|

IN BRIEF

|

When considering an expatriation, the choice ofhealth insurance adapted is crucial to guarantee optimal coverage of medical costs. With a multitude of options available on the market, it can be difficult to navigate. A comparison of health insurance abroad therefore proves essential to enlighten expatriates on the different guarantees offered. By taking into account factors such as reimbursement amounts, coverage scopes and the specifics of each contract, it becomes possible to make an informed and secure choice. Take the time to compare offers and make sure you select the one that will best meet your specific needs abroad.

Choose one health insurance abroad can be complex, as the offer is vast and varies from one country to another. This article helps you navigate the different options available, with a health insurance comparison for expatriates. We will examine the advantages and disadvantages of the different solutions to help you make the best choice based on your needs.

Benefits

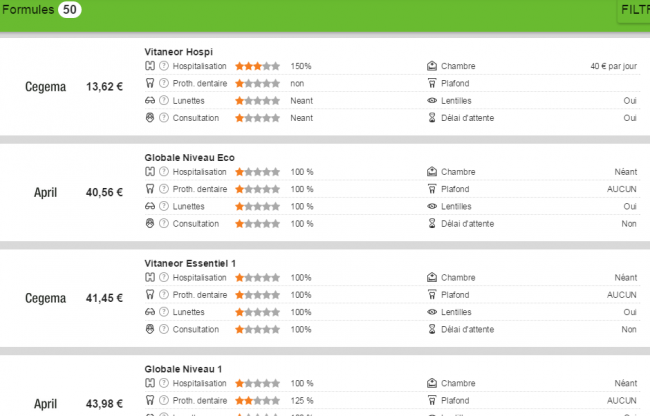

Health insurance comparators available online present several benefits not negligible. First of all, they allow quickly compare different offers in just a few clicks. In less than two minutes, it is possible to access a panel of 200 health guarantees to evaluate the proposed options.

In addition, these analysis and comparison tools offer you the opportunity to target the insurance that best meets your needs. specific needs. Whether for routine care, emergencies or even serious treatments, you can refine your search according to your personal situation.

Furthermore, a good comparison often includes opinions from experts who share their practical advice. This information can be valuable to expatriates, especially those who are not yet familiar with the healthcare system in their country of residence.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages associated with choosing health insurance abroad. Firstly, not all insurance companies offer the same level of coverage. Some contracts may seem attractive in terms of price, but offer limited warranties which do not cover all medical costs.

Then, understanding the different terms and conditions can be confusing. THE complex clauses and specific exclusions in contracts are often misunderstood, which can lead to unpleasant surprises when using medical services.

Finally, comparing several offers can become time-consuming, especially if you have to navigate between many sites or documents. To avoid feeling overwhelmed, it is crucial to stay organized and take note of the most important elements, such as which insurance companies reimburse the most for medical care.

Useful resources

To help you in your quest for the ideal overseas health insurance, you can check out resources such as Everything you need to know about international mutual health insurance, which will give you a complete overview of the options available, or Travel insurance comparisons, to evaluate the best options for your temporary stays.

When you go to live abroad, subscribe to a international health insurance adapted is essential to guarantee your well-being and safety. This article guides you through the crucial steps to choose the best health coverage based on a comparison of the available options.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Understand your health needs

Before starting to compare offers, it is important to carefully analyze your own health needs. Consider your medical history, whether you need regular or specialized care, and the type of treatment you may need abroad.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Find out about guarantees

THE money back guarantees are a key point in choosing your health insurance. Be sure to review the types of care covered, such as medical visits, hospitalization, dental or vision care, and medications. Good coverage should also include additional services such as teleconsultation.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Compare offers

To make an effective comparison of health insurance abroad, use a insurance comparator online. These tools allow you to visualize and analyze the advantages and disadvantages of each proposal quickly. In less than 2 minutes, you can compare up to 200 health guarantees, which helps you find the insurance that suits you best.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Choose the right type of contract

Health insurance abroad generally comes in several types of contracts: complementary, specific mutuals or first euro. Understanding these differences will help you choose the plan best suited to your personal situation. For example, a first euro contract may be more advantageous if you want to avoid advanced fees.

Review prices and conditions

The cost of health insurance is a determining factor. It is essential to compare the prices of international health insurance, but we must not neglect the quality of the services offered. Sometimes a low price can come with high deductibles or exclusions of guarantees which could prove problematic if necessary.

Opinions from other expats

Do not hesitate to consult the feedback of other expatriates who have subscribed to health insurance. Reviews can give you real insight into the quality of customer service, reimbursement times, and care coverage. This can be a valuable asset in making your final decision.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Finalize your choice

Once you feel ready to choose, read the general conditions of the contract carefully and do not hesitate to ask your insurer questions. Make sure you understand all the details before signing, to avoid unpleasant surprises.

Useful resources

To make your choice easier, consult platforms like ACS Or April International for more information and comparisons.

The search for the best health insurance abroad can seem daunting given the multitude of options available. Whether you are an expatriate, student, or posted worker, making the right choice is crucial to guarantee your health protection. This article offers tips and tricks to help you compare international health insurance and choose the one that best suits your specific needs.

Assess your health needs

Before you start your health insurance comparison, it is essential to make a list of your medical needs. What types of care do you anticipate needing? Do you have specific treatments or regular medications? By identifying your requirements, you will be able to better evaluate the different insurance options available to you.

Examine the guarantees offered

Compare the health guarantees offered by each insurance. Pay particular attention to the types of care covered, such as general medicine, specialized care, hospitalization, or dental care. Don’t forget to check the reimbursement ceilings and exclusions of each contract to avoid unpleasant surprises.

Consult the opinions of other expats

There is nothing like the experience of other users to inform your choice. Consult forums, blogs or groups on social networks related to expats. You will easily find testimonials on the different insurances. Feedback can be very valuable in measuring the quality of the services offered by each insurance company.

Use online comparison tools

To optimize your search, do not hesitate to use online health insurance comparison tools . These tools allow you to view the different options available at a glance, highlighting prices and guarantees. For example, Santexpat offers a complete comparison of expatriate health insurance.

Check the assistance and customer service

A good customer service and efficient assistance are criteria that should not be overlooked. Make sure that the insurer offers accessible support, especially in the event of a medical emergency. Find out about the response times to requests and the ease of access to advisors, as this can have a direct impact on your experience as an insured.

Compare the value for money

Finally, evaluate the value for money of different insurance policies. A low price may seem attractive, but it can hide gaps in coverage. It is often better to choose slightly more expensive insurance with better coverage and fewer exclusions. Check out sites like Best rates for relevant comparisons.

| Selection criteria | Explanations |

| Type of coverage | Check if the coverage is comprehensive or if it includes important exclusions. |

| Territoriality | Make sure the insurance is valid in the country(ies) where you reside. |

| Reimbursement limits | Analyze reimbursement ceilings for routine and specific care. |

| Support and services | Check the assistance services offered (repatriation, medical advice). |

| Cost of premiums | Compare prices taking into account the guarantees offered. |

| Franchise | Find out about any deductibles you may have to pay in the event of treatment. |

| Subscription conditions | Analyze the membership and termination conditions. |

| Pre-existing coverage | Check if pre-existing conditions are covered or excluded. |

| Reputation of the insurer | Find out about the financial strength and reputation of the insurer. |

Testimonials on the Comparison of Health Insurance Abroad

When I decided to move abroad, one of my biggest concerns was choose my health insurance wisely. Thanks to an online comparator, I was able to examine different options and discover the best mutuals for expatriates. In just a few minutes, I compared more than 200 health guarantees and found the one that perfectly suited my needs.

I remember hesitating between several offers. The advice of the experts on the comparison platforms was invaluable to me. They helped me understand the importance of compare reimbursements about the types of care that matter most to me, such as doctor visits or hospital care. Thanks to their clear recommendations, I was able to make an informed choice.

In 2025, I consulted an ultra-complete comparison of travel insurance to determine if I needed additional coverage while traveling. Options such as Chapka and Allianz were at the top of the list, and I was able to compare their prices and the guarantees offered. It was reassuring to see that so many choices were within my reach.

During my research, I also discovered that some countries offer better healthcare systems than others. This reinforced my decision to choose a international health insurance who protects me, no matter where I am. So, I was able to live with peace of mind, knowing that my medical expenses would be covered.

When I finally chose my expatriate health insurance contract, I took the time to read all the details. Online comparators allowed me to ensure that I would not leave out any essential guarantees and that I would not be exposed to a remains too heavy. This is a fundamental aspect that every expatriate, in my opinion, must absolutely check.

Choose the right one health insurance abroad is a crucial step for any expatriate, traveler or digital nomad. With a multitude of options available and varying offers, it is essential to carefully consider your specific needs and compare the different guarantees on offer. This guide presents clear recommendations to help you navigate the process of selecting the most suitable health coverage.

Assess your health needs

The first step in choosing a international health insurance is to assess your personal needs. Consider what care you may need, whether it’s regular checkups, dental care, or potential hospitalizations. Also consider your pre-existing medical situation and that of your family, if you go with them. This evaluation will allow you to better target the offers that will meet your expectations.

Types of coverage

There are several types of health insurance coverage: mutual, specific insurance for expatriates and travel insurance. Each has its advantages and disadvantages. Mutual insurance companies generally offer broader coverage, but may have waiting times. Expat insurance is designed specifically for people living abroad, while travel insurance is ideal for temporary stays. Consider the length of your stay and your specific needs when choosing the type of coverage.

Compare the guarantees offered

Once your needs have been identified, the time has come to compare guarantees offered by different insurance companies. Check the level of reimbursement for routine care, specialized medical procedures, surgical operations and hospitalization. Also examine the coverage limits, as some contracts may have limits that will not suit you, depending on your profile and lifestyle.

Additional services

Do not neglect the additional services which often accompany health insurance contracts. Services such as remote medical assistance, psychological support or access to networks of healthcare professionals can make a big difference when needed. Look for insurers that also offer a wide range of partners in the country of residence to ensure an easily accessible medical network.

Cost Review

Price is a deciding factor in choosing your expatriate health insurance. Compare prices by considering coverage levels, deductibles and co-payments. Be on the lookout for insurance without additional costs, because some may hide additional costs which increase the total cost. Use a health insurance comparator online can save you valuable time and help you find the best deal.

Evaluate insurer reviews and reputation

Before making your final decision, remember to evaluate the reputation of insurers. Consult feedback from other expatriates or users on dedicated forums and social networks. Reviews from past customers can give you insight into the quality of services, processing of refunds, and efficiency of customer service.

Choose the right one health insurance when you are an expatriate is a crucial step to guarantee your safety and that of your family. As part of your expatriation, it is essential to compare the different options available in order to find the coverage that best meets your specific needs. With a constantly evolving market, it is essential to stay informed of the latest offers offered by insurers.

First, start by evaluating your personal needs. Consider the type of care you may need depending on your health and the region you are relocating to. Some international mutual societies offer coverages more suited to extended stays, while others may be ideal for short-term stays or vacations. Take into account your medical history and the services available locally, this will help you direct your search.

Then, do an analysis of guarantees offered by each contract. Don’t just go by the price, but check the details regarding the healthcare reimbursements, waiting periods, as well as exclusions. A health insurance comparator will be very useful for you to visualize at a glance the major differences between the available options.

Finally, don’t forget to read reviews from other expats about the insurance they have chosen. Their experiences can provide valuable insights and additional decision-making elements to guide your choice. By following these steps, you will be able to approach your expatriation with peace of mind, with the certainty of being well protected abroad.

FAQ on comparing health insurance abroad

How important is it to compare health insurance abroad? It is crucial to compare health insurance abroad to find the coverage that best suits your specific needs and budget. Each country offers different guarantees, and a comparison allows you to avoid unexpected costs.

How to choose the best international health insurance? To choose the best international health insurance, it is essential to assess your medical needs, compare the types of guarantees offered and take into account discounts on specific treatments, in order to select an option that adequately protects you.

What criteria should you take into account when selecting expatriate insurance? When selecting expat insurance, it is important to consider coverage for routine care, quality of services abroad, reimbursement times, as well as assistance in the event of an emergency.

What are the differences between expatriate insurance and international mutual insurance companies? Expat insurance is generally designed to provide comprehensive cover abroad, while international mutuals may offer more flexible options for expats, with reimbursements varying depending on the nature of the care.

How to assess the value for money of international health insurance? To assess the value for money of international health insurance, compare the guarantees offered, the level of reimbursement and the prices. Also, be sure to read customer reviews to get an idea of the insurer’s reputation.

Is it possible to buy health insurance online? Yes, it is possible to purchase health insurance online. Many insurance comparators allow you to obtain quotes quickly and choose the coverage that meets your needs without having to travel.

What are the tips for avoiding the pitfalls of health insurance abroad? To avoid the pitfalls of health insurance abroad, read the general conditions carefully, be vigilant about warranty exclusions and do not hesitate to ask your insurer questions regarding unclear points.