|

IN BRIEF

|

Leave in journey is an exciting adventure, but it is essential to think about its health coverage to avoid unpleasant surprises. Indeed, whether for a stay abroad or a getaway in Europe, a good mutual can protect you against unforeseen events such as medical expenses, trip cancellation or loss of your luggage. So how do you choose the best option for you and your needs? Between the different insurance policies and the guarantees offered, it is crucial to be well informed to travel with peace of mind.

When you go on vacation, it is essential to choose your health coverage carefully in order to enjoy your trip with peace of mind. Whether through travel insurance or adapted mutual insurance, each option presents its own benefits And disadvantages. This guide aims to help you make the best choice according to your situation and your particular needs.

Benefits of travel insurance

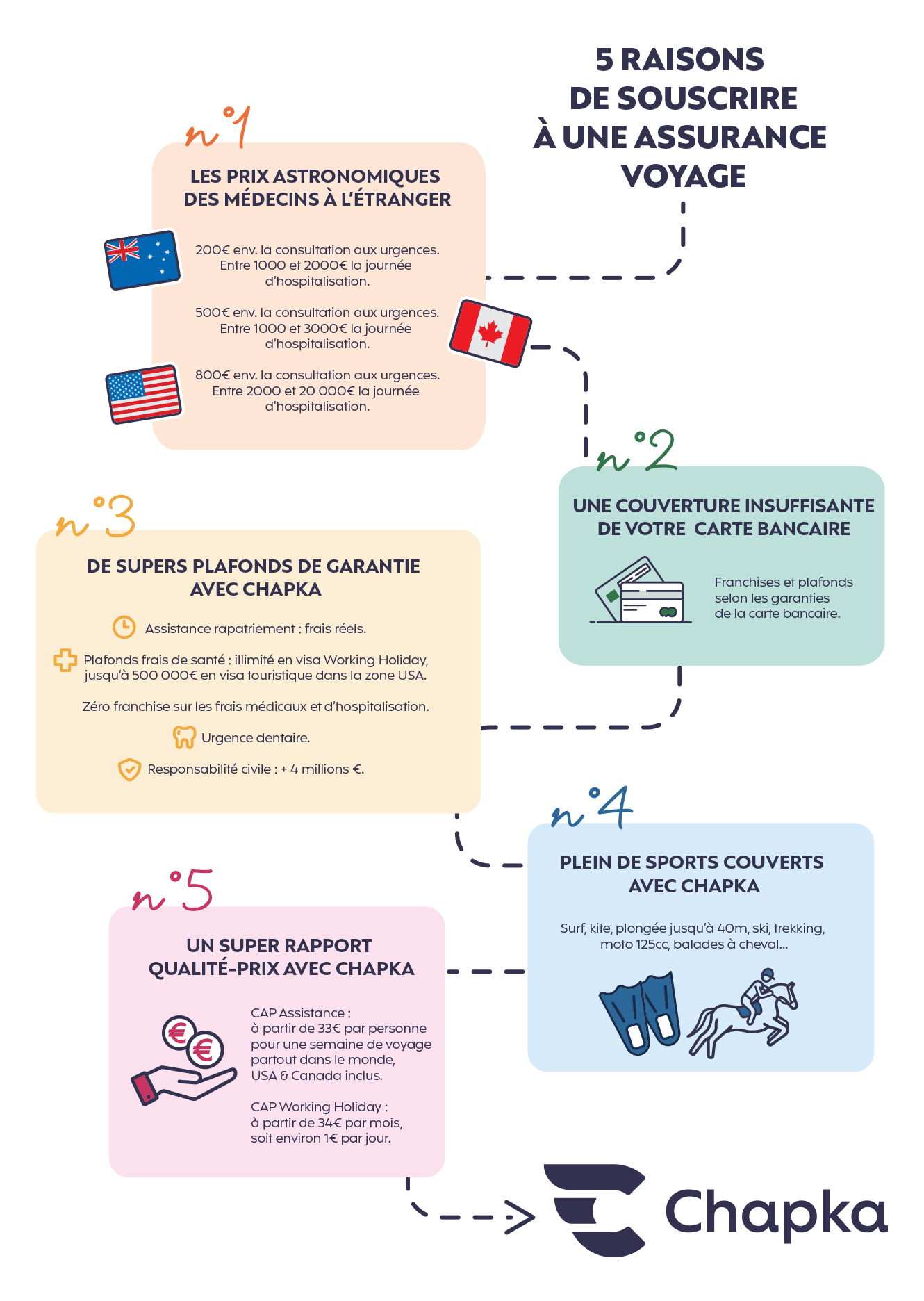

THE travel insurance offer a multitude of benefits that can greatly facilitate your experience abroad. Medical expenses covered in the event of an accident, trip cancellations, including loss of baggage, these policies are often very comprehensive. Travel-specific insurance can also provide direct support in the event of an emergency, giving you peace of mind. Additionally, some credit cards already include guarantees travel, which can make this choice even more advantageous for those looking for an economical solution.

Disadvantages of travel insurance

However, travel insurance may have disadvantages. They often do not cover pre-existing care, which can be a problem if you have a chronic illness. In addition, depending on the destination, some companies may exclude areas of coverage and, in the case of low-cost policies, coverage of medical expenses may prove insufficient. Finally, it can sometimes be difficult to navigate the different offers available and compare their guarantees.

Advantages of mutual insurance

THE mutual, for their part, also offer significant benefits. They can be tailored specifically to your health needs abroad, offering cover for medical expenses added on the go. Additionally, for some EEA countries, the European health insurance card allows you to access care at no additional cost if you are already covered by mutual insurance in France. This can make a European vacation more stress-free and less expensive.

Disadvantages of mutual insurance companies

However, it is important to keep in mind that mutual insurance companies can also include disadvantages. Depending on your coverage, franchises may apply, which means that you will sometimes have to pay part of the medical costs on your own. In addition, some mutual insurance companies do not cover treatment abroad as comprehensively as dedicated travel insurance, and reimbursement may take longer.

In short, the choice between travel insurance And mutual will mainly depend on your destination, your health profile, and your personal preferences. Remember to analyze the options offered to make the most informed decision before leaving on your trip.

Going on a trip is often an exciting adventure, but it is crucial to be well prepared, especially with regard to your health coverage. Choose the right one mutual can avoid a lot of hassle in the event of an accident or illness abroad. This guide will help you understand the key elements to consider when choosing the best health insurance for your vacation.

Understand your health coverage needs

Before embarking on the quest for the ideal mutual insurance company, start by evaluating your personal needs. Think about your health, your medical history and the activities you plan to do during your trip. If you’re considering risky activities, for example, it might be wise to opt for more extensive coverage.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

The essential guarantees to look for

A good travel insurance must include several essential guarantees. Among these, be sure to check:

- Medical expenses : This is the main reason why you need to get health insurance.

- Trip cancellations : In the event of a change of plans, this guarantee will protect you.

- Coverage for lost baggage : Your personal belongings are valuable, make sure you are protected.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

Review coverage options

When choosing your insurance, it is essential to consider the coverage options proposed. Some companies offer tailor-made plans, adapted to different types of trips. For example, if you are going for less than 2 months, options like the Tourist Card may be advantageous, while for longer stays, the AVAnture Health Plan could represent better value for money.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Compare insurance companies

Don’t stop at just one quote! Compare companies insurance is essential to finding the best option. Visit online platforms to collect different quotes, like this useful site, which offers reviews and advice. This will allow you to better understand the value for money of the different mutual insurance companies available.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Consider your destination

Each country has its own health needs. For example, in Europe, you can benefit from European health insurance card (CEAM). If you are going outside of Europe, such as Thailand or South America, it is crucial to check options specific to these destinations.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Read the fine print

Before signing an insurance contract, take the time to carefully read the small print. This can save you from unpleasant surprises. Make sure you understand what is included or excluded from your coverage, as well as the reimbursement terms.

Exploit available resources

Finally, don’t forget to explore online resources. Sites like this link provides valuable information on health coverage, while others help you compare different options. Take advantage of these tools to make the best possible choice.

Going on vacation is an anticipated and joyful moment, but it is essential not to neglect the safety of your health during your stay abroad. Choose one adapted mutual can make all the difference in the event of the unexpected. In this article, discover practical tips for selecting the ideal health coverage for your travels, taking into account your specific needs and your destination.

Evaluate your specific needs

Before subscribing to mutual insurance, start by analyze your specific needs. This includes the length of your stay, the type of activities you plan to do, and your general health. If you are going on a sporting adventure or an extended stay, consider opting for more extensive coverage which includes significant medical expenses.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Compare the guarantees offered

It is crucial to compare guarantees offered by different mutual insurance companies. Carefully look at the available options: coverage of medical expenses, repatriation, cancellation, and loss of baggage. Do not hesitate to consult insurance comparators to obtain an overview of the offers on the market and choose the one that best meets your expectations. For example, the site Tourdumondist offers several travel insurance comparisons.

Check geographic coverage

Make sure your mutual insurance covers the geographical area where you are going. If you are traveling outside Europe, check that the chosen mutual insurance company protects you adequately. Some destinations, such as Turkey or Brazil, may have specific health coverage requirements. For advice on health cover for expats in Brazil, see this guide.

Review waiting periods and exclusions

Before finalizing your choice, take a look at the waiting period and any possible exclusions of your contract. Some mutual insurance companies will not cover your costs if you become ill or have an accident for a certain period of time after signing up. Be aware of the limitations to avoid any unpleasant surprises during your trip.

Evaluate the value for money

Choosing cheap mutual insurance is not always synonymous with good coverage. Sometimes a higher price can be justified by extended warranties and more comprehensive support. Consider establishing a comparison of the quality-price ratio of the available offers. You can consult this link to find mutual insurance at a good price: Hyperassure.

Consult the feedback

Finally, it may be useful to consult feedback other travelers regarding their mutual insurance. Reviews can give you valuable insight into the quality of customer service, responsiveness in the event of a claim, and the efficiency of the reimbursement process. With this in mind, don’t hesitate to browse forums or travel groups on social media.

Comparison of health coverage for your vacation

| Criteria | Description |

|---|---|

| Destination | Identify if your destination country requires specific coverage. |

| Duration of stay | Adapt your mutual insurance to the duration of your trip for optimal protection. |

| Medical expenses | Check the coverage of medical expenses according to your needs. |

| Cancelation | Consider coverage for trip cancellation. |

| Lost baggage | Make sure your mutual insurance covers the loss or theft of your belongings. |

| Repatriation assistance | Opt for a repatriation assistance guarantee in the event of an emergency. |

| Exclusions | Check the exclusions in your contract to avoid unpleasant surprises. |

| Value for money | Compare prices and guarantees to find the best deal. |

| Additional options | Evaluate additional options based on your potential activities. |

Testimonials: Travel and mutual insurance

When I decided to go on a trip abroad, I knew that taking out a mutual was essential. Comparing several options, I finally found the one that suited my needs. It offered comprehensive coverage, including for medical expenses and thecancelation. This choice allowed me to leave with peace of mind, knowing that I was protected against the unexpected.

For my trip to Europe, I opted for coverage of my European health insurance card. However, I quickly realized that this was not enough for the sporting activities I had planned. So I chose a mutual additional which took into account the accidents related to skiing. In the end, this decision saved me a lot of unexpected expenses.

During my last trip to Thailand, I understood the importance of good health coverage. I chose a travel insurance which not only protected me for medical expenses, but also covered me in the event of lost baggage. Insurance companies like Chapka or Assur Travel offer very broad guarantees and gave me peace of mind throughout my stay.

Before leaving on a trip, I always make a detailed comparison of the different mutual. The coverage of care abroad is crucial, especially if risky activities are planned. By making this informed choice, I was able to leave with confidence, knowing that I could benefit from a refund if necessary.

Every trip reminds me how essential it is to choose the right trip. mutual. Whether you go to Europe or other continents, be calm in the face of unforeseen can change the situation. It’s an investment that’s definitely worth it!

When you go on a trip, choose the best mutual health is essential to ensure your peace of mind. Whether you are traveling within Europe or abroad, the unexpected can happen and it is crucial to be well protected. This guide will help you navigate through the different options of health coverage available, in order to find the mutual that will best meet your needs during your vacation.

Understand your specific needs

Before taking out travel insurance, it is important to understand your specific needs. Think about the length of your stay, the activities you will do, and your destination. For example, if you are going for an extended stay or planning risky activities, you may need more extensive coverage. Also assess your current health and anticipate possible specific medical needs during your trip.

Essential guarantees

A good mutual fund must include essential guarantees such as coverage of medical expenses, repatriation in the event of illness or accident, coverage of trip cancellations, and reimbursement in the event of lost baggage. Find out about the reimbursement ceilings and waiting periods for the different guarantees offered by insurers. Coverage tailored to your needs will allow you to enjoy your vacation worry-free.

Compare available offers

The travel health mutual market is vast and it is therefore wise to compare available offers. Use online comparison tools to simplify your search. Check reviews and feedback from other travelers to get an idea of the quality of services offered by different mutual insurance companies. It is also interesting to find out about the reputation of the insurer on the market and its level of assistance in the event of a claim.

The cost of mutual insurance

THE cost of mutual insurance can vary considerably depending on the guarantees and coverage levels chosen. However, a more expensive offer does not always mean better protection. Establish value for money based on the warranties included. Do not hesitate to request a detailed quote to assess what is included and what is not. Keep in mind that safety while on vacation should not be sacrificed for financial reasons.

Specificities depending on the destination

It is also essential to take into account the specificities depending on the destination. Healthcare can be very different from one country to another. If you are going to a country outside the Europe zone, for example, check that your mutual insurance is well adapted to local legislation. Some countries require specific levels of coverage to guarantee entry into their territory. So pay attention to these requirements before finalizing your choice.

Assistance during your trip

In the event of an emergency, it is essential to be able to count on an emergency service.effective assistance. Find out about the possibilities of contacting your insurer abroad, whether by telephone, by email or via a mobile application. A good assistance service must respond quickly and be able to guide you if necessary, which is a valuable asset for your peace of mind during your stay.

Preparing for your vacation often requires a lot of thought, and one of the most crucial aspects is undoubtedly the choice of mutual insurance. Go abroad generates unforeseen events, and be accompanied by a adapted insurance can make all the difference in financial security.

First, it is essential to assess your specific needs. A health coverage Adequate travel depends on several factors such as your destination, the length of your stay and the type of activities planned. For example, a trip to the mountains requires specific guarantees, while a stay on a quiet beach could be less risky. Take the time to identify possible medical risks that you might encounter there.

Next, compare the different offers available. Travel insurance and mutual insurance are not always equal. Pay attention to the guarantees offeredand check what is included in the contract: medical expenses,repatriation, cancellation, and evenloss of luggage . A higher price can often mean better protections, so do not hesitate to make acomparison to evaluate the value for money of each option. Finally, do not forget to read the opinions and testimonials of other travelers. The experiences of others can give you a valuable perspective on the

reliability and responsiveness of the insurance you are considering. The decision-making then becomes much clearer and reassuring. FAQ: Travel and mutual – Choosing the best health coverage How important is travel mutual insurance?

A travel mutual insurance is essential to guarantee coverage for medical expenses, cancellations or lost luggage, allowing you to enjoy your vacation without worry. How to choose the best health insurance for my vacation abroad?

To choose the best health insurance, consider your specific needs, your destination, the length of your stay, and the potential risks associated with your activities. Does my traditional health insurance cover me when I travel abroad?In general, your

traditional health insurance may have limitations abroad. Check the conditions and coverage offered for your destination. What guarantees should I look for in a travel health insurance? Look for guarantees such as coverage for

medical expenses, repatriation, cancellation, and loss or theft of baggage. What to do in the event of a medical need abroad?If you need medical care abroad, contact your insurance immediately to find out what steps to take and make sure to keep all receipts and documents. Do bank cards offer health coverage for travel?Some cards, such as

Premier Visa , include travel insurance, but check the details to understand what is covered and what is not.

Is there specific insurance for certain destinations? Yes, some travel insuranceare designed for specific destinations, such as

Thailand or the Türkiye , providing coverage tailored to these regions. What is the difference between traditional health insurance and travel mutual insurance? A traditional health insurancecovers home care, while a

mutual travel insurance is suitable for incidents and medical needs occurring abroad.