|

IN BRIEF

|

Subscribing to mutual health insurance is an essential step to guarantee good coverage of your medical expenses. Among the choices available on the market, the mutual Allianz stands out for its offers, but what do Internet users really think about it? Before committing, it is crucial to look at customer reviews on prices, THE services and the guarantees proposed. In this article, we walk you through the key points you need to know to help you make an informed decision about Allianz.

There mutual Allianz positions itself as a popular choice among the various offerings available in the healthcare market. However, before making a membership decision, it is crucial to explore both its benefits And disadvantages, as well as reviews from consumers who have experienced this coverage. Below we provide you with an overview of the key elements to consider.

Benefits

One of Allianz’s strong points is undoubtedly the competitiveness of its prices. For companies, the employer’s contribution to group health coverage is often at least 50%, which makes the offers attractive for employees. This provides comprehensive protection at a reduced cost to employees.

Many people express a general satisfaction with regard to the services offered by Allianz. The guarantees are often considered adequate to cover a wide range of health needs, ranging from routine care to more specific expenses. Indeed, prompt refunds are often cited in customer returns, although times can vary.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages to take into account. Many customers have noticed that prices can be high, especially for the elderly. They note the availability of special mutual insurance companies for EHPADs, which can offer rates up to four times lower while offering similar guarantees.

Another concerning aspect is the quality of customer service. Some users have shared unfortunate experiences, citing processing times of up to three weeks for refund requests. This led to a perception of lack of efficiency and competence within the management team, which can be frustrating for policyholders.

In short, although Allianz may present undeniable advantages, it is essential to carefully weigh the pros and cons. Inform yourself and read various opinions to inform your choice before committing to this mutual health insurance.

Before choosing complementary health insurance, it is essential to find out about the different offers available on the market. The Allianz mutual, recognized for its experience and its diversity of products, can appeal to many policyholders. In this article, we will look at user reviews and highlight the key aspects to consider when making an informed choice.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Allianz mutual insurance prices

When it comes to mutual health insurance, the prices are often at the heart of the concerns of future subscribers. Although the mutual Allianz offers competitive options, some feedback from Internet users highlights that prices can be high, particularly for older people. Comparatively, specific mutual insurance companies for EHPADs can offer similar guarantees for a cost of up to four times cheaper.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Guarantees and services

Before subscribing, it is crucial to carefully analyze the guarantees offered by Allianz mutual insurance. Customers generally appreciate the services varied options offered, which include reimbursements on various health expenses. However, it is recommended to compare these offers with other mutual insurance companies to ensure that specific needs are covered.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Feedback from policyholders

Reviews of Allianz mutual customer service vary. Some users report refund request processed in less than 72 hours, while others complain of long delays of up to three weeks. In addition, several clients highlight a lack of responsiveness on the part of managers, suggesting that it would be necessary to improve this line of service.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Allianz corporate health insurance

Allianz also stands out for its corporate health insurance. For employers, it is imperative to offer additional health coverage to their employees. The employer’s contribution is at least equivalent to 50% of the contribution, which represents a significant advantage for employees and encourages them to choose Allianz for their health coverage.

General assessment of Allianz mutual insurance

Overall, feedback on Allianz mutual health insurance are mixed. While some customers are satisfied with services provided, others express concerns about the reactivity customer service. Users are therefore encouraged to take the time to evaluate their priorities before committing.

When considering subscribing to a mutual health insurance, it is essential to learn about the different options available. There mutual Allianz, recognized in the market, attracts attention with its varied offers. However, before making a decision, it is crucial to explore customer feedback and compare the guarantees And prices proposed.

Internet users’ opinions on Allianz mutual insurance

Many customers share their opinions on Allianz mutual insurance, and these opinions can be very informative. However, their experiences are often contrasting. Some users praise the quality of services and refunds rapid, while others report difficulties with customer service, which could be improved according to several testimonies.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Price comparison

THE prices of the Allianz mutual insurance company can be high, particularly for the elderly. Comparison with other options, such as special mutuals EPHAD, sometimes reveals significant differences. The latter can offer similar guarantees at much lower prices, making reflection on the choice of mutual insurance imperative.

The competitiveness of Allianz company mutual insurance companies

For employees, the Allianz company mutual insurance offers interesting advantages, notably an employer contribution of up to 50% of the contribution. This may make this type of coverage more accessible, but it is important to check the guarantees included and ensure that they correspond to their personal and family needs.

Reimbursement times and customer service

Another point often mentioned by policyholders concerns the repayment period. Allianz claims to process requests within 72 hours, but many users note that delays can sometimes extend. This highlights the importance of evaluating not only the guarantees, but also the reactivity customer service, a crucial aspect for a good experience.

The specificities of Allianz senior mutual insurance

For retirees, the Allianz senior mutual insurance offers suitable formulas. However, it is essential to carefully analyze the refunds proposed, as well as the price, before making a choice. Reviews from retired customers can provide valuable information on the quality of services.

Provisional conclusion on Allianz mutual insurance

Before committing to Allianz mutual insurance, it is therefore essential to do your homework, compare offers and take into consideration feedback from policyholders. By visiting sites like International Health Mutual or by consulting comparisons such as Indeed, you will be able to better understand all the complexity of this decision.

| Evaluation axis | Details |

| Prices | Allianz mutual insurance prices are judged students, particularly for the elderly compared to other mutual insurance companies. |

| Refunds | Refunds are announced within 72 hours, but significant delays have been reported. |

| Customer service | Reviews report a bad customer service, with very long response times. |

| Guarantees | THE guarantees There are many options available, but it is essential to study them carefully before registering. |

| Company mutual insurance | Competitive with employer participation often above 50%. |

| Comparison | Specialized mutual insurance companies, such as those for EHPADs, can offer better rates. |

| Overall satisfaction | Many customers declare themselves satisfied services, despite some criticism. |

When it comes to choosing health insurance, Allianz attracts the attention of many policyholders. However, feedback shared by users reveals important aspects to consider before committing. Indeed, the question of price is frequently raised, particularly by older people. Many testimonials indicate that the prices can be exorbitant, in comparison with the offers of specialized mutual insurance companies for EHPADs, which can be four times cheaper for similar guarantees.

Another point often mentioned by customers concerns the customer service from Allianz. Several policyholders deplore delays in refund which do not correspond to the initial promises. Although Allianz advertises processing times of 72 hours, many users report situations where these refunds took up to three weeks, causing concern and frustration.

On the other hand, some customers express their satisfaction with the services offered by Allianz mutual health insurance. They highlight a wide range of guarantees, which can meet the varied needs of policyholders. However, it is crucial to carefully analyze these offers and find out about the prices, because the price difference can influence the final choice.

Another aspect often mentioned concerns the Allianz mutual company. Many point out that employer participation is often at least 50% contributions, thus allowing employees to access relatively competitive plans. This could be an advantage for those who choose to subscribe to mutual insurance as part of their employment.

Finally, even if Allianz is a recognized insurer, it is essential to be vigilant. Opinions are divided and it is therefore wise to compare the different options on the market before making a decision. By taking the time to analyze all of these elements, it is possible to make an informed choice regarding your mutual health insurance.

Before subscribing to the mutual Allianz, it is essential to know the opinions and feedback of policyholders. This article provides an overview of the main features of the Allianz offering, its value for money, as well as reviews regarding customer satisfaction. You will also discover the criteria to take into account to make the best choice in terms of complementary health insurance.

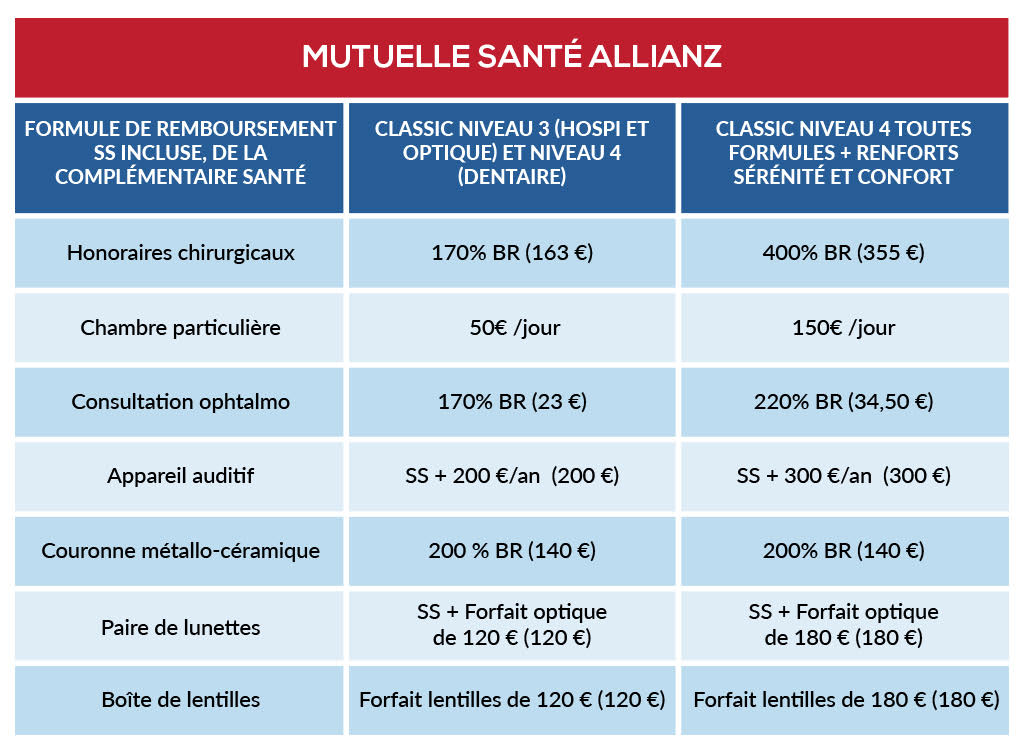

The guarantees offered by Allianz mutual insurance

There mutual Allianz is distinguished by a wide range of guarantees adapted to different profiles of policyholders. Reimbursements include common medical expenses, such as doctor’s visits, dental care, and optics. It is essential to understand the guarantees included in each contract before making a final choice. Indeed, certain guarantees may vary from one contract to another, while additional options may be offered such as coverage for alternative medicines.

Pricing and comparisons with other mutual insurance companies

It is important to note that the Allianz mutual insurance rates may be perceived as high, especially for older people. Several Internet users testify that mutual insurance companies specifically designed for EHPADs are up to 4 times cheaper while offering similar guarantees. Before you decide, it is wise to study the prices carefully and compare them to other offers available on the market. Do not hesitate to request quotes to better evaluate your options.

Customer satisfaction and feedback

Concerning customer satisfaction, reviews on the mutual Allianz are mixed. On the one hand, many customers appreciate the services, the reimbursement rate and the diversity of the offers. However, certain criticisms emerge around reimbursement deadlines. Several policyholders report delays of up to 3 weeks, while the company generally promises reimbursement within 72 hours. It is therefore crucial to find out about these aspects in the context of your choice.

Quality of Allianz customer service

Another point of concern for customers is customer service. Some testimonies speak of a lack of efficiency in the management of requests. Response times considered too long and customer service sometimes considered not very competent tarnish the overall experience. Before committing, it may be useful to test customer service to gauge their responsiveness and competence.

Company mutual health insurance: a significant advantage

For those working in the private sector, the company health insurance of Allianz represents a considerable advantage. It is now mandatory for employers to offer additional health coverage, and the employer’s contribution must be at least 50% of the contribution. This can make Allianz mutual membership more accessible and attractive to employees.

Finalizing your choice

To make the most informed choice possible regarding the mutual Allianz, it is essential to compare different offers, analyze the guarantees and take into account the opinions of policyholders. Also think about your specific needs, particularly in terms of health and budget. By informing yourself correctly, you will be able to make a decision that truly corresponds to your expectations and your personal situation.

Before subscribing to the mutual Allianz, it is essential to be informed about several critical aspects. User reviews show a diversity of feedback, with some customers being satisfied with the services and guarantees offered, while others express concerns about pricing and quality of customer service.

First of all, it is important to note that the prices of the Allianz mutual insurance company can seem high, especially for the elderly. Indeed, certain mutual insurance companies specializing in EHPADs, for example, turn out to be up to four times cheaper while offering equivalent guarantees. This highlights the need for careful comparison before making a decision.

Regarding reimbursements, the deadlines indicated by Allianz may vary. Although the company announces a refund within 72 hours, many policyholders have observed much longer delays, which can reach several weeks. This situation can cause financial stress for those who rely on these rapid reimbursements for their healthcare.

In terms of customer service, reviews are also mixed. Several Internet users describe an unsatisfactory experience, deploring a lack of responsiveness and competence on the part of managers. This can lead to frustration, especially when dealing with urgent refund requests.

Finally, despite these criticisms, many customers appreciate the overall services of Allianz mutual insurance and highlight its strong points. Before committing, it is therefore advisable to carefully analyze the offers, read feedback and ask yourself the right questions about your own health needs.

Frequently Asked Questions about Allianz Mutual

What is the general opinion on Allianz mutual insurance? Many customers express their satisfaction with the services offered by Allianz mutual health insurance. However, certain criticisms should be taken into account.

Are Allianz mutual rates competitive? Yes, Allianz stands out for its competitive rates, particularly for company mutual insurance companies where the employer’s contribution must be equivalent to at least 50% of contributions.

Are the prices suitable for elderly people? Several Internet users point out that prices can be exorbitant for elderly people, in comparison with other specific mutual insurance companies which are up to four times cheaper for the same guarantees.

What is the deadline for reimbursement of health costs? Allianz promises a refund within 72 hours, but some customers have experienced delays of up to three weeks, which can be frustrating.

How are customer support services at Allianz? Opinions regarding customer service are divided, with several users describing it as “level zero”, reporting ineffective handling of requests.

What are the main guarantees offered by Allianz mutual insurance? Before subscribing, it is crucial to find out about the guarantees offered, which may vary depending on the contracts chosen.

Is Allianz mutual insurance a good option for seniors? Allianz offers senior mutual insurance, but it is important to compare reimbursements and prices before making a decision.

Why is it important to be well informed before subscribing to Allianz? Find out about guarantees, prices and reviews from other customers to avoid unpleasant surprises and find the coverage that suits you best.