|

IN BRIEF

|

The world of mutual and the social security may seem complex at times, but it plays a crucial role in our healthcare system. Understanding how these two entities work is essential to maximizing your reimbursements and protecting your health. There social security, through a basic reimbursement, and the mutual, by supplementing these reimbursements, are essential allies in the care of our health expenses. Let’s discover together the mechanisms that govern them and benefits undeniable that they offer.

There mutual health insurance is often synonymous with enhanced protection for policyholders, but it is essential to know exactly how it works and what the benefits are. Indeed, a good understanding of its mechanisms allows us to better understand the reimbursement procedures and take advantage of financial benefits that she suggests. This article aims to explore the benefits as well as the disadvantages of such coverage to better guide your health choices.

Benefits

Mutual health insurance offers a range ofbenefits undeniable for policyholders. First of all, it allows complete the refund offered by Social Security. In fact, this often only covers part of the medical costs, leaving the insured with a remainder to pay, sometimes high. The mutual will reimburse you all or part of this amount, thus reducing your final bill.

Then, mutual health insurance offers guarantees which vary depending on the contracts, allowing personalized choice based on your specific needs. Some contracts include dental care, glasses, and even alternative medicine, which considerably increases the cost. financial protection for unexpected health expenses.

In addition, devices such as Supplementary solidarity health were introduced to help those who encounter difficulties, by offering coverage at a reduced rate depending on resources. You can find out more about this help on the website Ameli.

Disadvantages

Despite its many advantages, mutual health insurance also includes disadvantages to take into account. First of all, it is important to note that the cost of contributions can vary enormously, and some mutual insurance companies can become financially burdensome for policyholders, especially if the guarantees offered do not meet their needs.

In addition, the repayment period can be very long and often slower than expected, thus creating cash flow constraints. Therefore, before purchasing mutual insurance, it is crucial to carefully examine the available options and ensure that you choose the one that will be both advantageous and suitable for your situation.

Finally, many people ask questions about the difference between social security and mutual insurance. In fact, mutual insurance only reimburses part of the costs not covered by Social Security, making the judicious choice of good coverage all the more essential. To better understand these complementarities, you can consult the site The Lynx.

There mutual social security is an essential tool that complements the reimbursements offered by theHealth Insurance. Understanding how it works allows you to fully benefit from its advantages. This article will explain the foundations of this complementary health insurance, and how it differs from Social Security, while highlighting its many benefits.

What is a mutual social security fund?

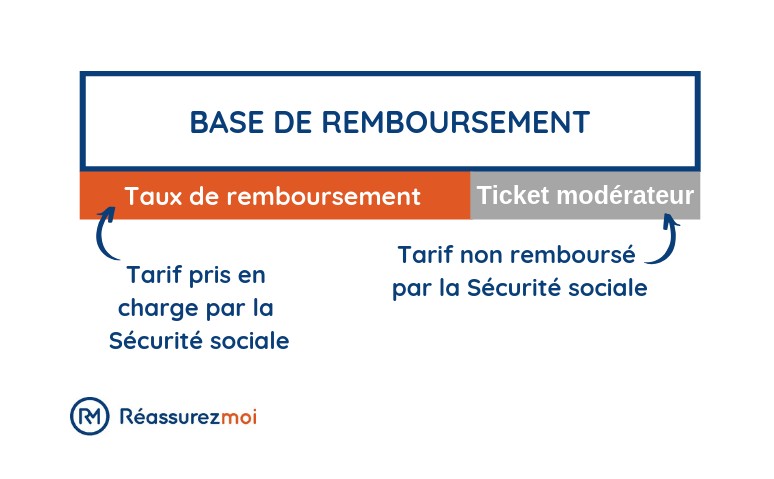

A mutual is an organization that offers reimbursements for health costs not covered by Social Security. Unlike theHealth Insurance, which reimburses part of the health costs, the mutual insurance covers the copayment, that is to say the difference between the convention rate and the amount reimbursed by social security.

The differences between Social Security and mutual insurance

Very often, these two notions are confused. L’Health Insurance offers a basic reimbursement, often around 70%, but this leaves a remainder to be borne by patients. There mutual, for its part, makes it possible to reduce this remaining charge. For example, a hospitalized person may find themselves having to pay costs that are much higher than what Social Security covers, hence the importance of mutual insurance.

How does mutual health insurance work?

THE mutual operate on the principle of solidarity. Members pay a membership fee, which is then used to reimburse members’ healthcare expenses. Mutuality is thus a system of mutual aid: the more there are of us, the less the costs can be for each person. This coverage also allows access to quality care without fear of excessive expenses.

The advantages of complementary health insurance

The advantages of complementary health insurance, or mutual insurance, are multiple. First of all, it allows you to reduce the remaining costs. Furthermore, some mutual insurance companies offer extended guarantees, such as reimbursements for dental and optical care, and even alternative medicine. Furthermore, the mutual health insurance can also offer support and prevention services.

Complementary solidarity health insurance

For those with limited resources, Supplementary solidarity health proves to be a valuable help in paying for uncovered health expenses. It facilitates access to care for all, by offering financial support. It is an ideal solution for people on low incomes who do not want to sacrifice their health because of costs.

How to choose the right mutual?

Choosing a mutual insurance company is crucial to maximizing your reimbursements. There are different plans and levels of coverage. To make the best choice, it is advisable to compare the offers available based on their specific health needs. It’s also a good idea to take reviews and opinions into account, which can help you avoid unpleasant surprises.

In summary, the mutual social security is an essential complement to our health system. It makes it possible to reduce the remaining burden and to have access to quality care. Understanding how it works and its advantages is a first step in making an informed choice and taking advantage of its advantages. Don’t hesitate to explore the different options available to find the solution that best suits your health needs.

There mutual health, often overlooked, plays a fundamental role in our health system in France. It completes the reimbursements of the Social security, thus allowing policyholders to benefit from optimal coverage for their medical expenses. Whether for doctor consultations, medications or even hospitalizations, understanding how mutual insurance works and its benefits is essential to successfully navigating the health care landscape. This article guides you through the key concepts of mutual health insurance, its differences with Social Security, and the benefits of membership.

What is mutual health insurance?

A mutual health insurance is an organization that offers its members reimbursements for health costs not covered or partially covered by Social Security. The main objective is to reduce the remaining liability, that is to say the amount that the insured must pay after the Social Security reimbursements. Depending on the plan chosen, the mutual insurance company can fully or partially cover costs such as medical consultations, dental care and hospitalization.

Differences between social security and mutual insurance

It is essential to clearly distinguish the Social security of mutual insurance. Social Security reimburses part of health costs, generally around 70%. However, there often remains a copayment, or the patient’s share. The mutual insurance company, for its part, steps in to cover all or part of this remaining liability, thus offering increased financial protection. For more details on this distinction, you can consult additional resources here.

The advantages of mutual health insurance

Joining a mutual health insurance company has many advantages. First of all, it provides expanded coverage, making it possible to avoid facing unexpected medical expenses. In addition, some mutual insurance companies offer additional services such as access to alternative medicine consultations or coverage for excess fees. As a bonus, devices such as Supplementary solidarity health are available to those with limited resources, ensuring access to care. Learning more about this help can be crucial, and you can find out here.

How to choose your health insurance?

Choosing health insurance can seem complex, but a few tips can help you. First, assess your specific needs: do you often consult specialists? Do you have significant dental costs? Then, compare the offers to find the mutual that best suits your situation and your budget. Some sites like offer practical advice to guide you in your choices. Also remember to check the reimbursement times and the customer service offered.

In short, the mutual health insurance is an essential partner to benefit from complete coverage of your health costs. Understand how it works, know how to differentiate it from Social security and knowing the advantages it offers will allow you to better manage your access to care. Do not hesitate to explore and compare the various mutual insurance companies available on the market to ensure your long-term well-being and health.

Mutual Social Security: Operation and Benefits

| Axis of Comparison | Description |

| Refund | The mutual covers the costs not reimbursed by Social Security, thus limiting the remainder payable. |

| Services Offered | Access to services such as dental, optical and hospital care. |

| Types of Contracts | Various contracts adapted to personal needs, from minimum coverage to extensive options. |

| Complementarity | It supplements Social Security reimbursements, improving health protection. |

| Financial aid | Possibility of financial assistance for low incomes via the Solidarity Health Supplement. |

| Access to care | Facilitates access to quality care without too many financial constraints. |

| Customer Service | Assistance and advice available to help with the choice and use of guarantees. |

| Legal protection | Some contracts include legal protection to cover disputes related to healthcare costs. |

| Membership | Open to all, without resource requirements, but the price may vary depending on the guarantees chosen. |

| Taxation | Contributions may be tax deductible in some cases, thereby reducing the net cost. |

Testimonials on Mutual Insurance and Social Security: Understanding How It Works and Its Advantages

When we talk about mutual and of social security, it is common to encounter questions about the functioning of these two complementary systems. Many people think that the social security is enough to cover all their health costs, but the reality is a little more complex. The testimonies we have collected demonstrate the importance of complementary health.

Marie, 68, recently shared her experience: “At first, I thought that the security would reimburse me for everything, but I quickly realized that some expenses were still my responsibility. It is by subscribing to a mutual that I was able to reduce hospitalization costs and consultations with specialists. Today, I no longer hesitate to seek treatment when necessary, knowing that my mutual insurance covers part of the costs.”

Jean, a young 30-year-old worker, also understood the benefit of complementary health insurance: “While I was a student, I thought I could get by with just one security, but when unexpected dental expenses arose, I regretted not having taken a mutual. By choosing a mutual fund adapted to my budget, I was finally able to have peace of mind regarding my health.”

For Sophie, a mother, the advantages of a complementary health are undeniable: “With children, visits to the pediatrician, orthodontic treatments, costs can quickly mount. Thanks to our mutual, we were able to cover a large part of these costs, without our budget suffering too much. It’s an invaluable comfort!”

Finally, Claude, who had to change jobs, highlights the establishment of a complementary solidarity health : “Being unemployed, I was worried about my health coverage. I discovered the complementary solidarity health, which allowed me to benefit from help to pay for my care. It’s really a great initiative for those who need it.” This testimony clearly illustrates that support systems exist to guarantee everyone access to care.

These testimonies clearly show how much mutual has become essential for many French people. It makes it possible to complete the reimbursements of the social security and thus reduce the cost of care, hence the importance of obtaining good information to choose the right formula adapted to your needs.

Understanding Mutual Insurance and Social Security

Mutual health insurance, often confused with Social Security, plays an essential role in the health system. social protection. This article will help you decipher how these two entities work and discover the advantages of joining a complementary mutual insurance company. In short, it is a complete guide which will enlighten you on the issues of health coverage in France.

What is Social Security?

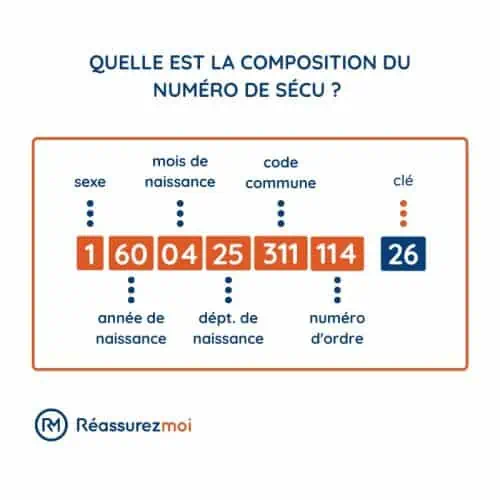

There Social security is an institutional system which guarantees the coverage of part of health costs. As a general rule, it reimburses approximately 70% medical expenses, whether for consultations, hospitalizations or medications. However, there is often a remainder to be paid, called copayment, which can be a source of concern for many.

The Role of the Mutual Health Insurance

The mutual, for its part, is an organization which supplements the reimbursements made by Social Security. Its aim is to help its members cover the portion not reimbursed by Health Insurance. By subscribing to mutual insurance, you can considerably reduce the amount of your out-of-pocket medical expenses. In other words, mutual insurance acts as a safety net that complements Social Security benefits.

The Different Types of Mutual Insurance

There are several types of mutual insurance, from standard options to mutual solidarity, intended for those who encounter financial difficulties. There Supplementary solidarity health, for example, is a valuable help for those whose resources do not reach a certain threshold. It can fully cover health expenses, thus easing the daily lives of many people.

The Advantages of Joining a Mutual

Subscribing to mutual insurance has several advantages. First of all, it allows you to benefit from a refund complete or partial of your health costs, thus reducing the remains responsible. In addition, many mutual insurance companies offer varied options adapted to different needs, such as dentistry, optics or even alternative medicine.

Extended Guarantees

Mutual health insurance companies do not just reimburse traditional medical expenses. Indeed, they can offer extended guarantees for care that is often poorly covered by Social Security, such as osteopathic care or the psychological consultations. This allows a global approach to health, taking into account everyone’s physical and mental well-being.

How to Choose Your Mutual?

Choosing a mutual insurance company is a crucial step in benefiting from optimal health protection. It is essential to assess your specific needs, particularly by taking into account your medical consumption habits. Do not hesitate to compare the offers and the prices from different organizations. A fake “care network” can also influence reimbursement, so you should pay attention to the options offered.

In short, mutual insurance and Social Security are two complementary elements of the health system in France. Understanding how they work and their benefits can make a big difference in your management of healthcare costs. Joining a mutual fund allows you to reduce the out-of-pocket costs and benefit from significant additional reimbursement. Take the time to choose the mutual insurance company that best suits you to better understand the future!

Conclusion: The essential role of mutual insurance as a complement to social security

In the French health system, mutual plays a fundamental support role in the partial reimbursement of medical costs by the social security. Although Social Security reimburses approximately 70% of health expenses, there is often still a copayment payable by the insured. This is where mutual insurance comes into play, by making it possible to cover these remaining costs, thus guaranteeing members access to care without too many financial constraints.

The advantages of complementary health insurance are numerous. Not only does it allow more complete reimbursement for medical procedures, but it also offers other services such as reimbursements for dental, optical and even certain medications. By subscribing to mutual insurance, the insured protects himself from the hazards of everyday life, particularly in the event of hospitalization or unforeseen illnesses which generate considerable expenses.

In addition, there are options adapted to each personal situation, whether a student, an employee or a retiree. Some mutuals even offer special offers, such as Supplementary solidarity health, which aims to help people with more modest resources to benefit from optimal protection without breaking the bank.

In summary, understanding how mutual insurance works and its interaction with social security is essential for anyone who wants to effectively manage their health expenses. It is therefore crucial to carefully assess your needs and choose appropriate health insurance, in order to guarantee a calm and surprise-free treatment process. Thus, mutual insurance proves to be a valuable ally in the quest for protected and peaceful health.

FAQ about Mutual Insurance and Social Security

What is mutual insurance? A mutual insurance company is an organization that offers additional health coverage. It allows reimbursement in whole or in part of medical expenses that are not covered by the Social Security.

How does mutual insurance work in relation to Social Security? There Social Security reimburses part of the medical costs, generally around 70%. The mutual insurance company, for its part, covers the remainder, known as copayment.

What are the advantages of having mutual health insurance? The benefits include better coverage of health costs, access to quality care and the possibility of reducing the out-of-pocket cost of medical consultations.

Can everyone subscribe to mutual insurance? Yes, theoretically, all citizens have the right to subscribe to mutual insurance. However, some mutual insurance companies may be more accessible than others depending on age or professional situation.

What is Solidarity Supplementary Health? There Complementary Solidarity Health is an aid intended for those who encounter financial difficulties. It makes it possible to cover health expenses not covered by compulsory insurance.

How to choose the right mutual? To choose the right mutual insurance company, it is important to compare the offers according to your needs, your budget and the reimbursements offered for different types of medical expenses.

Does the mutual fund cover hospitalization costs? Yes, most mutual insurance companies offer cover for hospitalization costs, but it is essential to check the conditions and level of reimbursement.

Can we have mutual insurance and complementary health insurance at the same time? Yes, it is possible to have mutual insurance and complementary health insurance simultaneously, but this may result in additional costs. It is therefore important to carefully evaluate the options.