|

IN BRIEF

|

Private health insurance is a subject that raises many questions, particularly in terms of pricing and of blanket. Whether you are a particular, A stranger or a student in France, it is essential to understand the costs associated and the different options available to you. Prices vary based on several criteria, such as age and length of stay, and can range from a few dozen to several hundred euros per month. In this exploration, we will provide you with clear and concise information to support you in your choice private health insurance.

When we talk about private health insurance, it is crucial to understand how prices are determined and what they mean in terms of coverage and financial protection. Prices may vary depending on various factors, including length of stay, L’age of the insured, and the guarantees chosen. In this article, we’ll look at the pros and cons associated with the price of private health insurance to help you make an informed choice.

Benefits

One of the great advantages of private health insurance is the pricing flexibility. For example, coverage for a period of two weeks can cost between 65 and 89 euros, while for one month the rates vary from 91 to 125 euros depending on your age. This allows policyholders to adapt to their budget while having access to comprehensive health services.

Additionally, choosing private health insurance can offer optimal coverage for medical care. Many health policies include benefits for fee overruns, allowing you to receive quality care without suffering excessive financial burden. Some insurance policies cover up to 200% of costs depending on the plan chosen, which ensures better protection.

Another major advantage is the third party payer, which allows you to avoid paying upfront healthcare costs. This can be particularly beneficial during medical consultations, because your coverage covers the portion reimbursed by health insurance.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

On the other hand, private health insurance prices can represent a significant cost, with monthly contributions ranging between 30 and 100 euros. For some people with limited financial resources, this can become a real burden. People not covered by social security should also be aware that prices for a health pack can start from 47 euros per month, but may not cover all necessary health costs.

It is also essential to understand that even if a complementary health can reimburse part of the costs, a part often remains the responsibility of the insured. For example, if a service is reimbursed up to €200, this amount is limited beyond the initial reimbursement from health insurance. As a result, an unexpected expense could impact your budget.

In conclusion, before subscribing to a private health insurance, it is crucial to carefully assess your needs and your budget. Take the time to compare the different offers and choose the one that suits you best, taking into account the costs, guarantees and services included.

In a world where health is essential, understanding price of private health insurance is essential for making informed decisions. Whether you are an individual looking to supplement your coverage or a foreigner living in France, there are several options adapted to your needs and your budget. This article will guide you through the different prices, the guarantees offered and the elements to consider when choosing the best private health insurance.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The different prices of private health insurance

The price of private health insurance varies depending on several criteria, including your age and the length of your stay. For example, for a stay of two weeks, prices can range from €65 to €89 depending on the options chosen. For coverage of a month, prices range between €91 and €125.

Monthly contributions

When you take out private health insurance, you will have to pay monthly contributions. These are generally between 30 and 100 euros per month, depending on the level of coverage and the guarantees chosen. If your financial resources are limited, it is important to explore the options available to you in this price range.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Health supplements and their costs

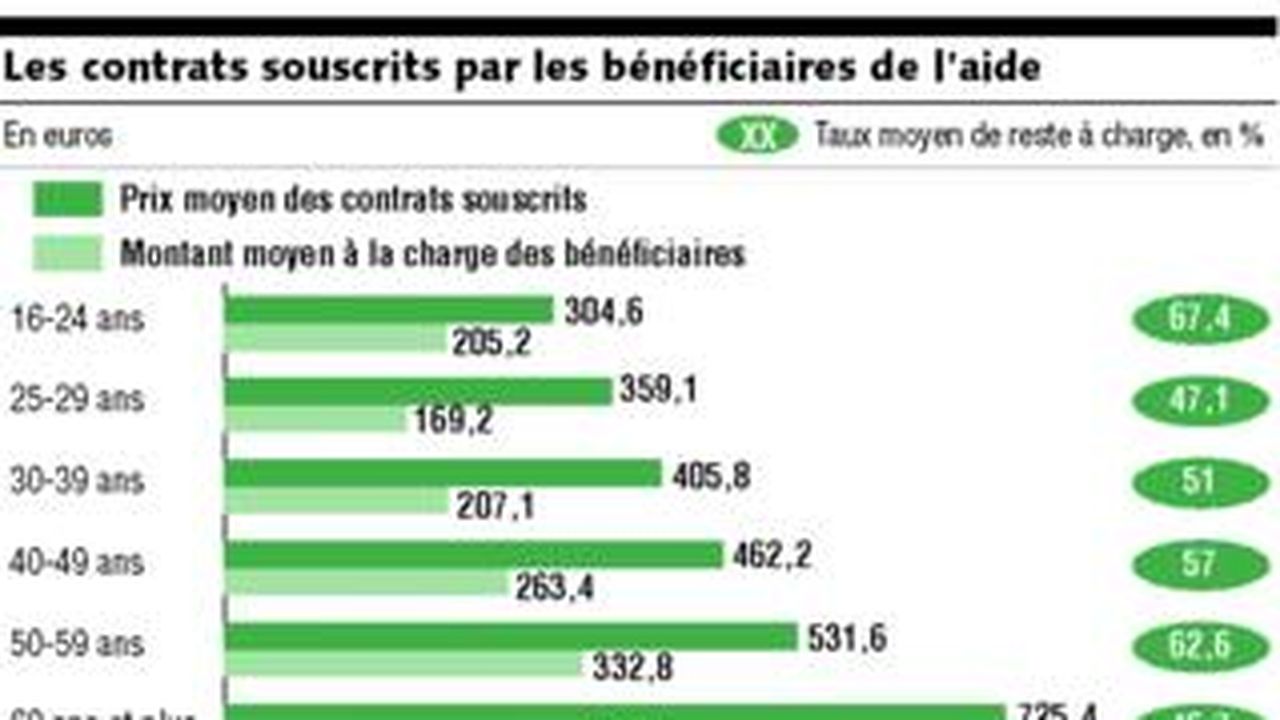

A complementary health can also reduce your expenses. For example, if you have complementary insurance, 30% of your remaining costs could be covered, which would reduce the financial burden on you by €7.50. Prices for health supplements vary according to age groups, ranging from €14 per month for people aged 30 to 49, to €30 for those over 70.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Private health insurance for non-social members

For people who are not affiliated with social security, there are solutions such as Health pack for non-affiliates, offering high-end guarantees from €47 per month. This option is valid in France and around the world, allowing you to ensure your health without difficulty.

Insurance suitable for foreigners

If you are a foreigner living in France, you need a private health insurance that meets your specific requirements. Many companies, such as AXA, offer quotes tailored to professionals, families and retirees. It is advisable to make a estimate to find out the options available to you and choose the one that is most advantageous.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Final Considerations on the Cost of Health Insurance

When you choose a private health insurance, it is vital to understand the conditions, reimbursement levels and annual ceilings. In addition, keep in mind the price changes href=”https://www.ameli.fr/assure/actualites/tarifs-des-consultations-medicales-ce-qui-change-au-1er-nouvelle#:~:text =In this case, the consultation only before November 1st.&text=As part of a.95 euros by the mutual.” target=”_blank”>which may occur from November 1st. This will allow you to avoid surprises during your consultations and guarantee your financial protection when needed. For more information on international health insurance, see this practical guide.

Choose one private health insurance can seem complicated, especially because of the very variable prices. This guide aims to enlighten you on the different aspects of the costs linked to this type of insurance, in order to help you make informed decisions. We will explore the prices, monthly contributions and the particularities of the different guarantees.

Rates based on age and duration

The price of your private health insurance usually depends on your age and the length of your coverage. For example, for a two-week stay, rates can vary between €65 and €89 depending on the age of the insured. For one-monthcoverage, rates are around €91 to €125. It is crucial to take these criteria into account when making your choice. Monthly contributionsMonthly contributions

for private health insurance are generally between €30 and €100, depending on the guarantees offered. These regular payments are essential to ensure adequate health coverage. It is wise to assess your financial resources to choose an insurance that suits you without jeopardizing your budget. For those with modest resources, options such as

complémentaire santé solidaire exist and can significantly reduce costs. Supplementary insurance and reimbursement When you have subscribed to supplementary health insurance , you should know that it covers part of the costs. For example, if a consultation costs €25, and the insurance only covers 30%, you will still have to pay €7.50. If you opt for supplementary insurance, make sure that it reimburses as much of your expenses as possible, in particular excess fees. For more information on reimbursement, you can consult this link:

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

third-party payer

. Private health insurance for non-affiliatesIf you are non-affiliatedto social security, insurance such as the

Health Pack

offers high-end guarantees starting at €47 per month. These offers can be particularly useful if you travel frequently or live abroad. It is crucial to assess your personal needs to choose the coverage best suited to your situation. The network of mutual insurance companies The reimbursement rates and guarantees offered by mutual can vary considerably. It is therefore important to compare the different options. To do this, use buying guides like this one:

guide to choosing the ideal cover

. This type of resource can help you make an informed choice. Price comparison To obtain a accurate estimateof private health insurance costs, it is essential to request several quotes. Comparing offers from different insurers can allow you to find the best option both in terms of pricing and guarantees. You can also consult sites like

understand European private health insurance

to better understand the requirements and specificities. Price of private health insurance in France Duration of stay Monthly rate (EUR) 2 weeks (under 30 years old)

65

| 2 weeks (30-49 years) | 76 |

| 2 weeks (50 years and over) | 89 |

| 1 month (under 30 years old) | 91 |

| 1 month (30-49 years) | 106 |

| 1 month (50 years and over) | 125 |

| Insurance for non-members (Health pack) | From 47 |

| Supplementary solidarity health insurance (45-49 years old) | 14 |

| Supplementary solidarity health insurance (60-69 years old) | 25 |

| Supplementary solidarity health insurance (70 years and over) | 30 |

| find out everything you need to know about health insurance prices in France. compare offers, guarantees and find the health coverage that best suits your needs and your budget. | View this post on Instagram |

| Many French people ask questions about the cost of | private health insurance |

private health insurancecan cover a good part of your costs, you remain responsible for around 30% of the expenses, which often corresponds to a few euros difference. However, if you have acomplementary health

, these additional costs can be reimbursed in full, reducing your financial concerns related to medical care.It is also important to take into account the monthly contributions , which are generally between 30 and 100 euros. These fees may seem high to some, but they ensure adequate healthcare coverage and peace of mind. By opting for aHealth pack

dedicated to non-affiliated people, for example, you can benefit from high guarantees starting from €47 per month, both in France and abroad. Therecomplementary solidarity health is an option not to be overlooked if your income is modest. Depending on your financial situation, it can be free or at a very affordable rate, ranging from €14 to €30 per month depending on your age group. This demonstrates that there are solutions adapted for everyone, making it possible to guarantee access to care. Finally, take into consideration the

third party payer can also facilitate your access to care. This system makes it possible to not advance the portion reimbursed by Health Insurance, which is a real advantage for policyholders. In summary, understand the market private health insurance

and the different prices associated with it is essential to make an informed choice adapted to your needs. In a world where health takes center stage, it is essential to understand the costs associated with private health insurance. This article presents the different factors influencing the price of this insurance, the types of coverage available, as well as practical advice for making the best choice according to your personal situation. Criteria influencing the cost of private health insurance

The price of aprivate health insurancevaries according to several criteria. First of all, the duration of your stay is a fundamental element in calculating your premiums. For example, for a 2-week stay, the costs can vary between €65 and €89, while for a month, the rates are between €91 and €125 depending on the age of the insured.

The age of the insured

Age is a determining factor in the cost of your health coverage. In general, the older you are, the lower the cost of health insurance will be high, due to increased risks of health problems. For example, younger policyholders can often find more affordable rates, contrasting with the higher premiums for people over 60.

Guarantees offered

THEguarantees chosen also influence the price. Basic coverage may seem less expensive, but it may not cover some important medical expenses. On the other hand, a

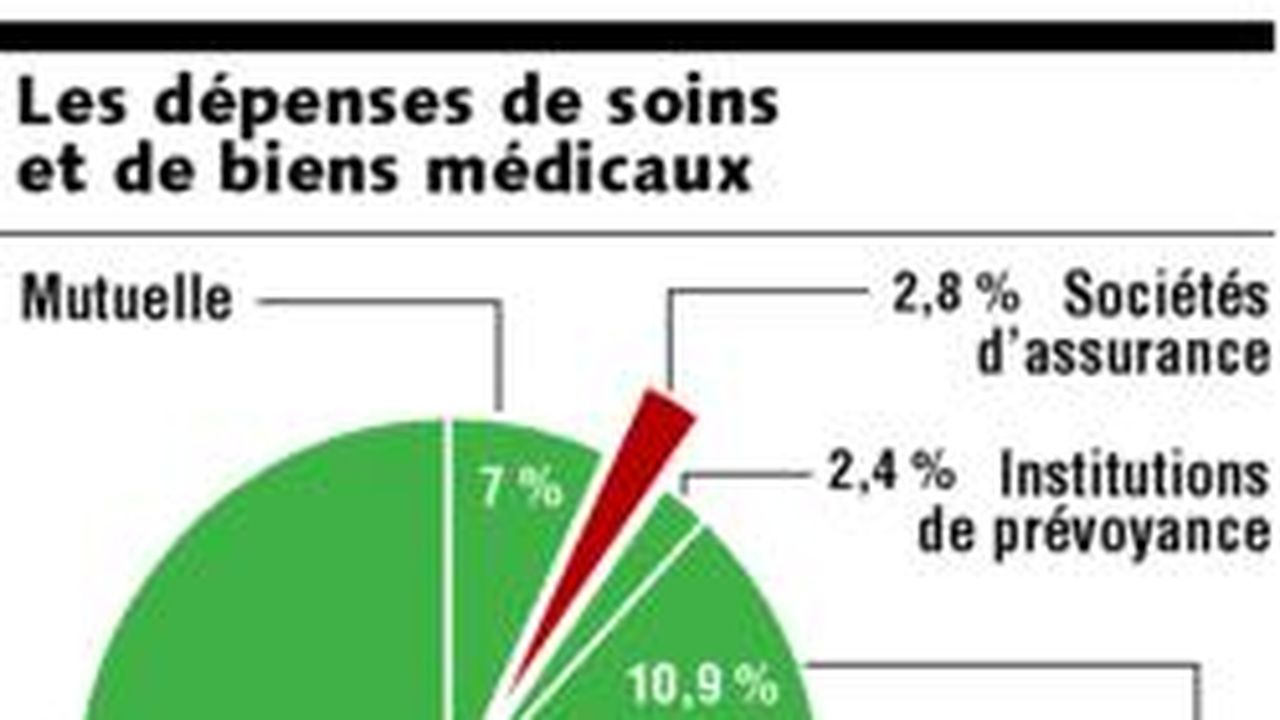

mutual

offering more comprehensive services may be more expensive but will save you from unexpected health costs. The different types of insurance It is important to understand the different types of private health insurance . Among these, we find health insurance for non-social members, which offer solid guarantees from €47 per month. This option is particularly suitable for expatriates or those unemployed in France.

Supplementary solidarity health

If your resources are modest, thecomplementary solidarity healthis an interesting solution. Its cost is adjusted according to your income and can even be free. This is a great option for those looking to minimize their healthcare costs while still getting adequate coverage.

Understanding reimbursement

A crucial aspect that should not be overlooked is the reimbursement of your healthcare costs. In general, around 70% of costs are reimbursed by the Health Insurance , leaving you responsible for around 30%. If you have subscribed to a

complementary health

, it will take care of this remaining part, providing additional peace of mind.The third party payerThe system of third party payeris also to be taken into account. It allows you not to advance the costs often reimbursed by the

Health Insurance

, thus avoiding cash flow problems during medical consultations. Choosing your private health insurance Finally, when you choose yourprivate health insurance, take the time to compare the different offers. It is advisable to consider not only the price but also the

services included

and reimbursement limits. An informed choice will allow you to optimize your healthcare expenses while protecting yourself effectively. find out everything you need to know about health insurance prices in France. Compare offers, guarantees and find the health coverage that meets your needs and your budget.When considering subscribing to a private health insurance in France, it is essential to understand the different factors that influence its price. Prices can vary considerably depending on the

, of your age , as well as the specific options you need. For example, for a two-week stay, rates can range from €65 to €89, while a month can reach up to €125. This diversity of prices makes it imperative to choose a formula adapted to your personal needs. Another important dimension is the importance ofcomplementary health . In fact, if you are covered by supplementary insurance, you can significantly reduce your costs. For example, if therefunds

only cover 70% of your expenses, it is up to you to pay the remaining 30%, unless your supplement covers the difference. For those looking to obtainguarantees robust despite modest resources, the complementary solidarity health

can offer options at discounted rates, sometimes even for free. This is an opportunity to explore to guarantee access to health care. In addition, certain individualized mutual insurance companies can reimburse significant excess fees, which represents a major advantage for those who often require medical care. Finally, it is recommended to compare offers. The prices of contributions generally range between 30 and 100 euros per month. Evaluating the different options available will help you better understand what is included in each contract and determine which coverage is best for you. Always look for the offers best suited to your personal situation to ensure optimal protection of your health. FAQs on the price of private health insurance