|

IN BRIEF

|

There Unéo Mutual stands out in the field of complementary health insurance through its personalized services adapted to the needs of its members. With a strong commitment to its members, this mutual offers a varied range of guarantees, combining offers of prevention, of refund and of foresight. In this article, we will look at the advantages and disadvantages of this mutual to help you fully appreciate its services.

Benefits

Careful listening to members

One of the strong points of the Unéo Mutual is its commitment to listening to its policyholders. Numerous testimonials from members underline the responsiveness and efficiency of the mutual in meeting their requirements. The ability to easily access a customer service responsive is often mentioned, thus promoting personalized support.

Adapted guarantees

The guarantees offered by Unéo are particularly flexible. They adapt to different profiles, whether you are active, retired, or military. The program Advantaged With allows members to benefit from advantageous offers, making mutual insurance even more attractive. In addition, reimbursements are often rapid, thus facilitating access to care.

Optimal care management

The Unéo mutual insurance company also stands out for its generous support. Whether for dental, optical, or other common medical procedures, members can benefit from reimbursements of up to 100% of costs incurred. This level of coverage allows you to feel calm if you need care.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Contribution costs

Although the quality of services is there, some members find that the contributions, especially for the most comprehensive plans, can be high. It is therefore relevant to compare offers to ensure that the budget is respected while benefiting from adequate coverage.

Complexity of formulas

Another aspect that can confuse some policyholders is the diversity of options available. The multitude of options can create confusion, requiring time to adapt to make the best choice. It is advisable to do your research and seek advice from an advisor to understand all the particularities of the options offered.

Warranty Exclusions

Like many mutual insurance companies, Unéo also includes exclusions in its guarantees. Certain medical procedures or services may not be covered, which can be a disappointment for some members. It is therefore crucial to read the contract conditions carefully to avoid any unpleasant surprises.

Overall, the Unéo Mutual offers a range of interesting services in line with the expectations of its customers. However, it is also important to consider the costs and possible exclusions to make an informed choice about your complementary health insurance.

There mutual Unéo stands out for its attentive listening and its solutions adapted to the needs of its members. In this article, we will explore in detail the services offered by Unéo, its advantages, as well as the feedback from its policyholders. Whether you are looking for complete coverage or specific guarantees, Unéo is keen to support you in meeting your health expectations.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Personalized listening and support

The feedback from policyholders reveals a mutually attentive and responsive to the needs of its members. The services are designed not only to optimize reimbursement for care, but also to guide members throughout their health journey. With Unéo, customer satisfaction is clearly a priority, as evidenced by the quality of the support offered.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The advantages of the Advantaged With program

One of the most appreciated aspects of mutual Unéo is his program Advantaged With. The latter offers a multitude of exclusive advantages, ranging from reimbursements better suited to frequent care, to specific services for seniors. This program is effective, since it simplifies the daily lives of members by allowing them to access guarantees that truly meet their needs.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Comprehensive coverage with an advantageous third-party payer

Unéo has set up the third party payer, a service that considerably facilitates access to care. Thanks to this option, policyholders avoid paying up front for consultations with many healthcare professionals. This not only saves time but also reduces the financial stress associated with medical care.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Optimized and transparent reimbursements

Unéo policyholders also emphasize the quality of refunds for all routine care, particularly optical and dental care. Thanks to efficient management, support is rapid and allows members to benefit from hassle-free follow-up. These transparent reports strengthen trust between the mutual and its customers.

Guarantees adapted for seniors

The Unéo mutual offers specific guarantees for people over 50 with the unéo-Référence Essentielle program. This plan allows you to benefit from quality protection at a controlled cost, allowing seniors to have optimal access to care, while respecting their budget.

Commitment to prevention and well-being

Unéo is not only limited to reimbursements; she also engages in prevention diseases. Through initiatives and information programs, the mutual provides practical advice to support its members in optimizing their daily health and well-being.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Access Unéo: how to do it?

For anyone wishing to join the Unéo mutual insurance company, the membership procedures are both simple and accessible. Quotes can be requested directly on their site, and advisors are available to guide everyone in choosing the most suitable formulas. Even for termination, Unéo supports its policyholders in the procedure, demonstrating a desire to ensure quality customer service.

Discover even more information on the services and benefits of Unéo mutual insurance by consulting the resources available on their official website. You will be able to explore the multiple facets of this mutual which is committed to offering the best service to its members.

There mutual Unéo is recognized for its responsiveness and attentiveness to its members. With its various formulas and services, it positions itself as a key player in the health sector. This article offers you a detailed overview of its advantages and services, to help you make an informed choice.

Varied and adapted services

Unéo mutual insurance stands out for the richness of its services. It offers different formulas to adapt to the specific needs of each insured person. Whether for routine care, optics, dentistry, or even prevention services, Unéo offers basic health guarantees complete. These guarantees allow you to benefit from attractive reimbursements and coverage adapted to everyone’s needs.

Particular attention to foresight

One of Unéo’s strong points lies in its approach to foresight. It distinguishes between different types of disability and offers specific guarantees which cover both permanent disability and absolute permanent disability. Thanks to these options, members can feel secure about their future and that of their family.

Coverage for dental and optical care

Unéo makes a point of ensuring 100% support numerous dental treatments, including prostheses and dentures. In addition, for your optical needs, the mutual also offers excellent coverage. This means less financial stress when it comes to health expenses, allowing policyholders to focus on their well-being.

Third-party payment to simplify your procedures

The system of third party payer offered by Unéo allows you to avoid advance costs during medical consultations. This greatly simplifies procedures for policyholders, making access to care much more fluid and without immediate financial constraints. This feature is particularly appreciated by members who can thus better manage their budget.

An exclusive benefits program

With its section “ My benefits guide », Unéo highlights a program that enriches the experience of its members. This guide is full of information on the different offers available, allowing optimal use of the services offered. It is a real added value that the mutual offers to its members. For more information, you can visit the website here.

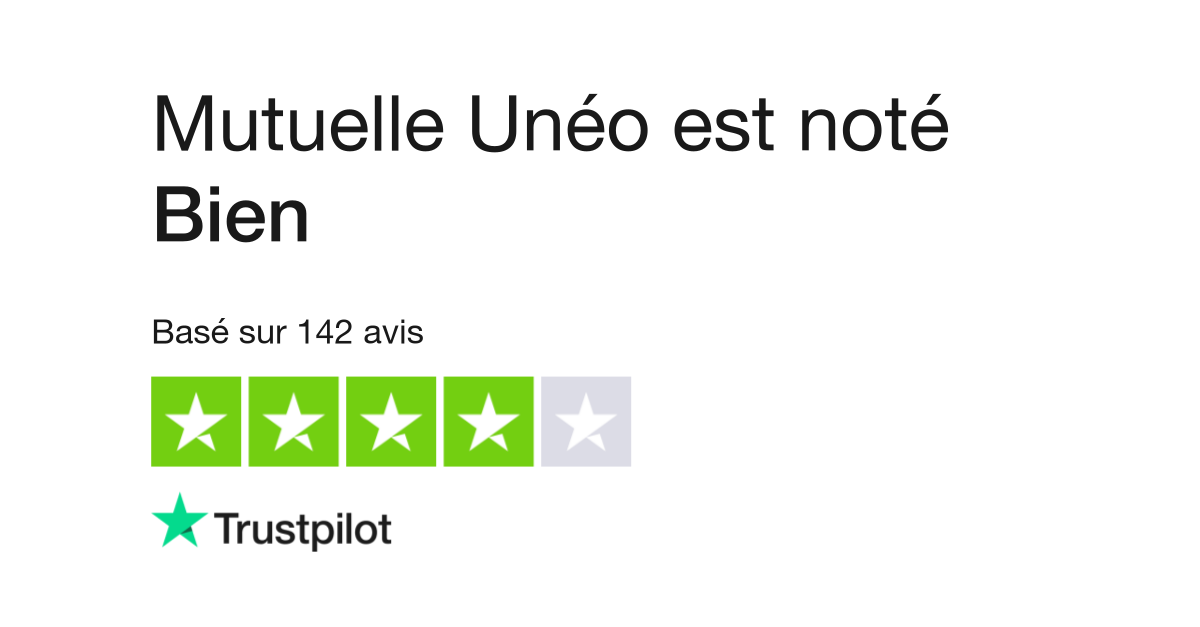

Positive customer reviews

Feedback from policyholders on Unéo mutual insurance is generally very positive. Many highlight the efficiency of customer service and the clarity of refunds. Members also appreciate the listening and support offered by the mutual in difficult times, such as disability or illness. For detailed reviews, visit this link.

Ease of access and membership

Another strength of Unéo is the ease of membership. In fact, everyone can join this mutual, whether employees in the public or private sector, or even the military. The procedures are simple and transparent, allowing everyone to quickly benefit from the services.

Comparison of the advantages of Unéo mutual insurance

| Criteria | Details |

| Listening to members | Unéo prioritizes communication to meet the needs of its policyholders. |

| Refunds | Complete coverage for routine, optical and dental care. |

| Support | 100% coverage for certain treatments, particularly dental. |

| Third party payment | Facilitates access to care without upfront costs. |

| Essential Guarantee | Complete protection for those over 50, with good value for money. |

| Prevention programs | Initiatives to encourage the health and well-being of policyholders. |

| Social support | Mutual company committed to personalized help and support. |

| Accessibility | Membership open to various profiles, including military. |

| Flexibility of formulas | Varied choices adapted to the specific needs of policyholders. |

Testimonials on Mutuelle Unéo: our complete opinion on its services and advantages

The mutual Uneo has established itself as a key player in the field of complementary health insurance, particularly appreciated for its active listening and its effectiveness towards its members. Numerous policyholder reviews attest to this, highlighting a relationship of trust and personalized support.

Members regularly express their satisfaction with the numerous benefits offered. The program Advantaged With is often cited as a major asset, allowing policyholders to benefit from attractive discounts and additional services that meet their specific needs.

According to user feedback, the refund process is also very popular. Unéo guarantees efficient and rapid support for a wide range of care, ranging from routine medical procedures to optical and dental costs. Policyholders feel supported and protected, knowing that they will not be left out of pocket if necessary.

Regarding the third party payer, many members emphasize the simplicity of this system. By avoiding advance fees for certain healthcare professionals, Unéo makes the daily lives of policyholders easier, making access to care smoother and less stressful.

Finally, Unéo is not limited to simple health coverage. The options of foresight that it offers allow members to benefit from even more complete protection. Whether it is a permanent disability or other health-related concerns, the guarantees are adapted to each situation.

For those over 50, the guarantee Essential is specifically designed to provide quality coverage at an affordable price. This type of approach reassures many members who are looking for additional protection adapted to their age.

To conclude, the Unéo mutual is not content to be a simple insurer. It asserts itself as a true partner for members, responding to their varied needs while offering services quality that makes the difference. The testimonies of policyholders leave no room for doubt: choosing Unéo means opting for comprehensive and responsive health coverage.

There mutual Unéo stands out for its attentive services and its offers adapted to the needs of its policyholders. In this article, we will explore in detail the many advantages that this complementary health insurance offers, the positive feedback from members as well as the guarantees that make its reputation. Whether you are looking for comprehensive health coverage or a program adapted to seniors, Unéo has plans to cover a wide range of needs.

Services offered by Unéo

Unéo is committed to providing quality health services to its members. One of the main assets of this mutual is the third party payer, which allows you to avoid advance costs during medical consultations. This means you won’t have to worry about immediate payments, making access to care much easier.

In addition, Unéo offers competitive reimbursement for the various acts of common medicine, including dental and optical care, as well as preventive actions. These reimbursements are one of the points most appreciated by policyholders, who often see a real reduction in their healthcare costs.

The advantages of Unéo mutual insurance

THE coverage options of the Unéo mutual are designed to adapt to a variety of member profiles. For example, the program Advantaged With allows for expanded support which is very interesting for families or professionals with specific needs.

For seniors, Unéo has set up the guarantee Essential, which offers quality protection at an advantageous cost. These guarantees include significant reimbursements for age-related care such as dental prostheses or specialist consultations.

Satisfied members

The feedback from policyholders demonstrates the attentiveness and responsiveness of Unéo mutual insurance. Many members emphasize the availability customer service, who is always ready to answer questions and support policyholders in their efforts. This local approach helps to strengthen users’ trust and commitment to their mutual insurance company.

General evaluations of Unéo’s services are positive, and policyholders appreciate the clarity of the information provided regarding guarantees and reimbursements. This transparency plays an essential role in member satisfaction.

Support for all

Unéo is not limited to its health guarantees. It also offers a social support to its members. A valuable initiative for those experiencing financial or personal difficulties, this demonstrates the mutual’s commitment to the overall well-being of its members.

Information programs, advice and assistance are put in place to support policyholders in their daily lives. Thus, joining Unéo means benefiting from a network of solidarity and mutual aid, beyond just the practical aspects of health.

In short, Unéo mutual insurance presents itself as a wise choice for those looking for reliable health coverage adapted to their needs. Its varied services, its personalized approach and its social support make it a mutual organization committed to the health and well-being of its members.

There mutual Unéo stands out for its attentive listening to its members and its efficiency in processing requests. This mutual, much more than a simple insurance contract, offers services adapted to everyone’s needs. Indeed, Unéo is committed to supporting its members at each stage of their health journey, which makes it a preferred choice for many people.

The advantages offered by the mutual Unéo are varied and meet diverse expectations. Thanks to his program Advantaged With, members can benefit from guarantees adapted not only to their budget, but also to their specific needs. The 100% coverage for dental care, for example, shows how much Unéo values the well-being of its members.

Reimbursements of health costs, whether they concern routine medicine, optics, or even prevention, are also among the strong points of this mutual. By adopting the system of third party payer, Unéo considerably facilitates access to care without the insured person having to pay out-of-pocket, an initiative which deserves to be welcomed.

In addition, the Unéo mutual offers options specially designed for those over 50, in particular with the guarantee Essential, which combines quality and attractive cost. Pension guarantees and social support services are also significant assets for those looking for comprehensive protection.

Overall, membership in the mutual Unéo represents a wise investment to guarantee your health while benefiting from personalized coverage and constant support. The opinions given by policyholders testify to the general satisfaction received by this mutual, thus consolidating its reputation on the market.

FAQ about Mutuelle Unéo

What sets Unéo mutual insurance apart from other mutual insurance companies? Unéo mutual insurance stands out for its attentive listening to its members and for personalized services that meet the specific needs of policyholders.

What are the advantages of the Avantagé Avec program? The Advantaged With program offers interesting services that facilitate access to care for members, with options adapted to various needs.

What is the general opinion on Unéo mutual insurance? The general opinion of the experts is positive, highlighting the quality of the guarantees and the support provided to policyholders.

What guarantees are offered by Unéo in terms of foresight? Unéo distinguishes two types of disability in its insurance guarantees: permanent disability and absolute permanent disability, offering appropriate protection in each situation.

How does reimbursement work at Unéo? Reimbursements at Unéo cover all routine medical procedures, including dental, optical and preventive care, thus guaranteeing optimal safety.

What is third party payment? Third-party payment allows you to avoid advance costs during consultations with certain health professionals, thus facilitating access to care.

Who can join Unéo mutual insurance? The Unéo mutual is open to various members, including military personnel and their families, as well as other specific groups depending on offers.

How to get a quote for Unéo mutual insurance? To obtain a quote, it is essential to inquire directly with the Unéo mutual insurance company, which will be able to provide detailed information on the different formulas.

What are the specific coverages for those over 50? The Essential guarantee is specially designed for those over 50, offering complete protection at an advantageous cost.

How do terminations work at Unéo? Termination of an Unéo mutual can be carried out according to the terms defined by the mutual, and it is advisable to consult the specific conditions for a simplified process.