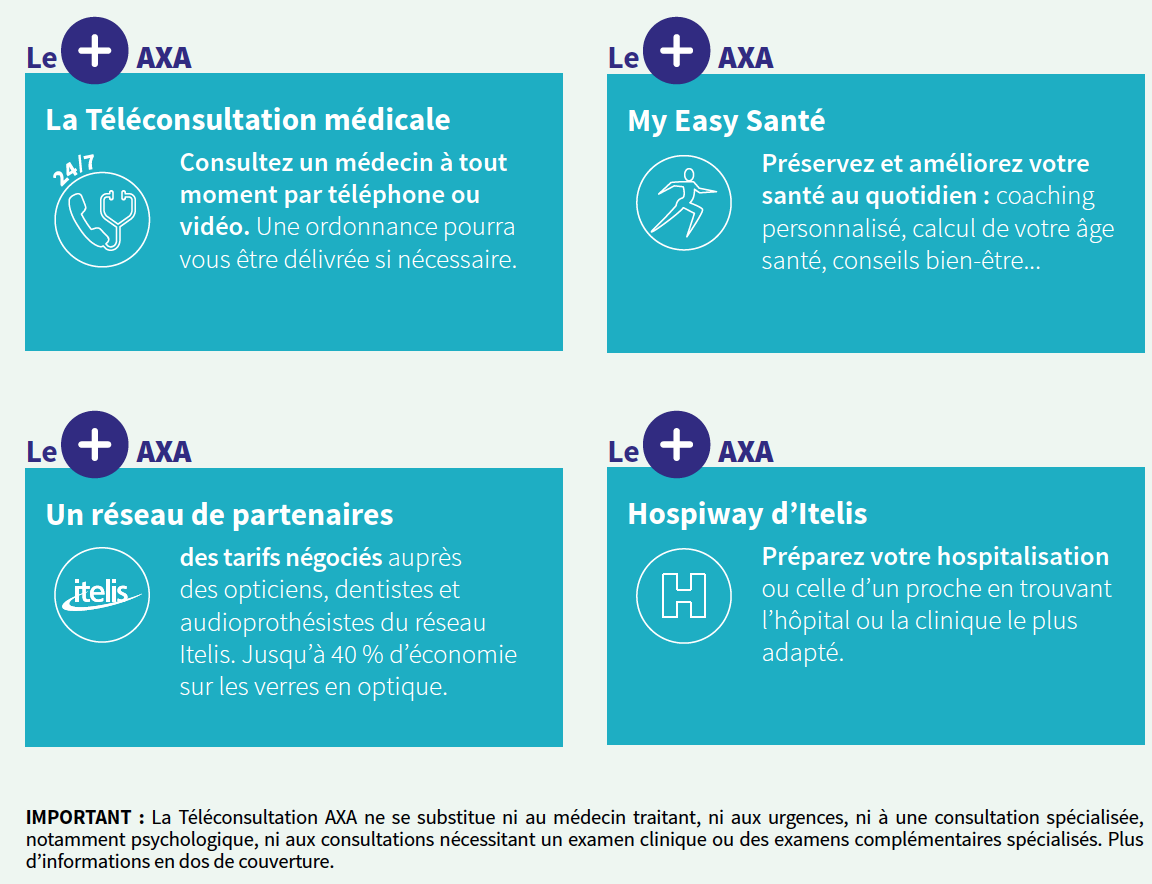

Additional support and services

In addition to health coverage, AXA offers services with high added value, such as personalized advice or support in managing health procedures. This makes life easier for employers and improves employee satisfaction.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Potentially high costs

Although AXA offers suitable cover, the cost of premiums may be higher than other insurers. Managers must be aware of the expenses to be incurred and assess whether this protection fits into their overall budget.

Complexity of options

The diversity of formulas and guarantees can also lead to some confusion. Executives must spend time analyzing different options to choose the most beneficial protection, which can be a challenge in already busy business environments.

Legal obligations

Since January 1, 2016, companies have been required to offer complementary health insurance to their employees. Although AXA offers flexible solutions, it is essential to be compliant with legislation, which can cause additional constraints for managers.

For a more detailed overview of the available options and for a free simulation, you can visit the websiteAXA. For expatriate employees, other solutions can also be explored, such as those offered by AgoraExpat or via mutual insurance comparators.

In a world where the health of your employees is essential, opting for complementary company health insurance is essential. AXA Santé Entreprise offers solutions adapted to the needs of your structure, while guaranteeing optimal protection for employees. This guide reveals the different options available and helps you make the best choice to ensure the well-being of your team.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Why choose AXA for your company’s complementary health insurance?

AXA stands out for its reputation and his experience. A world leader in insurance, it offers personalized solutions for businesses of all sizes. Thanks to their tailored offers, AXA guarantees complete coverage of health costs, including hospitalization, consultations and other delicate care. Customer testimonials also highlight their satisfaction with the services provided, proving that choosing AXA means choosing trust.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The different guarantees of AXA complementary health insurance

AXA complementary health insurance offers a range of guarantees ensuring the well-being of your employees. Among these, we find options for orthodontics, dental care, as well as consultations with general practitioners and specialists. Each company can personalize its coverage according to its specific needs thanks to à la carte packages. In addition, support is provided to better understand the guarantee tables and the refunds available.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Compliance with current legislation

Since January 1, 2016, it has become mandatory to insure your employees with company health insurance. AXA supports you in this process by offering you contracts that comply with legislation, while guaranteeing that the quality of services is maintained. This regulatory obligation not only ensures employee health coverage, but also contributes to their motivation and their commitment within your organization.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The advantages of group health coverage

Opting for group health insurance has many advantages: prices that are often more advantageous than an individual subscription, better protection for your employees, and strong added value for the image of your company. By integrating effective health coverage, you show your employees your commitment to their well-being, thereby strengthening their trust and long-term loyalty.

AXA’s role in healthcare management

AXA is responsible for managing health benefits, thus allowing your employees to concentrate on the essential: their work. The customer area offered by AXA facilitates access to information relating to their coverage, as well as the submission of reimbursement requests. This personalized follow-up ensures peace of mind to everyone, while reducing the administrative burden for your business.

How to get a personalized quote with AXA?

To benefit from AXA’s offers, it is possible to make a free online quote. This helps you evaluate coverage options that fit your business needs. In just a few clicks, you can compare guarantees and identify the plan that best meets your expectations. This accessible and rapid process promotes informed decision-making.

For more information, do not hesitate to consult AXA’s practical guides or other online resources that will help you understand the health coverage to adopt for your business. You can also explore the options available on specialized health sites, such as those covering cheap mutual insurance or international health insurance.

The health needs of employees are essential to foster a fulfilling and productive work environment. AXA offers solutions for complementary health companies perfectly adapted to your activity and the size of your company. This guide will help you navigate the different options available and understand how to provide your employees with optimal protection.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Essential guarantees for your employees

To ensure the well-being of your employees, it is crucial to offer them guarantees that cover their daily needs. With the complementary health insurance AXA, you have access to plans that cover a variety of care, ranging from medical consultations to hospitalization costs. Discover the different health guarantees offered, including routine care, orthodontic costs and more, to guarantee your employees comprehensive coverage.

The benefits of compulsory complementary health insurance

Since January 2016, each company has the obligation to offer a mutual health insurance to its employees. AXA stands out by offering personalized solutions that adapt to the structure of your business while respecting legal requirements. The objective is to guarantee adequate coverage for your employees while simplifying the membership process. You will find all the necessary information on the terms and conditions by consulting the AXA website.

Protection tailored to your business

Every company is unique, which is why AXA allows you to choose a health coverage custom made. Depending on the specific needs of your employees and your budget, you can opt for an à la carte contract that covers a wide range of health services. In addition, AXA is committed to supporting you in choosing the best formula thanks to its personalized advice and its rich customer experience feedback.

Evaluate costs and reimbursements

Invest in a complementary health quality represents a significant cost. However, it is essential to evaluate the reimbursements offered by AXA in order to minimize the remaining costs for your employees. By carefully examining the guarantee tables provided by AXA, you will be able to understand the financial issues and make an informed decision on the best protection to offer.

Easily access your customer area

To simplify the management of mutual health insurance of your employees, AXA provides a customer area accessible online. This allows employees to view their rights, submit their reimbursement requests, and take advantage of various practical features. This transparency and ease of access strengthens job satisfaction and the feeling of health security within your company.

Additional resources to choose wisely

To deepen your knowledge on the subject, do not hesitate to consult practical guides and mutual insurance comparators. Sites like AGF Mutual Or Medi Insurance offer detailed articles to help you choose your health coverage. These resources can be very useful in finalizing your decision and ensuring the best choice for your employees.

Comparison of business health coverage options with AXA

| Criteria | Details |

| Type of contract | Collective contract compulsory since January 1, 2016. |

| Basic warranty | Coverage of hospitalization costs and routine care. |

| Additional options | Orthodontics, advanced dental and optical care. |

| Flexibility | Customizable contracts according to the needs of the company. |

| Pricing | From €7.39 per month, adaptable depending on the number of employees. |

| Additional services | Support in health prevention and medical advice. |

| Refunds | Fast and simplified reimbursement. |

| Online access | Contract management and reimbursement via a secure customer area. |

Testimonials on AXA Santé Entreprise: Complete guide to optimal health coverage

“As the manager of an SME, I was faced with a crucial choice for my employees. I opted for the complementary health insurance AXA and I don’t regret it. The coverage is tailored to my team’s needs, and it has greatly improved their well-being. They feel safe and can concentrate on their work without worrying about their healthcare costs. »

“When I started my start-up, I wanted to offer my employees the best possible protection. Thanks to AXA, we have access to solid guarantees which cover routine care and hospitalizations. The feedback from my team is very positive, which creates a calm and productive working environment. »

“What really convinced me to choose AXA was the flexibility of contracts. We have been able to personalize our coverage based on the size of our business and the specific needs of our employees. This made everyone feel valued and supported in their health. »

“In terms of refund, AXA is exemplary! The deadlines are short and the transparency of the guarantee tables has allowed us to quickly anticipate the costs for our employees. I feel confident knowing that my colleagues are well protected. »

“Since the implementation of compulsory mutual insurance via AXA, the climate within our society has changed. Our employees discuss their health and the benefits of this coverage more often. This shows to what extent a effective health protection can strengthen team cohesion and employee engagement. »

In an ever-changing world, the health of your employees must be a priority for any business. There complementary health offered by AXA presents itself as a high-performance solution suitable for all business sizes. This article guides you through the different coverage options and the benefits of such protection.

Why choose AXA for the health of your employees?

AXA offers a health coverage comprehensive and flexible that meets the varied needs of employees. Since 2016, it has been mandatory for companies to guarantee mutual health insurance to their employees, and AXA stands out for its personalized offers. Choosing AXA means opting for simplified management of healthcare expenses and enhanced protection for your employees.

A variety of suitable guarantees

AXA offers a wide range of guarantees which allow companies to personalize their offers according to the needs of their staff. Whether for hospitalization costs, routine care or specific care such as orthodontics, the options are numerous. This allows you to offer your employees optimal coverage so that they can live peacefully.

Considerable financial benefits

Adopting AXA health insurance also means reducing the financial burden on your employees. Thanks to competitive prices and an efficient reimbursement structure, AXA is committed to making health more affordable. By choosing a complementary health company, you contribute to the peace of mind of your employees, which often translates into increased productivity.

How does health coverage work at AXA?

AXA health coverage works in addition to basic health insurance benefits. It thus makes it possible to improve the coverage of medical costs. To benefit from this coverage, simply choose a plan adapted to your business, taking into account criteria such as the size of the team and its health needs.

High added value services

In addition to basic coverage, AXA offers additional services that add real value to its offerings. A dedicated customer area allows employees to easily manage their reimbursements and access useful information about their health. Personalized support is also available to answer any questions regarding their guarantees.

How to choose the right formula?

To choose the plan that best suits your company, it is essential to assess the needs of your employees. Take stock of the frequent health expenses in your team and determine the options that would bring the most benefits. AXA offers the possibility of creating tailor-made contracts to meet the specific challenges of your company.

Professional advice

AXA does not just offer products, it also supports you in your choice. Specialized advisors are available to guide you through the different options and help you select the most appropriate coverage for your company. By opting for AXA, you ensure that you benefit from expert insurance advice, while guaranteeing the health of your employees.

In today’s professional world, employee health is more than ever a priority for companies. Ensuring optimal health coverage is essential for the well-being of employees, and this is whereAXA corporate health comes in. By offering a complete range ofcomplementary health

solutions, AXA allows managers to provide their team with the protection it deserves.

With the health contract offered by AXA, companies benefit from unique flexibility. Each company, regardless of its size, can choose specific guarantees that meet the needs of its staff. Whether for hospitalization costs, dental care or even for common medical prescriptions, AXA is committed to reducing the financial burden on employees, thus offering invaluable peace of mind. AXA’s practical guide also allows managers to better understand the options available. Thanks to personalized advice, they can choose the most appropriate coverage. Customer testimonials

show positive feedback on the quality and efficiency of the services offered. This demonstrates AXA’s commitment to meeting the expectations of its policyholders, by demonstrating flexibility and responsiveness in a constantly changing professional environment. Finally, since the introduction of the ANI law, employee health coverage has become a legal obligation. Thanks to AXA, comply with this obligation while offering your teams comprehensive and appropriate protection. By choosing AXA health company, you are choosinghigh-performance protection

that will help build employee loyalty and improve their quality of life at work.

FAQ on AXA corporate health coverage

What is the objective of the supplementary health insurance offered by AXA for companies? The objective is to offer high-performance protection

adapted to the size of your company, thus guaranteeing optimal health coverage for your employees.

What guarantees are included in AXA’s supplementary health insurance? AXA offers comprehensive guarantees

that include reimbursement of hospitalization costs, medical consultations, routine care and other medical services.

Is it mandatory to insure your employees with supplementary health insurance? Yes, sinceJanuary 1, 2016

, the subscription to compulsory mutual health insurance for employees is a legal requirement for all companies.

What advantages does AXA offer for group health contracts? AXA provides adapted offers to the needs of businesses and their employees, as well as personalized advice

to choose the best health coverage.

How can I get a quote for AXA’s complementary business health insurance? A free online quote

is available, allowing you to personalize à la carte health insurance for your business.

What reimbursement options does AXA offer? AXA offers guarantee tables

clear and varied options for reimbursements, in order to meet the expectations of policyholders.

What high value-added health services does AXA provide? AXA offers various high value added services

such as medical assistance, prevention programs, and dedicated support for its policyholders.

How does AXA help understand health coverage for its employees? AXA provides a practical guide