|

IN BRIEF

|

Welcome to the world of Kovers mutual, where health rhymes with savings. If you are looking for a complementary health that meets all your needs, you are in the right place! In this article, we will explore in detail the offers offered by Kovers, the guarantees they provide you and what customers really think of this mutual. Ready to find out if Kovers is right for you? Let’s go!

In a world where healthcare costs can skyrocket, choosing the right health insurance is crucial. Kovers mutual stands out for its accessible offers and varied options. This article offers a detailed opinion on the benefits And disadvantages of this mutual, in order to help you make an informed choice for your health and that of your family.

Benefits

One of the main advantages of Kovers mutual is its competitive price, with contributions starting at just €17.55 per month. This affordability allows a wide audience – working people, students, retirees or even unemployed people – to benefit from adequate health coverage. In fact, the complementary health Kovers offers guarantees adapted to the needs of all, thus allowing substantial savings on health costs.

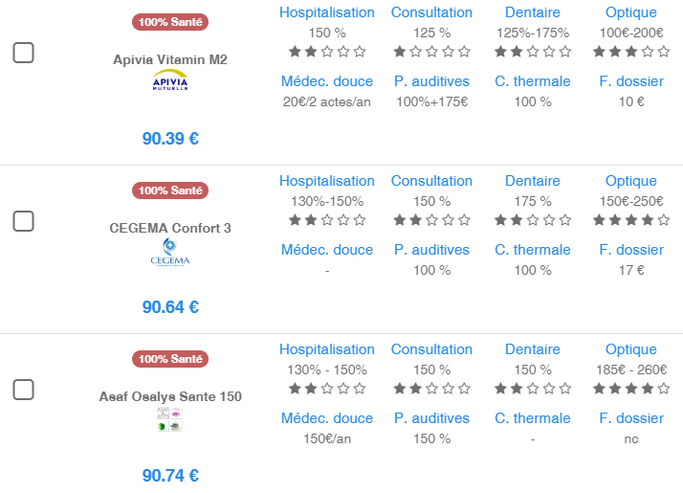

In addition, Kovers is committed to offering generous guarantees on common treatments as well as less traditional services, such as alternative medicine or spa treatments. This flexibility is particularly appreciated by members who want complete coverage, without breaking the bank. The table of guarantees Kovers’ detailed information provides significant transparency, making reimbursements easier to understand.

Disadvantages

disadvantages which are worth mentioning. First of all, although the rates are attractive, some users have noted that customer services can sometimes be slow to respond. Feedback on platforms such as TrustPilot show that this problem can harm overall customer satisfaction.

Another point to consider is that some reviews highlight a lack of choice when it comes to partner networks for dental and optical care. If you are used to accessing a wide range of practitioners, this could be a limiting factor in your decision. Still, it is essential to weigh these elements before subscribing.

To summarize, Kovers mutual is an attractive option for those looking for health coverage at a reasonable price, but it is recommended to carefully assess your specific needs and compare offers in order to make an informed choice. For additional advice, do not hesitate to consult the 8 criteria to take into account when making your selection.

There Kovers mutual stands out in the health insurance landscape with offers suitable for a wide range of customers, from working people to retirees and students. In this article, we will explore in depth its different services, prices And guarantees, while collecting user opinions to help you better understand if this mutual is right for you.

Kovers mutual offers

At Kovers, the offers are specifically designed to meet various needs, ranging from traditional health to alternative medicine. Different levels of coverage are offered, allowing everyone to choose the plan that best suits their requirements. From €17.55 per month, it is possible to access appropriate health coverage.

Warranty and Refunds

The Kovers mutual offers an attractive table of guarantees, covering routine care as well as less conventional treatments. Whether for a consultation with a specialist, reimbursement of dental fees, sessions with an osteopath or even spa treatments, Kovers strives to guarantee competitive reimbursements. To learn more about these guarantees and refunds, customers can consult their site.

Customer reviews about Kovers mutual

With an average rating of 3.1/5 on Google Reviews, users shared their experiences. Generally speaking, the feedback is rather positive, highlighting the quality of service and the competitive rates. Customers especially appreciate the quality-price ratio of this mutual. You can check out testimonials on sites like this for a broader view of reviews.

Contact and support

For any questions or support needs, Kovers customer service is easily reachable by telephone at 01 82 88 73 16. In addition, their online customer area allows you to manage your contracts and track your reimbursements quickly. This is a real plus for those who like to keep an eye on their healthcare costs.

Conclusion: Why choose Kovers mutual?

Kovers mutual presents itself as an interesting option for those looking for health coverage that is both accessible and comprehensive. THE customer reviews, affordable prices, as well as the different guarantee options make Kovers a choice to seriously consider. For more information about this mutual, go to their official website: Kovers.fr. Compare with other offers to make sure you make the best choice for your health and your budget.

If you are looking for a complementary health which combines affordable rates and solid guarantees, Kovers mutual deserves your full attention. With a rating of 3.1/5 on Google reviews, this mutual offers a range of services and benefits that could well meet your needs. In this article, we will explore the different Kovers offerings, their highlights, and customer reviews to help you make an informed choice.

The varied offers of Kovers

Kovers offers several options adapted to different audiences. Whether you are a student, working, retired or unemployed, there is an option for everyone. For example, the formula Kovers Tribe is ideal for families, offering generous guarantees on common health needs, as well as on specific treatments such as alternative medicine or thermal cures.

Competitive rates

From only €17.55/month, contributions remain competitive taking into account the numerous benefits offered. The idea is to save on your healthcare costs without sacrificing the quality of reimbursements. Additionally, you can easily request a estimate online to easily and quickly assess the cost of different options.

Customer reviews: what they think

Feedback regarding Kovers is generally positive. Users particularly appreciate the rapid reimbursement and accessibility of the offers. However, as always, it is essential to read several reviews to get a complete idea. To learn more about customer feedback, you can visit the Kovers site as well as review platforms such as Trustpilot.

The key advantages of Kovers mutual

Kovers doesn’t just offer great prices; it also offers reimbursements that meet expectations. For example, it reimburses better than certain competing offers, and you benefit from easier access to your rights and services. In fact, policyholders can follow the progress of their reimbursements and manage their services via a customer area online.

Conclusion: Kovers, a good choice?

In short, Kovers mutual offers undeniable advantages for those looking for complementary health adapted to their personal situation. With competitive rates, a diversity of offers and generally favorable customer reviews, this mutual could establish itself as an effective solution. Before making your choice, do not hesitate to compare the options available on Mutual Advice and to consult the rankings of the best mutual health insurance companies for 2024.

| Criteria | Description |

| Prices | From 17.55€/month for basic blankets. |

| Customer Ratings | Average rating of 3.1/5 based on 44 Google reviews. |

| Access to care | Guarantees for everyday needs, alternative medicine and spa treatments. |

| Target audience | Intended for everyone: working people, students, retirees and the unemployed. |

| Refunds | Fast and improved reimbursements for healthcare expenses. |

| Administration | 100% online, easy to manage via the customer area. |

| Formulas available | Varied formulas to suit everyone’s needs. |

| Savings | Save on your healthcare costs with competitive prices. |

| Quality label | Reward for fair price offers. |

Testimonials and opinions on Kovers mutual: complementary health insurance to discover!

Kovers mutual insurance company is quickly making a name for itself in the complementary health insurance market, but what is it really worth? With a average score of 3.1 out of 5 on Google, customer opinions vary, but many seem happy with their choices. Let’s take a closer look at what its members think about it.

A customer recently shared their positive experience: “I am not only impressed with the affordable price that I got, from only €17.55/month, but also through the generous guarantees offered. Not only are my health costs well reimbursed, but I also have access to alternative medicine and even spa treatments. This is a real plus in the world of mutual insurance! “.

Other testimonials highlight the flexibility of Kovers’ offerings. “As a student, I was worried that I wouldn’t be able to find good health coverage at a reasonable price. Kovers made it easy for me to compare different options, and I found the one that suited me best, especially with special youth discounts,” says an enthusiastic young man.

However, not all reviews are entirely positive. Some users have expressed their dissatisfaction with the customer service. “I had some difficulty contacting an advisor to clarify certain guarantees. Despite everything, monitoring and reimbursement are rapid, which is a good point to note,” specifies a retiree who took out a contract for himself and his wife.

Another aspect often mentioned by users is the transparency of offers and prices. “I really appreciate the fact that Kovers presents a table of guarantees clear, which helped me choose my supplement without surprises. I know exactly what is covered,” says a satisfied young mother.

Finally, it seems that Kovers has a model that appeals to a wide audience, from working people to retirees, students and those without jobs. The diversity of offers is an undeniable asset. “For my family, Kovers has been an excellent decision, helping to reduce our healthcare costs,” concludes one loyal member. It therefore appears that, despite a few small hiccups, Kovers mutual appears to be an option to seriously consider for those looking for a advantageous complementary health.

Overview of Kovers Mutuelle

Kovers mutual insurance stands out in the complementary health insurance market thanks to its affordable prices and varied guarantees. With a rating of 3.1/5 on Google, user feedback is generally positive, demonstrating notable satisfaction. Let’s take a look at the benefits of Kovers and how its offerings can meet the needs of various audiences.

A range of suitable guarantees

Kovers offers a table of guarantees which meets a multitude of health needs. Whatever your situation – active, student, retired or even looking for a job – you will find a formula that suits your profile. The first formula already offers generous guarantees covering routine care as well as alternative medicine, and even thermal cures!

Competitive prices

Prices at Kovers are particularly attractive, with contributions starting at 17.55€/month. This allows significant savings on your healthcare expenses while guaranteeing you a good level of reimbursement. This moderate pricing is a real plus for those who want to benefit from coverage without breaking the bank.

Positive testimonials

Customer feelings about Kovers mutual are rather positive. Numerous testimonials on platforms like Trustpilot highlight the quality of services and efficient reimbursements. Members also report rapid support and simplified processes for claiming their reimbursements, which is essential for complementary health insurance.

Online Accessibility

The Kovers mutual has also been able to take advantage of digital tools. Indeed, his online customer area allows its members to easily manage their contracts, view their reimbursements and ask questions. This feature is particularly appreciated by younger generations, but is also useful for anyone who wants to simplify their health management.

An offer for all segments of society

Kovers Mutual strives to meet the needs of various segments of the population. Whether you are a young active wanting to protect your health at a low cost or retirement Looking for comprehensive coverage, Kovers has a solution for you. This makes it an attractive option for those who are not covered by group plans or are looking to benefit from personalized coverage.

Focus on alternative medicine

Another notable aspect of Kovers’ offering is the inclusion of alternative medicine in its guarantees. This choice reflects a growing awareness of the importance of health alternatives. Thus, members will be able to benefit from treatments such as acupuncture or osteopathy, often neglected by other mutual insurance companies.

Conclusion: Why choose Kovers?

In summary, Kovers Mutual presents itself as a solid option for those looking for comprehensive health coverage at competitive rates. With broad guarantees, effective online management and overall positive customer feedback, it is worth considering to protect your health. Do not hesitate to evaluate this mutual to discover how it can enrich your daily life and meet your specific needs.

Conclusion on Kovers mutual: A wise choice for your health

In summary, Kovers mutual presents itself as a particularly interesting option for those looking for a complementary health affordable and adaptable to different profiles. With subscriptions starting from €17.55 per month, it provides access to varied and often generous guarantees. Whether you are active, student or retired, the packages offered are designed to best meet your specific needs, while allowing you to make significant savings on your healthcare costs.

Customer reviews, although varied with an average rating of 3.1/5 on Google, reveal a general level of satisfaction with customer service coverage and responsiveness. This demonstrates Kovers’ desire to continually improve its offers, taking into account feedback from policyholders. In addition, the possibility of accessing reimbursements for various items, ranging from routine health needs to alternative medicine, makes it a relevant choice for families.

In addition, Kovers’ commitment to providing transparency on its prices and guarantees is another undeniable asset. This allows future members to compare the different options without ambiguity. In a nutshell, if you are looking for a mutual which combines economics and comprehensive coverage, Kovers positions itself as an actor to be seriously considered. Its flexible model and online access also make it easier to manage your contract, in a world where digital is part of our daily lives.

FAQ about Kovers Mutuelle

What is Kovers’ overall customer satisfaction rating? Kovers customers gave an average rating of 3.1/5 on Google, reflecting general satisfaction with complementary health insurance.

What are the Kovers mutual rates? Kovers prices start at 17.55€/month, offering moderate contributions adapted to various profiles such as active people, students, retirees and even the unemployed.

What types of guarantees are offered by Kovers mutual? Kovers offers guarantees generous for everyday health needs, including alternative medicine, spa treatment, and access to a wide range of treatments.

Is Kovers mutual accessible to all profiles? Yes, Kovers aims to hit all audiences, particularly those who are not covered by group plans.

What reviews do customers leave on Kovers mutual insurance? Customer feedback is generally positive, highlighting effective coverage and good value for money, although some points for improvement are mentioned.

How does the reimbursement of health expenses work with Kovers? Kovers offers a reimbursement system that strives to better cover medical expenses, with a simple and quick online process.

Does Kovers offer mutual insurance for seniors? Yes, Kovers has offers specially designed for seniors, allowing them to be 100% covered at all health posts.

Is there a customer area option at Kovers? Yes, Kovers has a online customer area to manage your contracts and reimbursement requests easily.