|

IN BRIEF

|

With all the choices available in the market, it can be confusing to navigate the world of general mutual quote. Whether you are more attracted to basic guarantees or looking for more comprehensive coverage, it is essential to carefully assess your needs before making your choice. This guide will help you understand the fundamental criteria to take into account in order to select the mutual health insurance which best suits your situation. Ready to dive into the world of complementary health and find the ideal formula?

Choosing mutual health insurance can be a real headache, as the offers are varied and everyone’s needs are specific. This article aims to enlighten you on the different facets of general mutual insurance quotes to help you find the health coverage that best suits your needs. By examining the advantages and disadvantages, you will be better equipped to make an informed decision and optimize your health protection.

Benefits

Customizing options: One of the main advantages of a general mutual insurance quote is the possibility of personalizing your coverage. Depending on your age, your professional status or your health problems, you can choose guarantees adapted to your specific needs.

Competitive rates: By comparing quotes, you will be able to find competitive offers. General mutual insurance often offers attractive rates with attractive reimbursement levels, which can reduce the total cost of your health expenses.

Transparency of guarantees: With a good quote, reimbursement terms, waiting times, and exclusions are clearly laid out. This allows you to better understand what you are really going to get by subscribing to mutual insurance, thus avoiding unpleasant surprises.

Disadvantages

Difficulty of comparison: Despite the many advantages, it can sometimes be difficult to compare quotes effectively. The different plans and options offered can be confusing, and it is not always clear which coverage is best suited to your personal situation. To facilitate this process, you can rely on online comparison tools.

Hidden costs: Some quotes may hide additional costs, such as membership fees or deductibles. It is essential to read the general conditions carefully in order to avoid unpleasant surprises when subscribing or when you need to call on your mutual insurance company.

Membership Questions: Depending on your medical history or your age, admission to certain mutual insurance companies may be conditional. Some mutual insurance companies may refuse to insure people with high health risks, which may limit your choices.

In conclusion, a general mutual quote is a great starting point for exploring your health coverage options. Take the time to analyze the benefits and the disadvantages of each proposal to find the solution that suits you best.

Choose the mutual health insurance tailored to your needs may seem like a daunting task, but with the right information, it becomes child’s play. This article will guide you through the process of choosing your health coverage by providing you with practical advice for obtaining a general mutual insurance quote which perfectly meets your expectations.

Understand your health needs

Before you start looking for your complementary health, it is crucial to take the time to assess your needs. Consider the frequency of your doctor visits, your pharmacy expenses, and any medical treatments you may require in the future. A prior health check will help you determine the essential guarantees you need.

Compare mutual insurance offers

Once you have clarified your needs, it’s time to start compare quotes. Many online sites, such as the Insurance Comparator, offer comparison tools that will allow you to explore different options of general mutuals. Take note of the included guarantees, reimbursement times and associated prices. This will give you an overview of the best solutions available to you.

Analyze guarantees and options

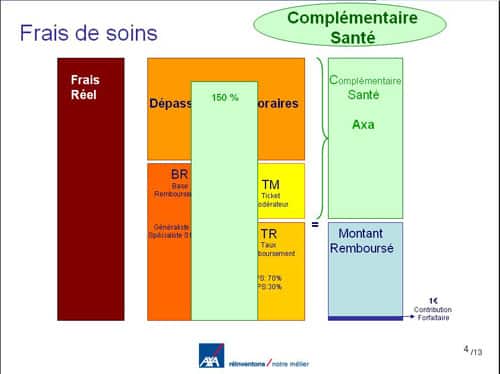

THE guarantees are at the heart of your choice of mutual insurance. In particular, check whether routine care, hospitalization and alternative medicine are covered. Don’t forget to look at additional options, often offered, which could be very useful depending on your specific needs. For example, an optical option can be very beneficial if you wear glasses.

Selection criteria

Use objective criteria to guide your choice. Some things to consider include price of contributions, the level of coverage offered, and customer service. You can also read user reviews on sites like Borrowed to get an idea of member satisfaction.

Request a personalized quote

Once you have a shortlist of mutual insurance companies that interest you, it’s time to request personalized quotes. Most mutual insurance companies offer an easy-to-use online service. Do not hesitate to fill out a quote request form and to ask your questions in order to obtain precise information adapted to your situation.

Project yourself into the future

When you choose your mutual health insurance, think about the durability of your coverage. Prices may change, and it is therefore wise to consider whether the guarantees remain suitable for your long-term needs, particularly if you anticipate changes in your professional or personal life. Also remember to check the flexibility of your contract in the event of a change in your situation.

Choose one general mutual may seem complex, but by understanding your needs, comparing offers, and analyzing guarantees, you will be able to make an informed choice. Remember to compare quotes and include specific options that can greatly impact your daily health. For more information on the process of comparing and choosing your health coverage, visit relevant online resources.

Choose one mutual health insurance can be a real challenge. At the heart of all these offers, the general mutual quote is an essential element in making an informed decision. This article guides you through the crucial steps to finding the health coverage that meets your needs.

Assess your health needs

Before diving into the world of quotes, start by making a assessment of your health needs. Consider your usual, specialized or preventive care. What frequencies do you have for your consultations? Do you need regular medications or specific care? By understanding your requirements, you will be able to better target the appropriate formulas.

Compare the different formulas

Mutual insurance companies offer various formulas which vary in terms of guarantees and prices. To avoid getting lost in this jungle of offers, use a mutual insurance comparator. This will allow you to quickly visualize the differences in terms of prices and of services included. Remember to check coverage for routine care, hospitalizations and alternative medicine.

Beware of hidden details

It is crucial to carefully read the general conditions of each quote. Some mutuals may hide options or limitations that could cost you dearly in the future. Also check the repayment period and if franchises apply. Very often, an attractive price hides services that are not very advantageous in the long term.

Consider the opinions and rankings of mutual insurance companies

Before committing, consult the reviews from other consumers and facies of mutual insurance rankings. Sites like Good Insurance will provide you with information on the best options available. The reputation of a mutual insurance company is an important indicator of its reliability.

Adapt your insurance to your personal situation

Whether you are a young worker, a senior or even an expatriate, each profile has distinct needs. Take into account your professional status and your life plans. For example, if you are considering going abroad, explore relevant solutions on the health coverage abroad, because this could influence your choice of mutual insurance.

Use a quote analysis service

To help you in your process, do not hesitate to use a servicequote analysis. Some mutuals, such as General Mutual, offer personalized advice from experts. This will allow you to better understand the advantages and disadvantages of each coverage.

Choose the right one mutual health insurance through a general mutual quote may seem complex, but by following these tips, you will be equipped to make an informed choice. Take the time to assess your needs, compare the plans and inform yourself to find the ideal coverage that will accompany you peacefully in your daily life.

Comparison of the key elements for choosing your general mutual insurance

| Selection criteria | Importance |

| Type of guarantees | Determining whether you need basic guarantees or more comprehensive coverage is essential. |

| Reimbursement ceiling | Check the ceilings to avoid uncovered costs in the event of extensive care. |

| Reimbursement period | A short deadline is preferable to avoid financial inconvenience. |

| Additional options | Consider options like hospitalization or dental depending on your needs. |

| Cost of contributions | It is crucial to choose a mutual that fits your budget. |

| Customer service | Good customer service makes refunds and questions easier to manage. |

| Reputation of the mutual | A recognized mutual guarantees a better experience and satisfaction. |

Testimonials on choosing health coverage with Devis Mutuelle Générale

When it comes to choosing a mutual health insurance, testimonials from other policyholders can be very valuable. It’s a bit like asking for recommendations for a restaurant, it’s better to have opinions before embarking on the adventure! Here is some feedback on the general mutual insurance quote.

Martine, 58 years old, testifies: “Before choosing my mutual insurance, I spent hours comparing the different quotes. I took into account the guarantees offered and I also checked the reimbursement deadlines. I finally opted for the Essential formula from Mutuelle Générale, and I am not disappointed. Reimbursements are quick and routine care is well covered.”

Jean, 45, adds: “For me, the main criterion was the price. I used a mutual insurance comparator to see what was on offer. I chose a mutual that offered good coverage at an affordable price. Thanks to my choice, I save money every month while having protection adapted to my needs.”

Sophie, a young mother of twins, shares her experience: “With children, health expenses can add up quickly. So I filled out a online mutual quote form and I met an advisor who helped me find the Reinforcement formula. What’s great is that I was able to add specific options that seem essential to me for the medical monitoring of my children.”

Finally, Lucas, a future retiree, explains: “I was surprised by the complexity of the mutual insurance choices. I had to sort out my real needs and the useless options. By discussing with an expert from the Mutuelle Générale , I was able to better understand my expectations and choose coverage that suited me perfectly. The quote analysis service was a real asset.”

In conclusion, the choice of a mutual health insurance is not to be taken lightly. Listen to the experiences of others, use tools like comparators, and consulting experts are key steps to ensuring appropriate and effective health coverage. Take the time to inform yourself well and you will be fully satisfied with your choice!

Choosing a mutual health insurance can be a real headache, as the offers are multiplying and the evaluation criteria are numerous. This article offers you clear recommendations for choosing your health coverage according to your needs, your budget, and the guarantees offered. Follow these handy tips to decipher company quotes General Mutual and find the formula that suits you best.

Analyze your personal needs

Before embarking on the quest for the ideal mutual insurance, it is essential to identify your health needs. Think about the types of care you see most often: general practitioners, specialists, hospitalization, optical, or dental. Each profile may require different guarantees. For example, if you wear glasses or plan on dental work, be sure to select coverage that includes these items.

Compare the various formulas

There General Mutual offers different formulas, such as Eco, Essential, And Reinforcement. These options meet varied needs and different budgets. Take the time to compare quotes, focusing on the guarantees included in each plan. Sometimes a slightly more expensive plan can save you money in the long run if it covers essential care.

Take into account value for money

Price is a determining criterion, but it should not be the only one. A cheaper quote does not necessarily guarantee a good refund. Find out about the repayment deadlines offered and the effectiveness of the mutual’s customer service. A mutual insurance company with affordable prices is attractive, but it must also offer quality service to avoid inconveniences in the future.

Check repayment deadlines

Another key element to consider is the repayment period after your care. Some mutual insurance companies can take several weeks to process a reimbursement request, which can be problematic, especially if you have to advance significant expenses. Find out more about this to avoid unpleasant surprises. A mutual that offers fast and efficient reimbursements can significantly improve your experience.

Anticipate changes in your needs

A good mutual fund must be adaptable over time. Your health needs may change, whether due to changes in personal circumstances, such as retirement or the birth of a child. Make sure that the General Mutual allows you to adjust your guarantees according to the stage of life you are at.

Examination of additional options

Do not hesitate to explore the additional options proposed. Sometimes, additional guarantees can prove very useful, such as alternative medicine or home assistance. Play on flexibility and personalize your coverage according to your preferences to obtain a tailor-made contract.

Use comparison tools

Finally, don’t forget to use comparison tools online. These tools allow you to quickly compare quotes from different mutual insurance companies. They provide an overview that can greatly facilitate your choice and save you time. With these recommendations, you are now ready to choose the health coverage that suits you best, while calmly enjoying the benefits offered by your complementary health insurance.

Conclusion: Find the ideal health coverage with the general mutual insurance quote

Choosing your health insurance can seem like a real obstacle course, but with the right tools and a rigorous method, it becomes child’s play. The first step towards optimal coverage is to assess your specific needs. Whether you are a young worker, in professional retraining or a future retiree, it is crucial to carry out a assessment of your health requirements. Consider the frequency of your medical visits, the specific care you may need, and your preferences for specialists.

Next, let’s move on to the exciting part of the comparison of quotes. At this stage, a mutual insurance comparator turns out to be your best ally. This will allow you to easily access a multitude of offers and better visualize the differences in prices, guarantees and options. Don’t ignore the essential guarantees : reimbursement of routine care, optical or dental care, prevention services. Also look at reimbursement times, because coverage is useless if you can’t benefit from your care quickly.

Finally, once you have made your choice, it is always useful to look into the members’ opinions. This feedback will give you an overview of the quality of customer service and help you determine whether the chosen organization meets your expectations. Do not hesitate to ask questions about the customizable options to best adapt your health coverage.

In summary, choosing your mutual with a general quote is a process that requires reflection, but which can lead you to solutions adapted to your needs. With good preparation and use of the tools available, you will be equipped to make the best choice when it comes to health coverage.