|

IN BRIEF

|

The prices of the mutual health insurance AXA are a crucial topic for many policyholders wanting to know the options available. Understanding how these prices are determined is essential to making an informed choice. Several factors influence the cost of this complementary health insurance, such as your profile, your age, your place of residence and the level of guarantees wish. In a market where it is possible to find offers from €9.04 per month, it is important to explore the different formulas in order to maximize your reimbursements for your health expenses.

In a world where health expenses can sometimes become a major concern, choosing the right health insurance is essential. There Axa mutual health insurance offers a variety of pricing options that fit many profiles. In this article, we’ll explore the key aspects of Axa’s pricing, highlighting both the pros and cons associated with its offerings.

Benefits

One of the main benefits of Axa mutual health insurance is the flexibility of its formulas. Prices start from €9.04/month, which makes it accessible to a wide audience. You can therefore choose health insurance adapted to your specific needs in terms of guarantees and of refunds.

Axa also offers a personalized calculation of its price, taking into account criteria such as your age, your profile and your place of residence. This allows us to offer you optimal coverage while respecting your budget. In addition, compared to other mutual insurance companies, Axa stands out with competitive reimbursements for various treatments, whether optical or dental, for example.

Another strong point is the presence of a free online quote, thus allowing possible options to be quickly evaluated. This service also makes it easier to understand the offers and guarantees available, allowing you to make an informed choice about your complementary health insurance. To learn more, see this link.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many advantages, it is worth noting a few disadvantages relating to Axa mutual insurance rates. First, costs can increase significantly depending on the level of coverage chosen. Depending on your state of health and your needs, some policyholders may find themselves with high contributions, especially for formulas offering maximum guarantees.

Another point to consider, the charges linked to contract management can also increase the final price. Although Axa is a reputable company, it is essential to compare these costs to offers from other insurers to ensure you are getting the best value for money. To explore this analysis in more depth, see this guide.

Finally, there may be limits on certain services, especially concerning less frequent specific treatments. Although Axa is known for its excellent support many services, it is important to check the details in the reimbursement bases proposed.

For a more complete understanding of Axa mutual health insurance offers, do not hesitate to visit this page, which provides advice on how to choose your complementary health insurance.

Whether you are young active, senior or family, the prices of the Axa mutual health insurance can vary considerably depending on several criteria. This mutual offers a multitude of options adapted to all health needs. In this article, we will present the essential elements you need to know to make the choice that suits you best.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Criteria Impacting the Price

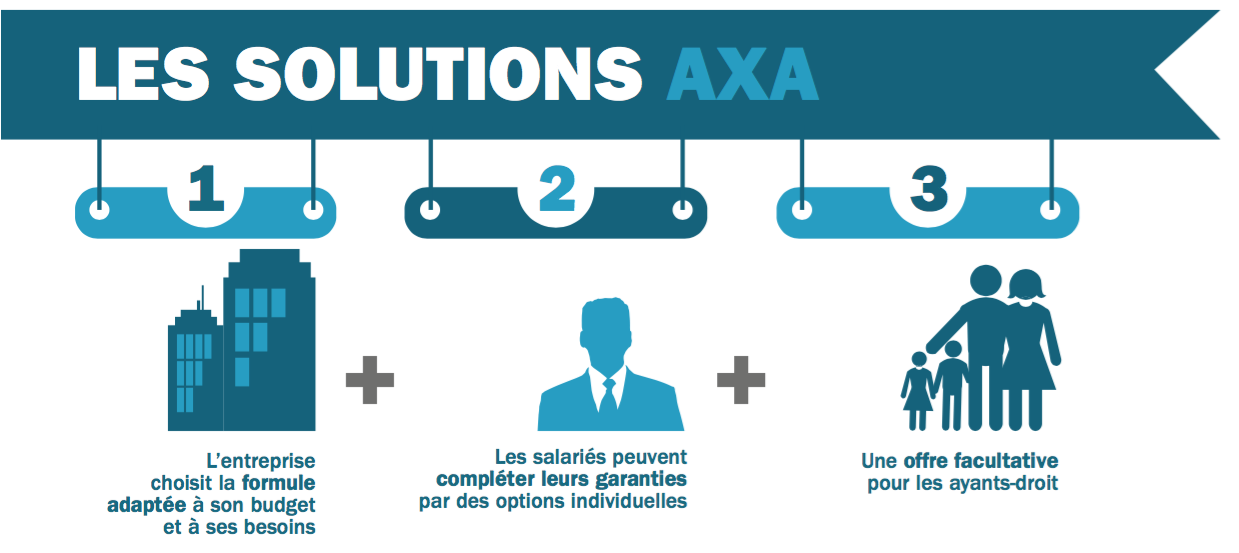

Calculating the price of your supplementary health Axa depends on various criteria. First of all, the profile of the insured plays a crucial role: age, family situation and place of residence influence the cost. Then, the level of guarantees chosen also has a significant impact. The higher guarantees and full refunds you opt for, the higher the price will be.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Free Online Quote

Axa offers a service of free online quote to help you choose the mutual that meets your needs. You can explore different coverage options, from €9.04/month, and simulate several scenarios to find the formula that suits you best.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Refunds and Guarantees

The reimbursements offered by Axa vary depending on the treatment. For example, the Social Security reimbursement basis is generally €25, with 70% covered by this, or €16.50 after deduction of the fixed contribution. Axa mutual guarantees include reimbursements for various medical, dental and optical treatments, helping to relieve your health expenses.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Available Formulas

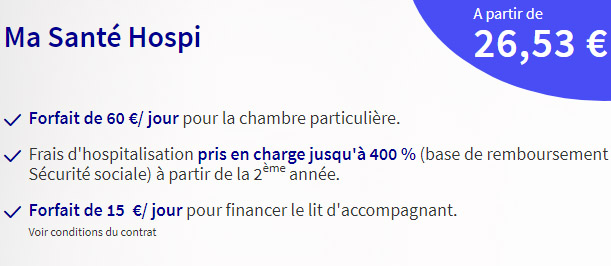

Axa offers several mutual insurance formulas whose possible options may include specific coverage such as coverage of doctors’ fees up to 220% or the choice of a particular room in the hospital. The cost of these plans can start around €25/month and evolve according to each person’s needs.

Avoid Common Pitfalls

When choosing health insurance, it is essential to avoid certain pitfalls. Indeed, some people neglect to compare the Basis of Reimbursement and the prices of care that will actually be reimbursed to them. Take the time to evaluate all the elements before signing up for an offer.

Access More Information

To take your thinking further and compare the options, we advise you to consult the guarantee and reimbursement tables available online. You will find useful information about guarantee tables as well as on the prices mutual societies.

Finally, do not hesitate to visit the Axa website to find out more about the health reimbursements, and to obtain personalized advice for your situation.

Choosing complementary health insurance is an essential step for optimal medical coverage. THE rates for Axa mutual health insurance are varied and depend on several criteria. This article offers you keys to better understand these prices and make the best choice for your health.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Criteria influencing prices

The price of your Axa health supplement is determined by various criteria such as your age, health profile, place of residence and level of guarantees wish. For example, a young insured person with good health can benefit from more advantageous rates compared to a senior with more specific medical needs. Remember to carefully evaluate your personal situation to find the formula that suits you best.

The levels of guarantees available

Axa offers different formulas mutual health insurance ranging from basic coverage to more comprehensive options. Plans starting at €9.04/month offer reimbursements for routine care, while higher options include coverage for hospitalization, dental care and even optics. It is therefore crucial to choose a level of guarantee adapted to your expectations and your budget.

Free online quote

To facilitate your choice, Axa provides you with the possibility of obtaining a free online quote. This will allow you to quickly compare the different plans and their prices. Do not hesitate to explore this option to visualize the expenses to be covered and save money on your monthly contributions.

Examples of refunds

It is important to understand how the refunds of your mutual insurance company. For example, the Social Security Reimbursement Base (BR) for a medical consultation is often set at €25, 70% of which is covered by the latter. By taking into account the guarantees of your mutual insurance company, this can considerably reduce your medical costs. Concrete examples of reimbursements for routine care are available on comparative sites such as GoodAssur.

Traps to avoid

When choosing your Axa health supplement, it is essential to avoid certain traps. Don’t let yourself be seduced only by very low prices which can mask insufficient coverage. Take the time to read the general conditions contracts and to fully understand the warranty exclusions. Also be sure to assess your long-term health needs.

Contact and support

For any questions or need for assistance, Axa puts specialized advisors at your disposal. You can contact them directly via their website or by telephone for details on the prices and guarantees proposed. For more information, visit the Axa website.

Comparison of AXA Mutual Health Prices

| Criteria | Details |

| Basis of price | From €9.04/month |

| Insured profile | Age, professional situation, state of health |

| Guarantee level | Choice between several options (optical, dental, hospitalization) |

| Average age | Prices change with age, generally higher for seniors |

| Equivalent cost | From €25/month for a standard warranty level |

| Dental reimbursement | Variable support depending on the formula chosen |

| Hospitalization | Examples: 220% of fees + private room |

| Optical reimbursement | Included in certain formulas, different levels of support |

| Management fees | Included in the overall price, variable depending on the insurer |

When it comes to choosing a complementary health, prices are often at the heart of concerns. Many policyholders testify that the prices of mutual, like those proposed by AXA, vary considerably according to several criteria. A young couple recently shared their experience, saying the price they pay largely depends on their profile, of their age and their place of residence. They found that even a slight difference in these parameters could influence the amount of their monthly premium.

A senior also testified on the AXA mutual insurance, stressing that the prices he encountered were adapted to his situation. He chose a formula that offered a good balance between guarantees And costs, particularly with regard to the reimbursement of medical expenses. The latter clarified that, although the base price seemed reasonable, it was crucial to carefully examine the coverage options to avoid unpleasant surprises.

A health professional also shared his opinion on AXA prices, specifying that the mutual offered attractive options starting from €9.04/month. However, he cautioned that these starting prices can be misleading. It is important to compare the formulas and take into account the level of guarantees included in each. Reimbursement for dental and optical care can vary significantly from one plan to another, which has a direct impact on the overall cost.

Finally, several users highlighted the importance of making a free online quote before subscribing. This step not only allows us to compare the prices, but also to personalize the guarantees according to its specific needs. The flexibility offered by AXA, combined with a good understanding of cost criteria, can make subscribing to complementary health insurance much more advantageous for policyholders.

Understanding the prices of AXA mutual health insurance

When considering subscribing to a mutual health insurance, it is essential to understand the prices applied. The prices of the AXA mutual health insurance vary depending on several criteria, such as the profile of the insured, their age, their place of residence and the level of guarantees chosen. In this article, we will explore these key elements to help you make an informed choice.

Criteria influencing prices

Calculating the price of your complementary health is based on various criteria. First of all, the profile of the insured plays a vital role. Age and status (employed, self-employed or retired) can have a significant impact on contributions. Then, the level of guarantees which you choose will have a direct impact on the price. Indeed, more extensive guarantees often mean higher contributions.

THE place of residence is also a factor to consider. Regions where healthcare costs are higher may result in higher health insurance rates. Beyond these criteria, the management fees insurance can also influence the final price.

Determine the appropriate level of guarantees

AXA offers a multitude of packages to adapt to the needs of each policyholder. It is crucial to clearly define your needs before making your choice. A free online quote is available to help you compare the different options and determine which guarantees are best suited to your situation. For example, if you have regular optical or dental care needs, choose a plan that offers better coverage for these categories of care.

Formulas and reimbursements

AXA mutual insurance plans are varied and adapted to different types of profiles. For example, you will be able to find plans with attractive reimbursement rates for medical fees, THE hospitalizations and even options for private rooms. Consider finding out about the refunds specific for routine care, in order to understand what you can expect in terms of reimbursement.

Average price and monthly contributions

The average price of a mutual health insurance depends on many factors. For AXA mutual insurance, monthly contributions generally start around €25, but this amount can vary considerably depending on the level of guarantees chosen. So, it is exciting to know that there are options from €9.04 per month, but be careful not to neglect the guarantees which may be minimal at this price.

Avoiding common pitfalls

Choosing health insurance can sometimes be a real challenge. Hence the importance of avoiding common pitfalls during your selection. For example, don’t be guided solely by the lowest price, as this can often mean insufficient guarantees. Be sure to read the guarantee tables and understand the coverage associated with each form of insurance.

AXA, a reliable mutual?

AXA is recognized for its solidity and seriousness in matters of insurance. Before committing, check reviews from other policyholders to see how they rate their reimbursements and the effectiveness of customer service. A mutual health insurance efficient is one that ensures good value for money while remaining attentive to the needs of its customers.

When it comes to choosing a complementary health, price is often a determining criterion. The prices of the Axa mutual health insurance vary depending on several factors, making it crucial to understand the constituent elements of these costs. The first parameter to consider is the profile of the insured, including their age, place of residence and specific health needs.

Thus, for a young insured person with no medical history, the price can start from €9.04 per month, but this contribution can quickly change depending on the level of guarantees chosen. Each Axa formula offers refunds different for varied care, whether for hospitalization costs, dental or optical care. It is therefore essential to carefully analyze the available options and the associated reimbursement rates.

In addition, it is recommended to take into account the management fees which can influence the final price. These costs are often included in the calculation of contributions and can vary from one insurer to another. By taking all these criteria into account, you will be able to better understand and anticipate the amount of your mutual insurance.

Furthermore, the Basis of Reimbursement of the Social security should also be considered when evaluating your health coverage. A thorough understanding of these different elements will help you avoid common pitfalls when choosing complementary health insurance.

Ultimately, the success of your choice of mutual insurance is based on a clear assessment of your needs, in-depth price research and a comparison of the different offers offered by Axa and other insurers. This will allow you to find the best mutual insurance adapted to your personal situation.

FAQ on AXA mutual health insurance prices

What are the factors that influence the price of AXA mutual health insurance? The price of your AXA health supplement depends on your profile, especially your age, of your place of residence and of level of guarantees that you choose.

Is it possible to obtain a free quote online for AXA mutual insurance? Yes, AXA offers free online quotes, allowing you to explore health insurance options adapted to your budget, with prices starting from €9.04 per month.

What are the guarantees of AXA mutual health insurance? AXA mutual insurance plans include reimbursements for doctors’ fees, as well as options such as private room in the event of hospitalization.

How are health reimbursements calculated? The reimbursement base is generally €25, of which 70% is covered by the Social security, which means that you can obtain up to €16.50 after deducting the flat-rate contribution.

What pitfalls should you avoid when choosing AXA mutual health insurance? It is crucial to check the Basis of reimbursement and avoid relying solely on the price of the mutual without taking into account the coverage offered.

From what amount does the price of contributions at AXA start? In general, contributions for AXA mutual health insurance start around €25 per month, but this may vary depending on your personal situation.

What options are available for optical and dental care with AXA? AXA offers basic guarantees for optical and dental care, including for example management of refractive surgery for myopia.

How to choose the right health supplement? To choose the right complementary health insurance, it is important to understand the offers available and seek advice from experts, such as those offered by AXA.