|

IN BRIEF

|

When it comes time to choose your private health insurance, it is essential to find a solution that is both adapted to your needs and affordable. With the multitude of offers available on the market, it can be difficult to navigate. This guide supports you in this process by providing you with practical advice for assessing your health needs, comparing guarantees and identifying the cheap mutual health insurance which offer good value for money. Take the first step towards informed and economical health coverage!

Choose one cheap private health insurance can be a real headache, especially when it comes to getting optimal coverage without breaking the bank. In this article, we will explore the benefits And disadvantages associated with low-cost private health insurance, to help you make the best choice for your situation. We will also give you practical advice for navigating through the different offers available on the market.

Benefits

Opt for one cheap private health insurance presents several notable advantages. First of all, these contracts are generally more financially accessible, allowing a greater number of people to benefit from adequate health coverage. Thanks to attractive prices, you can save on your health expenses while offering you attractive guarantees.

Then, growing competition in the private health insurance sector pushes insurers to offer flexible options and improve their services. As a result, it is possible to find contracts with customizable options based on your profile and your health needs. Additionally, some contracts offer reimbursements that increase with loyalty, rewarding you for your long-term loyalty.

Insurance for expatriates: the importance of flexibility in your choices

In a constantly changing world, and with the resumption of expatriation expected in 2025 after the slowdown caused by the Covid-19 pandemic, the role of expatriate insurance has never been more crucial. Companies must now ensure that their employees, spread…

Disadvantages

Despite the many benefits, it is important to be aware of the disadvantages which can occur with cheap private health insurance. Indeed, some low-cost offers may include significant limitations in terms of guarantees. For example, you may have to wait longer for reimbursement for certain treatments or certain crucial services may not be covered.

In addition, the franchises and the reimbursement terms can sometimes increase your healthcare costs, making an initially attractive contract less advantageous than expected. Therefore, it is essential to carefully analyze the details of each contract before making a decision. Make sure you understand what your insurance actually covers to avoid unpleasant surprises when using your benefits.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

How to choose your cheap private health insurance

To make an informed choice, start by evaluating your health needs and your healthcare consumption. Will we pay attention to the frequency of your medical visits or the nature of your treatments? This will help you determine what types of warranties are most important to you.

Do not hesitate to use comparators online to quickly view the different offers available. Sites like LeLynx.fr offer rankings of the cheapest contracts based on your profile. Finally, keep in mind that the most low premium does not always mean the best coverage! Take the time to consider the elements of each contract, including additional guarantees that they offer.

In a context where health is a priority for each of us, it is crucial to choose the right private health insurance. This guide is designed to help you find coverage that fits your budget, while providing you with adequate guarantees for your health needs. Discover practical advice for comparing offers, assessing your needs and saving on your contract.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Understanding private health insurance

Private health insurance is an alternative to Social Security for those who do not have public coverage. It can be essential, especially for self-employed workers, expatriates or anyone with special situations. Before you begin your search, it is important to understand the different types of contracts available and what they include.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Assess your health needs

Before selecting a cheap mutual insurance, take the time to assess your specific health needs. Ask yourself questions about the frequency of your care: do you see doctors regularly? Do you have specific needs (optical, dental, etc.)? A good starting point is to summarize your health expenses over the past few years to better guide your choice.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Compare available offers

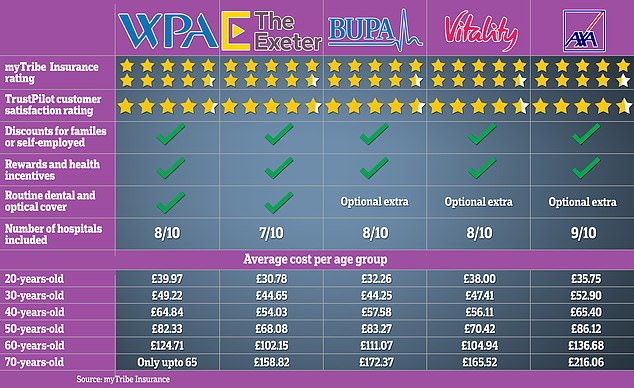

Use insurance comparators to get an overview of the different offers. Platforms like BestRate will allow you to compare offers from more than 30 mutual insurance companies for free. This step could save you up to 416€/year on your contract!

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Choose suitable guarantees

THE guarantees offered by different mutual insurance companies vary considerably. It is essential to choose the ones that best suit your needs. Pay particular attention to reimbursement items (hospitalization, consultations, routine care, etc.) and favor evolving packages which increase their coverage over the years.

Consider local offers

Prices and quality of care can vary greatly depending on the region. Do not hesitate to take particular interest in the offers that apply to your city or department. This approach will not only allow you to benefit from adapted reimbursements but also from attractive reductions linked to your location.

Use online resources

Sites like UFC What to Choose offer useful buying guides and advice to help you in your choice of mutual insurance, while telling you what is best for self-employed workers and liberal professionals. This can guide you towards attractive and well-reimbursed pricing options.

Check customer reviews

Before taking out a contract, consult the opinions of other policyholders on the mutual insurance companies that interest you. This can give you a clear view of current member satisfaction and avoid unpleasant surprises after you join.

Finally, be sure to carefully read the terms and conditions of the contract you plan to sign. Understanding what each clause entails will help you avoid unpleasant surprises later.

In a world where healthcare costs can quickly add up, it is essential to find a private health insurance which offers suitable coverage without breaking your budget. This guide will help you identify the key criteria for finding affordable health insurance while guaranteeing quality guarantees.

Assess your health needs

Before choosing a mutual, it is crucial to analyze your own health needs. Consider your medical history, the frequency of your doctor visits, and the types of care you are most likely to need. By determining your priorities, you will avoid paying for guarantees that are not useful to you.

Compare available offers

Use online comparators to examine the different mutual health insurance. Platforms like LeLynx.fr allow you to view a ranking of the cheapest contracts, based on the criteria that are important to you. Do not neglect the importance of transparency in the prices and services offered.

Check guarantee levels

THE guarantees proposed by each contract must be carefully examined. Compare the reimbursement packages and choose a mutual that meets your requirements. Some contracts increase their packages with loyalty, which can be advantageous for long periods.

Measure repayment times

Another essential point to consider is the repayment period. Find out about the average times for processing reimbursement requests. This factor can make all the difference, especially if you need rapid reimbursement after medical treatment.

Take advantage of local offers

Doctor prices and health issues may vary depending on your region. So take an interest in local offers offered by mutual insurance companies. Sometimes, policyholders can benefit from better service at a reduced cost, especially if coverage is provided for local care.

Check user reviews

Before finalizing your choice, take the time to read the opinions of other policyholders. Sites like 60 Million Consumers provide feedback that can shed light on the quality of a mutual’s services. This will allow you to have a more precise idea of the choices to make.

Don’t hesitate to negotiate

When you have identified one or more mutual insurance companies that interest you, do not hesitate to negotiate, especially if you are a potential customer who plans to take out a contract for a long term. Some insurance companies may offer discounts for extended commitments or sponsorships.

Finally, for those who want to know more about theprivate health insurance at the international level, sites like International Health Mutual offer interesting perspectives on overseas practices and available options.

Guide to choosing cheap private health insurance

| Criteria | Details |

| Needs assessment | Take stock of your state of health and your medical habits. |

| Essential guarantees | Identify the care you need most. |

| Comparison of offers | Use comparators to examine different mutual insurance companies. |

| Refunds | Check reimbursement rates for routine care. |

| Franchise and ceilings | Analyze imposed deductibles and coverage limits. |

| Membership Duration | Favor contracts that increase guarantees over time. |

| Prices | Compare the prices of the different offers while taking into account the guarantees. |

| Customer service | Find out about the quality of customer service offered by the mutual. |

| Local offers | Consider mutuals that understand the specifics of your region. |

| Waiting periods | Ask about waiting periods for refunds. |

When I decided to look for a private health insurance, I felt a little lost in the multitude of options available. After taking the time to evaluate my health needs specific, I realized how important it was to understand the guarantees offered by each contract. Thanks to this guide, I was able to compare the prices and the levels of refund, and finally choose a cover that perfectly fit my budget.

While talking with friends, I discovered that they also needed help finding a cheap mutual health insurance. We decided to get together and make a list of criteria to consider. Rate our healthcare consumption, for example, allowed us to identify the medical services which we really needed. This helped us avoid paying for unnecessary warranties.

Another tip I learned is to always check the local offers. THE prices care can vary considerably from region to region. By focusing on the mutual which well cover the practitioners around me, I not only found an affordable contract, but also one which guaranteed refunds appropriate for my needs.

I discovered that many sites offer mutual insurance comparators, and by using them, I was able to make significant savings, up to 400 euros per year. It was both simple and quick! By comparing more than 30 partner mutuals, I was able to feel more confident in my choice, knowing that I was not overpaying for my health coverage.

Finally, after following these tips and doing my research, I found a private health insurance which not only matched my budget, but which also offered a good level of refund for routine care. I am delighted with my decision, and I feel better prepared to face any health eventualities that may arise in the future.

Choose one private health insurance cheap doesn’t have to be a complex task. It is essential to take several criteria into account to find the coverage that best suits your needs and your budget. This guide will help you navigate through the different options available and make an informed choice.

Assess your health needs

Before you start looking for a private health insurance, start by taking stock of your health needs. This includes your medical history, how often you see healthcare professionals, and the care you plan to use. For example, if you are generally in good health, you might opt for coverage with a copayment higher, while people with greater health needs will need to consider more comprehensive guarantees.

Compare offers

Compare the different mutual health insurance is a crucial step in finding a cheap option. Use online comparators to evaluate more than 200 offers in just a few minutes. Also check the prices and the reimbursement levels offered by each contract. By taking the time to compare, you will have a clear view of the options available and can save up to €392 per year.

Analysis of the guarantees offered

THE guarantees vary considerably from one policy to another. It is important to check what care is covered, as well as the reimbursement packages associated with it. Some health insurance companies offer reimbursements that increase over time, which can be an advantage if you plan to stay with the same insurer in the long term. Do not hesitate to ask for further explanations if there are any points that are unclear.

Consider the balance between price and coverage

It is tempting to choose the cheapest policy, but it is essential to find a balance between price and the level of coverage. A cheap policy may have significant exclusions, or may not provide adequate coverage for the most common care. Make sure that items that are crucial to your health, such as specialist consultations, are reimbursed.

Check the insurer’s reputation

Before taking out private health insurance, find out about the insurer’s reputation. Read reviews from other customers to assess the quality of customer service and the speed of reimbursements. A good reputation is often indicative of efficient management and a satisfactory relationship with policyholders.

Adapt your choice to your personal situation

Finally, take your personal situation into account when choosing your coverage. Retirees, young workers or self-employed workers (TNS) have different health needs. Consider consulting rankings and comparisons that focus on your profile to find the best option. This way, you will maximize your chances of choosing a mutual health insurance that truly meets your expectations.

When we find ourselves in need of a private health insurance, it is essential to browse the market wisely. Evaluate your health needs is the first fundamental step in choosing suitable coverage. Indeed, each individual has specific requirements depending on their age, lifestyle and medical history. This prior assessment not only saves money, but also ensures optimal protection.

It is also crucial to be attentive to the different guarantee levels offered by mutual insurance companies. Some offers may seem attractive due to their price, but may lack essential coverages. Analyze the reimbursement packages and understanding exclusions are key steps in avoiding unpleasant surprises when using your rights.

Do not overlook the importance of comparing several mutual health insurance. Using specialized comparators can save you up to several hundred euros per year. In just a few minutes, you can discover a multitude of diverse offers that adapt to your personal situation. By observing the discounts and benefits offered by each insurer, you will be able to select the most advantageous coverage.

Finally, keep an eye on market developments. The prices and guarantees of private health insurance may change regularly. This means that an option that was attractive a few months ago may no longer be attractive today. Anticipating and reassessing yourself regularly is a sure way to stay in the best value for money.

FAQs about Cheap Private Health Insurance

What is private health insurance? Private health insurance is health coverage that supplements Social Security reimbursements, providing increased financial protection in the event of medical expenses.

Why choose cheap private health insurance? Choosing affordable private health insurance allows you to benefit from coverage adapted to your needs while controlling your budget, thus avoiding excessive spending.

How to choose the best cheap private health insurance? To choose wisely, it is essential to evaluate your health needs, to compare the guarantees offered, to examine the prices, and take into account the reputation of the insurer.

What criteria should you take into account when comparing private health insurance? The criteria include guarantees proposed, the reimbursement rate, there franchise, and the additional services such as assistance or prevention programs.

Are there any price differences depending on the region? Yes, private health insurance prices can vary depending on the regions, of the doctors and frequency of health problems specific to each area.

Is it possible to change private health insurance? Yes, it is possible to change insurance, even during the year, but it is important to carefully check the conditions of any possible penalty or respect for notice periods.

How do I evaluate my healthcare consumption to choose suitable insurance? A good way to evaluate your healthcare consumption is to carry out a health check, to analyze your medical expenses past and reflect on your future needs in health.

What are the best practices for finding cheap private health insurance? It is advisable to compare offers from several insurers, read customer reviews, and not hesitate to seek advice from health or financial professionals.