|

IN BRIEF

|

In a world where digitalization is becoming more and more widespread, AXA stands out for its practical and effective solutions to manage your online invoices. Whether you want to understand the payment process for your insurance contribution, submit a Invoice or track your reimbursements, AXA provides you with simple and secure tools. Let’s find out together everything you need to know to make the most of these digital services at your disposal.

Payment of your insurance contribution online with AXA is part of a simple, fast and secure approach. Thanks to powerful digital tools, AXA makes it easier for you to manage your invoices and reimbursements. This article invites you to discover the advantages and disadvantages of online invoicing offered by AXA, in order to help you make informed decisions regarding your finances.

Benefits

Opt for the service of online billing of AXA has many advantages. First of all, the simplicity and speed of transactions allow you to pay your insurance contributions in just a few clicks. Thanks to secure online payment, you can carry out your transactions without worrying about your information being hacked. AXA uses the protocol 3D Secure to ensure your payments are protected.

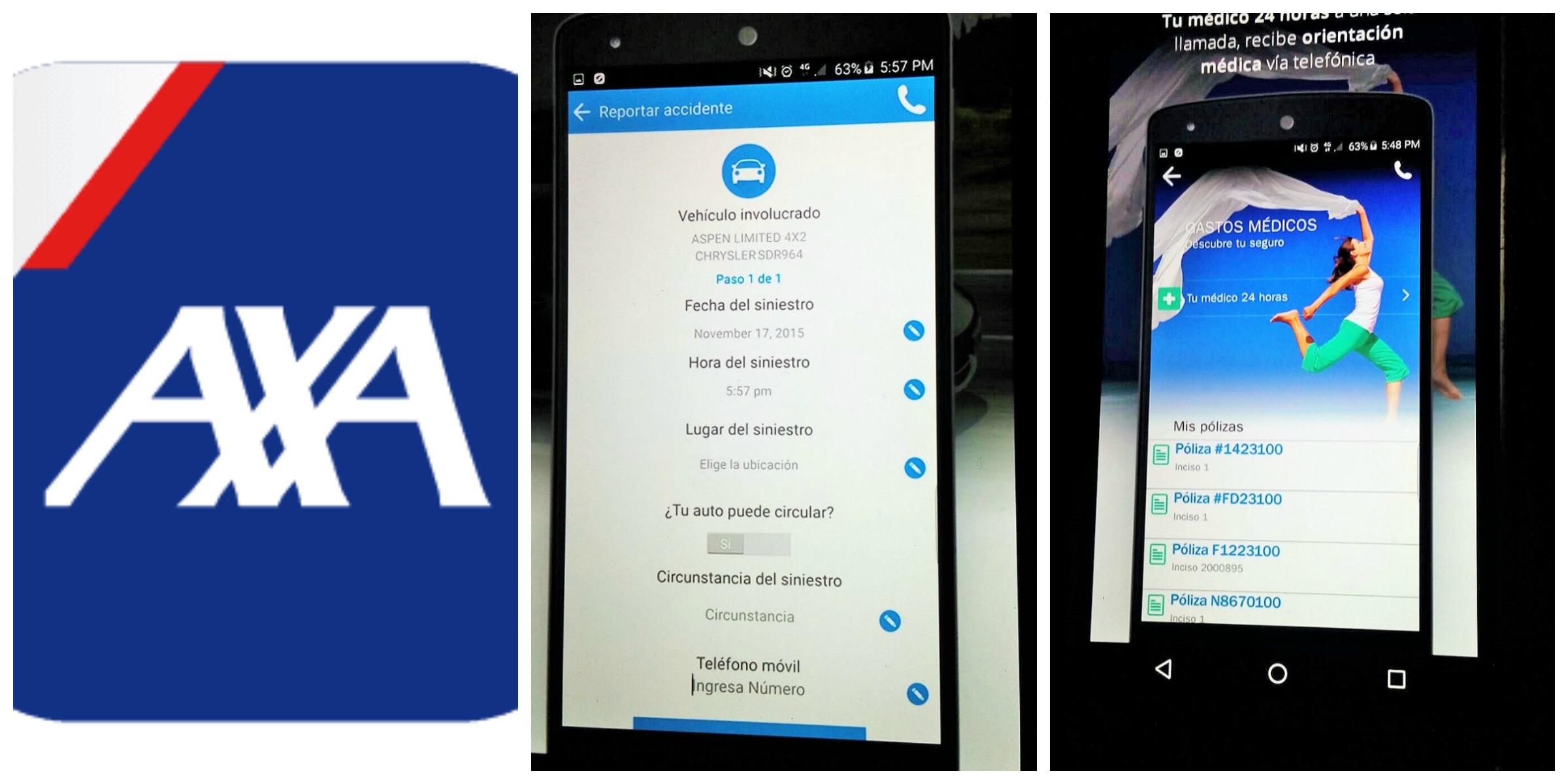

Then, AXA offers the possibility of sending your invoices directly to your health insurance via the app myAXA. In a few simple steps, simply photograph your invoice and upload it, saving you the hassle of managing a lot of physical documents. You can then monitor the status of your reimbursements in real time, thus ensuring better management of your health budget.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite the many advantages, there are also some disadvantages to AXA online invoicing. One of the main challenges is the need for a reliable internet connection and a compatible device. If you encounter technical problems, this may hamper your ability to transact online.

Additionally, although the platform is generally intuitive, some users may encounter difficulties when navigating their Customer Area. It is therefore recommended to familiarize yourself with the different features available for optimal use. Furthermore, reimbursement requests can sometimes take longer than expected, slowed down by the need to provide supporting documents additional in the event of a disaster.

Finally, the transition to online invoicing may require a period of adaptation for some users, accustomed to more traditional methods of managing their finances.

In this guide, we present to you all the essential elements regarding online invoicing with Axa. Whether you want to pay your contribution, manage your reimbursements or send your invoices, this detailed tutorial will guide you step by step in using the digital services offered by Axa.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Online payment of your contribution

THE online payment of your insurance premium is designed to be simple, fast And secure. If your Axa advisor has sent you a code by SMS, simply follow the link provided to make your payment hassle-free. It is the ideal solution for those who want to manage their financial obligations easily and securely.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Send your invoices to the health insurance

To declare your care, do not hesitate to use the application myAXA. Open the app, take a photo of your invoice making sure it is in good quality, then charge it directly from your phone. This method greatly facilitates your administrative procedures.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Ensure you are compensated as best as possible

In the event of property damage, it is crucial to provide all the necessary documents to maximize your chances of compensation. Remember to keep proof of value and existence to facilitate the processing of your file. Consult the Axa website for precise information regarding documents to provide.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Secure payment on the internet

The security of your transactions is a priority for Axa. Payments made online with your bank card are protected by 3D Secure protocol, in compliance with current regulations. Rest assured, each payment is clearly secure and you will receive notifications via the application to confirm the smooth running of your transactions.

Online health services

Axa provides you with online services such as Hospitality, which helps you analyze fee overruns in the event of hospitalization. This service allows you to proactively manage your healthcare costs while staying informed of potential costs.

Online reimbursement tracking

Thanks to your AXA Customer Area, it is very easy to follow the details of your reimbursements. You will be able to consult each operation and learn about the progress of your requests. It’s an effective way to keep control of your budget.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Request for payment deferral or split payment

If you have received a payment reminder from Axa, please note that it is possible to request a postponement payment or opt for a split payment. For more details, go to the dedicated Axa page to benefit from solutions adapted to your financial situation.

Obtain supporting documents and information

Are you wondering how to obtain proof of transfer or an information statement? Thanks to your Customer Area, you can immediately download all the necessary documents. Do not hesitate to consult the Axa FAQ for all your questions.

Other useful information

To better understand your options and rights, Axa offers various online guides on various themes. For example, discover the benefits of1st euro insurance or everything you need to know about loss of salary insurance.

Managing your AXA invoices online has never been so simple and secure. Thanks to AXA’s digital services, you can pay your contributions, send your invoices and track your reimbursements easily. This guide will provide you with all the information you need to optimize your online experience with AXA.

Paying your membership fee online

Paying your insurance premium online is a quick and secure process. If your AXA Advisor sent you a code by SMS, simply go to the AXA website to finalize the payment. For more information on the steps to follow, consult their page dedicated to this purpose here.

Send your invoices to the health insurance

With the app myAXA, sending your invoices to the health insurer is child’s play. Simply take a photo of your invoice in good quality and upload it directly to the app. For detailed instructions, feel free to visit this page on sending invoices here.

Ensure you are properly compensated

In the event of a claim, providing the correct documents is essential. AXA will help you determine the documents to submit to guarantee your compensation. Do not neglect to gather proof of value and existence, this is crucial for your case.

Secure payment on the Internet

Payments made on the AXA online platform are made in a secure environment thanks to the 3D Secure protocol. This system protects you against fraud when using your bank card. To learn more about security measures, visit the page on secure payment.

Online reimbursement tracking

Your AXA Customer Area allows you to easily track all your repayments. There you will find a complete breakdown of each refund, giving you a clear overview of the status of your requests. Log in now to view your information.

Flexible payment options

AXA also offers you flexible payment solutions, such as payment deferral or split payment. If you have received a reminder, do not hesitate to request an option adapted to your needs to best manage your finances.

Keep your file up to date

To ensure proper follow-up of your file with AXA, consider regularly update your supporting documents. This includes updating your KYC (Know Your Customer), which allows AXA to have precise information about your situation. For more information on this procedure, visit this link.

| Appearance | Details |

| Secure payment | Using the protocol 3D Secure to protect your transactions. |

| Payment method | Your bank card is accepted for fast payments. |

| Electronic invoicing | Send your online invoices via the app myAXA. |

| Reimbursement tracking | Access your AXA Customer Area to track reimbursements. |

| Supporting documents | Download transfer proof via your personal space. |

| Payment deferral | Possibility of requesting a postponement or a split payment. |

| Necessary documents | Keep proof of value for optimal compensation. |

| Online support | Use the service Hospitality to analyze hospitalization costs. |

| Virtual card | A virtual card AXA Bank for secure online payments. |

Testimonials on Axa online invoice: everything you need to know

When it comes to managing my insurance contributions, I can only recommend the online payment offered by AXA. The process is simple And fast, which makes it much easier to track my expenses. I received a code by SMS from my AXA advisor, and all I had to do was click to pay my contribution. No more stress about late payments!

Use the app myAXA to send my bills to the health insurance was a revelation. I particularly appreciate being able to take a photo invoices and load them directly in high quality into the application. This saves me unnecessary travel and allows me to have a history of my reimbursement requests at my fingertips.

In terms of refunds, AXA has always supported me well. Thanks to my Customer Area, I can easily follow the details of my reimbursements and ensure that I am well compensated. Having access to the necessary documents in the event of damage is also a big plus. This allowed me to quickly gather the information requested during an unfortunate situation.

Security is paramount in my online transactions, and that’s why I’m relieved to learn that payments made with my bank card are protected by the 3D Secure protocol. This allows me to make my payments with complete peace of mind, without fearing for the security of my data.

I was also able to take advantage of the service Hospitality from AXA who helped me understand the fee overruns linked to hospitalization. This service is really valuable in avoiding surprises and allowing me to better plan my healthcare expenses.

Finally, during an unexpected financial event, I chose to request a payment deferral via my online account. The procedure was clear and quick, which allowed me to better manage my situation without additional stress. AXA really shows understanding in these delicate moments.

In an increasingly digital world, Axa has been able to adapt by offering simple and secure online invoicing solutions. This article will guide you through the different options you have for managing your invoices, pay your insurance contributions and track your refunds. Thanks to the myAXA app and other digital tools, you will be able to manage your insurance efficiently.

Paying your contributions online

Paying your insurance contributions has never been easier. With the options of online payment from Axa, you benefit from a simple, fast and secure process. If your Axa advisor has given you a code via SMS, you can use it to make payment hassle-free. All you need to do is log in to your customer area to carry out this transaction with complete confidence.

Transaction Security

Security is paramount when making online transactions. Axa uses the 3D Secure protocol, ensuring that your credit card payments are protected against fraud. So you can have peace of mind by making your payments online. In addition, thanks to notifications from the Axa app, you will stay informed at every stage of your transaction.

Medical Bill Management

For your medical bills, the process is just as simple. The myAXA app allows you to send your invoices to the health insurer in no time. Simply open the app, take a photo of your invoice and upload it. Make sure the image quality is good for efficient processing.

Reimbursement Tracking

Once your invoices have been sent, you can follow the progress of your reimbursements directly from your Axa Customer Area. There you will find details of your reimbursements, which will allow you to manage your finances more easily. This transparency helps you stay informed and anticipate your healthcare expenses.

Flexible Payment Options

If you receive a payment reminder from Axa, don’t panic! You have the possibility to request a payment deferral or opt for split payment via your online space. It is a very convenient option that helps you manage your finances without stress.

Enable Remote Transmission

To make your procedures even easier, Axa suggests activating the teletransmission for your reimbursements. By doing this, your invoices will be sent automatically to your insurance fund, reducing the waiting time for your reimbursements to be processed. Remember to consult your Customer Area to activate this function and simplify your procedures.

Obtain Payment Proofs

Do you need proof of your payments? Axa provides you with transfer proof downloadable immediately after confirming your payment. This allows you to keep rigorous monitoring of your finances and to have all the necessary evidence in the event of an audit.

In summary, Axa offers a wide range of digital services to simplify the payment of your contributions, the monitoring of your invoices and your reimbursements. Thanks to these online tools, you can manage your insurance efficiently and securely.

Use the service of Axa online invoicing allows you to manage your payments simply and efficiently. Whether you need to pay a insurance contribution or send invoices to your health insurer, everything can be done easily using the myAXA app. All you have to do is take a photo of your invoice and submit it in just a few clicks, which optimizes your time and simplifies your reimbursement management.

Security is a top priority when transacting online. Axa uses the protocol 3D Secure to ensure fully protected online payments. This means that every time you make a payment, your identity is verified to avoid any risk of fraud. Furthermore, with the AXA Bank virtual card, you benefit from a free solution to make payments in complete security, thus reducing the risk of hacking.

In the event of a claim, it is essential to know what documentation to provide in order to be properly compensated. Axa informs you of the necessary documents and helps you manage the complexity of administrative procedures. You can also request a payment deferral or a split payment directly online if you need financial flexibility.

Finally, your AXA Customer Area gives you immediate access to the history of your refunds, your invoices and other essential documents. At a glance, you can assess your finances and make informed decisions about your insurance coverage. With all this, you have at your disposal a set of tools that make your experience with Axa online invoicing not only convenient, but also reassuring.