|

IN BRIEF

|

In a world where expenses can quickly add up, it’s essential to get the most out of your budget, especially when it comes to your insurance. Thanks to digital tools, obtain online insurance quote has never been so simple and quick. By using comparison platforms, you will be able to access a multitude of offers and thus find the most advantageous rates without sacrificing the quality of the guarantees. Follow our advice to master this tool and make significant savings on your insurance contracts.

In a world where technology makes our daily lives a little easier every day, getting an insurance quote online has never been easier. By using the comparison tools available, it is possible to find the best offer adapted to your needs without spending a cent. In this article, we’ll explore the pros and cons of this method to help you maximize your savings.

Benefits

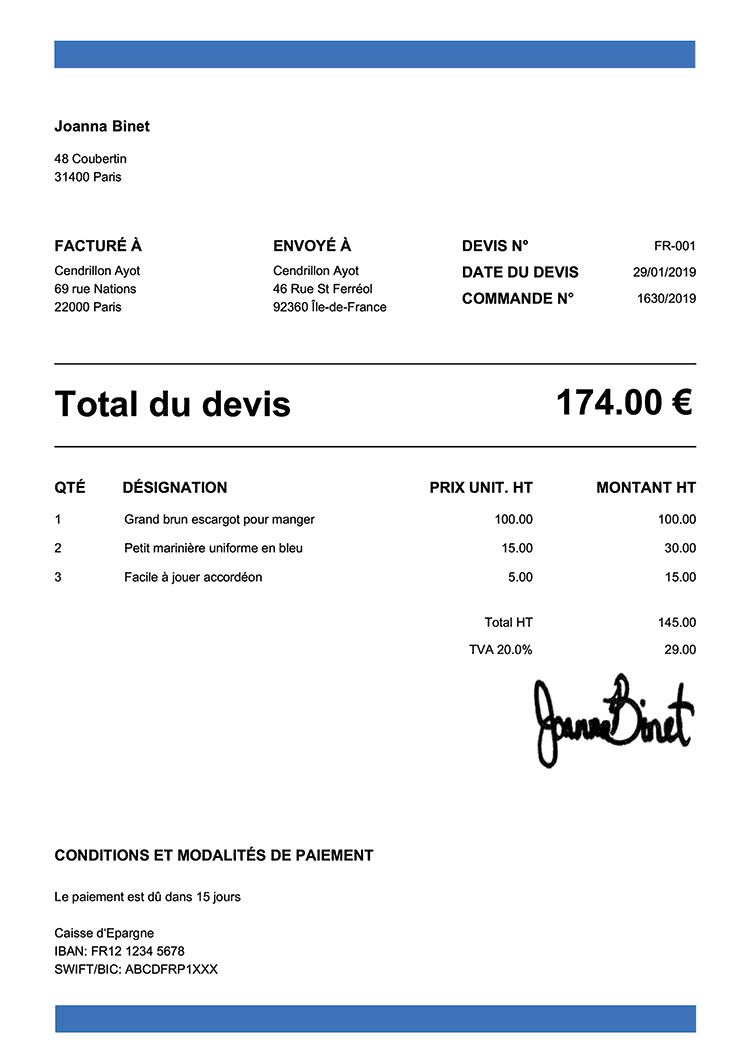

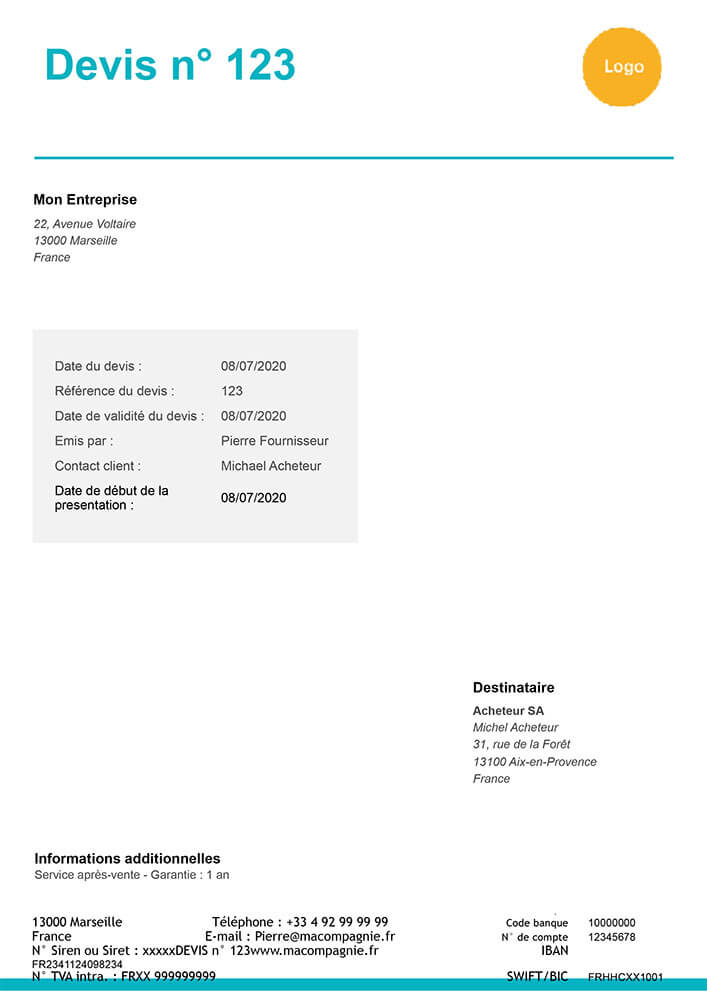

One of the main benefits of obtaining insurance quotes online is the speed and simplicity of the process. In just a few clicks, you can fill out a single form and receive several car, home or health insurance quote proposals. Platforms such as LeLynx.fr And lesfurets allow you to quickly compare offers from more than 100 insurers.

In addition, by comparing several quotes with equivalent guarantees, you could save on average up to €360*. This represents a real opportunity to save money while benefiting from the best coverage possible. Thanks to online tools, you can also personalize your simulations and target specific guarantees according to your needs.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages of making insurance quotes online. First of all, the multitude of offers and calculations can be confusing. Choosing the cheapest offer does not always guarantee the best coverage. Sometimes it is essential to carefully read customer reviews and comments to fully understand the service offered by each insurer.

Additionally, some companies may offer online offers that differ from the prices you would have obtained by contacting an advisor directly, which could hinder your ability to negotiate. Finally, free quotes should not serve as an illusion; It is crucial to fully understand what is included in each offer before making a final decision. Clearly, although it is an effective method, it is not uncommon to get lost in the flow of information.

In a world where competitive insurance offers are essential, it is essential to know how to navigate effectively to obtain the best quotes. This article will guide you step by step on the best practices to adopt to carry out online simulations and compare the available offers, in order to choose the one that perfectly matches your needs while optimizing your budget.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Perform a free online simulation

One of the key steps to obtaining insurance quote competitive is to start by carrying out a free simulation. Using tools such as LeLynx.fr, it is possible to access a range of personalized proposals at no cost. By answering a few questions about your profile and your insurance needs, you will have instant access to tailored quotes.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Compare several offers

To find the best insurance offer, it is crucial to compare several quotes. Use comparators such as Assurland Or The Insurance Comparator will allow you to visualize the price differences and the guarantees offered. With this analysis, you could make significant savings, up to €360* per year according to certain studies.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Adapt your needs to your budget

To obtain the most advantageous quote, it is necessary to clearly define your needs according to your budget. Evaluate the necessary guarantees and those that can be excluded is ideal. For example, certain options such as 0 km assistance or guarantees linked to replacement value can often be omitted if this corresponds to your personal situation. This will help lower the total cost of your insurance.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Use simulation tools to refine your choices

Take advantage of simulation tools offered by insurers and online comparators. For example, platforms like Macif allow you to personalize your simulation by inputting precise details about your vehicle and your insurance history. This not only allows you to receive tailored quotes, but also to refine your search based on specific criteria.

Do not hesitate to ask for additional information

It is important not to hesitate to contact the insurance companies if you have questions or need clarification on the quotes obtained. Sites like Allianz And Groupama offer customer support which can be very valuable in understanding the intricacies of proposals. This step ensures that you make an informed choice.

Turn to options tailored to your situation

Finally, it is recommended to consider specific offers that may meet your particular needs. For example, if you are an expatriate, solutions such as those offered by AgoraExpat are worth exploring, because they are adapted to the health insurance requirements of expatriates.

When you are looking to subscribe to a insurance, it is essential to get the best possible quotes. Thanks to the internet, it is now easy to compare different insurance offers in just a few clicks. This article offers you tips and tricks to optimize your chances of finding a advantageous quote online.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Use an insurance comparator

One of the most effective ways to get multiple insurance quotes quickly is to use a insurance comparator. Tools like LeLynx.fr Or AcommeAssure allow you to fill out a single form and receive several personalized quotes. This saves you valuable time while helping you visualize the different options available.

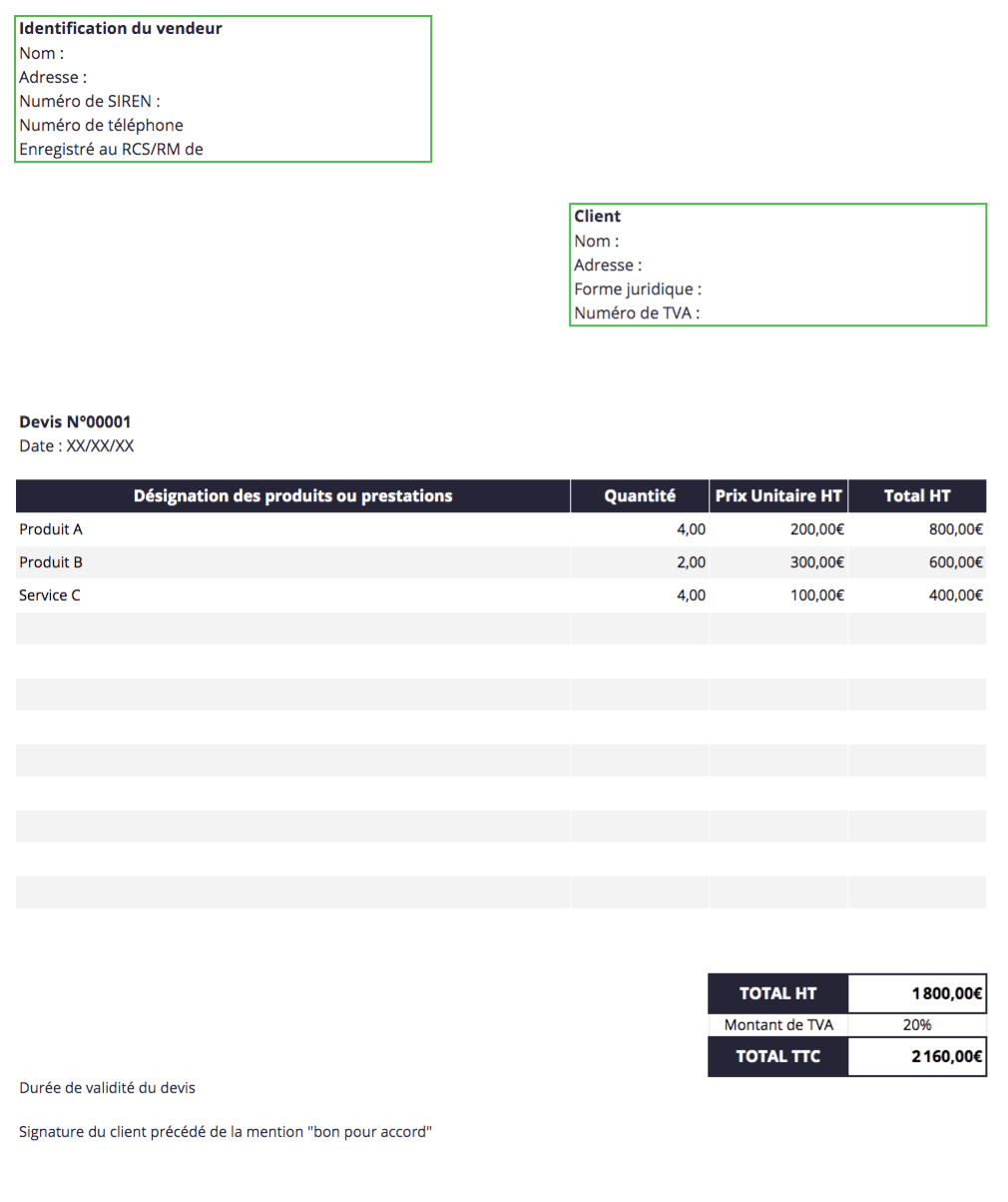

Compare warranties and prices

When searching for quotes, it is important to compare not only prices, but also guarantees offered. Make sure the covers are equivalent to get a fair comparison. Sometimes a deal may seem cheaper, but it might include exclusions or coverage limits that don’t meet your needs.

Take advantage of free simulations

Many insurance companies, such as Direct Insurance, offer free online simulations. Take advantage of these tools to estimate the cost of your insurance before requesting a quote. This gives you a clear idea of your budget.

Really assess your needs

Before looking for a quote, take the time to think about your real insurance needs. What type of coverage is really necessary for you? By clearly defining your expectations, you will be able to better direct your search and exclude offers that do not suit you.

Stay vigilant about promotions and discounts

It is common for insurance companies to offer promotions or discount to attract new customers. Stay on the lookout for these offers, especially during special periods, such as back-to-school or the end-of-year holidays. This can help you save a lot of money on your insurance premium.

Show a good driver profile

If you are looking for a car insurance, your profile as a driver plays a crucial role in the quote offered. Maintaining a good driving record, with no claims or violations, can help you obtain more competitive rates. Some insurance companies also take into account your seniority in the field to adjust their rates downward.

Consult customer reviews

Before committing to an insurance company, it is wise to consult the customer reviews. These can give you insight into service quality, claims handling and overall policyholder satisfaction. This will help you choose a reliable company that truly meets your expectations.

| Evaluation axis | Practical advice |

| Comparison of offers | Use online comparators to see several quotes simultaneously. |

| Personalization of guarantees | Refine your search by choosing guarantees that match your needs. |

| Free simulation | Take advantage of insurance simulations to view rates without obligation. |

| Analysis of customer reviews | Read feedback to better assess the reliability of insurers. |

| Accurate estimate | Provide accurate information to get realistic quotes. |

| Potential Savings | Comparing several quotes can save you up to €360 on average. |

| Additional options | Consider the additional services offered by insurers. |

| Contract and conditions | Read the contract carefully to avoid surprises when subscribing. |

Testimonials on How to Get the Best Insurance Quotes Online

When I decided to compare the car insurance quote, I didn’t know where to start. I discovered an online service that offers free simulation. This allowed me to receive several personalized quotes in just a few clicks! How effective! Thanks to this, I was able to avoid unnecessary expenses while obtaining coverage adapted to my needs.

With the comparison tool I used, I was able to compare over 100 insurance quote live. By analyzing these options, I realized that significant savings could be made. On average, I’ve seen other users save up to €360 per year. This motivated me to take the time to explore each proposal in detail.

Another aspect I liked was the simplicity of the process. By filling out just one form, I was able to receive the best offers on the market. No more spending hours on the phone with various insurers. I had everything at my fingertips, which allowed me to make an informed decision quickly.

Using the online simulation, I also found a rate personalized perfectly suited to my profile. It reassured me to know that the estimate that I received were based on objective criteria, which could only guarantee me insurance at the fairest price.

Finally, I can only recommend that everyone take a look at these comparison platforms. The ability to save while having access to a range of choices is incredible. Not only did I find a great rate, but I also gained peace of mind knowing that I had made the best decision in terms ofcar insurance.

In a world where expenses can quickly add up, it is essential to find insurance quote favorable. Thanks to the Internet, it is now possible to make price comparisons in just a few clicks. This article will guide you through essential steps to get the best insurance quotes online, helping you save money while still getting the coverage you need.

Use insurance comparators

To begin your search for a insurance quote advantageous, it is wise to use a insurance comparator. These online tools allow you to complete a single form to access several offers from insurers. In just a few minutes, you will have access to a wide selection of quotes, giving you an overview of the different options available and the prices charged.

Compare the guarantees offered

When looking at insurance quotes, it’s essential not to focus solely on price. Take the time to compare the guarantees included in each offer. Make sure the insurance protection you choose is tailored to your specific needs. Sometimes it may be more economical to pay slightly more for more comprehensive coverage, which will protect you better in the long run.

Simulate your quote

Many sites, such as LeLynx.fr or Assurland.com, offer you the possibility of carrying out a free online simulation. This simulation will allow you to personalize your quote according to your profile and your needs. Whether it’s auto, home or health insurance, these tools will help you define the level of coverage you want before making a decision.

Take advantage of promotional offers

Don’t forget to find out about the promotional offers which may be available. Many insurers offer temporary discounts that can significantly lower the cost of your insurance. By remaining attentive to promotional periods, you will be able to benefit from very attractive prices.

Don’t neglect customer reviews

It is crucial to look at the customer reviews before choosing insurance. These testimonials will give you a clear idea of the quality of customer service and the experiences of other policyholders. Look for feedback on claims processing, customer service responsiveness and transparency of your insurance terms.

Take your driver profile into account

If you are looking for a car insurance, remember that certain factors will influence the cost of your policy. Your age, driving experience, claims history and the type of vehicle you own will all play a role in determining your rate. Be honest when reporting this information to avoid any disappointment when signing your contract.

Have the right reflexes when subscribing

Finally, once you find the insurance quote that suits you, make sure you read the terms and conditions and the contract carefully. This includes the franchises, warranty exclusions and termination terms. Good value for money is not limited to the initial price, but also includes the risks and limitations that might arise.

By following these recommendations, you will be able to get the best insurance quotes online, while ensuring coverage tailored to your needs. Your savings are just a click away!

In the digital age, get insurance quotes online has become an accessible and effective approach. Insurers now offer simulation platforms that allow users to easily compare insurance offers. To maximize your chances of obtaining the best price, it is essential to take the time to carefully complete the simulation form. Every piece of information you provide will influence the customization of the final quote.

One of the best tips for reduce the cost of your insurance is to compare several offers. Use online comparators that allow you to access a wide range of quotes with just one click. This way, you can view the differences in guarantees offered as well as the associated prices, which will help you make an informed decision. Some studies show that by taking this step, it is possible to save on average up to €360 per year.

It is also crucial to learn to identify essential guarantees compared to those that are optional. Avoid subscribing to superfluous options which increase the cost of your insurance without providing real added value. Take the time to read the terms and conditions to understand the exclusions and limitations of your contract.

Finally, do not hesitate to seek help from professionals if you feel the need. Insurance brokers can guide you towards the best solutions adapted to your situation. With all of these strategies, you are now ready to navigate the world of online insurance quotes and find the best deal for you!

FAQ – How to Get the Best Insurance Quotes Online

How to create an online insurance quote simulation? To obtain an insurance quote, simply go to an online insurance comparator. Fill out a simplified form with your personal information and your insurance needs. In just a few clicks, you will obtain several personalized quotes.

Is it possible to get a free insurance quote? Yes, most insurance comparison sites offer free quote simulations. This allows you to access different offers at no additional cost.

How to effectively compare insurance quotes? To compare quotes, carefully examine the guarantees offered and the contribution amounts. It is important to ensure that the guarantees are equivalent to obtain a fair and accurate comparison.

What elements influence the price of an insurance quote? The price of an insurance quote can be influenced by several factors such as your age, driving experience, vehicle type, location and insurance history.

Can I take out my insurance directly online? Yes, many insurers offer the possibility of purchasing insurance directly online, once you have found the offer that meets your needs.

How can I lower the cost of my car insurance? You can reduce the cost of your car insurance by comparing different quotes, increasing your deductible or taking advantage of discounts for safe drivers.

When is the best time to request an insurance quote? It is advisable to request an insurance quote before the expiry of your current contract, to ensure that you are not caught off guard and can properly compare offers.

Are online insurance quotes reliable? Yes, insurance quotes obtained online are generally reliable, as long as you use reputable insurance comparators and provide accurate information.