|

IN BRIEF

|

With the growing importance of good complementary health, choosing the mutual that best suits your needs is essential. There mutual Allianz stands out for its varied offering and prices adapted to each profile. Whether you are a young working Parisian or a dynamic family in Lyon, it is crucial to understand the prices and the guarantees available. Let’s dive together into the world of health insurance from Allianz and let’s find out how to optimize your reimbursements while reducing your out-of-pocket costs.

Allianz mutual health insurance stands out for its varied offers and prices adapted to different profiles. Whether you are a young worker, a family with children or a senior, Allianz offers customizable plans that meet your specific health needs. In this article, we will explore the benefits and the disadvantages Allianz mutual insurance rates to help you make an informed choice.

Benefits

Competitive rates

Allianz mutual insurance rates are designed to be accessible. For example, a young Parisian can benefit from health coverage from 53€ per month, while a Lyon family with two children can access a formula from 55€. These prices allow many people to find a solution that fits their budget.

Choice of varied guarantees

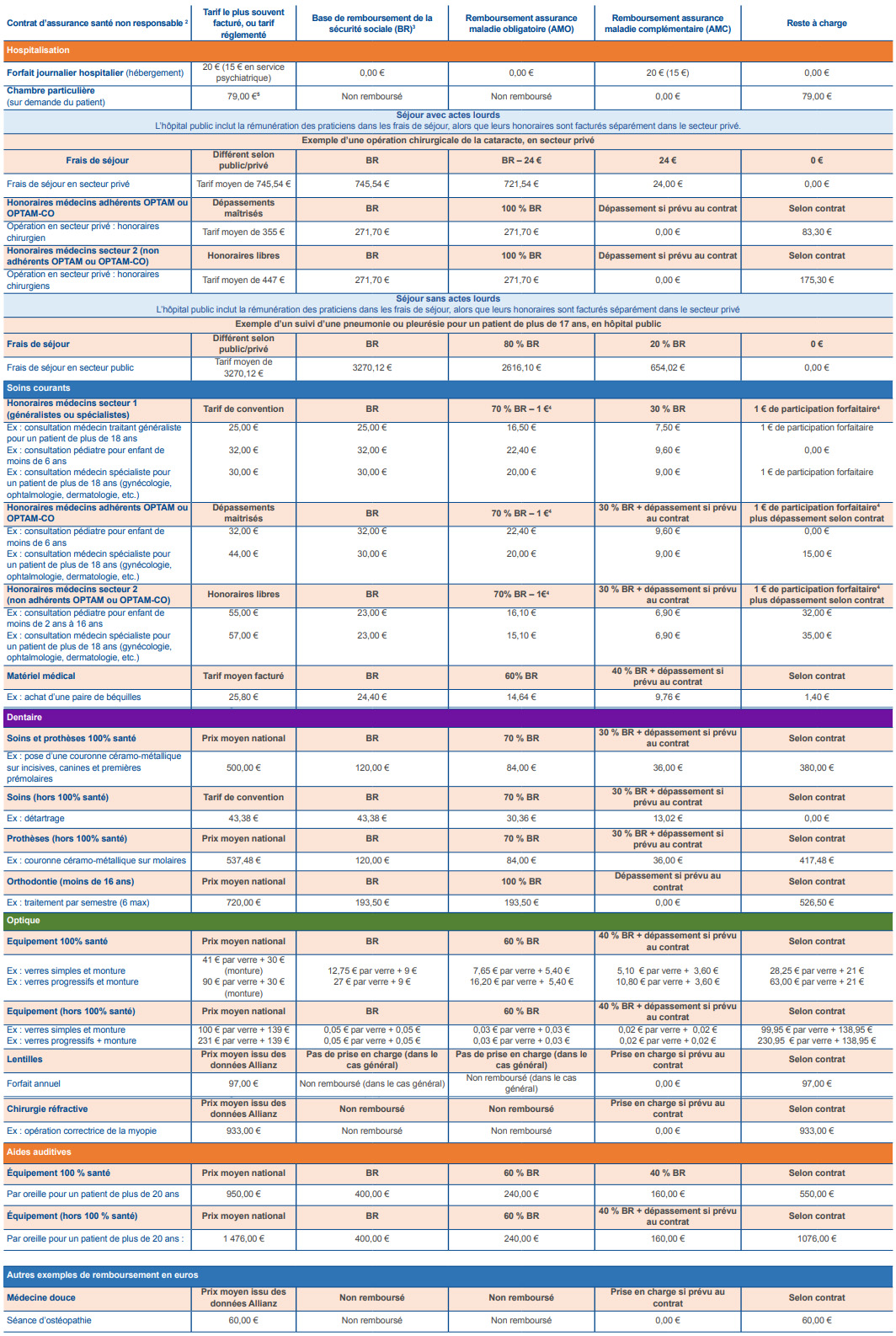

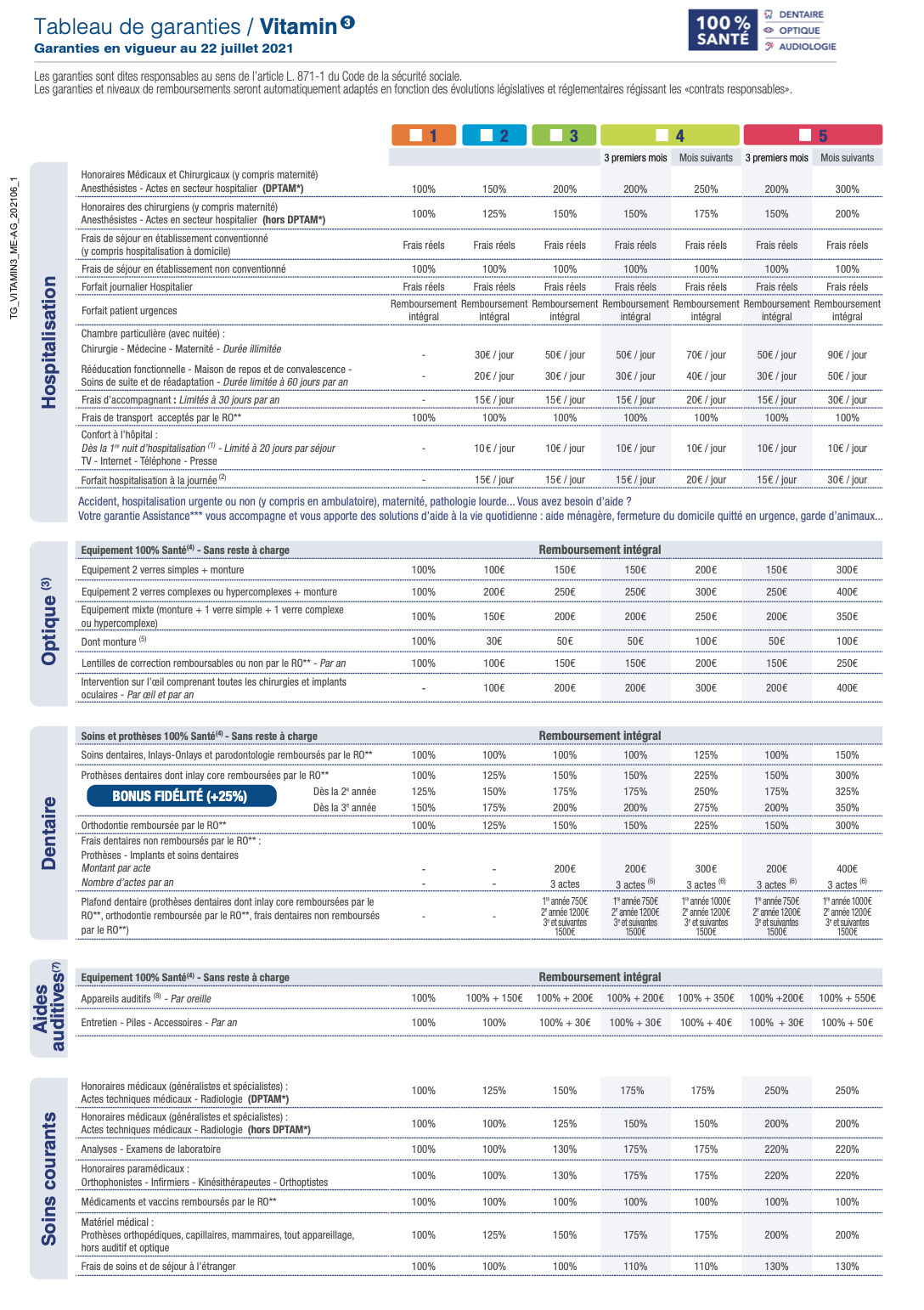

Allianz allows you to personalize your contract according to your needs. Options include reimbursement of hospitalization costs up to 150€ per day in a private room, covering consultations with specialists with reimbursements reaching 120€, and even optical, dental or audiology guarantees with the device 100% Health without any remaining charges.

Generous refunds

The reimbursements offered by Allianz mutual insurance are often higher than those of traditional health insurance. For example, the reimbursement base for certain consultations can reach 26.50€, with a reimbursement rate of up to 70%. This means that you will be able to benefit from attractive coverage for your current health expenses.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Variable rates depending on profile

It is important to note that the prices of the Allianz mutual insurance vary depending on the profile of the insured and the guarantees chosen. This means that some individuals may end up with high contributions if their profile presents specific risks. Therefore, before subscribing, it is recommended to carefully compare the available options.

Reimbursement limits

Despite potentially attractive reimbursements, benefit amounts are subject to ceilings which may be perceived as limiting for certain health benefits. Reimbursement rates are set according to the level of guarantee chosen, and this could result in advance costs in certain cases of care.

Limitation of certain guarantees

Finally, certain guarantees may be excluded from the basic formulas, and you must therefore carefully check the conditions of your contract. It is sometimes necessary to subscribe to additional options to benefit from complete coverage for specific healthcare areas.

For more details on Allianz mutual prices, you can consult user reviews, online comparisons and find out how the assistance works. Whether for health insurance or for specific guarantees such as those related to hearing health, Allianz offers a range of possibilities to explore.

The prices of the mutual Allianz are designed to meet a variety of needs in terms of complementary health. This article will allow you to discover the different pricing options, the levels of coverage available, as well as the benefits you can get from them, whether you are alone or with your family.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Understanding coverage levels

With Allianz mutual insurance, you can choose from several levels of coverage adapted to your situation. Options vary from a modest starting price to more comprehensive packages. It is crucial to identify the level of guarantee that corresponds to your personal needs, particularly with regard to hospitalization, routine care or even hearing aids.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Prices based on profiles

THE Allianz mutual insurance rates are determined based on different insured profiles. For example, a young Parisian can expect to pay around €53 to €73 per month, while a Lyon family of 2 children could be between €55 and €76. The more you personalize your contract with additional options, the more the price will be adjusted.

Specific rates for seniors

THE Allianz senior mutual insurance offer reimbursement options that take into account the specific needs of seniors. Prices can start at attractive levels, but it is essential to carefully analyze the guarantees offered according to the care often necessary at this stage of life.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Integrated reimbursements

One of the greatest advantages of complementary health at Allianz is undoubtedly the high reimbursements. For example, for hospitalization in a private room, you can benefit from up to €150 per day. Likewise, for consultations with specialists, reimbursement can reach €120, thus offering real coverage for your health expenses.

100% Health Guarantee

With the guarantee 100% Health, you have the possibility of paying nothing out of your pocket for essential care by optical, dental Or audiology. This option is particularly appreciated by policyholders wanting complete protection without any out-of-pocket costs.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Get a quick quote

Before subscribing, it is possible to obtain a free quote in less than a minute. This will allow you to compare the different options and choose the one that best suits your expectations and your budget. Use online tools to facilitate this process and make an informed decision.

The advantages of choosing Allianz

Choose the mutual Allianz means opting for personalized health coverage, adapted to each individual’s needs. Thanks to a system of third party payer, the procedures are simplified and you will not have to advance medical costs in most cases. To learn more about the services offered, check out resources such as this link.

Finally, do not hesitate to explore further the information available on Allianz mutual insurance by consulting practical guides and insurance comparisons. Sites like Selectra Or International Health Mutual can be of great help in your choice.

In a world where health is essential, choosing the right mutual insurance is essential to guarantee a optimal reimbursement of your medical expenses. Allianz mutual insurance offers a varied range of rates adapted to each profile, from students to seniors. This article guides you through the different aspects to know about these prices, in order to help you make an informed choice.

The different types of contracts offered

Allianz offers several formulas of complementary health that adapt to your specific needs and your budget. Whether you are single, in a relationship, or with children, there are personalized options. Contributions vary depending on the coverage chosen: hospitalization, routine care, or even optical and dental.

Prices according to your situation

THE Allianz mutual insurance rates may differ depending on your geographic location and profile. For example, a young Parisian can expect a contribution of around €53 per month, while a Lyon family of four could see rates starting from €55. It is therefore important to take these criteria into account when subscribing.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Reimbursements: a key aspect

Another crucial point to consider is the level of refund offered by the different formulas. Thanks to the 100% Health guarantee, you have the possibility of not having any out-of-pocket expenses for optics, dental or audiology. Furthermore, please note that if your specialist consultation costs €26.50, health insurance generally reimburses 70%, with a flat rate contribution of €2.

Reimbursement limits

THE reimbursement limits also depend on the level of guarantee subscribed. Thus, if you opt for more comprehensive coverage, your hospitalization costs could be reimbursed up to €150 per day in a private room, and consultations with a specialist doctor could be reimbursed up to €120.

Get a personalized quote

Don’t forget to ask for a free quote on the Allianz website to find out precisely the prices adapted to your needs. This will allow you to have a clear view of the guarantees included and the associated costs. You will find all the information necessary to establish a quote here.

Compare before subscribing

Before finalizing your choice, it is wise to compare the different plans and their prices. Specialized sites allow you to consult rankings and opinions on the best mutual insurance companies to optimize your daily care. You can discover these rankings here.

Conclusion on Allianz mutual insurance prices

To guarantee your health and that of your loved ones, consider the Allianz mutual insurance rates is a crucial step. By taking into account your personal situation, reimbursement options, and by requesting a quote, you will be able to choose the best complementary health insurance for you.

| Insured profile | Average monthly rate |

| Young Parisian | 53€ – 73€ |

| Lyonnaise family (2 children) | 55€ – 76€ |

| Senior | From 26€/month |

| Full coverage (hospitalization) | 150€/day |

| General consultations | 16.50€ – 20€ |

| Specialist consultations | Up to 220% BR |

| Optical, Dental, Audiology | 0€ remaining charge (100% Health guarantee) |

| Savings on laser operations | 30% on average |

Testimonials on Allianz mutual insurance prices

The choice of a complementary health is essential for many French people, and opinions on the mutual Allianz are not lacking. For Thomas, a young 28-year-old Parisian, the attractive rate of €53 per month for complete coverage made the difference. “With the guarantee 100% Health, I had no out-of-pocket expenses for optics, dentistry or audiology,” he shares enthusiastically.

In a family from Lyon, Sandrine and Marc also wanted to make an informed choice. “We have two children and were delighted to discover that for €76 per month, we had access to optimal reimbursement for our consultations,” they explain. They were particularly impressed by the flexibility of the repayment options based on need.

Seniors, often concerned about health-related costs, also find satisfaction in Allianz’s offers. Marie, a 65-year-old retiree, testifies: “I opted for the senior formula and I benefit from attractive reimbursements for my visits to the doctor. I pay around €100 per month, and this allows me to concentrate on what is really important: my health.”

Another point often raised is the simplicity of access to services. Eric, a young worker, explains: “The online insurance simulation is very practical. In less than 5 minutes, I was able to compare the Allianz mutual insurance rates and choose the one that best suited my needs.” This modern approach has attracted many policyholders.

Finally, the question of value for money is central. According to several testimonies, Allianz stands out for its competitive prices and its numerous refunds. “I feel reassured knowing that my health coverage is managed by experts,” she concludes, mentioning that she does not hesitate to recommend Allianz to those around her.

Introduction to Allianz mutual insurance rates

In a world where health remains a key priority, it is crucial to choose the right complementary health. There mutual Allianz offers prices adapted to each profile, thus allowing you to benefit from the best guarantees. This article will explain in detail the different rates, reimbursements, and the options available to choose the mutual insurance company that best suits you.

Allianz mutual insurance rates: a general overview

The prices of the Allianz mutual health insurance vary depending on several parameters, such as the age of the insured, family composition and the level of guarantees selected. On average, for a young Parisian, prices start at around 53€, while a family with two children in Lyon could pay 55€ per month. These flexible prices allow everyone to find a solution that fits into their budget.

The different formulas offered by Allianz

Allianz offers a diversity of mutual insurance formulas, ranging from the basic option, such as the “Health ECO” formula, to more complete options. Each of them is designed to guarantee a variable level of reimbursement, depending on the care desired. For example, there are specific guarantees for optics, audiology or dental which are the delight of many policyholders.

Formulas adapted to seniors and families

THE mutual health insurance for seniors are particularly well designed to meet the specific needs of this population. With reimbursements of up to 200% of the reimbursement base for specialist consultations, seniors can have peace of mind. As for families, adapted formulas offer competitive prices and attractive reimbursements for all members.

The attractive guarantees of Allianz mutual insurance

One of the main advantages of the mutual Allianz is the guarantee 100% Health, which offers reimbursements to 0€ remaining charge for certain optical, dental and audiology services. This means that policyholders can benefit from quality care without worrying about costs where the basic reimbursement level covers the entire expense.

How to choose the best pricing?

Choosing the best mutual health insurance must be carried out carefully. You should take into account your personal needs, your budget and the most frequently requested health posts. THE free quotes offered by Allianz allow you to obtain clear visibility on prices and guarantees in order to compare the different options before subscribing.

Reimbursements and the basis of reimbursement

Allianz mutual reimbursements are determined by the reimbursement basis of the Social Security. For example, for a general practitioner consultation, this basis is 26.50€, with a reimbursement rate of 70%, to which must be added a fixed contribution of 2€. Reimbursement levels therefore strongly depend on the plan chosen and you will be able to increase these reimbursements by subscribing to additional options.

Choosing mutual health insurance is essential to guarantee your well-being and that of your loved ones. Allianz provides you with a range of varied offers, ranging from the simplest formula to one that covers you in more depth. Analyzing the different prices and guarantees will allow you to choose the most appropriate solution for your needs.

When considering subscribing to a mutual health insurance, it is essential to understand the prices associated and the different options available. There mutual Allianz offers a varied range of contracts adapted to all needs and budgets. Prices can vary significantly depending on your personal situation, whether you are a young Parisian or a family with children.

Mutual insurance rates are often expressed per month, with offers starting at very competitive prices. For example, for a young adult, we can expect contributions around €53, which remains attractive for young workers looking for basic coverage. For families, prices may increase, but they remain attractive compared to other market players.

THE guarantees The choices also play a crucial role in the final price. By opting for higher levels of cover, you will be able to benefit from refunds consequences on care such as consultations with specialists, hospitalization in a private room or dental care. For example, some plans can offer up to €150 per day for a hospital stay, valuable help in managing unforeseen medical emergencies.

In addition, Allianz mutual insurance provides you with tools to assess your needs and quickly understand the prices proposed. From the online simulation to the free quote, each step is designed to simplify your process. This way, you can choose with complete peace of mind the contract that best suits you.

FAQ on Allianz mutual insurance rates

What is the average price of Allianz health insurance? The price of Allianz mutual health insurance varies depending on the profile of the insured and the guarantees chosen. On average, prices can range from €53 for a young Parisian to €76 for a Lyon family of two children.

What reimbursements are offered by Allianz mutual insurance? Allianz offers attractive reimbursements, for example up to €150 per day for hospitalization in a private room and up to €120 for consultations with a specialist.

What is the 100% Health Guarantee and what are its advantages? The 100% Health guarantee allows you to have 0€ out of pocket for optical, dental or audiology, thus guaranteeing access to quality care at no additional cost.

How do I know the amount of company mutual insurance contributions? The amount of contributions depends on the options chosen and can be determined using a personalized quote, taking into account the specific needs of each insured person.

Are there possible savings on certain care items? Yes, it is possible to make savings, for example up to 30% during laser vision operations, depending on the guarantees taken out.

What are the reimbursement limits with Allianz mutual insurance? The amounts of benefits are subject to ceilings which vary depending on the level of guarantee chosen and are clearly indicated in the table of guarantees provided when subscribing.

How does third-party payment work with Allianz mutual insurance? Third-party payment allows the insured not to advance health costs, the insurance taking care of the payment directly to the health professionals, subject to being in good standing with their contract.