|

IN BRIEF

|

There AXA company mutual insurance represents an essential solution for employers seeking to offer their employees quality health coverage. Thanks to a varied range of formulas, ranging from the most accessible options to the most comprehensive coverage, AXA adapts to the specific needs of each structure. By subscribing to a contract of complementary health according to the provisions of the Madelin Law, companies can optimize their taxation while guaranteeing increased well-being to their staff. Discover the key advantages of this support, both for the company and its employees.

There Axa company mutual insurance represents a suitable solution for professionals seeking to offer reliable and advantageous health coverage to their employees. With varied formulas and the possibility of opting for reinforced guarantees, Axa positions itself as a key player in the collective mutual insurance market. In this article, we offer you an overview of the main benefits And disadvantages of the Axa offer, to allow you to make an informed choice for your business.

Benefits

A wide range of formulas

One of the great strengths of the mutual company Axa is the diversity of its formulas. Indeed, Axa offers six distinct options: First, Eco, Medium, Confort, Bien-être and Optimale. Each of these formulas is designed to meet the specific needs of employees, whether in terms of routine, hospital or dental care. This customization allows employers to choose the solution best suited to their team.

Coverage adapted to all

With guarantees that include dental, optical and hospital care, Axa provides complete health coverage. In addition to traditional medical care, the formulas also allow you to benefit from constant monitoring via the Déclaration Sociale Nominative (DSN) and easy access to contractual documents. This ensures transparency and monitoring of contributions that facilitate management within companies.

Tax benefits for companies

Subscribing to a supplementary health contract eligible for the Loi Madelin is another point to highlight. This allows managers to deduct a portion of their contributions from their taxable profit, thus offering a tax-advantageous solution for companies while ensuring optimal coverage for employees.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Contribution costs

Although Axa’s plans are varied and customizable, it is important to note that prices can be relatively high compared to other insurers. Companies must therefore assess whether their budget can support these potentially high contributions, especially for the most comprehensive plans.

Administrative obligations

Managing contributions and declarations can also be a challenge for some employers. Healthcare staff management requires rigorous monitoring of documents and regulatory obligations, which can generate an additional administrative burden for human resources.

Limited portability

Finally, although the portability of complementary health insurance is an advantage, it is important to know its limits. Some employees leaving the company may retain their coverage, but there are conditions that may restrict this possibility. It is crucial to inform employees of the terms and conditions to avoid any confusion.

In a world where the health and well-being of employees are becoming priorities for companies, subscribing to a company mutual insurance is essential. AXA offers a range of health insurance solutions, guaranteeing coverage adapted to the needs of each company and its employees. In this article, we will explore the different options, the tax advantages, as well as the portability of guarantees.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

AXA company mutual insurance formulas

AXA offers several packages adapted to the various demands of businesses. The six options available—First, Eco, Medium, Comfort, Wellness and Optimal—allow employers to choose the level of coverage they want. Each formula is designed to meet the specificities of routine medical, hospital, dental and optical care. With AXA, it’s easier than ever to align employee and business interests.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The obligation to insure your employees with AXA

In accordance with the legislation, each employer is required to subscribe to a pension contract which includes a complementary collective health. This obligation, which may represent a contribution of 1.50% payable exclusively by the employer, aims to guarantee equitable access to care for all employees. By choosing AXA, companies ensure they comply with regulations while providing a valuable investment in the well-being of their staff.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Tax advantages linked to complementary health insurance

Another advantage to consider when subscribing to company mutual insurance with AXA is the possibility of benefiting from tax exemptions. By opting for a complementary health insurance contract that complies with the Madelin Law, company directors can deduct contributions from their taxable profit. This represents a real asset for optimizing the financial management of companies.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The portability of mutual insurance: maintaining your coverage

A crucial aspect of AXA company mutual insurance is the portability of guarantees. Employees who leave the company can usually keep their coverage for a period of time. This allows employees to benefit from continuity of care and additional security, even during periods of professional transition. It is important to consult the specific conditions of your contract to understand all the details.

Why choose AXA for your company mutual insurance

Choose AXA for company mutual insurance means opting for quality health coverage, accompanied by excellent customer service. Thanks to personalized options and reinforced guarantees, AXA not only ensures the protection of employees, but also their peace of mind. A partner like AXA is undoubtedly an invaluable asset to the overall success of your business.

Learn more about AXA and its offers

To deepen your understanding of the offers and services that AXA offers, do not hesitate to visit the official website of AXA.AXA. Whether you are an employer wishing to protect your staff or a manager looking for suitable solutions, AXA provides the necessary resources to make the best health choice.

AXA company mutual insurance

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

is an essential asset for any company wishing to offer health protection adapted to its employees. It not only guarantees effective coverage, but also meets legal obligations while improving employee well-being. Discover here all the essential aspects of this offer, including its formulas, how it works and the advantages linked to subscription.

Mutual insurance formulas offered by AXA AXA offers a diverse selection ofcompany mutual insurance formulas

, ranging from the basic offer to more comprehensive options. Among the six formulas available, named First, Eco, Medium, Confort, Bien-être and Optimale, you will certainly find the one that best suits your structure. The First offer, for example, is ideal for companies looking for basic coverage, while the Optimal option is recommended to benefit from a wide range of care, including optical and dental.

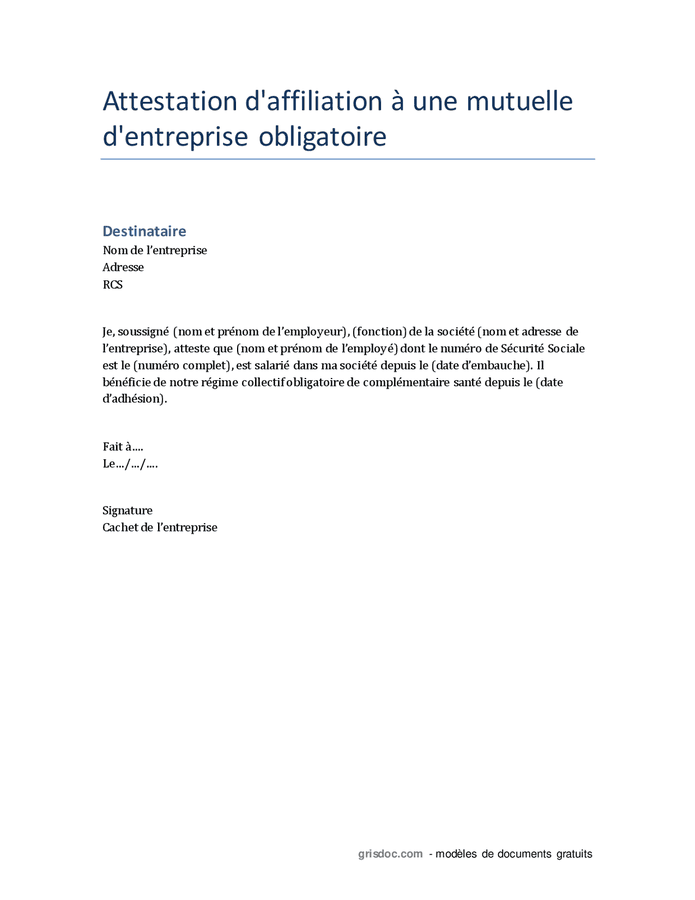

Subscription obligations Under current legislation, each employer is required to subscribe to a complementary health insurance contract for its employees. This contract must comply with the Madelin Law, which allows the contribution to be deducted from taxable profit each year. To better understand your responsibilities and those of your employees, do not hesitate to consult ourguide on mandatory supplementary health insurance

.

Contribution management and documentation Contribution management and the nominative social declaration (DSN) are crucial steps to ensure the proper functioning of the mutual. Thanks to AXA’s dedicated customer area, you can easily monitor the status of contributions, consult contractual documents and effectively manage the health of your staff. Rigorous monitoring of these elements will allow you to remain compliant while optimizing your resources.

The portability of mutual health insurance

There portability of complementary health insurance is an essential aspect to take into account when managing your company mutual insurance. If an employee leaves, they have the option of keeping their health coverage within your company for a specific period. To find out everything about this device, consult our page dedicated to portability of mutual health insurance.

The advantages of AXA as a company mutual

Opting for AXA means benefiting from health coverage performance and quality services, adapted to the needs of your employees. A mutual fund like that of AXA not only contributes to the personal protection of your employees, but it also strengthens the image of your company as an employer concerned about the health and well-being of its teams. In addition, as a group insurance, this mutual allows you to exempt certain social charges, which constitutes a significant asset for your finances.

Additional information and support

For any additional questions or if you would like personalized advice, do not hesitate to consult our frequently asked questions, which is full of relevant information. You will find answers to the most common questions regarding the AXA mutual insurance and its terms, in order to better manage the health of your employees.

| Axis of Comparison | Details |

| Formulas | Offer made up of six formulas: First, Eco, Medium, Comfort, Well-being and Optimal. |

| Cost of contribution | A contribution equivalent to 1.50% of salary for welfare payable by the employer. |

| Social exemptions | Company directors can benefit from exemptions under certain conditions. |

| Portability of rights | Outgoing employees can keep their group health coverage under certain conditions. |

| Management of contributions | Monitoring and consultation via the Nominative Social Declaration (DSN). |

| Legal protection | Assistance included for damage caused to a third party in the course of the activity. |

| Reinforced guarantees | Optional packs available for specific treatments such as dental and optical. |

| Customer area | Online access for contract management and reimbursement tracking. |

Testimonials on AXA mutual business: everything you need to know

Many employers testify to the benefits of complementary collective health with AXA. The feedback shows that the management of contributions and the Nominative Social Declaration (DSN) are simplified, allowing managers to focus on other aspects of their business. With AXA, the clarity and accessibility of contractual documentation promotes a good understanding of the services offered.

Employees appreciate the different options offered, ranging from First has Optimal, adapted to all health needs. Many opinions highlight the richness of the guarantees, particularly on care dental, hospital And optical. This allows employees to access quality care without worrying about costs.

Another point often mentioned is the importance of portability of mutual insurance. Employees who leave the company can keep their health coverage, which provides enormous reassurance during professional transitions. This aspect strengthens the bond of trust between the employer and its employees.

Finally, the tax advantages linked to subscribing to a contract eligible for Madelin Law for leaders are also valued. This makes it possible to reduce taxable profit, thus improving the profitability and sustainability of the company. AXA’s sound advice on this subject contributes to informed decision-making.

There AXA company mutual insurance represents a valuable asset for employers and their employees. In fact, subscribing to collective health insurance has become an obligation for companies. This article offers you a detailed overview of AXA’s offers, prices, benefits linked to the Madelin Law as well as advice for choosing your coverage.

The different formulas offered by AXA

AXA stands out for the diversity of its mutual insurance formulas. These offerings are designed to meet the varied needs of businesses and their employees. In total, AXA offers six plans which are:

- First

- Eco

- Medium

- Comfort

- Well-being

- Optimal

Each formula presents specific guarantees. For example, more premium forms generally include enhanced coverage for dental and optical care, thus providing better support for sometimes high healthcare expenses.

Employer obligations and related benefits

Subscribe to a collective mutual is an obligation for every employer. In fact, this helps protect the health of employees while complying with current legislation. In addition, this approach may result in a contribution payable by the employer, generally 1.50% of salaries. However, investing in the health of its employees is a strategic decision that promotes staff loyalty and improves the social climate within the company.

Elements to consider when choosing mutual insurance

When you choose a complementary health For your business, several criteria must be taken into account. First, it is essential to assess the needs of your employees in order to select the most suitable formula. This may involve routine, hospital care or even specific services such as optics and lenses.

Secondly, the guarantees offered by each formula must also be examined. Some options may include additional services such as preventive care or teleconsultations. It is essential to check that these elements are in line with the expectations of your employees.

Advantages of the Madelin Law

By choosing a supplementary health contract eligible for Madelin Law, you will be able to benefit from significant tax advantages. In fact, this commitment allows you to deduct part of the contributions from your taxable profit each year. This represents an opportunity not to be missed to optimize the financial management of your business.

The portability of mutual insurance

It is also important to learn about the portability of complementary health insurance. Indeed, employees can continue to benefit from their collective health protection even after leaving the company, under certain conditions. This promotes a smooth transition and coverage history for employees, whether for personal or professional reasons.

The offers of AXA company mutual insurance are resolutely adapted to the needs of modern societies. Whether you are considering deploying a health offer for your employees or are simply looking to improve what already exists, AXA positions itself as a partner of choice thanks to its comprehensive packages and sound advice.

There AXA company mutual insurance is a major asset for employers wishing to offer their employees effective and comprehensive health protection. This mutual benefit is not only a benefit for employees, but also a wise investment for the company itself. In fact, subscribing to a contract complementary health allows the employer to meet its legal obligation while guaranteeing the well-being of its team.

One of the strengths of the AXA offering lies in its different formulas adapted to the varied needs of companies: First, Eco, Medium, Comfort, Well-being And Optimal. Each formula is designed to provide specific guarantees, whether in terms of routine, hospital or dental care. This diversity allows companies to choose the most appropriate solution for their size and sector of activity.

In addition, by subscribing to a mutual insurance contract that complies with the Madelin Law, managers have the possibility of deducting part of their tax contributions, which constitutes a significant advantage for optimizing their tax burden. The management of contributions is also made easier by the possibility of online monitoring and by the possibility of consulting contractual documents. This makes life easier for employers while ensuring transparency in the management of Nominative Social Declaration (DSN).

Finally, the social scope of this mutual helps strengthen the bond between the company and its employees. By opting for AXA, employers ensure they offer solid coverage that reassures and values their teams, thus promoting a healthy and productive work climate.