|

IN BRIEF

|

When considering subscribing to a mutual health insurance, it is essential to take into account the notice from other users to make an informed choice. There mutual Allianz, recognized for its varied offerings and quality services, elicits numerous reactions and testimonials. In this article, we will explore the different perceptions of policyholders regarding their experience with Allianz, highlighting both the positives and the areas that could be improved. This way, you will be able to better assess whether this complementary health meets your expectations and needs.

There mutual Allianz is a solution popular with many policyholders looking for complementary health insurance tailored to their needs. Before committing, it is wise to explore the different notice users to weigh the pros and cons. This article presents a summary of the benefits and disadvantages to take out mutual health insurance with Allianz.

Benefits

One of the main assets of the mutual Allianz lies in its diversity of offers. In fact, the mutual offers customizable contracts allowing them to be perfectly adapted to the specific needs of each insured person. Whether you are a student, a senior or an active worker, you will find an offer that will meet your requirements.

Another decisive element is the attractive price-quality ratio of this mutual. Thanks to the guarantee 100% Health, you can benefit from refunds significant for your optical, dental or audiology expenses, thus reducing your remains responsible at 0 €.

There financial stability of Allianz is also reassuring for many policyholders. Its weight on the market allows it to respect its commitments to its customers and to guarantee reliable services.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

refunds. Testimonies indicate a customer service disappointing, with late or imprecise responses to their requests.

In addition, some policyholders note that reimbursement services do not always live up to their expectations. Despite the choice of guarantees, it is important to carefully check the terms of each contract to avoid unpleasant surprises during refunds.

Finally, although the prices are competitive overall, certain add-ons may prove more interesting depending on the specific needs policyholders. Thus, a free quote and one comparison with other mutual health insurance companies is strongly recommended before committing.

There mutual Allianz is a popular option for many consumers looking for a complementary health adapted to their needs. Before making the decision to subscribe, it is essential to examine user reviews in order to better understand the strengths and weaknesses of this mutual. In this article, we will review the feedback from policyholders, the services offered as well as the prices.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

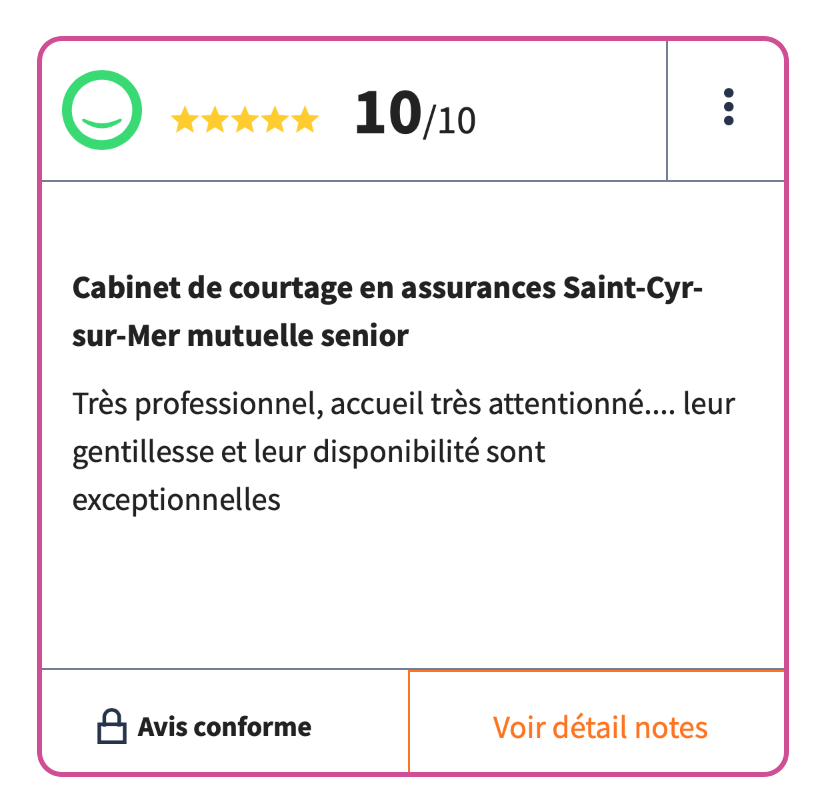

User feedback on Allianz mutual insurance

Opinions on the Allianz mutual health insurance are varied. Some users express satisfaction with the speed of reimbursements and the quality of customer service. However, others point out reimbursements deemed insufficient, particularly in optics and dentistry. It is therefore essential to take an overview of the reviews to better understand the quality of the services offered. You can consult platforms such as Trustpilot to get an overview of the experiences of policyholders.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The main guarantees offered by Allianz

There mutual Allianz offers a wide range of guarantees which can be adapted according to the needs of each family. Policyholders can benefit from 0€ remaining charge on services such as optical, dental or audiology thanks to the guarantee 100% Health. Before opting for a contract, it is wise to determine your needs in order to choose the most appropriate formula.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Allianz mutual insurance prices

The prices of the mutual Allianz are also an important aspect to consider. A free quote allows you to determine the costs in just a few minutes. In addition, Allianz offers competitive rates, but it is essential to compare these to those of other insurers to choose a contract that fits your budget. To obtain a personalized quote, go to this link.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The importance of comparing offers

Before subscribing, it is recommended to compare the offers available on the market. This includes not only guarantees and prices, but also the reputation of the insurer. Many online comparison sites, such as those available on Indeed, can help you evaluate Allianz against other companies.

Conclusion on Allianz mutual insurance

By evaluating all of this information, you will be better prepared to make an informed decision regarding mutual Allianz. It may prove to be an advantageous solution depending on your health needs and your budget. However, it is crucial to carry out an in-depth analysis of reviews and services to find the mutual that will suit you best.

There mutual Allianz is a major player in the health insurance sector, offering a range of offers that adapt to the varied needs of policyholders. Before choosing to subscribe, it is essential to take into account user opinions, in order to evaluate the quality of the services and the value for money. In this article, we invite you to explore what Internet users think of this mutual, as well as the aspects to consider before making your final decision.

Evaluation of the services offered

Customer reviews on the mutual Allianz reveal varied experiences regarding reimbursements. Some users express their dissatisfaction with reimbursements deemed insufficient, particularly in important fields such as optics, dentistry, and even audiology. It is therefore crucial to carefully analyze the guarantees offered, and to compare them with the costs incurred.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Importance of the tariff

Another point of importance in the opinions concerns the price transparency. Allianz offers free online quotes, allowing a quick estimate of costs. However, it is recommended not only to compare the basic prices, but also to evaluate the relationship between the services included and the cost of the contract to choose. Don’t forget to take into account the 100% Health offers which can significantly reduce your out-of-pocket costs.

Customer service feedback

Customer service is often a decisive point in choosing a mutual insurance company. Reviews of Allianz sometimes highlight delays in processing files and a lack of communication. Response times may vary, which could cause frustration. Responsive and attentive customer service is essential to properly manage administrative procedures. Do not hesitate to check the feedback of other policyholders on this subject and to test the service yourself if possible.

Selection criteria for subscribing to mutual insurance

Before subscribing, it is also fundamental to clarify your specific needs. To do this, you can evaluate your personal situation, such as the level of use of medical care, your age or whether you wish to cover your family. Furthermore, solutions like complementary solidarity health (CSS) could be accessible to you. Find out about your eligibility to maximize your benefits.

Finally, be sure to read the general conditions of the Allianz mutual insurance company. Understanding the termination formalities and reporting obligations can help you avoid unpleasant surprises in the future. For more information and reviews you can visit this link or other resources on the subject.

| Evaluation axis | Details |

| Refund | Refunds can be insufficient according to user reviews. |

| Prices | Offers competitive rates, with an option of 0€ remaining charge for certain guarantees. |

| Financial stability | A financial stability appreciable which reassures members. |

| Customer satisfaction | Shared opinions: some are satisfied, others express disappointments. |

| Ease of subscription | There subscription is simple, but the choice of guarantees can be confusing. |

| Assistance | Accessibility to a customer service, but variable response times. |

| Warranty options | Range of guarantees adapted to various needs, but be careful of exclusions. |

| Reputation | Allianz enjoys a good reputation, but negative experiences are reported. |

| Expert assessment | Experts recognize quality services provided you choose your options carefully. |

When considering subscribing to a mutual health insurance, it is crucial to look at user reviews to make an informed decision. Many Internet users share their experiences regarding mutual Allianz, with varied opinions on the quality of the services offered.

Many policyholders express their disappointment as for the refunds, citing examples of insufficiently covered medical costs. This feedback raises legitimate questions about the effectiveness of the service and the relevance of the guarantees offered.

On the positive side, some testimonials highlight the responsiveness of Allianz advisors and the simplicity of the service. subscription process. Users particularly appreciate the possibility of obtaining a free quote, which allows them to easily compare offers before committing.

It is also important to note that the complementary health from Allianz offers attractive guarantees, in particular the 100% Health, guaranteeing an out-of-pocket cost of €0 for positions such as optics, dental and audiology. This type of coverage is particularly tempting for families and seniors.

However, not all reviews are glowing. Some Internet users report delays in processing files or a lack of follow-up after subscription, which can lead to a feeling of dissatisfaction. It is therefore recommended to be well informed about claims management and the quality of customer service.

In short, although the mutual Allianz has undeniable advantages, it is worth thinking carefully about it, taking into account your own needs in terms of health and of budgets. Testimonials from other policyholders can provide valuable perspective to guide this crucial choice.

When it comes to choosing a mutual health insurance, it is essential to take user opinions into account to make an informed choice. This article examines the feedback from Internet users on the mutual Allianz, its services, its prices, and the aspects to consider before committing. We also discuss the strengths and weaknesses of this mutual to help you determine if it meets your health needs.

User feedback

There mutual Allianz has generated many opinions on the internet. Some customers express notable satisfaction regarding the quality of their services and the efficiency of their reimbursements. It is interesting to note that many appreciate the 100% Health Guarantee, which offers the possibility of zero out-of-pocket costs in optics, dental and audiology.

On the other hand, some users criticize the refunds, sometimes considered insufficient. These testimonials highlight the importance of carefully reading the contract conditions before getting started, in order to understand what expenses are really covered.

The advantages of Allianz mutual insurance

There mutual Allianz is popular for several reasons. First of all, its financial stability reassures many members. A good level of solvency ensures that the mutual will be able to honor its commitments in the long term.

Then, the offers offered by Allianz are varied and allow you to find a complementary health adapted to personal or family needs. The possibility of receiving a free quote is also a positive point, facilitating decision-making for future policyholders.

Disadvantages to consider

Despite the advantages, some disadvantages are worth noting. Some customers have reported a customer service disappointing, particularly with regard to the processing of files. Prolonged waits for a response can lead to dissatisfaction, highlighting the importance of fluid and responsive support.

Furthermore, the quality-price ratio of prices offered must be weighed against the offers of competitors. Although attractive options exist, it is essential to compare the prices and services of several insurers before making your choice. Using online reviews for this purpose can be particularly beneficial.

Evaluate your needs before subscribing

Before subscribing to a mutual health insurance, it is essential to assess your own care needs. This work of reflection will not only allow you to check your eligibility for certain guarantees, such as complementary solidarity health, but also to determine whether Allianz’s offers meet your specific expectations.

It is also advisable to discuss with a broker in insurance if you have any doubts. This specialist will be able to guide you towards the options best suited to your situation, while providing you with detailed analyzes of the different contracts.

In summary, user reviews of the mutual Allianz reveal a nuanced image of its services. By weighing the pros and cons, and taking your personal needs into account, you will be better equipped to make an informed decision regarding your mutual health insurance.

There mutual Allianz is positioned as a major player in the field of complementary health insurance, offering a diversity of contracts adapted to a multitude of needs. However, the opinions expressed by Internet users reveal a range of opinions regarding its services. Although some people welcome the financial stability of the group which allows it to honor its commitments, others express their disappointment in the face of insufficient reimbursements in crucial fields such as optics or dentistry.

It is essential to take the time to consult the customer reviews available online. Dedicated platforms allow comments to be sorted according to the ratings awarded, thus providing a clear and precise vision of the mutual’s strong and weak points. An element often highlighted in these feedback concerns the speed of processing files. Some members report frequent delays in responses, which can be a frustrating factor that should not be overlooked.

Before embarking on subscribing to a contract, it is advisable to carefully compare options which are available to you. Allianz offers guarantees ranging from 0€ out-of-pocket costs to capital reimbursed depending on the care provided. Make sure that the chosen contract corresponds to your personal expectations in terms of health services.

Finally, do not hesitate to ask for a free quote in order to assess whether the proposed prices are in line with your budget. Allianz mutual insurance may be suitable for a varied audience, but a careful analysis of your specific needs is the best way to guarantee optimal coverage.

FAQ about Allianz mutual insurance

What are the opinions of Internet users on Allianz mutual insurance?

Internet users’ opinions regarding Allianz mutual insurance are varied, with opinions ranging from very positive feedback on services and prices, to less favorable comments, particularly with regard to reimbursements.

Does Allianz mutual insurance offer a competitive rate?

Yes, Allianz mutual insurance offers competitive rates, particularly with options such as “100% Health”, guaranteeing an out-of-pocket cost of €0 in areas such as optics, dental or audiology.

How can policyholders react in the event of a problem with Allianz?

These policyholders have ways to share their experience, whether through online reviews or by contacting Allianz customer service directly.

What guarantees does Allianz mutual insurance provide?

Allianz offers a range of guarantees adapted to the needs of policyholders, including coverage for routine care as well as customizable options to better meet the needs of each subscriber.

Can we get a free quote for Allianz mutual insurance?

Yes, it is entirely possible to request a free quote from Allianz, which allows you to evaluate the available options and determine if they suit your needs.

What is the reputation of Allianz mutual insurance?

Allianz has a generally good reputation, although some user experiences can be mixed, especially when it comes to case processing and processing times.

What criteria should you take into account before subscribing to Allianz mutual insurance?

It is important to take into account the guarantees offered, the prices, the opinions of other policyholders, as well as your personal and medical situation before making a subscription decision.