|

IN BRIEF

|

Going on a trip is often synonymous with adventure and discovery, but it is crucial not to forget one essential element: thevacation insurance. Whether you’re a seasoned globetrotter or an occasional vacationer, choosing the right coverage can turn your trip into a worry-free experience. Between the multiple options and guarantees to examine, how to navigate? In this article, we will guide you step by step to select thetravel insurance which perfectly suits your needs, so that you can fully enjoy your getaways without worries!

How to choose the best vacation insurance for your trips

Going on a trip without insurance is a bit like going on an adventure without a compass. We hope that everything will go well, but if something goes wrong, it can become a real headache. This article aims to enlighten you on how to choose the best vacation insurance for your adventures around the world. Whether you are a seasoned globetrotter or an occasional traveler, understanding insurance terms is essential to travel with peace of mind.

The advantages of choosing good vacation insurance

Opting for insurance tailored to your needs has many advantages. First of all, it gives you a peace of mind. In the event of a health problem or accident, you will be covered and can benefit from rapid assistance. You will not have to worry about medical costs which can quickly add up abroad.

Another positive aspect is the cancellation protection. If your schedule changes unexpectedly, good insurance can help you recover your expenses and avoid losing money on non-refundable plane tickets. In addition, some insurances offer additional guarantees such as loss of baggage or legal assistance, which represents a significant advantage during your travels.

The disadvantages of vacation insurance

price. Premiums can vary considerably from one insurer to another, and it is not always easy to find the best value for money. This sometimes tends to discourage travelers who want to reduce their expenses.

Additionally, it is crucial to read the general conditions carefully, as some exclusions may be surprising. For example, some policies do not offer coverage in certain destinations or for practices considered risky. It is therefore essential to be well informed to avoid unpleasant surprises when it really counts.

Tips for choosing your vacation insurance

To select the insurance that is best for you, start by determine your specific needs. What type of trip are you planning? Are your activities considered risks by insurance companies? A mountain hiking trip will require different needs than a trip to the beach, for example.

Then, do not hesitate to use insurance comparators available online. Sites like Tourdumondist Or Lesfurets will allow you to view the available options, compare guarantees and prices, and choose the best offer according to your budget and your specific needs.

Finally, remember to consult reviews from other travelers and recommendations on specialized platforms. Sources like International health insurance Or Le Figaro will provide you with valuable information that may influence your final choice.

In short, choosing the best vacation insurance requires a certain investment of time, but it is well worth it. Take a few moments to think about what suits you best and set off with peace of mind towards your new adventures.

When planning a trip, vacation insurance is often an overlooked aspect. However, the best insurance can turn a stressful travel experience into a peaceful adventure. This guide will help you navigate the jungle of insurance offers, in order to find the one that perfectly meets your needs.

Understand the importance of vacation insurance

Before diving into the heart of the matter, it is essential to understand why a vacation insurance is essential. In the event of an unforeseen event, whether it is flight cancellation or a health problem, having appropriate coverage can save you considerable costs.

The different types of vacation insurance

There are several types of vacation insurance, each adapted to specific situations. Among the most common are:

cancellation insurance

This coverage is ideal if you have to cancel your trip for unforeseen reasons, such as a natural disaster or health issue. It allows you to recover the costs incurred.

Health insurance abroad

Essential for those who go outside their country, this insurance covers medical costs that can be exorbitant depending on the destination. Don’t forget to check if your current insurance offers international coverage.

Baggage insurance

If you are carrying valuable goods or traveling with fragile items, this option is for you. It covers the loss, theft or damage to your personal effects.

How to compare different offers

Comparing insurance offers can be confusing. Use insurance comparators online to ease this task. Platforms like voyageavecnous.fr will allow you to see the differences in prices and guarantees at a glance.

Criteria to check before subscribing

It is crucial to review certain criteria before making your choice:

The covers offered

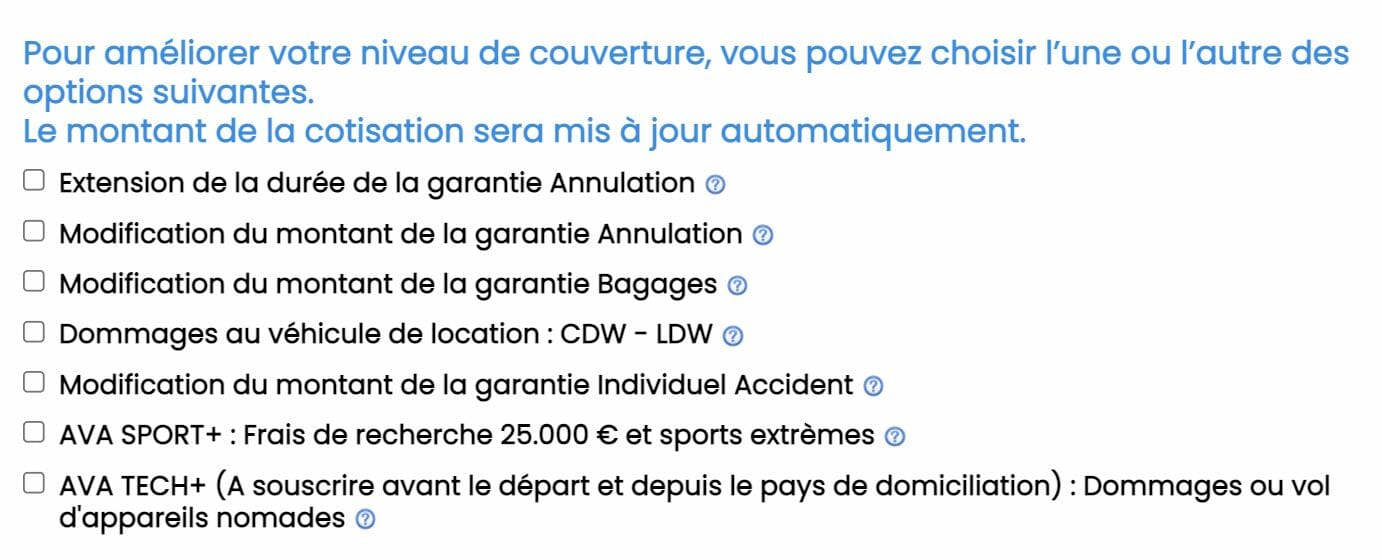

Make sure the insurance you choose covers all aspects of your trip, including the activities you plan. For example, extreme sports may require additional coverage.

Exclusions

Each contract has its share of exclusions. Read them carefully. Some insurance plans do not cover certain pre-existing conditions or alcohol-related incidents.

The guarantee/price ratio

Price is not the only criterion. A cheaper contract may offer insufficient guarantees. Rate it value for money before subscribing.

The best insurance for your vacation

To help you make the right choice, consult reliable comparators such as goyav.com Or reassure-me.fr. There you will find up-to-date information on best vacation insurance available in 2024.

Choosing the best vacation insurance can seem complex, but with the right tools and information, the process becomes much simpler. Don’t forget to take into account all the criteria mentioned to leave alone. Whether for a short stay or a long getaway, choose serenity!

When it comes to planning your vacation, it’s easy to focus on plane tickets and accommodations, but don’t forget the importance of travel insurance. To fully enjoy your adventures, it is essential to choose coverage adapted to your specific needs. This article will provide you with practical advice for selecting the best insurance for your travels.

Analyze your travel needs

Before you start comparing different options, ask yourself a few questions about the nature of your trip. Will you explore destinations with limited medical infrastructure? Are you traveling with children or elderly people? These elements will influence the type of protection you need. Take the time to evaluate whether you need insurance coverage. disease, A repatriation or even protection against flight cancellations.

Compare offers and guarantees

Use several insurance comparators to explore the different offers available on the market. Each insurer offers guarantees which vary depending on specific needs, such as coverage for sports activities, lost baggage, or emergency medical care. In this regard, it is useful to consult reference sites like this insurance comparator which will help you choose the one that best suits your situation.

Estimate the cost of insurance

The cost of travel insurance can vary greatly. In general, the average price Insurance for a week of vacation can reach $228 in Canada depending on the coverage desired. Striking a balance between affordability and robust warranties is essential. Tips for saving include looking for bundle deals or cheap insurance accessible on sites like Miss Travel.

Read customer reviews

Don’t underestimate the power of other travelers’ experiences. Before confirming your choice, take the time to read reviews and testimonials about the insurance companies you are considering. This can give you an idea of the quality of customer service and claims handling. Watch how-to videos on platforms like YouTube can also give you interesting insights on the subject.

Ask questions

Finally, don’t be shy! Contact insurance companies to ask any questions you may have. What you really need to know is how your insurance works in real-world situations. This will help you determine whether the contract is right for you and whether you will be able to benefit from rapid service if needed.

By following these tips, you’ll be well on your way to choosing the best vacation insurance for your travels. Remember, peace of mind starts with proper protection. Enjoy your next getaways!

Guide to choosing the best travel insurance

| Selection criteria | Description |

| Covers offered | Check if the insurance includes cancellation, medical expenses, and repatriation. |

| Destinations covered | Make sure your destination is included in the contract. |

| Duration of travel | Compare prices for short and long periods, which are often different. |

| Specific exclusions | Identify situations not covered before making your choice. |

| 24/7 support | Choose insurance offering continuous assistance during your stay. |

| Cost of premium | Evaluate the value for money of the different options available. |

| Ease of subscription | Look for insurance that is easy to take out online, without complications. |

| Customer reviews | Consult the feedback of other travelers for an informed choice. |

Testimonials: Choosing the best vacation insurance for your trips

When preparing to go on vacation, it is natural to think about the details of your stay: flight, accommodation, activities… However, one crucial element is often neglected: thetravel insurance. Here are some testimonials from travelers who took the time to choose the best insurance for their adventures.

Marie, 32, tells us about her experience: “Before my trip to Thailand, I realized that I had no insurance. So I started comparing different options online. Many sites offered insurance comparisons, which allowed me to find coverage that met my needs. Thanks to the advice of a comparator, I finally chose insurance that included repatriation and themedical assistance. This allowed me to leave with peace of mind.”

Julien, a hiking enthusiast, also shared his story: “During my last mountain expedition, I took the time to check the essential criteria good insurance. I not only wanted a cheap offer, but also guarantees for outdoor activities. By using an insurance comparator, I found a suitable package that covered mountain accidents. Ultimately, it was this choice that saved me during a small incident. I can only advise future travelers to be well informed.”

Amandine, who travels frequently for work, emphasizes the importance of good coverage: “For me, travel insurance has become a priority. Each time I travel, I take the time to consult the offers available, and I pay attention to the options of refund in case of cancellation. Once, I had to cancel a flight due to an unforeseen event, and thanks to my thoughtful choice, I was able to recover a large part of my costs.”

Finally, Paul and Clara, a globetrotting couple, share their progress: “During our first trips, we often ignored insurance. After a few mishaps, we understood its importance. Today, we always take the time to compare different companies We discovered that some offer advantages, like the. protection against lost baggage or cover in the event of illness. It changes everything during our getaways!”

These testimonials show how crucial it is to choose the right vacation insurance. Whether you’re planning an adventure abroad or a business trip, taking the time to compare and choose wisely can make all the difference! So, before confirming your reservation, make sure you have appropriate insurance. You won’t regret it!

How to choose the best vacation insurance for your trips

When going on a trip, preparation often focuses on itineraries, accommodation and activities to be carried out. However, one crucial step struggles to capture the attention of travelers: the choice of vacation insurance. This guide helps you navigate through the different options to ensure your safety is as well protected as your sun tan!

Evaluate your personal needs

The first step to choosing the best vacation insurance is to assess your specific needs. Whether you are traveling solo, with family or friends, insurance requirements may vary. Also think about the length of your stay and your activities. If you plan to practice risky sports such as diving or skiing, it is essential to opt for suitable coverage.

Compare different types of coverage

Once you have identified your needs, it is time to compare the different types of coverage offered by insurance companies. Common options include medical coverage, trip cancellation, lost baggage and liability. Be sure to read the fine print to understand what is actually included and excluded in each contract.

Medical coverage

In a world where medical costs can quickly climb, choosing a good medical coverage is essential. Check if expenses in the event of hospitalization, repatriation or accidents are fully reimbursed. Some insurance companies also offer 24/7 assistance services, a real plus in the event of an emergency abroad.

Trip cancellation and interruption

Unforeseen events can arise. For this reason, it is advisable to have coverage for trip cancellation or interruption. If you have to cancel your trip due to illness or a family emergency, make sure that the insurance guarantees reimbursement for the costs incurred.

Analyze value for money

Comparing prices is also essential, but don’t be fooled by cheap insurance. This does not always guarantee adequate coverage. Study the value for money : Slightly more expensive insurance could offer valuable benefits that will save you money if something goes wrong.

Check company reviews and ratings

Feedback from other travelers can provide valuable information. Before making your choice, consult the reviews and ratings of the different companies. Look for testimonials about speed of support, customer service, and ease of handling complaints. A good service provider will always be one who supports his clients even in delicate moments.

Take into account your frequent trips

If you are a frequent traveler, it may make more sense to take out a annual insurance rather than making individual requests for each trip. This can be economical and practical if you often travel to various destinations.

In short, choose the best vacation insurance for your travels requires a little research and evaluation of your specific needs. By taking the time to compare options and fully understand the guarantees, you will be able to leave with peace of mind. Remember that the goal is to enjoy your trip worry-free: good insurance can help you achieve this goal with complete peace of mind.

Conclusion: Finding the Ideal Vacation Insurance

Choose the best vacation insurance for your travels doesn’t have to be a complicated process, but it does require a little thought and preparation. By taking into account the different criteria, you will be able to select coverage that not only protects you during your stay, but also allows you to leave with peace of mind.

First of all, it is essential to assess your personal needs. Is it a business trip, a family trip, or a last-minute getaway? Each situation requires different levels of coverage. Be sure to pay attention to things like overseas medical expenses, trip cancellation, and lost baggage coverage.

Then don’t forget to compare the offers available. There are a multitude of insurance companies that offer various packages. Using comparison tools, review the warranties offered and prices. Keep in mind that the lowest price doesn’t always mean the best coverage. Take the time to read customer reviews to get an idea of the quality of customer service.

Finally, don’t leave purchasing your vacation insurance to the last minute. Ideally, you should sign it up as soon as your trip is confirmed. This will save you a lot of hassle if unforeseen events disrupt your plans.

In short, the best insurance for your vacation is the one that perfectly meets your expectations and allows you to explore new horizons without worry. Take the time to do your research and make the right choice, because your peace of mind is worth it.