|

IN BRIEF

|

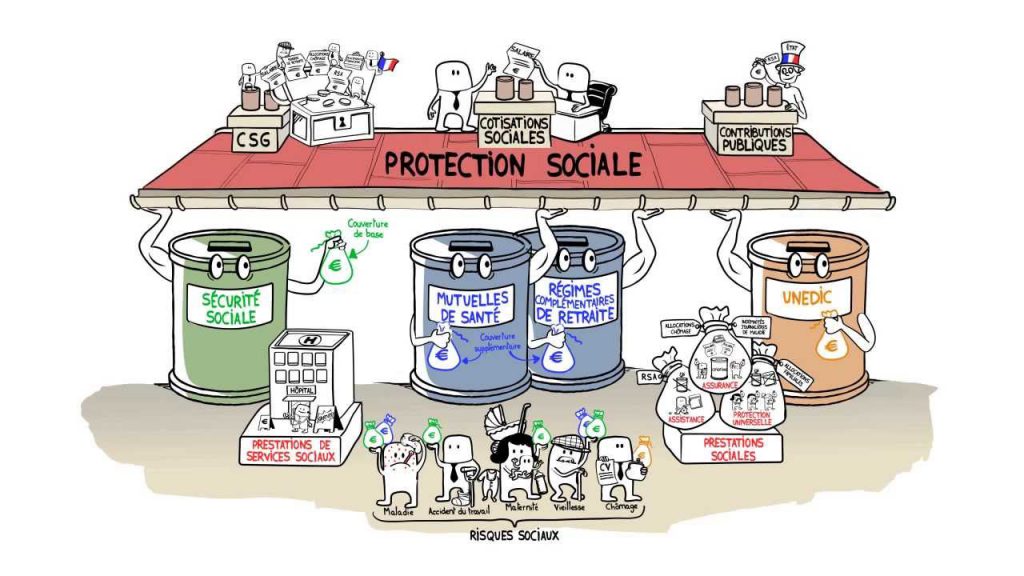

L’private health insurance in Europe represents an increasingly popular option for many individuals wanting coverage that adapts to their specific needs. In a context where public health systems vary from country to country, it is crucial to understand the benefits and the disadvantages of this form of protection. Whether to benefit from rapid access to care, to cover costs not covered by the social security or simply to obtain additional guarantees, it is essential to carefully evaluate the available offers. This analysis allows you to make informed choices for your health and that of your family.

In the health landscape in Europe, private health insurance stands out for its various options and specificities. It represents an alternative to public health systems, offering broader coverage that can meet the varied needs of policyholders. This article explores the benefits and the disadvantages of this form of insurance, in order to help readers make informed decisions regarding their health coverage.

Benefits

Extended coverage

One of the main benefits of private health insurance lies in the quality of the coverage offered. Unlike public systems, private insurers often offer contracts that extend beyond basic care, including services such as specialized consultations, hospitalization and specific treatments. This allows policyholders to benefit from more comprehensive support, facilitating access to appropriate, quality care.

Flexibility and choice

Making decisions about health can be tricky. With private health insurance, policyholders benefit from expanded choice in terms of practitioners and health establishments. They can select their doctors and hospitals, which promotes a more personalized experience tailored to their individual needs.

International protection

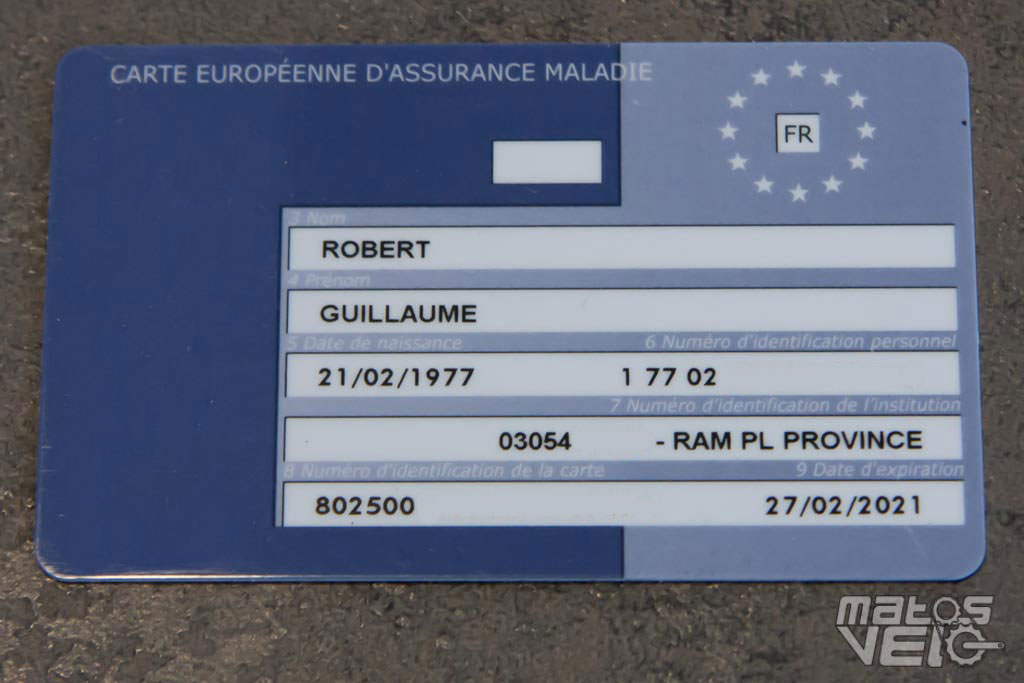

For those who travel or live abroad, private health insurance offers international protection. With guarantees that include medical care abroad, policyholders can institutionalize their peace of mind, knowing that they are covered even outside their country’s borders, including in Europe. There European Health Insurance Card (EHIC) also facilitates access to care in EU countries.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

High cost

One of the main disadvantages of private health insurance is its cost. Premiums can be high and unaffordable for some people, especially those who have to juggle other expenses. This can be a deterrent for many people, especially if they don’t have an urgent need for specialized health care.

Complexity of contracts

Private health insurance contracts can be complex and difficult to understand. It is essential to carefully review the conditions, exclusions and limitations of the coverages before committing. This complexity can complicate the comparison of offers and lead to unwise choices, potentially resulting in insufficient coverage.

Risk of non-support

There may also be a risk of non-support for certain services or treatments, according to the stipulations of each policy. This highlights the importance of a preventive assessment of health needs and consultation of general policy conditions. Policyholders must be vigilant to avoid surprises when requesting reimbursement.

Private health insurance in Europe is gradually becoming an essential option for many citizens. By offering additional guarantees to those of public health systems, it proves to be a wise choice for individuals and families seeking to optimize their medical coverage. In this article we will take a close look at the benefits And disadvantages of private health insurance, highlighting the specificities that distinguish it in different European countries.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The advantages of private health insurance

One of the main advantages of private health insurance is undoubtedly its flexibility. Unlike public coverage, private insurance policies can be personalized according to the specific needs of each insured person. This allows you to choose a suitable level of cover, whether for routine care, hospitalization or specialized treatments.

Another significant advantage lies in the speed of access to care. With private health insurance, waiting times to get an appointment with a specialist or to undergo surgery are often reduced. This can be crucial, especially in urgent medical situations where every minute counts.

For expatriates, private health insurance is a real asset. It provides a international coverage, allowing policyholders to receive medical care wherever they are in Europe or beyond. This is particularly beneficial for those who travel frequently or stay abroad for business reasons.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The disadvantages of private health insurance

Despite its many advantages, private health insurance also has disadvantages. disadvantages notable. Firstly, the cost can be a hindrance for many individuals. Premiums can vary considerably depending on age, pre-existing medical conditions and the benefits chosen, which can represent a significant financial investment.

Another element to consider is the complexity contracts. The multitude of offers available on the market can make it difficult to choose the most suitable coverage. It is essential to take the time to compare the different options and to read the general conditions carefully to avoid unpleasant surprises in the event of a claim.

Finally, it is important to remember that private health insurance does not always replace social security. Although certain guarantees can be very advantageous, it is crucial to maintain public coverage, in particular to benefit from the universal protection and basic care guaranteed by the state.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The European Health Insurance Card (EHIC)

For those traveling in Europe, the European health insurance card (CEAM) is a significant asset. It guarantees direct access to medical care in EU member countries, without the need for prior procedures. This means that during a temporary stay abroad, policyholders can benefit from the same rights to care as residents of the visited country. More information about the EHIC can be found here.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Conclusion of reflections

Before subscribing to private health insurance, it is essential to carefully assess your personal and family needs. Although the advantages are considerable, it is vital to weigh these factors against the potential disadvantages to make an informed choice about the coverage that is best for you.

Private health insurance in Europe may seem complex, but it offers interesting options for those who wish to supplement the guarantees of social security. This article presents the main advantages and disadvantages associated with this type of insurance, while highlighting key elements for making an informed choice.

The advantages of private health insurance

First of all, private health insurance offers a more extensive coverage than traditional social security. For example, it can include services such as hospitalization costs, consultations with specialists and dental or optical treatments, which are often not reimbursed or poorly reimbursed by public systems.

In addition, private insurance contracts are often customizable, allowing policyholders to adapt their coverage according to their specific needs. This means it is possible to add options, such as treatment abroad, which is particularly interesting for expats or frequent travelers.

Finally, the speed of support care is another notable benefit. Reimbursements are generally made quickly, and the insured is often exempt from paying medical expenses thanks to direct agreements with health establishments.

The disadvantages of private health insurance

Despite these advantages, private health insurance also has disadvantages. disadvantages. First of all, the cost Premiums can be quite high, making this solution less accessible for some people. Prices vary depending on age, state of health and coverage chosen, which can have a significant impact on personal budget.

Another disadvantage lies in the lack of transparency contracts. The general conditions can sometimes be difficult to understand, and it is essential to read the clauses carefully to avoid surprises when requesting a refund. It is therefore recommended to compare offers, for example, on sites such as a guide to health supplements.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

The European Health Insurance Card (EHIC)

The European Health Insurance Card (EHIC) is an element to consider in the context of health insurance on a European scale. It allows you to benefit from a easy access to medical care in European Union countries without complicated administrative procedures. To find out more about its use, visit the website Public service.

Tips for choosing the right private health insurance

Before subscribing to private health insurance, it is crucial to think carefully about your needs and compare the different offers available. Take the time to analyze the guarantees proposed, the reimbursement limits and the franchises, in order to find the formula that best suits your situation.

For those who travel often or who expatriate, specific insurance abroad, such as those available on this link, could be particularly advantageous, ensuring health protection even outside France.

Finally, it may be useful to seek advice from a expert in insurance in order to obtain recommendations adapted to your profile and your needs. Don’t neglect the importance of being well informed before making a decision.

| Criteria | Information |

| Blanket | Private insurance offers extended coverage, often higher than that of social security. |

| Access to care | Rapid access to treatments and specialists, reduces waiting times. |

| Cost | Premiums can be high and vary depending on the chosen guarantees. |

| Flexibility | Possibility of personalizing your contract according to your specific needs. |

| Refund | Reimbursement on the first euro allows immediate coverage. |

| Protection abroad | Private insurance often covers care outside the country, which is advantageous for expatriates. |

| Simplicity | Simplified procedures compared to the public system, with management facilitated. |

| Risks of non-reimbursement | Treatments not covered by the contract may result in a significant cost. |

| Choice of service providers | Freedom to choose your doctor and its health establishments. |

| Complexity of contracts | It is crucial to read the conditions carefully, because some details may surprise. |

Testimonials on European private health insurance: advantages and disadvantages

In a world where health is essential,European private health insurance attracts more and more interest. For many, it represents a strategic choice in the face of the uncertainties of the public health system. Jean, an expat living in Spain, shares his experience: “Having a private health insurance allowed me to benefit from rapid access to care. Delays in the public system can be daunting, and I feel reassured knowing I can see a specialist without waiting months.”

Marylène, a young student in France, also highlights the advantages of this insurance: “As a student, I opted for a supplementary health insurance. This helped me cover hospital costs and dental care, expenses that can quickly become unmanageable.” Her situation is a good example of how adequate coverage can alleviate the financial burden of an illness or accident.

However, private health insurance is not without its drawbacks. Pierre, a professional working in Germany, shares his experience: “Although I was able to recruit good insurance, the cost remains very high. It is a significant investment that some cannot afford.” His testimony highlights the issue of budget, which can be a barrier for many individuals.

Émilie, an expatriate in Italy, also raises a crucial point: “Before choosing private health insurance, it is essential to read the contract carefully. Certain clauses may seem advantageous, but turn out to be less beneficial in practice.” This warning recalls the importance of transparency and theeducation on insurance products.

All these testimonies converge towards a reality: private health insurance in Europe, with its benefits And disadvantages, requires careful consideration. Although very attractive, it requires carefully analyzing your needs and comparing offers. Each individual experience helps inform this essential decision to preserve your health and financial security.

Understanding European private health insurance

Private health insurance in Europe is an important topic that deserves close examination. In several countries, it offers complementary coverage to public health systems, thus offering better protection in terms of medical care. This article explores the advantages and disadvantages of private health insurance in Europe to help you make an informed choice.

The advantages of private health insurance

Access to expanded coverage

One of the main benefits of private health insurance is access to expanded coverage. By subscribing to private health insurance, you can benefit from benefits that exceed those offered by the public plan. This often includes full reimbursement for hospitalization costs, medical procedures and preventive care.

Freedom of choice of practitioner

With private health insurance, you generally have the freedom to choose your doctor or your specialist, without having to go through a GP. This allows you to consult healthcare professionals of your choice, thereby improving your healthcare experience.

Prevention and personalized care

Private insurers tend to promote prevention and personalized medical monitoring. This may include regular health checkups, dietary counseling, wellness programs, and many other services that contribute to your quality of life.

International protection

For expatriates, private health insurance is an undeniable asset. It will guarantee medical coverage when you travel, even outside your host country. This can reassure those who travel frequently for work or other reasons.

The disadvantages of private health insurance

High cost of premiums

One of the main disadvantages of private health insurance is the cost. Premiums can be much higher than those for social security, which can represent a significant budget for many households. It is crucial to compare offers to find the one that best suits your financial situation.

Conditions and exclusions

Private health insurance contracts often contain terms and exclusions which may be restrictive. Some insurance may not cover certain pre-existing conditions or specific treatments. Before subscribing, it is imperative to read the terms of the contract carefully.

Administrative complexity

The administrative management of private health insurance can be complex and sometimes tedious. Obtaining reimbursements, submitting documents and communicating with insurers can be time-consuming. This can be a barrier for those who prefer simplicity.

Risk of healthcare subcontracting

Finally, some insurance companies may use third parties to manage care, which can create a disconnect between patient expectations and care delivery. It is therefore vital to choose a reputable insurer to avoid unpleasant situations.

Conclusion on private health insurance in Europe

Understanding the nuances of private health insurance in Europe is essential to making an informed choice. By carefully weighing the benefits and the disadvantages, you will be able to determine the solution that best meets your needs and those of your family.

L’private health insurance in Europe offers numerous benefits for policyholders, including access to quality care and extensive coverage. Health insurance contracts can be adapted to the specific needs of each individual, thus allowing personalization of health benefits. This often includes additional services such as reimbursement for hospitalization costs, medical consultations and specialized treatments.

There European Health Insurance Card (EHIC) also represents an important asset for policyholders when they travel abroad. Thanks to this card, it is possible to benefit from a support immediate care within the public health system of the country of stay. This greatly facilitates access to medical care, without complicated administrative procedures, allowing expatriates and travelers to concentrate on their health.

However, private health insurance can also have disadvantages. One of the main aspects to consider is cost. THE insurance premiums can be high and vary depending on the guarantees chosen. In addition, many contracts stipulate waiting periods for certain care, which can temporarily limit access to essential services.

There is also the risk of being underrepresented in the coverage for pre-existing conditions, which may not be covered by certain insurances. Policyholders must therefore be vigilant and carefully read the contract conditions. In short, although private health insurance in Europe can offer undeniable advantages, it is crucial to understand its limits and weigh the pros and cons before committing to a contract. A thoughtful approach will guarantee optimal coverage adapted to everyone’s needs.

European Private Health Insurance FAQ

What are the main benefits private health insurance in Europe?

Private health insurance often offers coverage options more complete than the social security system. They allow a quick access to care, a better support during hospitalizations, and personalized services.

What are the disadvantages private health insurance?

Among the disadvantages, we can cite the high cost bonuses, which can represent a real budget. In addition, some pre-existing conditions may not be covered, which requires special attention when subscribing.

How European Health Insurance Card (EHIC) does it work?

The EHIC facilitates access to care in another European country and allows you to benefit from coverage of medical costs without prior steps with the local institution.

Is it possible to maintain a blanket even in the event of a change of situation?

Yes, private health insurance generally allows you to keep your blanket even in case of loss of activity or changes in your personal situation.

What options insurance are offered for expatriates?

Private health insurance for expats is designed to meet the specific needs of people living abroad, providing suitable coverage and French-speaking interlocutors.

How to choose the best health insurance for my needs?

It is essential to compare the different offers taking into account the guarantees, of the services, and price. Considering reviews from other users can also help in the choosing process.

THE mutual Are they included in private health insurance?

No, mutual societies and private health insurance are two separate systems. Mutual insurance companies offer complementary to care reimbursed by social security while private insurance offers solutions alternatives.

What is the role of complementary health in the insurance system?

Supplementary health insurance reinforces basic coverage by making it possible to cover costs not covered by the social security system, thus offering increased financial protection.