|

IN BRIEF

|

L’ health insurance is a crucial issue at the heart of the concerns of individuals around the world. Understanding its mechanisms and its specificities is essential to calmly navigate the varied health systems. On an international scale, health insurance differentiate themselves by their coverage and their terms, going well beyond simple temporary vacations. Whether it is access to care, the quality of treatment or the associated costs, each country presents distinct realities that shape the experience of policyholders. This overview opens the way to a better understanding of this complex and essential area.

Health insurance is a vital issue for every citizen, no matter where they are. In an increasingly connected world, it is crucial to understand the nuances international health insurance systems. This article highlights the benefits and the disadvantages health insurance abroad, while examining the significant differences that exist between the various countries.

Benefits

One of the benefits major players in international health insurance is its extended coverage. Unlike temporary travel insurance, which often limits care to certain situations, international health insurance offers comprehensive protection covering any type of necessary medical care. This is especially essential for expats and frequent travelers who want to benefit from a secure access medical care, whatever the unforeseen circumstances.

In addition, many countries have high-performance health systems which ensure exceptional quality of care. For example, countries such as France, Germany or Japan are often cited among those with best health systems in the world. For those who live or stay in these countries, registering for health insurance compatible with the local system strengthens the social protection.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

However, it is important to recognize the disadvantages associated with health insurance abroad. One of the major challenges lies in the administrative complexity. Navigating the registration process, understanding the benefits offered and becoming familiar with the claims procedures can be confusing for many individuals.

Another notable drawback is the high cost of certain international health insurances. Premiums can vary greatly depending on the country and level of coverage chosen, sometimes making the option of international insurance prohibitive for some. Furthermore, while care may be of high quality, there are disparities in terms of refunds that some insurance policies offer, especially in countries with very different health systems from the original ones.

Finally, some countries impose additional restrictions which may limit access to specific care, based on nationality or residential status. This can lead to frustration for those who claim to receive the maximum benefits from their health coverage.

When we consider the question ofhealth insurance On an international scale, it is essential to understand the differences that exist from one country to another. Through this guide, we’ll explore the basics of health insurance, the most effective systems, as well as the benefits of coverage abroad, while providing practical tools for navigating this complex area.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

What is health insurance?

L’health insurance is a form of financial protection that covers medical and hospital costs. It is essential to access appropriate care and avoid unforeseen expenses. Two main categories stand out:health insurance national, generally managed by public bodies, and theprivate health insurance, which is offered by private companies. Each type has its own advantages and disadvantages.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Health systems around the world

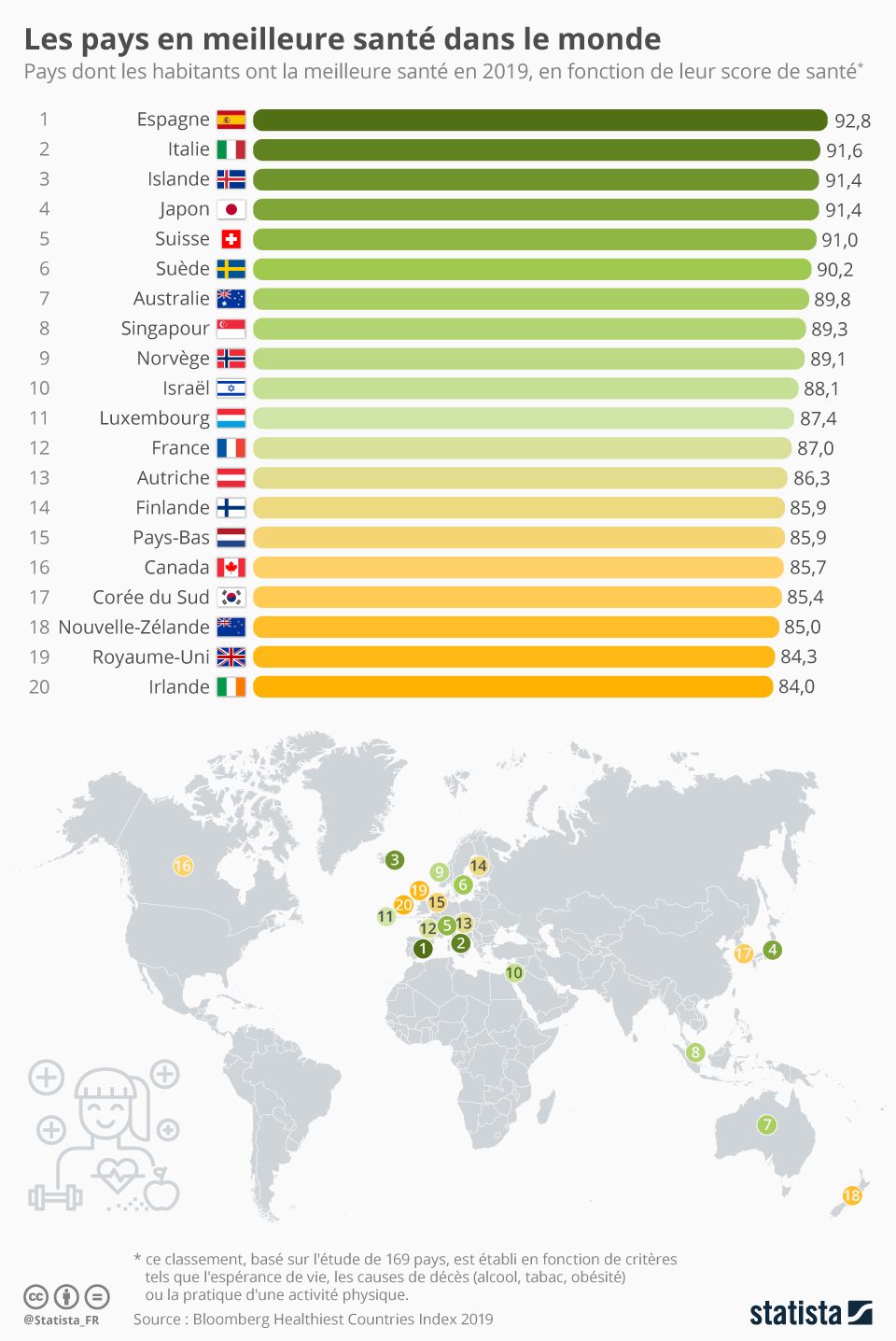

It is fascinating to watch how countries structure their health system. Some countries like France are regularly ranked among those with the best health care in the world, while others face more difficulty in providing universal access. Based on various criteria, including quality of care, access to services and costs, it is possible to compile a list of countries with the best health systems.

The best countries for healthcare

There France, recently mentioned as the 15th best country in health, is often cited for its excellent healthcare reimbursement system. Other notable countries include theSpain and the The Netherlands, which also offer high quality health services. These systems are based on principles ofequality and of solidarity, supported by adequate public funding. Finally, public and private initiatives make it possible to meet the health needs of citizens.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The advantages of international health insurance

L’international health insurance has considerable benefits, especially for expats, frequent travelers or those living abroad. Unlike temporary travel insurance which generally only covers emergency situations, international health insurance covers a wide range of medical care. This includes regular consultations, hospitalizations, as well as specific care related to pre-existing conditions.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The importance of access to care

One of the founding principles ofHealth Insurance is theequal access to care. This principle is crucial to guarantee that each individual can benefit from the necessary care without economic distinction. Unfortunately, reality shows that health expenses are constantly increasing, which sometimes complicates access to treatment. Governments must therefore continually work to maintain a balance between cost and accessibility.

Choosing the right health coverage

When considering options forhealth insurance, it is vital to understand your personal needs and those of your family. This involves looking at different plans, available coverages, and associated fees. To guide your choice, tools and guides are available to help you navigate this complex world. Do not hesitate to consult specialized sites to obtain comparisons and advice adapted to your personal situation.

To learn more, explore other resources such as UFE, which guides you in your health insurance choices abroad, or Caritat, for an in-depth understanding of the different health insurance systems.

In a constantly changing world, understand health insurance is crucial for navigating the diverse healthcare systems offered by each country. This article explores the differences between international health insurance and term policies, while highlighting countries that stand out for the quality of their healthcare systems. Be ready to discover practical advice for choosing your health coverage, wherever you are.

The characteristics of international health insurance

Unlike temporary travel insurance, which generally only covers emergency care,international health insurance offers comprehensive coverage for all types of care, including consultations, specialized treatments and more. This type of insurance is particularly essential for expats and frequent travelers, providing peace of mind in all circumstances. It ensures constant access to quality care in the host country.

The benefits of international coverage

Opt for one international health insurance allows access to health services without having to worry about reimbursement arrangements specific to each country. This flexibility is a major advantage for people who live or work abroad. In addition, guarantees such as repatriation and 24/7 medical assistance are often included, further strengthening the security of policyholders. These guarantees are often highly valued in the event of an emergency.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

Countries with the best health systems

Choosing where to go can also depend on the quality of care available. Several studies show that certain countries have health systems that stand out for their efficiency and quality of service. There France, for example, is often cited as having one of the best healthcare systems in the world, providing widespread coverage with an excellent standard of care. Other countries, such as Suede And Japan, also have well-established reputations thanks to their investments in healthcare infrastructure.

Criteria for evaluating health systems

Health systems are evaluated on several key criteria, notably accessibility, quality of care, and efficiency of spending. There solidarity and equality of access are fundamental principles that are often taken into account in these assessments. It is also crucial to consider the cost-effectiveness of care to determine which country is most beneficial for expats.

Tips for choosing good health coverage

When it comes to choosing a health insurance, it is essential to assess the specific needs of each individual. Consider the length of your stay abroad, the nature of your activities, as well as your medical history in order to choose a plan that suits you. Take the time to compare offers and check reviews from other policyholders.

Resources to deepen your knowledge

To better understand your options, consult reliable resources oninternational health insurance. Sites like AXA Or International Health Mutual provide detailed guides that can help with your decision-making. Understanding the subtleties of insurance policies can make all the difference in keeping you safe and comfortable wherever you are.

Comparison of International Health Insurance Types

| Type of Insurance | Details |

| National Health Insurance | Provided by the State, it guarantees universal access to health care for all citizens. |

| Private Health Insurance | Covers services not included in public insurance, often with reduced waiting times. |

| Travel Insurance | Offers temporary coverage for one-off medical expenses while traveling abroad. |

| International Health Insurance | Designed for expatriates, it covers a wide range of international medical services. |

| Universal Health Systems | Guarantee access to care for all, financed by taxes or social security contributions. |

| Private Health Systems | Based on direct payments or insurance, limiting access to the wealthiest. |

| Provident Insurance | Financial protection in the event of illness or accident, including reimbursements. |

| Full Coverage | Includes medical expenses, hospitalizations, and preventive care. |

| Group Insurance | Often offered by employers, it reduces costs for employees. |

Testimonials on understanding health insurance around the world

“As an expatriate in Spain, I quickly understood the importance of choosing a international health insurance adapted. Health systems vary greatly from country to country, and travel insurance is not enough to cover all my medical needs. By opting for comprehensive coverage, I was able to concentrate on my work and daily life, without worrying about medical emergencies. »

“I am originally from Canada and settled in France. Surprised by the quality of French health system, I realized that “Health Insurance” offers unique and supportive protection. What particularly touched me was this principle ofequal access to care, where every citizen has the right to quality care, regardless of their economic status. »

“After living in the United States, I noticed that the system ofhealth insurance is vastly different. Care is often employer-provided, and I have encountered many people who do not have adequate coverage. This experience opened my eyes to the importance of a health system accessible to all. »

“While traveling through Europe, I was able to appreciate various health systems. Some countries, such as France and Germany, stand out for their quality of care. However, other countries had gaps that I observed. These experiences inspired me to learn more aboutinternational health insurance to better understand my options as a traveler. »

“Residing in Dubai, I realized that the health is often influenced by economic factors. I opted for private insurance to guarantee rapid and quality care. This allowed me to live in complete peace and be calm in the face of unforeseen health emergencies. This choice was crucial to maintaining a good standard of living internationally. »

In a world where health is paramount, it is essential to understand how thehealth insurance internationally. This coverage varies considerably between countries, and health system evaluation criteria provide valuable insight into the best options available. This article provides an overview of health systems, of the international insurance guarantees and countries that stand out for their quality of care.

International health insurance

THE international health insurance play a crucial role for expatriates and travelers. Unlike the temporary travel insurance, they offer comprehensive coverage that includes not only medical expenses, but also repatriation, L’assistance, cancellations and baggage protection. This is essential security for those who travel frequently or live abroad.

The advantages of international insurance

Opt for one international health insurance has many advantages. First, it ensures rapid access to medical care of quality, thus avoiding delays or refusals of treatment, often observed in public health systems of certain countries. Then, this coverage also offers the possibility of choosing its healthcare providers, thus promoting personalized care. For expatriates, it allows them to maintain an acceptable standard of living, even in the event of an unforeseen event causing a loss of income.

The best health insurance in the world

On a global scale, certain countries stand out for the exceptional quality of their health systems. For example, countries like France, Switzerland, and Japan are among the best in terms of medical coverage and equal access to care. The French system, for example, is often praised for its efficiency and solidarity, guaranteeing universal access to health care.

Health systems assessment

It is essential to use key criteria to evaluate the health systems of different countries. This includes theaccessibility to care, the quality of service, the cost of treatment, and the rationality of public funding. Health organizations such as the WHO regularly produce rankings based on these criteria. Therefore, a good understanding of health systems can guide your choice towards a destination offering optimal coverage.

Choosing the right health insurance

Choose the good health insurance international is a process that requires reflection. It is appropriate to assess your specific needs: what types of medical care are necessary? What level of financial protection is required for you and your family? Comparing the offers available on the market as well as a thorough understanding of the contract terms will help you make the right choice.

Barriers to accessing health insurance

Despite advances in the field, access to health insurance can present challenges. In some countries, complex administrative formalities, a lack of clear information or excessive costs can make the system difficult to access. This is why it is vital to research thoroughly before committing, in order to avoid possible unpleasant surprises when using health services.

Understanding thehealth insurance on a global scale is essential for navigating a complex and varied landscape. Each country has unique health systems, often influenced by cultural, economic and political factors. This makes the comparison of international health insurance both fascinating and astonishing. In fact, the international health insurance offer extensive coverage that includes all types of care, unlike the limitations of temporary travel insurance.

It is important to evaluate countries that stand out for the quality of their health systems. For example, certain countries like France, known for its social security system, are leaders in access to care. Other countries, while having more recent systems, strive to guarantee equitable health coverage for all their citizens. The fundamental principle ofequal access to care remains a major challenge, strengthening solidarity and the efficiency of health systems.

Financial issues related to health are also crucial. Constantly increasing health spending requires countries to reassess their health strategies. social protection. Thus, theinternational health insurance appears as a shield, protecting individuals against the unexpected, while allowing them to maintain their standard of living in the event of work stoppage. Learn about the different optionshealth insurance is therefore essential to make an informed choice in line with your needs.

In short, the diversity of health systems around the world invites us to reflect on our own choices in terms of health coverage. A better understanding of the differences and the advantages that characterize them will allow us to make more appropriate and informed choices for our health and that of our loved ones.

Worldwide Health Insurance FAQ

What are the different types of health insurance available internationally? There are mainly two types of health insurance: international health insurance, which cover a wide range of medical care, and temporary travel insurance, which generally focus on emergency situations.

Which countries are considered to have the best health systems? According to several assessments, countries that offer the best healthcare systems in the world include nations like France, Germany and Japan, thanks to their quality of care and accessibility.

What is international health insurance? International health insurance is a form of coverage that allows expatriates and travelers to benefit from medical cures, assistance and repatriation, regardless of their location in the world.

What is the impact of health insurance on access to care? Health insurance is a key factor in ensuringequal access to care, a fundamental principle which aims to reduce inequalities in access to health services.

How are health spending evolving globally? Health spending has increased significantly, reaching around 10% of gross domestic product (GDP) worldwide, while they represented only 3% in 1948.

What are the advantages of private health insurance? THE private health insurance offer additional guarantees, such as reduced waiting times for care and access to better quality health services.

How to choose the right health insurance for expatriates? To select the ideal health insurance for an expatriate, it is crucial to consider criteria such as healthcare coverage, bonuses, the network of health professionals and the opinions of other policyholders.