|

IN BRIEF

|

Navigating the world of healthcare reimbursements can sometimes seem complex, especially when it comes to your AXA company mutual insurance. Understand the different aspects such as conventional rate, THE fee overruns or even the third-party payer is essential to benefit from coverage adapted to your needs. In this guide, we will provide you with the necessary information on the address to use as well as the refund process, in order to simplify your procedures and optimize the coverage of your health costs.

AXA mutual company presents a key solution for companies wishing to offer their employees comprehensive health coverage. This article walks you through the refund processes, as well as the different contact options to optimize their users’ experience. You will also discover the advantages and disadvantages of this mutual to better assess whether it meets your needs.

Benefits

One of the great strengths of AXA mutual enterprise is its accessibility. Thanks to a customer area online, policyholders can track the status of their reimbursements, view the details of each transaction, and download the necessary statements with ease. This allows greater transparency and a considerable saving of time.

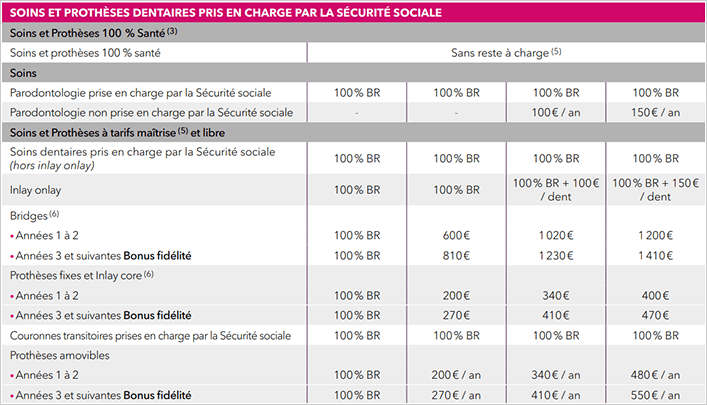

Another positive point is the diversity of reimbursement methods proposed. AXA offers scales adapted to different types of care, including medical consultations and hospitalizations. This flexibility allows companies to choose the most appropriate coverage for their employees. To find out more about the AXA mutual reimbursement scale, you can consult specific resources.

Disadvantages

disadvantages. The refund process can sometimes be

complex

, especially for those who are unfamiliar with health benefits. Terms like

fee overruns

Or

conventional rate

can be misleading, requiring a thorough understanding of these concepts.

Furthermore, the support availability may vary. Although several channels are made available, such as telephone and online support, there may be times when wait times are longer than expected. To avoid this, it is advisable to prepare your request carefully before contacting AXA, using the practical advice available on the AXA website.AXA.

Finally, the share of complementary health insurance must also be taken into account. Coverage by Social Security as well as the participation of supplementary health insurance can sometimes lead to coordination difficulties, which complicates access to certain reimbursements which sometimes turn out to be lower than expected.

In this article, you will find out everything you need to know about AXA mutual company, with emphasis on the reimbursement process and useful addresses to facilitate your procedures. Whether to understand your complementary health or follow your reimbursements, we will guide you step by step.

Understanding the reimbursement process

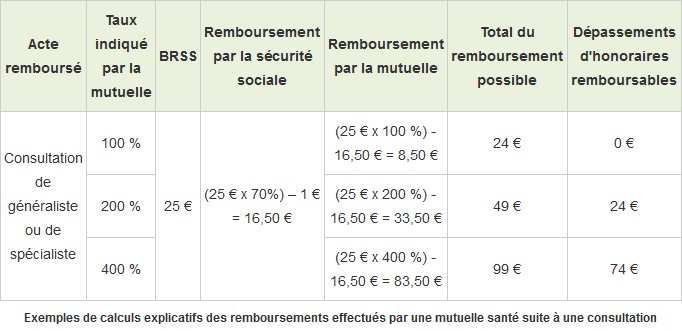

Reimbursing your healthcare costs through AXA is designed to be simple and efficient. There reimbursement basis is determined by Social Security and can be supplemented by your complementary health. Actual costs, excess fees and the agreed rate are essential concepts that influence the final amount of your reimbursement.

The different stages of reimbursements

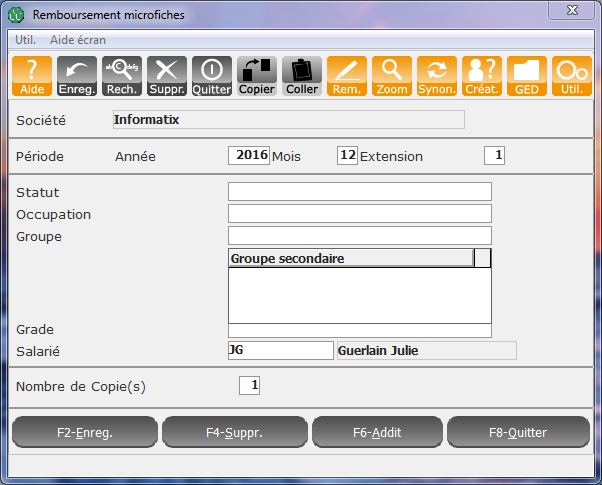

To benefit from optimal reimbursements, start by consulting your AXA Customer Area. You will find a complete tracking of your reimbursements, as well as the possibility of carrying out searches and downloading your statements. Make sure to keep all your invoices and statements, because you will need these documents when you file your declaration.

Access AXA contact details

For any questions or to clarify an aspect of your reimbursement, contacting AXA becomes essential. You can do this by telephone, by email or online. It is recommended to consult this practical guide which details the different options available to you, including opening hours and the types of services offered.

Using your Customer Area

One of the most efficient ways to manage your reimbursements is to access your AXA Mutuelle Entreprise Customer Area. This portal allows you to consult your contracts, track your reimbursements and communicate easily with AXA. For more information, follow this link.

Claims and reimbursement monitoring

In the event that a situation requires special monitoring, it is always good to know how to make a claim. Your Customer Area allows you to send useful documents (statements, invoices) securely. Do not hesitate to use this feature to simplify your procedures.

Documents required for reimbursements

To ensure that your requests are processed quickly and efficiently, make sure to provide all the required documents, such as your invoices and statements. You can send them directly via your Customer Area or by contacting AXA by email or telephone.

Learn more about reimbursement options

Every situation is unique, and it is essential to know what repayment options are available to you. AXA offers a variety of solutions tailored to your needs, including hospitalizations, medical consultations and routine care. To learn about these options, see this reimbursement trip.

Knowing your health insurance better will allow you to benefit from optimal health coverage, while ensuring your team has the necessary well-being.

In this article, you will discover practical tips for effectively navigating the reimbursement system of your AXA mutual company. You will learn how to access your customer area, the different contact options and the steps to follow to maximize your healthcare reimbursements.

Understanding Reimbursement Options

Before starting your steps, it is essential to understand the different repayment options which are available to you. AXA offers several terms, whether for actual costs, conventional rates or fee overruns. This will help you know what to expect in terms of coverage and reimbursement.

Access your AXA customer area

To track your reimbursements and manage your contracts, nothing could be simpler! Access your AXA customer area by going to the official website. Once logged in, you will be able to view your details of reimbursements, do research and even download your statements securely. For a detailed guide on accessing your customer area, you can consult this link here.

Contact AXA efficiently

If you have questions or need assistance, it is crucial to know how contact AXA effectively. Whether you prefer telephone, email or online exchanges, AXA provides you with several communication channels. To optimize your procedures, consult the AXA contact guide to find telephone numbers and opening hours.

Optimize your reimbursements

To get the most out of your health coverage, make sure you follow the reimbursement process carefully. Always keep your invoices and statements up to date, and do not hesitate to send all the necessary documents via your customer area. This will facilitate the speed of your reimbursements and allow you to avoid unnecessary delays.

Useful resources for reimbursements

For a complete summary of the steps to follow and useful addresses for reimbursements, you can consult this link. This will provide you with valuable information for every step of your reimbursement process.

| Axis of comparison | Details |

|---|---|

| Reimbursement Type | Reimbursement of actual expenses, conventional rates, fee overruns. |

| Support | Part of the Social security and complementary health. |

| Access to the Customer Area | Simplified management of reimbursements and documents. |

| AXA contacts | Available by phone, email or online portal. |

| Necessary Documents | Invoices, statements and other supporting documents. |

| Reimbursement Deadlines | Refunds processed under a variable delay according to requests. |

| Administrative Procedures | Transmission of reimbursement requests via the Customer Area. |

| Customer Support | Support available for any questions related to refunds. |

T testimonials about Axa Mutuelle Entreprise

Marie, human resources manager in an SME, shares her experience: “When we decided to opt for Axa as a company mutual, it was a revelation for our team. The process of refund is simple and effective. I had no trouble understanding the reimbursement scales and actual costs. Thanks to their intuitive interface, I was able to help my employees navigate the process with ease.”

Pierre, a satisfied employee, testifies: “I needed recent medical consultations, and I must say that the reimbursement by Axa was very satisfactory. third-party payer really made my days easier. In just a few clicks, I was able to view my reimbursements via my customer area. Waiting for long repayments is now a distant memory!”

Sophie, who recently contacted Axa for reimbursement questions, says: “I was a little lost at first with all these notions like fee overruns And conventional rates. But by consulting the practical guide on their site, I found all the necessary information. I quickly received precise and clear answers to my questions.”

Lucas, a young entrepreneur, adds: “With my team, we appreciated the support of Axa.assistance for the refund process is exceptional. Every time we needed help, whether by telephone or email, the Axa team was attentive and very responsive. This allowed us to obtain reimbursements within a very reasonable time frame.”

Finally, Clara, a healthcare professional, shares: “I often work with companies that choose Axa for their mutual insurance. I have noticed that reimbursements are not only fast, but also transparent for employees. They can follow everything in their customer area. This gives employees great peace of mind, knowing that they are well covered.”

Introduction to Axa Mutuelle Entreprise

In the world of health, understanding the refund process and the different terms associated with your company mutual insurance may seem complex. This article will help you discover the steps to follow to obtain optimal reimbursement for your medical expenses with Axa. We will explain to you how to access your account, the necessary information and the useful contacts to facilitate your procedures.

Access Your Axa Customer Area

To take full advantage of Axa Mutuelle Entreprise’s services, it is essential to know how to access your customer area. This online platform is designed to be simple and intuitive. To log in, simply go to the Axa website, click on the “Customer Area” option and enter your credentials. There you will find all the necessary information regarding your reimbursements.

Managing your contracts

Once connected to your customer area, you will be able to manage your contracts with ease. You will be able to consult your different insurance policies, check the status of your reimbursements, and also download your reimbursement statements. This will allow you to save time and ensure clear monitoring of your health expenses.

The Reimbursement Process

Reimbursement of your healthcare costs by Axa is divided into several stages. First of all, it is crucial to understand the different types of refunds that exist, such as conventional rate, there reimbursement basis and the fee overruns.

Understanding Reimbursement Types

THE conventional rate corresponds to the amount that Social Security covers for a medical procedure. In the event that your expenses exceed this base, the excess portion constitutes a fee overrun which will be covered by your complementary health insurance, within the limits of your guarantees. It is therefore essential to know the details of your coverage to optimize your reimbursements.

Transmission of Documents

To facilitate the process, you will need to send certain documents to Axa. This includes your invoices And counts care. This transmission can be done directly via your customer area in complete security, which greatly simplifies your procedures. Please ensure that all documents are complete and legible to avoid any delays in processing your reimbursement request.

Useful Contacts

You may want to ask questions about your company mutual insurance. To do this, Axa provides you with several means of contact. You can contact them by telephone, by email or via the online chat available on their site. Do not hesitate to refer to your card Third Party Payer to find the appropriate number, or use your customer area to send your questions to an advisor.

Hours of operation

Axa’s opening hours are generally designed to meet customer needs. Be sure to check these times so you can contact them at the most convenient time with your questions or concerns. This will allow you to get quick answers and improve your experience with the mutual.

Understanding how your Axa Mutuelle Entreprise works has never been easier. By following these recommendations, you will be able to effectively manage your reimbursements and optimize your health coverage. Do not hesitate to consult your customer area regularly to stay informed of the progress of your reimbursements and services.

Practical Guide to Assistance and Reimbursement with AXA Mutuelle Entreprise

It is essential to have a good understanding of how the health reimbursements to take full advantage of the benefits offered by your AXA company mutual insurance. Several elements come into play, such as reimbursement basis, THE fee overruns and the conventional rate. By having these concepts in mind, you will be better equipped to manage your healthcare costs without stress.

Your AXA Customer Area proves to be a valuable tool for tracking your refunds. Through this platform, you will be able to consult the details of each reimbursement, carry out specific searches and download your statements securely. In addition, AXA facilitates the sending of necessary documents, such as invoices or care certificates, to speed up the reimbursement process.

If you have any questions or need assistance, contacting AXA is easy. Whether by telephone, email or online, you have multiple channels to obtain details about your company mutual insurance. This guide will guide you on best practices for contacting AXA and opening hours to maximize efficiency.

Additionally, it is important to be aware of the different options of complementary health which can adapt to your professional situation. The guarantees offered by AXA are designed to meet the specific needs of your company, thus ensuring optimal health coverage for your employees.

In summary, take the time to familiarize yourself with the reimbursement procedures and the support services of your AXA mutual insurance, it guarantees daily serenity, both for you and for your employees.

FAQ about Axa Mutuelle Entreprise: Reimbursement

Q: How do I access my Axa customer area?

A: You can easily access your Axa Mutuelle Entreprise customer area from the official website. Simply log in with your login details to view your contracts and reimbursements.

Q: What documents are needed to submit a reimbursement request?

A: To submit a reimbursement request, you generally must provide your invoice and any supporting documentation relating to the healthcare costs incurred. You can transmit these documents securely via your customer area.

Q: What reimbursements can I expect for my medical consultations?

A: The refunds for medical consultations depend on the conventional rate and any fee overruns. Your complementary health insurance will cover part of the costs according to the contract signed.

Q: How do I request a refund?

A: You can make a reimbursement request by downloading the necessary documents from your customer area or by sending them by mail to the address indicated on your Third Party Paying card.

Q: What is third-party payment?

A: The third-party payer allows you not to advance health costs during your medical consultations, because your mutual insurance company takes care of payment to health professionals directly.

Q: What should I do if I haven’t received my refund?

A: If you have not received your reimbursement within a reasonable time, contact Axa Mutuelle Entreprise customer service, either by telephone or via your customer area, to obtain information on the status of your request.

Q: Are health reimbursements covered by Social Security?

A: Yes, the Social security covers part of your healthcare costs. The rest can be covered by your complementary health insurance according to the terms of your contract.

Q: Who can help me if I have questions about my refunds?

A: You can contact Axa customer service, either by telephone, by email, or directly via your customer area, in order to obtain the necessary assistance on your questions. refund.

Q: What are the opening hours to contact Axa Mutuelle Entreprise?

A: Business hours to contact Axa may vary, but customer service is generally available during weekdays during business hours. Consult their site or your Third Party Paying card for exact times.