|

IN BRIEF

|

In a world where unforeseen events can often disrupt our plans, it is essential to surround ourselves with solid financial protection. Inter Europe Insurance is positioned as a key player in the insurance market in France, offering a range of services adapted to each need. Whether you want a health insurance, a travel insurance or even one car insurance, Inter Europe Assurance guarantees you complete coverage and considerable benefits. Let’s find out together how these offers can truly secure your daily life and give you invaluable peace of mind.

Inter Europe Assurance stands out for its varied range of services adapted to your insurance needs. Whether it is protection against unforeseen events, specific coverage, or assistance services, this company is a trusted player in the field of insurance in France. This article will explore the benefits And disadvantages associated with Inter Europe Assurance offers, in order to help you better understand its services and the benefits they can provide.

Benefits

One of the first benefits of Inter Europe Assurance lies in its ability to provide financial protection facing the vagaries of life. Whether for health insurance, travel insurance, or even car insurance, you benefit from adapted and comprehensive coverage, helping you to minimize the financial impacts linked to unforeseen events.

There regulation in which Inter Europe Assurance participates, contributes to the stability of the insurance market, thus offering a reassuring guarantee to subscribers. With competitive prices and assistance services available 24/7, the subscriber can feel safe, whatever the situation.

Inter Europe Assurance is also positioned as a leader in the field of international insurance programs, allowing risk coverage on a European scale without requiring local policy issuance. This offers reduced costs and great flexibility for those who travel regularly to Europe.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages. One of the main challenges lies in understanding the optional guarantees. Although “comprehensive” insurance is attractive, it can sometimes lead to a certain complexity for the consumer who must ensure they fully understand what is included.

In addition, the specific conditions of certain insurance programs may vary, leading to inconsistency which could destabilize certain policyholders. It is therefore advisable to obtain detailed information and carefully read the terms of the contracts before subscribing.

Finally, the domain ofinternational insurance can sometimes be confusing for customers unfamiliar with the regulations in force in other European countries, requiring increased vigilance.

Welcome to the world of Inter Europe Assurance, a key player in insurance in France. In this article, we will explore the different services offered by this company as well as the many benefits that result from them. Whether you are looking for health, travel or auto insurance, Inter Europe Assurance presents itself as a solid partner to support you and protect your financial interests.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Essential coverage for all your needs

Inter Europe Insurance offers a varied range of services adapted to the requirements of each insured person. Whether you are a globetrotter, a daily driver or a family wishing to ensure your health, you will find efficient solutions here. From comprehensive travel insurance coverage to customizable auto insurance options, this company meets your needs efficiently.

Health insurance

Health is essential and Inter Europe Insurance knows it well. With its health insurance plans, you benefit from extensive coverage, particularly abroad, thus ensuring your well-being without hassle. By purchasing health insurance, you give yourself peace of mind knowing that you are protected against unforeseen medical events. Learn more about the importance of health insurance, especially for young people living abroad, at this link: here.

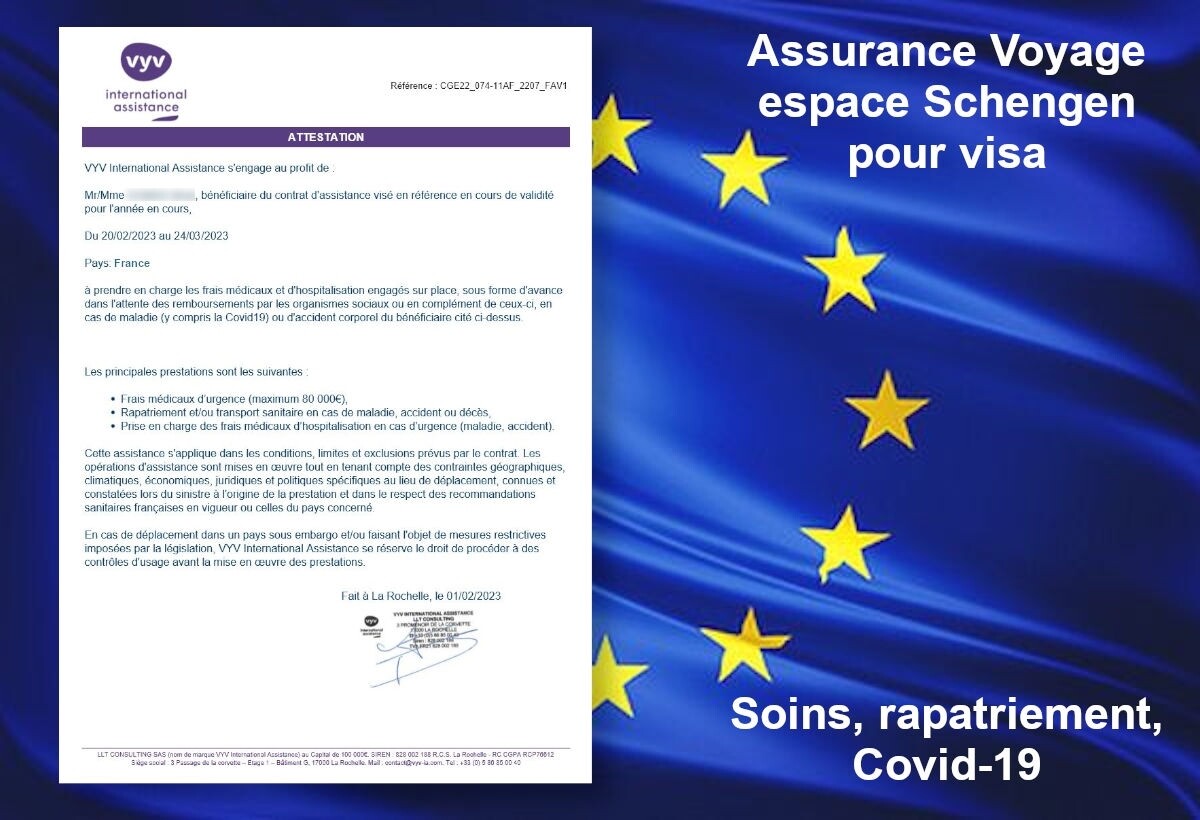

Travel insurance

Travel insurance is essential to minimize the financial impacts of possible unforeseen events. It allows you to benefit from assistance services when you need them most. Whether to cover unexpected medical expenses or to manage a flight cancellation, this insurance is essential for travelers. To learn more about why it makes sense to purchase travel insurance, check out this article: here.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Benefits of international insurance programs

Insurance programs offered by Inter Europe Insurance also offer the possibility of covering risks in other EEA member states without the need to issue a local policy. This flexibility is particularly beneficial for expats and frequent travelers. The main benefits include reduced costs and extensive coverage tailored to the specific needs of each client.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Guaranteed peace of mind

By taking out insurance with Inter Europe Insurance, you ensure not only your own safety, but also that of your family. Guarantees that protect your loved ones against unforeseen events linked to work stoppage or death allow you to maintain a decent standard of living. Solutions like life insurance can also prove beneficial in the long term.

All-risk car insurance

When you choose comprehensive car insurance, you protect yourself as much as possible. This formula allows you to be compensated for any damage suffered by your vehicle as well as for your bodily injuries as a driver. For more information on the benefits of comprehensive car insurance, visit this link: here.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The challenges of the insurance sector in Europe

It is also important to understand the context in which Inter Europe Insurance. The insurance sector in Europe faces various challenges, including the fight against fraud and adaptation to new regulations. This means that insurers must constantly innovate to offer reliable services adapted to the needs of their customers.

Finally, Inter Europe Insurance is a wise choice for anyone looking for reliable and comprehensive insurance coverage, while ensuring they benefit from quality support and advice.

Inter Europe Assurance positions itself as a key player in the insurance sector in France, providing essential financial protection to its policyholders. This article highlights its various services as well as the many benefits it offers, ranging from health insurance to travel insurance to international insurance programs.

A varied range of services

Inter Europe Assurance offers wide range of services to meet the different needs of its policyholders. Among these services, we find thehealth insurance, which covers unexpected medical expenses, andtravel insurance, dedicated to protecting travelers against the risks associated with their travel. Furthermore, thecar insurance is also available to drivers, providing comprehensive coverage for property damage and personal injury.

The advantages of Inter Europe Assurance

Subscribing to Inter Europe Assurance presents many benefits. Firstly, policyholders benefit from a extended coverage which allows them to be protected in several situations. Additionally, support is available 24/7, guaranteeing immediate support in the event of an emergency, regardless of where you are.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Adapted international protection

THE international insurance programs offered by Inter Europe Assurance allow the insurer to cover risks located in other member states of the European Economic Area, without requiring the issuance of a local policy. This system offers reduced costs, making coverage accessible to a greater number of people, whether for temporary stays or expatriates.

Motivating conclusion on travel insurance

Opt for one travel insurance with Inter Europe Assurance, you choose security when traveling. In the event of an unforeseen event, this insurance helps minimize the financial impact and provide access to essential assistance services. To learn more about the details of these services, feel free to explore the additional information on the benefits of private health insurance and discover how this coverage can meet your expectations.

| Services | Benefits |

| Health insurance | Medical expense protection and 24/7 assistance |

| Travel insurance | Minimization of financial impacts in the event of an unforeseen event |

| Car insurance | All-risk formula for optimal coverage |

| Life insurance | Preservation of heritage and advantageous taxation |

| International programs | Coverage in the EEA without local police, reduced costs |

| Legal assistance | Advice and assistance in the event of a dispute |

Testimonials on Inter Europe Assurance: Understanding its Services and Benefits

Inter Europe Insurance is positioned as a key player in the field of insurance in France, offering a wide range of services which attract many subscribers. Testimonials from policyholders on the different offers highlight the importance of financial coverage and quality support.

Many customers highlight the financial protection offered by their policies, which help reduce financial stress in the event of the unexpected. For example, an insured person testifies: “I was pleasantly surprised during my last trip. My flight was canceled, but thanks to thetravel insurance from Inter Europe, I was able to benefit from immediate assistance and avoid financial losses.” This responsiveness is often mentioned as a strong point of the services offered.

THE various services from Inter Europe Insurance, such as health insurance, car insurance and many others, are also popular. Another customer shares his experience: “I took out health insurance for my family, and we have never regretted our choice. The extensive coverage guarantees us peace of mind, even when abroad.” This coverage not only ensures the health of loved ones, but also ensures access to quality care, wherever you are.

One of the main advantages mentioned by policyholders is the24/7 support. “Having support available at all times is essential to me,” says one user. “This allows me to travel with complete peace of mind, knowing that I am covered everywhere in Europe.” This constant availability reassures policyholders and encourages them to travel with more confidence.

Furthermore, the appearance competitive pricing is often highlighted. Customers appreciate being able to benefit from solid coverage without breaking the bank. “I compared several insurers before choosing Inter Europe. The quality-price ratio really convinced me,” says a satisfied customer. This financial accessibility is a determining factor for many individuals who seek to protect their future without exceeding their budget.

The programs ofinternational insurance offered by Inter Europe Assurance also make it possible to cover risks abroad without the need for a local policy. One policyholder explains: “I enjoy traveling around Europe without having to worry about complex administrative formalities. This is a great advantage for me.” This shows the insurance company’s commitment to adapting to the needs of an international clientele.

In a constantly changing world, protecting yourself against the unexpected has become essential. Inter Europe Insurance offers a range of varied services that meet the financial protection needs of individuals and families. This article helps you understand the different services offered by this insurance company as well as the benefits it can provide, whether for travel, health or automobile insurance.

Inter Europe Assurance services

Travel insurance

Subscribe to a travel insurance is a wise choice for those who want to travel with complete peace of mind. Whether you are leaving for work or leisure, this insurance protects you against unforeseen events that could impact your budget. With Inter Europe Assurance, you benefit from 24/7 assistance, allowing you to minimize the stress linked to an unforeseen incident while traveling.

Health insurance

Health insurance is a fundamental element of financial security. Thanks to Inter Europe Assurance, you can access a extended coverage which protects you in the event of illness or accident. Whether you are a resident or an expatriate, having suitable health insurance guarantees not only your well-being, but also that of your family. Proper coverage can save you from unexpected medical costs that can quickly add up.

Car insurance

When you hit the road, it’s essential to be prepared. L’car insurance offered by Inter Europe Assurance allows you to be covered in the event of a claim, thus protecting you against possible property damage and injuries. You can opt for the formula all risks, which compensates you not only for damage to your vehicle, but also for your personal injuries as a driver. This gives you peace of mind, knowing you are protected on the road.

The advantages of Inter Europe Assurance

Competitive rates

One of the major assets of Inter Europe Assurance lies in its competitive rates. Thanks to in-depth market analysis, this company is able to offer prices adapted to all budgets. By choosing the right insurance, you can get adequate coverage without putting a strain on your finances.

Assistance and support

Inter Europe Assurance also stands out for the support it offers to its customers. By opting for their services, you have access to a 24/7 support which meets your needs at all times. Whether for a question regarding your contract or for a claim declaration, the Inter Europe Assurance team is there to help you, providing essential support in sometimes difficult times.

Flexibility and choice

Flexibility is another strong point of Inter Europe Assurance’s offer. Their different insurance formulas allow you to choose the coverage that really suits your needs. Whether you want travel insurance, health insurance, or car insurance, each contract can be adapted to better meet your requirements. This allows you to build an insurance package aligned with your lifestyle and priorities.

International protection

Finally, with the international insurance programs, Inter Europe Assurance allows you to benefit from coverage in many countries without worrying about local legislation. This is a real advantage for expats or people who travel frequently within the EEA. You are thus protected while avoiding high costs linked to local insurance.

In terms of insurance, Inter Europe Insurance is positioned as a major player on the French market, offering a wide range of solutions adapted to each need. Whether you are an individual or a professional, it is crucial to understand the benefits that these services can provide to secure your finances and guarantee your peace of mind.

One of Inter Europe Assurance’s main strengths lies in its ability to offer financial protection against the vagaries of life. In the event of an unforeseen event, particularly during travel or accidents, travel insurance not only helps minimize the economic impact, but also provides valuable assistance. This responsiveness is all the more essential in critical moments.

Furthermore, Inter Europe Assurance is not limited to simple risk coverage. Its commitment to providing 24/7 support make this insurance a wise choice for those seeking support in delicate situations. Whether for health or automobile assistance or travel-related expenses, the services are accessible at any time, ensuring seamless support.

Finally, the international insurance programs offered by Inter Europe Assurance represent real added value for frequent travelers. These schemes cover risks within the European Economic Area, offering reduced costs and a simplification of administrative procedures, while maintaining a high level of protection.

In summary, the services and benefits offered by Inter Europe Assurance constitute a real keystone for anyone wishing to navigate life’s unexpected events with confidence. Opting for this insurance means choosing serenity and financial security in the face of challenges.

FAQ about Inter Europe Assurance

What types of services does Inter Europe Assurance offer? Inter Europe Assurance offers a varied range of services, including health insurance, travel insurance, car insurance, as well as other personalized options to meet the needs of policyholders.

What are the advantages of travel insurance? Subscribe to a travel insurance allows you to minimize the financial impact of unforeseen events while benefiting from assistance services available if necessary during your travels.

How does international insurance work? International insurance allows an insurance company to cover risks in an EEA member state without having to issue a local insurance policy, thus providing reduced costs and simplification of procedures.

What are the benefits of life insurance? Life insurance has many benefits such as financial protection for your loved ones in the event of death, the ability to maintain your standard of living in the event of incapacity to work, and opportunities to plan for your retirement.

How does “all risks” car insurance work? Car insurance “all risks” covers damage to your vehicle as well as your injuries as a driver, ensuring your safety and peace of mind on the road.

Why choose Inter Europe Assurance? Inter Europe Assurance stands out for its extensive coverage, 24/7 support and competitive rates, making it a wise choice for those looking for reliable protection tailored to their needs.