Are you about to move abroad? Do not take the choice of your expatriate mutual insurance. This article will review the many pitfalls to avoid when choosing the right health coverage. We will highlight the importance of professional support rather than managing this complex task alone. From the mistake of purchasing the wrong local insurance to the risks of not asking the right questions, we’ll break down the key elements to help you make an informed decision.

Avoiding the trap of inappropriate local insurance

One of most common pitfalls that expatriates encounter is to subscribe to a local insurance without really understanding the implications. Health systems vary greatly from country to country and it is easy to be confused about what is covered and the potential limitations. If you opt for this solution, you risk ending up with uncovered healthcare costs or substandard medical service.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Do not use AI alone to select a formula

Nowadays, many expats use online tools and artificial intelligence software to compare different mutual insurance offers. Although these tools are valuable for a first selection, it is essential to discuss with a advise human. An expert can ask the right questions and guide you in choosing the right plan for your specific needs.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Subscribe before departure: a necessity

Wait until you are well established to subscribe to a health insurance is a mistake to be avoided at all costs. Anticipation is key to avoiding problems once there. Without adequate coverage before your departure, you expose yourself to significant financial risks in the event of a health problem upon your arrival.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

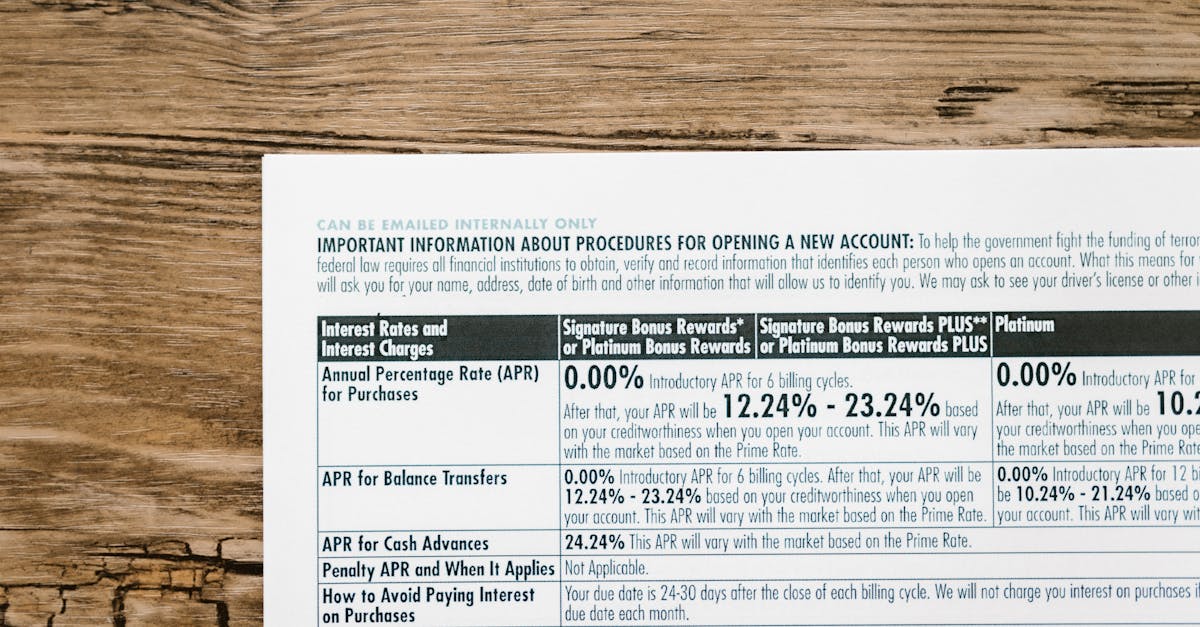

Understanding the differences between insurance

It is crucial to understand the differences between the different expatriate insurance plans. Why could a French contract be more advantageous than a local contract? French contracts often offer global coverage, which means you will be covered even when traveling to other countries, unlike some local insurance which may be limited geographically.

Joining the circle of expatriates in Finland is not only discovering picturesque landscapes and a unique culture, but it also means accessing a new approach to professional life. Flexible working is deeply rooted in Finnish culture, providing remarkable autonomy to…

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Mistakes not to make: placing price before coverage

Focusing solely on the price of insurance can lead to neglecting essential coverage. It is tempting to choose the cheapest offer, but this can be disastrous if that offer does not cover significant medical expenses. Evaluate the reimbursement limits and the guarantees offered is crucial to avoid unpleasant surprises.

The importance of asking the right questions

Professional support allows you to ask the right questions and obtain precise answers. For example, what benefits are included for chronic illnesses? What are the conditions for medical repatriation? Do you have access to English or French speaking doctors? Answering these questions is essential to ensure you make the right choice.

Don’t hesitate to ask for help

In terms of health coverage, you should not hesitate to ask for help. An advisor can offer you professional assistance and guide you through the intricacies of different contracts and options. This approach not only saves you time, but also ensures that your coverage will be optimal.