|

IN BRIEF

|

In today’s professional world, mutual health company represents a major asset for both employers and employees. In particular, the AXA mutual health insurance stands out for its ability to offer solutions adapted to everyone’s needs. With unique refund guarantees and personalized services, AXA is committed to protecting the health of your employees while allowing you to control your costs. Discover all the facets of this collective coverage and how it can strengthen the well-being of your team.

There AXA company health insurance is a valuable asset for professionals concerned about the well-being of their employees. This additional coverage system makes it possible to significantly reduce health costs not reimbursed by Social Security. In this article, we will explore the advantages and disadvantages of this mutual insurance to help you make an informed choice for your business.

Benefits

AXA corporate health insurance offers many benefits which contribute to the health of employees and the peace of mind of managers. First of all, policyholders benefit from a remaining charge of 0 € for routine care, an initiative put in place since 2020. This is particularly welcome given the increase in health spending.

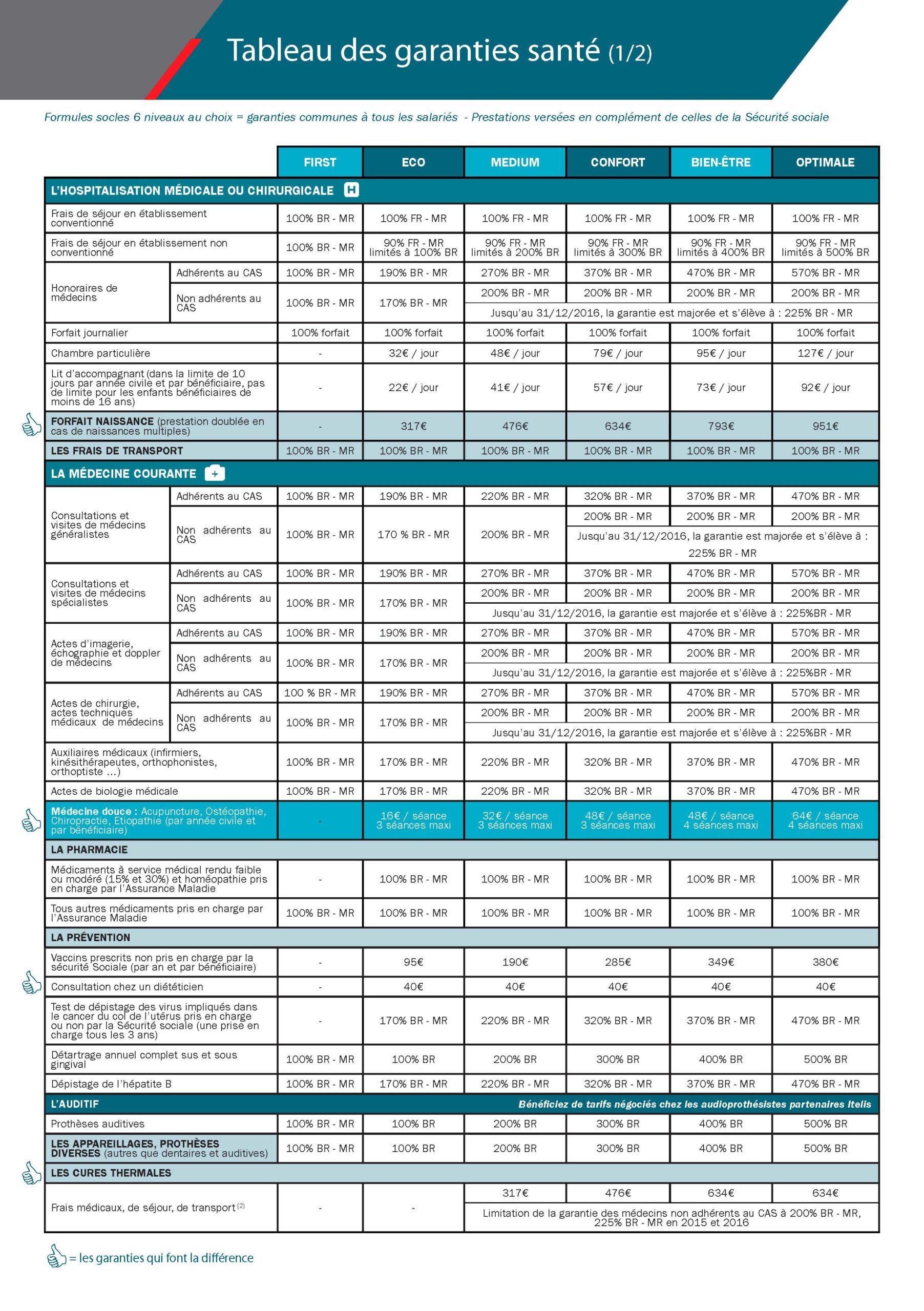

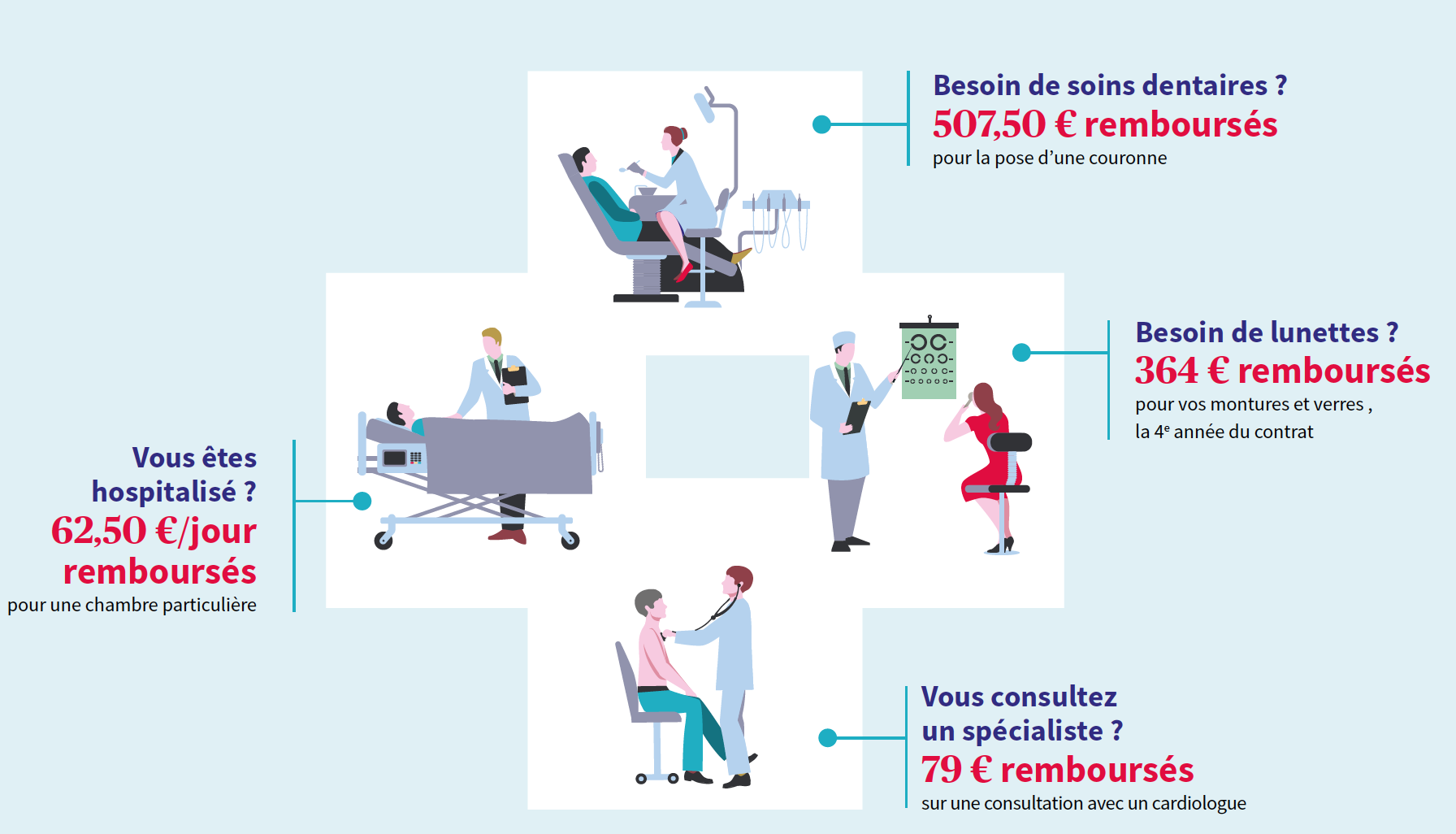

In addition, AXA offers comprehensive protection through varied coverage ranging from dental tooptics, through specialist consultations. Companies can also choose levels of guarantees adapted to their needs and those of their employees.

Another significant advantage is access to a network of more than 12,000 healthcare professionals, which facilitates the management of care and simplifies the health journey of employees.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many advantages, the AXA company health insurance can also have disadvantages. First of all, the cost of contributions can be a deterrent for some companies, especially for small structures. It is important to carefully evaluate the rates, available here, before taking out a contract.

Then, the diversity of coverage options can sometimes complicate the choice for managers. It is essential to understand the differences between a mutual and a supplementary health insurance in order to choose the best solution for your company. For more details on this difference, consult this link here. Finally, although coverage is mandatory for business leaders, it is not uncommon for employees to be less motivated to sign up or get involved. Communication and information are therefore essential keys to maximizing the benefits of this mutual insurance within the team.

AXA corporate health insurance offers coverage tailored to the needs of employees and business leaders. By choosing AXA, you are opting for a reliable partner that guarantees not only high-performance health solutions, but also quality support. In this article, we will explore the main advantages of this mutual insurance, the specific features of the offer and how it contributes to the well-being of all employees.

The advantages of AXA health insurance for companies

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

AXA’s corporate health insurance allows employees to benefit from advantageous conditions. For example, since January 1, 2020, it is possible to benefit from a

remaining charge of 0 € for routine care. This means that health expenses, often expensive, are largely covered by this collective supplement. This way, employees can focus on their work without worrying about large medical bills. Comprehensive coverage for everyone

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

AXA offers comprehensive coverage including various services such as optical, dental, as well as routine care, to meet the needs of each individual. Through a network of more than

12,000 healthcare professionals , AXA guarantees easy access to quality care, whether from specialists such asdental surgeons , THEhearing aid specialists , or even well-being experts like theosteopaths And psychologists .Social exemptions for business managers

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Taking out complementary group health insurance is not only an asset for the health of employees, but also an obligation for business leaders. By opting for AXA mutual health insurance, managers can benefit from social exemptions, under certain conditions. This makes this solution even more attractive, both financially and organizationally.

How to subscribe and manage your AXA mutual insurance

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The procedure for subscribing to AXA’s corporate health insurance is simplified thanks to online tools accessible on the AXA website. Companies can easily view the different offers and prices available to them, and register directly online. For more information, visit

this page . In addition, responsive customer service is available to answer all your questions and help you manage your contract. To contact customer service, go tothis page .Understand the difference between mutual and complementary health insurance

It is important to distinguish company mutual insurance from complementary health insurance. A mutual insurance company is generally a non-profit organization which brings together policyholders, while a complementary health insurance contract is an insurance contract which supplements Social Security reimbursements. To better understand these distinctions, you can read this article on

the differences between these two concepts .Prices for AXA mutual health insurance

AXA health insurance prices are competitive and vary depending on the options chosen. By comparing these offers, companies can ensure they are making the best choice for their employees while respecting their budget. To explore these rates in detail, visit

this resource .In summary, AXA corporate health insurance offers many advantages for employees and business managers. With extensive guarantees, access to quality care and the possibility of benefiting from social exemptions, AXA positions itself as a key player in the field of mutual health insurance.

discover axa mutual health insurance, designed to offer you coverage adapted to your needs. Protect your health and that of your family with comprehensive warranties, responsive customer service and personalized solutions. opt for peace of mind with axa.

The advantages of AXA mutual health insurance

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Choosing an AXA company mutual health insurance company means benefiting from many advantages. First of all, you benefit from &strong;€0 out-of-pocket costs from January 1, 2020&strong;, which significantly reduces your medical expenses. In addition, the offer includes health services adapted to the needs of employees, covering a wide range of routine, often expensive care.

Health coverage suitable for everyone

The &strong;AXA supplementary health&strong; is designed to meet the varied needs of businesses, whether large structures or small SMEs. Each employee can thus access quality care, which includes optical, dental and routine care. With AXA, ensure that all your employees are protected.

The simplicity of membership

Subscribing to AXA corporate health insurance is a quick and simple process. Companies must indeed guarantee health coverage to their employees, and AXA facilitates this process by offering adapted contracts. This approach not only allows compliance with the law, but also improves employee well-being, a key factor in productivity.

Advantageous social exemptions

An interesting specificity of the AXA collective health insurance is the possibility of benefiting from social exemptions for company directors. These exemptions, under certain conditions, reduce the cost of health protection for the company while promoting a calm and secure working environment.

A network of health professionals

By opting for AXA mutual health insurance, you have access to a large network of more than 12,000 health professionals. throughout the territory. This network includes general practitioners, specialists, and alternative medicine practitioners, allowing employees to choose the best care according to their preferences.

To find out more

For further details and to explore all the options offered by &strong;AXA corporate health insurance&strong;, do not hesitate to consult the official AXA website

here . You will find useful resources to help your company make the best choice when it comes to complementary health insurance.Finally, be aware that the rates for AXA corporate health insurance remain competitive, with an average cost of around &strong;105 euros per month&strong;. To find out the details on these prices and compare with other offers, visit the following link

here .Comparison of the Benefits of AXA Corporate Health Insurance

Criteria

| Details | Remains payable |

| 0 € remaining payable since 2020 for routine care. | Blanket |

| Coverage of all or part of unreimbursed costs. | Network access |

| Access to a vast network of more than 12,000 healthcare professionals. | Health equipment |

| Integration of | 100% Health for optics and dentistry. Social exemptions |

| Conditions for benefiting from exemptions for directors. | Peace of mind |

| Securing your health and that of your employees. | Flexibility |

| Offers adaptable to the specific needs of the company. | Support and customer service |

| Availability of support services and information. | discover axa mutual health solutions, adapted to your needs and your budget. benefit from optimal health coverage, dedicated customer service and a large network of partners to support you on a daily basis. |

Marie, HR Manager:

“Since our company chose AXA’s collective health supplement, we have seen a real improvement in the well-being of our employees. The €0 out-of-pocket coverage for routine care has enabled our team to concentrate on your work without worrying about unexpected medical costs. This is a real plus which reinforces the feeling of security within our society.” Jean, Employee:

“I have always found medical care expensive, but with AXA company mutual insurance, the situation has changed. Thanks to their offer, I can easily access optical and dental care without it weighing on my budget . This allowed me to take care of my health without hesitation.” Sophie, Manager:

“Subscribing to group health insurance for my employees was an essential step. With AXA, we not only benefit from optimal coverage, but we are also exempt from certain social charges. This has allowed me to better manage our budget while giving my employees peace of mind.” Luc, Independent:

“Whether for medical consultations or specific examinations, my AXA health insurance allows me to be reimbursed quickly. Access to a vast network of health professionals reassures me and gives me confidence in my coverage. I feel supported in my professional activity.” Aline, Financial Manager:

“With AXA’s mutual company insurance, we have benefited from great ease of use. The online platform is intuitive and allows us to manage our reimbursements in one click. It’s a real time saver and a service that “addressed to companies concerned about their efficiency.” Thomas, Collaborator:

“I particularly appreciate AXA’s encouragement of health prevention. The workshops offered on well-being at work and health are very enriching. They show that my mutual is really involved in the health of its policyholders.” Introduction to AXA company health insurance

AXA company health insurance is an essential solution for employees, offering appropriate coverage for health expenses. Thanks to its collective offer, AXA allows companies to guarantee access to quality care without out-of-pocket costs, thus contributing to the peace of mind and well-being of their employees. Let’s discover together the advantages, specificities and conditions of membership of this leading mutual insurance company.

The advantages of AXA company health insurance

AXA corporate health mutual insurance is distinguished by numerous

benefits significant for employers and employees. Firstly, it benefits from the system of 100% Health , thus allowing your employees to access optical, dental and hearing aid care at no additional cost. This system includes quality equipment, thus guaranteeing optimal protection.Then, AXA offers a

extended coverage which covers a wide range of reimbursements, from medical consultations to hospitalization costs. This allows employees to be better protected against unexpected healthcare expenses, thereby reducing the financial stress often associated with these situations. Conditions of membership of AXA mutual health insurance

To benefit from the benefits of AXA corporate health insurance, it is crucial to understand the membership conditions. First, the

subscription Complementary collective health insurance is compulsory for employers, including managers. This obligation aims to guarantee minimum coverage for all employees of the company. Additionally, it is important to check employee eligibility criteria, such as working time or professional status. AXA also offers specific solutions for self-employed workers (TNS), allowing everyone to access coverage adapted to their needs.

Mutual health insurance and social exemptions

Another strong point of AXA corporate health insurance lies in the

social exemptions offered. In fact, the contributions paid for complementary health insurance are subject to specific regimes which reduce the financial burden on the company. This constitutes an additional advantage for managers wishing to optimize their turnover while taking care of the health of their employees. How does healthcare reimbursement work?

AXA mutual health insurance ensures rapid reimbursement of care thanks to an extensive network of

healthcare professionals . Employees can consult more than 12,000 practitioners, such as opticians, doctors and psychologists, ensuring easy access to care.Following a consultation, the employee can submit their expenses to AXA for reimbursement. Depending on the nature of the care, reimbursement may be immediate or require a few days of processing. It is essential to keep in mind that tracking expenses and reimbursements is beneficial for optimal management of personal finances.

Ultimately, AXA corporate health insurance offers adapted and efficient coverage, contributing to the peace of mind of employees while reducing the financial burden on employers. Thanks to its personalized solutions, everyone can benefit from effective health protection, for a peaceful professional and personal daily life.

discover axa mutual health insurance, your partner for optimal protection. benefit from tailor-made guarantees, an extensive care network and personalized support for you and your family. protect your health with complete peace of mind with axa.

AXA company health insurance is positioned as an essential solution for professionals keen to ensure the financial security of their employees when it comes to healthcare costs. Since January 1, 2020, this collective supplement allows employees to benefit from a 0 € remaining charge for daily care, which constitutes a major asset for any company wishing to offer optimized coverage to its employees. By joining this mutual insurance company, companies are not only complying with a legal obligation, they are also committing to a social approach by protecting the health and well-being of their teams. AXA complementary health insurance includes health care

optical , indental and many others, thus guaranteeing quality care. This promotes a climate of trust within the company, while contributing to the motivation employees. In addition, AXA offers access to a vast network of

healthcare professionals , facilitating the search for appropriate care and strengthening responsiveness to medical needs. This personalized and accessible approach to health insurance allows business leaders to focus on developing their businesses, while ensuring that the health of their employees is in the best hands.Finally, the

AXA collective health insurance is also a vector of peace of mind , both for managers and employees. By offering complete and adapted protection, it becomes a key element of the human resources management strategy. By choosing AXA, companies commit to investing inhealth of their teams and to promote a healthy and fulfilling work environment. FAQ about AXA corporate health insurance

What is specific about AXA corporate health insurance?

AXA company health insurance is designed to offer comprehensive coverage to employees, ensuring effective protection against health expenses. What are the advantages of subscribing to AXA group health insurance?

By opting for AXA collective health insurance, you can benefit from 0 € remaining charge for various treatments, which means better coverage of your medical costs. Does AXA mutual insurance provide social exemptions for managers?

Yes, subscribing to collective complementary health insurance is compulsory for business managers, and it allows you to benefit from certain social exemptions under certain conditions. How does reimbursement work with AXA complementary health insurance?

AXA supplementary health insurance covers all or part of medical costs not reimbursed by Social Security, guaranteeing optimal reimbursement of your health costs. Which professions can benefit from AXA complementary health insurance?

AXA complementary health insurance is accessible to employees as well as managers and self-employed people, with access to a vast network of health professionals. What types of care are covered by AXA mutual health insurance?

AXA mutual health insurance covers a wide range of care, including optical, dental and hospitalization expenses, allowing you to benefit from 100% Health .How can I access AXA mutual health insurance services?

Policyholders can access services and information regarding their AXA mutual health insurance via the dedicated customer area. What prices does AXA health insurance apply?

AXA mutual health insurance prices vary depending on the contracts and options chosen, allowing customization to meet the needs of companies and their employees.