|

IN BRIEF

|

When planning a trip, it is essential not to neglect the importance oftravel insurance. However, with the multitude of choices available, it can be difficult to navigate. To help you make the best choice, turn to a insurance comparator is a great solution. But how do you select the comparator that will best meet your specific needs? In this article, we will explore the key elements to take into account to find the one that will allow you to find thetravel insurance ideal for your next adventures.

When planning your vacation, it is crucial to think about your travel insurance. However, choosing the right insurance comparator can be complicated. This article guides you through the essential steps to select the best travel insurance comparator, highlighting its advantages and disadvantages, so that you can make an informed choice.

Benefits

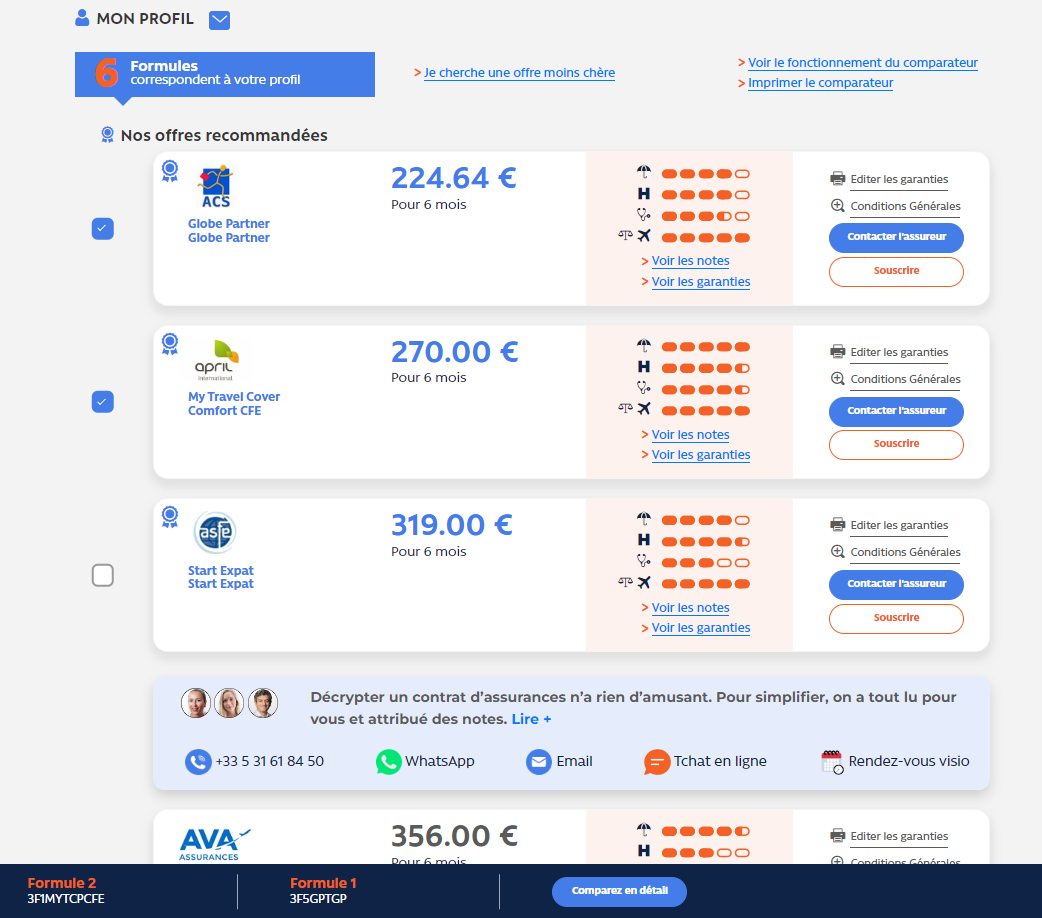

One of the main benefits of using a travel insurance comparator lies in the simplicity and speed with which you can find offers adapted to your needs. With just a few clicks, you can view a multitude of quotes and policies, saving you valuable time. For example, sites like Ferrets Or Tourdumondiste offer a comparison of the best options available on the market.

Additionally, these tools often allow you to filter results based on specific criteria, such as price, warranties, or user reviews. This makes your search easier and helps you find the insurance that perfectly meets your requirements.

Disadvantages

potential disadvantages of using insurance comparators. First of all, some comparators may not include all available fonts, which narrows the range of possibilities. It is therefore advisable to consult several sources to ensure that you are well informed.

In addition, the information presented can sometimes be biased, with promotions highlighted which do not necessarily reflect the quality of the service. Always reviewing terms and conditions and consumer reviews before making a final decision is essential. Do not hesitate to consult sites like The Globe Bloggers to get an overview.

Finally, some comparators are not completely free and may include hidden fees, thereby diminishing the initial comparison advantage. For this reason, it is best to be vigilant and fully understand each offer before signing.

Choosing the right travel insurance comparator is a crucial step to guarantee a peaceful vacation. By weighing the benefits and the disadvantages of the different options, and by using recognized platforms, you will be able to select the insurance that perfectly meets your needs and your budget. Remember to always compare several offers and carefully read user reviews to avoid unpleasant surprises.

When you go on a trip, travel insurance is a key element not to be overlooked. With the multitude of choices available in the market, it can be difficult to choose the best one. In this article we guide you on how to choose the best travel insurance comparator so you can find the right coverage for your needs, while saving money.

Understand your travel insurance needs

Before diving into the world of comparison tools, it is essential to define your personal needs. What are you looking for in travel insurance? Is it to cover a flight cancellation, health problems abroad or lost luggage? Your answers to these questions will guide your research and help you choose the right comparator.

The selection criteria for a travel insurance comparator

Not all travel insurance comparators are equal. When evaluating a comparator, consider the following criteria:

Ease of use

A good comparator must be simple and intuitive to use. You should be able to enter your information quickly and easily access the results.

Coverage options

Make sure the comparator offers a wide range of options insurance. The more choices you have, the better you can tailor your insurance to your specific needs.

Information transparency

A reliable comparator must provide clear information and transparent on the different insurance policies. Check that it clearly states exclusions, deductibles and coverage limits.

Best travel insurance comparators

Among the many comparators available, some stand out for their reliability and efficiency:

- Le Figaro offers advice on the criteria to take into account when choosing your insurance.

- Guava offers a complete comparison of the best travel insurance options on the market.

- AXA Assistance has a simple tool to quickly compare different insurance policies.

Take into account value for money

Although price is an important criterion, it should not be the only one to influence your choice. Compare not only the costs, but also the benefits offered. Cheaper insurance may not cover you adequately if something goes wrong.

Choosing the right travel insurance comparison site can seem overwhelming, but by doing the preparatory work and using the tools available online, you will be able to make an informed decision. Remember that on International Health Mutuals, you can also find useful recommendations for choosing your travel insurance.

Planning a trip is an adventure in itself, but let’s not forget one crucial step: choosing the right one. travel insurance. To help you in this process, we will explore how to find the best insurance comparator that meets your specific needs. By following these tips, you will be able to concentrate on the essential: enjoying your trip with complete peace of mind.

Analyze your coverage needs

Before even browsing a comparison site, it is essential to determine your insurance needs. What type of coverage are you looking for? Repatriation assistance, trip cancellation, or even medical coverage abroad? Every trip is unique, and so are your safety expectations. Take the time to study what could be useful to you during your stay so as not to underestimate your needs.

Compare prices and guarantees

Evaluating prices is an important step, but don’t focus only on this criterion. Prices can vary widely between insurers and often the lowest price does not necessarily provide the best coverage. Do not hesitate to consult comparators like philtr.fr which will allow you to see the differences at a glance. Make sure each offer includes the guarantees that really interest you.

Check user reviews

Feedback from other travelers can be very valuable. Browse forums and review sites to see what others are using and recommending. The experiences of others can give you insight into the quality of customer service, speed of compensation, and handling of claims. This feedback can sometimes make all the difference in your choice.

Choose a reliable comparator

Not all comparators are equal. Opt for recognized and effective platforms. In general, reputable comparison sites will give you verified and reliable options. Platforms like AVI International are good starting points for exploring your choices. Also check that the comparator regularly updates its offers, in order to benefit from the best options at the moment.

Make sure subscription is simple

An ideal comparator must offer simple and quick subscription. The last thing you need is to get lost in complex forms. Make sure the site allows you to make your choice easily and quickly access an online quote. Offers with clear processes and no technical jargon are often a sign of trust.

See additional options

Also think about additional options. Some insurers offer additional services, such as continuous assistance or specific guarantees for risky activities (scuba diving, skiing, etc.). Make sure the comparator highlights these options, so that you can make an informed choice based on your type of trip.

Finally, don’t forget to take into account the average cost of a travel insurance. According to some studies, the average price is around $228 (source: Sun Life). By following these tips, you will be able to choose the best travel insurance comparator and leave with peace of mind.

| Selection criteria | Advice |

| Specific needs | Identify the guarantees necessary for your trip. |

| Price | Compare prices for the same covers. |

| Coverage options | Check deductibles and compensation limits. |

| 24/7 support | Choose an offer that includes emergency assistance. |

| Reputation | Consult the reviews of other travelers on the comparator. |

| Ease of use | A good comparator should be simple and quick to use. |

| Expert opinions | Find professional reviews and recommendations. |

Travel Insurance Testimonials: How to Choose the Best Comparator

When it comes to planning a trip, planning isn’t just about plane tickets and accommodation. A crucial, but often overlooked, step is the choice oftravel insurance. For me, use a insurance comparator was a real revelation. I took the time to compare several options and the results were surprising.

A few months ago, during my research, I discovered the Tourdumondiste.com comparator. In just a few clicks, I was able to obtain several quotes tailored to my needs. What I liked was the clarity of the information presented. Each offer was accompanied by a summary table of guarantees and prices. This allowed me to make an informed choice without getting lost in complex details.

Another aspect that surprised me was the processing time. On Lelynx.fr, for example, I was able to receive my quotes in less than 5 minutes. My travel insurance is now purchased at an unbeatable price, and I feel reassured at the thought of leaving with adequate coverage. In the past, I often settled for the first option I found, thinking it was enough. Something I will never do again!

A friend of mine also shared his experience. He chose to use a comparator to travel abroad. He stressed the importance of checking specific guarantees, particularly for medical assistance. Thanks to his comparison, he realized that a more affordable price could sometimes mean less protection. This awareness helped him select an option that provided quality coverage while remaining within his budget.

In short, use a travel insurance comparator has become a reflex for me. Not only did this save me money, but it also gave me peace of mind during my adventures. Don’t forget: taking the time to compare ensures a hassle-free trip!

How to choose the best travel insurance comparator

When you are preparing to go on an adventure, it is essential not to neglect the question oftravel insurance. Choosing the best coverage requires careful analysis, and this is where the insurance comparator comes in. In this article, we guide you through the key criteria to consider when selecting the comparator that will best meet your travel needs.

Why use a travel insurance comparator?

Before diving into the selection criteria, it is crucial to understand why a travel insurance comparator is essential. These online tools allow you to quickly view different offers and better understand the guarantees provided. Thanks to a comparator, you can compare the prices, conditions and specific coverage of different companies, which helps you make an informed choice without spending too much time.

Analyze your specific needs

To choose the best comparator, start by asking yourself the right questions about your needs. What type of trip are you planning? Is it a short getaway or an extended stay? Traveling abroad presents potential risks, making it important to identify whether you will need medical, trip cancellation or lost baggage cover. By defining these criteria from the start, you will be able to select a comparator that will allow you to filter the offers according to your needs.

Review coverage options

Once your needs have been identified, it is essential to examine what type of coverage the comparator offers. Some insurance plans include things like repatriation assistance, coverage for medical care abroad, or even protections against loss of property. Compare the guarantees offered for each plan to ensure that you only pay for what you really need.

Check the reputation of insurers

The reliability of the insurer is a crucial criterion. A good travel insurance comparator should provide you with information on the reputation and reviews of the insurance companies it references. Don’t hesitate to do additional research on insurers, as the quality of their customer service can greatly influence your experience in the event of a claim. Testimonials from other travelers can also provide valuable insight into a company’s ability to handle complaints effectively.

Compare prices with caution

Cost is often a determining factor in choosing a travel insurance. However, it is essential not to be seduced solely by the lowest price. An effective comparator should allow you to observe how prices correlate with the guarantees offered. An attractive rate can sometimes hide minimal coverage, which could work against you. Thus, a balance between cost and protection is essential.

Use relevant filters

A good comparator offers you the possibility of filtering the results according to specific criteria. Whether you are looking for insurance adapted to students, families or professionals, these filtering options are crucial to finding the best solution for your particular situation. Do not hesitate to explore these tools to simplify your selection.

In short, choosing the best travel insurance comparator can transform the way you protect your adventures. By taking the time to assess your needs, compare coverage, check the reputation of insurers and use the appropriate filtering tools, you will be well equipped to make a wise choice. Don’t leave insurance behind and go with peace of mind!

Conclusion: Choose the best travel insurance comparator

A travel insurance is an essential for any getaway, whether for a weekend or an extended expatriation. However, with a myriad of options available in the market, choosing a travel insurance comparator may seem like a daunting task. However, taking the time to select the best comparison site is crucial to avoid unpleasant surprises during your trip.

First of all, choose a comparator that meets your specific needs. Whether you’re a casual traveler or a seasoned globetrotter, your insurance requirements will vary. Look for a comparator that differentiates offers according to the length of your stay, your destination or the type of activities you are planning. This way, you will maximize your chances of finding the suitable cover to your personal situation.

Then, make sure that the comparator offers a range of diversified insurance packages. The quality of the services must be analyzed based on the reputation and reviews of the insurance companies presented. By considering your expectations, you ensure that you subscribe to an insurance policy that not only offers financial protection, but also responsive customer service when needed.

Finally, keep a close eye on value for money. A good comparator should offer you competitive options while guaranteeing a good level of protection. In summary, choosing the best travel insurance comparator is based on a careful assessment of your needs, the characteristics of the available offers and user recommendations. By following these tips, your next adventure will be one of peace of mind.

FAQ: Travel insurance – How to choose the best comparator

Q: Why is it important to compare travel insurance?

A: Comparing travel insurance allows you to find coverage tailored to your specific needs while avoiding paying more than necessary.

Q: What criteria should I consider when comparing travel insurance?

A: It is essential to take into account your destination, length of stay, planned activities and your state of health.

Q: What are the best travel insurance comparators?

A: Among the best comparators, we find Tourdumondiste.com, Lelynx.fr and Assurland.com which offer options adapted to different needs.

Q: What does travel insurance typically cover?

A: Travel insurance generally covers medical expenses, trip cancellation, lost luggage, and sometimes repatriation assistance.

Q: Can I buy travel insurance online?

A: Yes, most comparison sites allow you to take out insurance online quickly and easily.

Q: What is the average cost of travel insurance?

A: The cost of travel insurance varies depending on the coverage chosen and the length of stay, but is often between 2% and 10% of the total trip price.

Q: When should I purchase travel insurance?

A: It is advisable to take out travel insurance as soon as you book your trip to benefit from maximum coverage in the event of cancellation.

Q: What should I do if I need assistance during my trip?

A: Most insurance plans include a 24-hour assistance hotline that you can contact in case of an emergency during your trip.