|

IN BRIEF

|

When considering taking out complementary health insurance, it is essential to understand the different options available. AXA mutual insurance company, recognized for its quality of service and expertise in the field of insurance, offers a wide range of

guarantees

adapted to each need. Whether to cover your

routine care

, your

hospitalization

, or even your expenses in

optical

And

dental

, AXA offers you customizable solutions. In this article, we will explore everything you need to know about AXA mutual and its

guarantees

to make an informed decision for your health and that of your family.

Axa mutual guarantee: everything you need to know

There AXA mutual insurance is a complementary health solution that deserves your attention in 2024. With guarantees adapted to different health needs, AXA mutual insurance is positioned as a key player in the field of health insurance. In this article we will examine the benefits and the disadvantages of this mutual to help you make an informed choice.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Benefits

There AXA mutual insurance offers a wide range of guarantees that cover various aspects of your health. First of all, it supports routine care such as medical consultations, medications and medical analyses, thus allowing rapid and efficient reimbursement.

Then, the coverage in the event ofhospitalization is also a strong point. You benefit from coverage of accommodation costs, surgical procedures and daily fees, which frees you from some of the financial worries linked to hospitalization.

Finally, AXA offers coverage optical and dental, with reimbursements for glasses, lenses and dental care, tailored to your needs and budget. This flexibility allows you to personalize your coverage according to your priorities. To find out more about the details of these guarantees, you can consult this link.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Disadvantages

Despite its many advantages, the AXA mutual insurance also has certain disadvantages. First of all, the cost of contributions can be a negative point for some people. Indeed, depending on the option chosen, prices can vary considerably, and it is essential to study your budget carefully before committing.

Additionally, some policyholders may find that the process of refund is not always as fast as they would have liked. Although support is often efficient, delays can sometimes occur, creating concern for those who need funds quickly.

It is important to note that the formulas of AXA mutual insurance can be a bit complicated to understand, which can make comparison with other offerings on the market difficult. To make it easier for you, you can visit this link for advice on how to choose your health insurance.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Axa mutual guarantee: everything you need to know

AXA supplementary health insurance represents an ideal solution to guarantee you optimal coverage for health expenses. Between its customizable guarantees and competitive rates, AXA strives to meet the specific needs of each policyholder. In this article, we will explore all the essential elements you need to know to choose your AXA mutual guarantee.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The main points of the guarantees offered

AXA mutual insurance offers you complete coverage for routine care, including reimbursements for consultations, medications and medical tests. In the event of hospitalization, you will be covered for accommodation costs, there surgery and the daily package. If you need optical or dental care, AXA also offers reimbursements for glasses, THE lentils and dental care.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

How to choose your complementary health insurance?

Choosing your complementary health insurance is a crucial step. It is essential to take several factors into account. To begin, it is important to study your budget. Indeed, defining the amount that you can devote to your health on a recurring basis will help you better guide your choices. Also consider your specific medical needs and those of your family.

AXA’s customizable formulas

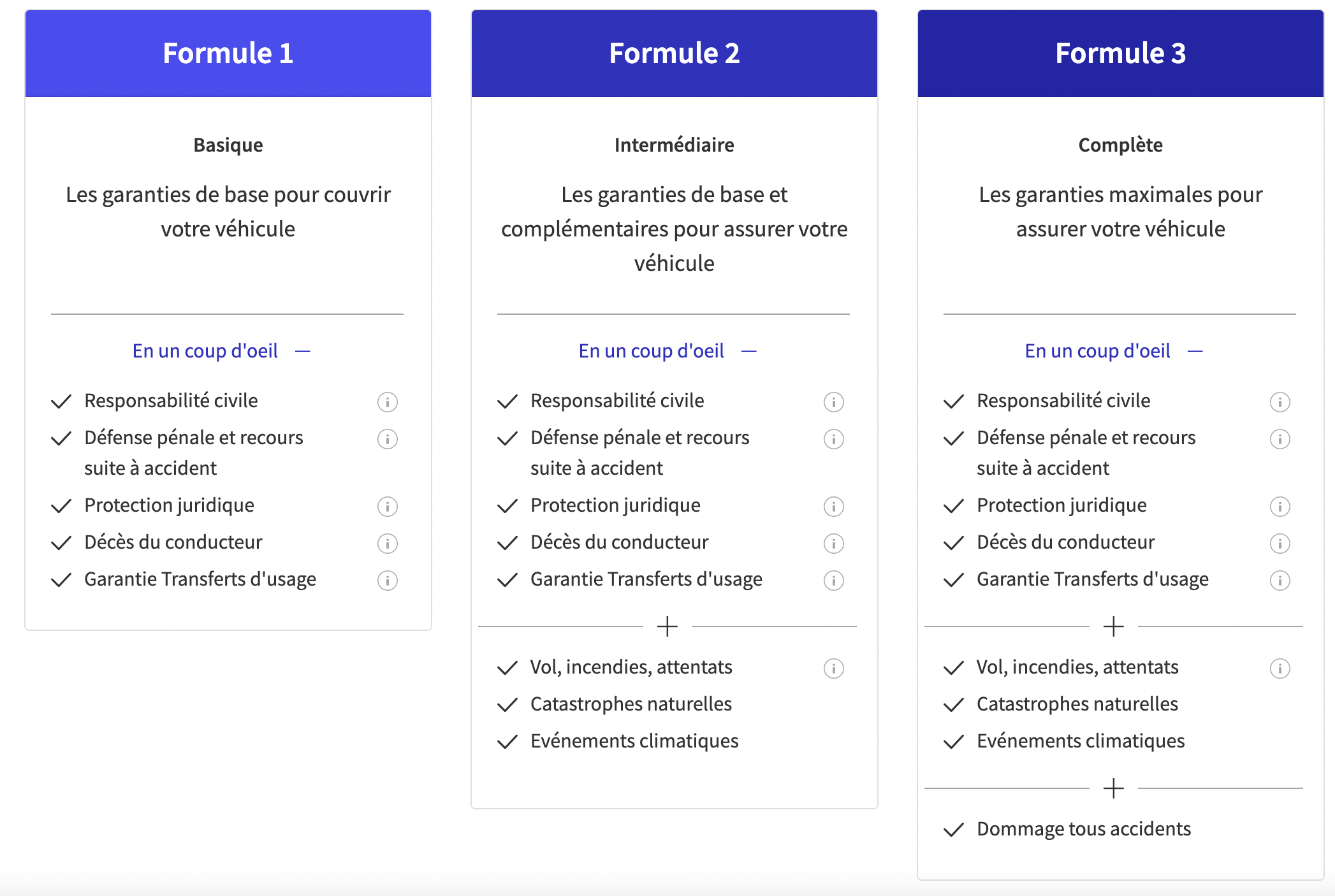

AXA offers several customizable formulas adapted to various profiles. It is possible to choose from seven different options to maximize coverage according to your requirements. Each plan allows you to adjust the reimbursement level according to your needs and your health care consumption habits.

Opinions and feedback from policyholders

Before subscribing to a AXA mutual insurance, it is advisable to consult the feedback from other policyholders. Reviews of the guarantees, prices and customer service can give you an idea of the advantages and disadvantages of the offer. It is important to form an informed opinion in order to make the choice that suits you best.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Contact and assistance

In order to better understand the AXA offer that suits you, you can contact the advisors by telephone or via their website. AXA experts are available to answer all your questions and help you compare the different guarantees available. Do not hesitate to consult their online resources for detailed information.

For more information on the options and guarantees, you can consult the following links:

- All about AXA supplementary health insurance

- AXA supplementary health insurance

- AXA home loan insurance

Axa mutual guarantee: everything you need to know

The AXA supplementary health insurance is an ideal solution for those who want to benefit from complete coverage for their medical expenses. Whether for routine care, hospitalization, optical or dental, this mutual insurance company offers guarantees adapted to various profiles. In this article, we offer you an overview of the main advantages and options of AXA health insurance, in order to help you choose the formula that suits you best.

The guarantees offered by AXA

In 2024, AXA offers complete health coverage that is available in several areas. First, it covers routine care such as medical consultations, medications and medical tests. Then, the mutual insurance company covers hospitalization costs, including the cost of stay, surgery and the daily rate. In addition, AXA also takes care of optical coverage and dental, with effective reimbursements for glasses, lentils And dental care.

How to choose the right formula?

To choose the complementary health that suits you, start by studying your budget. Evaluate how much you can spend on your health each month. AXA offers several customizable plans, so you can adjust the guarantees according to what you are ready to invest. Visit Axa Health Insurance to explore the different options available.

Opinion on AXA mutual insurance

THE customer reviews play a crucial role in choosing a mutual insurance company. By consulting specialized platforms, you can get an idea of the experiences of other policyholders. Discover the feedback on JeChange to better understand the advantages and disadvantages of AXA mutual insurance.

Additional services

AXA does not just offer basic guarantees. By subscribing to their complementary health insurance, you will benefit from quality customer service, ready to answer your questions and support you on your health journey. For more details on health insurance tailored to your needs, explore information from International Health Mutual.

Calculate reimbursements from your mutual insurance company

Understand how the refunds of your AXA mutual insurance is essential. The mutual offers various tables of guarantees which allow you to evaluate the costs covered, depending on the formula chosen. To consult the different reimbursement levels, do not hesitate to download the guarantee tables on the AXA website.

Take your specific needs into account

Every person has different health needs. It is recommended to analyze your needs based on your personal situation: do you frequently have consultations, do you have children, or do you require more extensive dental coverage? These elements will guide you towards a AXA mutual insurance which will provide you with the security and comfort required throughout the year.

Axa mutual guarantee: features and benefits

| Criteria | Description |

|---|---|

| Coverage of routine care | Reimbursement of consultations, medications and medical analyses. |

| Hospitalization | Coverage of accommodation costs, surgery and daily fee. |

| Optical | Reimbursement of glasses and contact lenses. |

| Dental | Reimbursement of dental care, prosthetics and orthodontics. |

| Personalization | Modular formulas adapted to your specific needs. |

| Assistance | Responsive and attentive customer service. |

| Prices | Competitive options for all budgets. |

| Birth bonus | Up to €960 in the event of birth or adoption. |

| Consult a professional | Access to a large network of healthcare professionals. |

AXA Mutual Guarantee Review: Everything you need to know

Alice, 32 years old: “I have always had doubts about mutual health insurance, but since I subscribed to the complementary health insurance AXA, everything has changed. THE guarantees offered are truly complete, particularly for routine care such as consultations and medications. I feel much more confident in the event of unexpected expenses!”

Jean, 45 years old: “With three children, health expenses can quickly add up. Thanks to AXA, I benefit from efficient reimbursements for dental care And optical. It’s reassuring to know that the whole family is well protected. I highly recommend this mutual.”

Céline, 28 years old: “There complementary health insurance AXA is very customizable. I was able to adjust the contract according to my budget and my specific needs, which is a big plus. The prices are competitive compared to other mutual insurance companies, without compromising the quality of services.”

Paul, 51 years old: “As a senior, it is important for me to be well covered. hospitalization guarantee from AXA particularly reassures me. The accommodation costs and daily package are well reimbursed, which allows me to focus on my health without worrying about the bills.”

Lucie, 36 years old: “I was lost when faced with the many mutual insurance options, but with the help of AXA advisors, I finally found the offer that met my expectations. guarantee tables are clear and accessible, facilitating comparison with other insurances.”

Axa mutual guarantee: everything you need to know

AXA’s complementary health insurance is designed to offer policyholders optimal protection faced with health costs which are not entirely covered by Social Security. With a variety of customizable plans, AXA strives to meet the specific needs of each individual, whether it’s covering routine care, hospitalization, or even care optical And dental. Here is everything you need to know, from the guarantees to consider to the advice for choosing your mutual insurance company.

The guarantees offered by AXA complementary health insurance

AXA offers comprehensive coverage, including several essential aspects of your health:

Coverage of routine care

Your AXA health supplement covers consultations to the doctor, drugs prescribed as well as the medical analyzes. This allows you to benefit from significant reimbursement on the majority of everyday health expenses.

Hospitalization coverage

In the event of hospitalization, AXA offers coverage for accommodation costs, from the surgery as well as a reimbursement of daily package. It provides peace of mind to face the ups and downs of life.

Optical and dental coverage

The health of your eyes and mouth is essential! AXA mutual insurance companies not only reimburse glasses And lentils, but also the dental care such as scaling and caries care, allowing you to maintain your daily well-being.

How to choose the right AXA health insurance

Choosing the right mutual insurance company may seem complex, but here are some key steps to guide you in your choice:

Evaluate your budget

Before making a decision, clearly define the amount you can spend on your complementary health. This will help you avoid exceeding your financial capabilities while still meeting your medical needs.

Analyze your health needs

Identify the types of care you use most frequently. If you need regular dental care or glasses, opt for a plan that offers increased coverage in these areas.

Compare the formulas

AXA offers seven customizable formulas which can meet different requirements. Take the time to compare the guarantees and the prices to find the one that best meets your expectations.

Opinion on AXA mutual insurance

AXA is often praised for the quality of its customer service and its flexible coverage options. Customer reviews highlight the clarity of the offers as well as the effectiveness of reimbursements. Be sure to take these testimonials into account when evaluating the mutual insurance company that interests you.

Personalization at the heart of AXA offers

By subscribing to AXA’s complementary health insurance, you will have access to a range of personalized services. This means that each policyholder can adjust their policy based on their specific health concerns, ensuring coverage that fits their lifestyle.

Choosing AXA for your complementary health insurance means choosing security and comfort in the face of life’s unexpected events. The varied guarantees and quality customer service will allow you to take care of your health with complete peace of mind.

Axa mutual guarantee: everything you need to know

Supplementary health insurance AXA is a valuable solution for those looking for coverage tailored to their needs. With a range of guarantees, it covers essential care such as medical consultations, THE drugs, and even the medical analyzes. So, by opting for AXA, you benefit from complete protection which allows you to manage your healthcare expenses with peace of mind.

Another essential aspect of the AXA offering is the hospitalization cover, which includes accommodation costs, surgery and daily rate. This guarantee is crucial because it protects you in the event of hospitalization, an often unpredictable and financially burdensome situation. By being well covered, you can focus on your recovery without the burden of financial stress.

Care optical And dental are also taken into account with reimbursements on glasses, THE lentils and the dental care. This represents an undeniable advantage for families, who can often face high costs in these health areas. AXA has designed its plans to meet contemporary demands, while offering its customers the ability to personalize their coverage.

Finally, it is essential to choose your complementary health insurance carefully. AXA offers customizable options to adapt to your financial situation and your state of health, thus making access to care simpler and more efficient. By studying your budget and using the comparison tools, you will find the option that will perfectly suit your expectations. Leave nothing to chance and opt for coverage that will guarantee you peace of mind in the face of the unexpected events of daily life.

Axa mutual guarantee: everything you need to know

What is the main function of AXA mutual insurance? The AXA mutual aims to complete reimbursements of Social Security for all your health costs.

What types of care are covered by AXA mutual insurance? AXA offers coverage for routine care (consultations, medications, analyses), as well as forhospitalization (stay expenses, surgery) and care optical and dental (reimbursement of glasses, lenses, dental care).

How to choose the right AXA mutual insurance plan? To choose wisely, it is important tostudy your budget, but also your health needs in order to select the most suitable formula.

What AXA plans are available? AXA offers several customizable packages to meet the requirements and specific needs of each insured.

Are AXA mutual insurance rates competitive? Yes, AXA offers competitive rates while guaranteeing quality coverage and responsive customer service.

Is it possible to personalize guarantees with AXA? Absolutely, AXA mutual insurance allows policyholders to personalize their guarantees according to their individual needs.

What are the opinions of policyholders regarding AXA mutual? Customer feedback generally shows satisfaction, highlighting the benefits and the reliable customer service.

How do I contact AXA for questions about my mutual insurance? For any questions regarding your mutual insurance, you can contact AXA customer service via their website or by telephone.