|

IN BRIEF

|

In Luxembourg, understand how the mutual health insurance is essential for all policyholders. The choices regarding complementary health can have a significant impact on the coverage of your medical expenses. Whether you are a resident or border, it is crucial to be well informed about the options available to ensure adequate protection. This comprehensive guide will allow you to explore the different facets of mutual health insurance in Luxembourg, in order to make an informed choice adapted to your specific needs.

The Luxembourg healthcare system stands out for the quality of care provided, but it is essential to fully understand the details of the mutual health insurance in order to optimize reimbursements. Dedicated to all policyholders, this mutual allows you to cover medical costs not covered by social security. This article presents a complete guide to better understand the advantages and disadvantages of mutual health insurance in Luxembourg.

Benefits

One of the main benefits of mutual health insurance in Luxembourg is its reimbursement level. Indeed, for adults, medical expenses are reimbursed up to 88%, while for children, this rate reaches the 100% on general practitioner fee bills. This supplement is crucial to reduce the out-of-pocket costs for families and ensure access to quality care.

In addition, mutual insurance allows you to benefit from a specific contract for care carried out in Luxembourg, which is particularly interesting for cross-border workers. This guarantees a supplement to the reimbursements of the Luxembourg social security and offers high-end coverage for routine care as well as hospitalizations.

Finally, understand your mutual health insurance allows you to optimize your healthcare expenses. Thanks to online tools and comparators, policyholders can easily identify the health insurance that best fit their profile.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

disadvantages. First of all, membership fees can vary significantly from one company to another, and some contracts may have high contributions that do not always correspond to your health needs.

Another point to consider is the fact that not all care is necessarily covered by the mutual, which can leave the insured with unexpected expenses. It is important to review the terms of the contract and what is actually covered to avoid surprises. Consequently, the selection of a good mutual insurance company requires particular attention, in order to guarantee a good level of reimbursement.

Also, some mutual insurance companies may have waiting periods for certain treatments, making their immediate use complicated. Therefore, it may be necessary to find out about the terms and conditions before signing a contract.

To learn more about health insurance and its implications, you can check out resources like Just Arrived and guides available on DKV Or AXA Luxembourg.

There mutual health insurance in Luxembourg is an essential subject for all residents, particularly for those working as border. This comprehensive guide analyzes the different options available and the rights of policyholders, with a view to helping you navigate this complex world, while guaranteeing you protection adapted to your health needs.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The Luxembourg health system

In Luxembourg, the health system is based on National Health Fund (CNS), which manages health and maternity insurance and pays medical costs. Once registered, notably through your employer, you are eligible for reimbursements from the CNS. However, it is essential to understand what this coverage includes and the limitations of the support.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

Why choose complementary health insurance?

Although the CNS covers a large part of health costs, certain treatments are not covered, which makes it complementary health essential. For example, medical costs are reimbursed at 88% for adults and 100% for children on general practitioner fee bills. Specific treatments, such as orthodontics or acupuncture, may require additional coverage.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The different mutual insurance options in Luxembourg

There are several mutual and insurance companies which offer contracts adapted to the specific needs of policyholders, in particular for border workers. These contracts are designed to supplement Luxembourg Social Security reimbursements and guarantee optimal care, particularly in the event of care provided abroad.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

How to choose your health insurance?

Choose the mutual health insurance insurance may seem difficult, but tools exist to help you identify the insurance that best suits your profile. It is essential to consider your specific needs, your health habits and your budget before making a choice. To do this, you can consult practical guides, such as those offered by LALUX Insurance, which provides you with information on essential insurance in Luxembourg.

Practical advice for properly managing your mutual insurance

To take full advantage of your mutual health insurance, it is recommended to regularly check the coverage of your contract and to ensure that the care you need is well covered. In addition, keep yourself informed of new developments that may influence your mutual insurance rates. Online comparison sites can also help you get competitive quotes, such as those available fromAllianz.

Useful links to deepen your knowledge

To better understand how mutual insurance works in Luxembourg and discover options for residents and non-residents, you can consult the following resources:

- Home – Health insurance

- Mutual health insurance for non-residents

- Private mutual health insurance

- Mutual health insurance for traveling abroad

- AXA – Health insurance

- How does the health system work in Luxembourg?

The Luxembourg healthcare system may seem complex to many, but it is essential to fully understand the different health care options. mutual health insurance available. This article offers you a practical guide to navigate through the choices of complementary health in Luxembourg, helping you make informed choices that meet your needs.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

What is mutual health insurance in Luxembourg?

Mutual health insurance in Luxembourg constitutes an essential complement to the coverage offered by the CNS (National Health Fund). Although the public system reimburses a large part of medical costs, there are still certain costs that are not covered. This is where mutual insurance comes in, which allows policyholders to benefit from a more complete reimbursement.

The specifics of reimbursements

In Luxembourg, reimbursements of medical expenses are exceptionally advantageous. For adults, the reimbursement generally amounts to 88%, while for children it reaches 100% for care provided by general practitioners. This underlines the importance of good mutual insurance to cover any additional costs and guarantee access to quality care.

The distinction between mutual and complementary health

It is crucial to understand that the term mutual and that of complementary health do not mean exactly the same thing. The mutual is generally a non-profit institution which offers specific guarantees, while complementary health insurance can be offered by private insurers and have varied characteristics. Learn about the differences and choose the one that suits you best.

Tips for choosing your health insurance

To choose your mutual insurance, start by analyzing your personal needs and those of your family. Ask yourself questions like: What types of care are you planning? Frequency of medical consultations, specific treatments or dental care? Once you have clearly defined your needs, you can choose the guarantees that best meet your expectations.

Compare insurer offers

Do not hesitate to use online comparison tools to evaluate the different offers of mutual health insurance. For example, you can consult specialized platforms that allow you to view the guarantees, prices and options available to you. Find out more about this here: family health protection.

Evaluate the quality of reimbursements

A key element to check before subscribing to mutual insurance is the table of guarantees. The latter details the coverage provided for each type of care. If you want to make sure that your mutual reimburses your expenses, consult resources like this page which explains how to know if your mutual reimburses well: table of guarantees.

Pay attention to the devices for cross-border workers

If you are a cross-border worker working in Luxembourg, it is essential to inform yourself about the contracts specific to this status. These mutual insurance companies offer protection adapted to the care provided in Luxembourg. Find out about the details and options offered to ensure you choose the best coverage.

Explore suitable offers

The multitude of offers on the market can be confusing. For this, it is recommended to request quotes from several insurers, for example via Allianz to better understand the best options available that match your situation.

Choosing the right health insurance is an essential act to secure your well-being and that of your family. Taking the time to understand and compare the different offers will allow you to make an informed choice, adapted to your needs.

| Axis | Concise Information |

| Refunds for adults | 88% of medical expenses covered. |

| Refunds for children | 100% of medical expenses covered. |

| Supplementary health | Essential to cover care not reimbursed by the CNS. |

| Registration conditions | Registration by the employer with the CNS. |

| Insurance for cross-border workers | Specific contracts for care in Luxembourg. |

| Additional services | Access to services not provided by the public system. |

| Types of contracts | Vary depending on individual needs. |

Testimonials on understanding mutual health insurance in Luxembourg

Emilie, 34 years old, office worker: “When I started working in Luxembourg, I was a little lost about the health system. mutual offer significant coverage, particularly for medical care that is not fully covered by social security. Thanks to this guide, I understood how to select a complementary health adapted to my needs and those of my family.”

Jean-Pierre, 45 years old, cross-border worker: “As a cross-border worker, I had concerns about reimbursement for my work-related care. I learned that certain mutual insurance companies are specially designed for cross-border workers and that they yield to the requirements of my guarantees. This helped me gave me immense relief and reassured me about the quality of care.”

Sophie, 27 years old, young mother: “When my child was born, I realized that reimbursement of medical expenses for children was essential. Thanks to the guide, I discovered that medical expenses are reimbursed up to 100% for children. This was valuable information that helped me choose the right mutual.”

Marc, 50 years old, independent: “As an independent, I had several choices of mutual, but I was hesitant about which program would be best for me. The guide helped me evaluate all the options available and understand the scope of different coverages. It’s a tool that I highly recommend.”

Laura, 30 years old, expatriate: “Living abroad and having to understand a new healthcare system can be complicated. After studying how healthcare mutual health insurance in Luxembourg, I was able to compare the plans and select the one that suited me best. This guide was a real asset in my efforts.”

Mutual health insurance is an essential element in guaranteeing adequate medical coverage in Luxembourg. Whether it concerns routine care, hospitalizations or specific treatments, a good knowledge of the options available is crucial to making an informed choice. This guide will allow you to understand how the health system works in Luxembourg, the different health and mutual insurance plans available, as well as advice on finding the complementary health insurance that best suits your needs.

How the Luxembourg health system works

Luxembourg is distinguished by an efficient health system, mainly managed by the CNAS (National Health Fund). When you arrive in the country, your employer takes care of your registration with this fund. Once registered, you already benefit from basic coverage, covering medical expenses up to 88% for adults and 100% for children for consultations with general practitioners.

Why use complementary health insurance?

Although basic coverage is relatively comprehensive, certain medical expenses are not covered by the public system. Costs related to consultations with specialists, dental or optical care can generate significant expenses. This is where complementary health insurance comes in. It makes it possible to cover remaining costs and ensure access to quality care without too many financial constraints.

Types of mutual and health insurance available

In Luxembourg, there are several types of mutual societies and health insurance, each offering specific coverage. Insurance for borders, for example, offer contracts adapted to care provided in Luxembourg, supplementing Social Security reimbursements. These contracts are often more flexible for workers residing in another country, while still guaranteeing adequate support.

Many insurance companies, such as Allianz And AXA, offer varied solutions to meet the needs of policyholders. Investing time to compare the different offers is essential in order to make a choice adapted to your profile and your specific health needs.

How to choose the right health insurance?

Choosing a suitable health insurance plan is not always easy. Here are some tips to guide you in your decision:

Analyze your specific needs

Before choosing a mutual insurance company, clearly identify your health needs. Do you have recurring health problems? Do you often visit specialists? These elements will help you determine the level of coverage needed.

Compare offers

Use comparison tools to evaluate the different mutual insurance companies available. Don’t just look at the rates, but also look at the levels of cover offered. Some mutual insurance companies can offer interesting additional services, such as home support or preventive care.

Find out about refunds

Before committing, find out how reimbursements work. How fast are requests processed? What are the amounts reimbursed for this or that treatment? This information is essential to avoid unpleasant surprises.

By understanding the functioning and specificities of mutual health insurance in Luxembourg, you will be better equipped to make your choices. Take the time to analyze and compare the different options to find the one that best suits you and your family’s needs.

Mutual health insurance is an essential element of the health system in Luxembourg, allowing policyholders to benefit from more complete financial coverage. With reimbursement of medical expenses reaching up to 88% for adults and 100% for children regarding certain care, it is crucial to choose a mutual insurance adapted to your needs. Luxembourg offers a variety of health insurance options, including specific contracts for border workers. Those who work in Luxembourg but reside in another country can thus have access to quality healthcare while optimizing their reimbursements.

When selecting a mutual insurance company, it is essential to evaluate the services offered and to find out about the differences between the policyholders within the CNS (National Health Fund) and other insurance companies. Employers play a crucial role in registering their employees for the CNS, but everyone has the possibility of taking out additional options to improve their medical coverage.

The Luxembourg health system stands out for its coverage of medical and maternity care, while offering long-term care insurance. However, certain treatments may not be fully reimbursed by the public system. This is why policyholders must inform themselves about the uncovered care and possible remedies, such as mutual insurance adapted to their specific situation.

Finally, it is advisable to compare different offers using simulation tools to identify the most advantageous health insurance for your profile. By taking the time to fully understand the options available to you, you will be able to make informed choices and ensure your well-being as well as that of your loved ones. Luxembourg has a solid healthcare system, and with the right mutual insurance, you can focus on what really matters: your health and your peace of mind.

FAQ: Understanding mutual health insurance in Luxembourg

What is mutual health insurance? A mutual health insurance is a contract which complements the reimbursements provided by social security. It ensures more complete coverage of medical costs.

How does the health system work in Luxembourg? In Luxembourg, the health system is mainly managed by the Caisse Nationale de Santé (CNS). The employer is responsible for registering employees with the CNS, which covers a large part of health expenses.

What reimbursements are offered by the mutual? For adults, reimbursement of medical costs is 88%, while for children it reaches 100% on general practitioner fees.

Why subscribe to complementary health insurance? Subscribing to complementary health insurance is essential, because certain treatments are not covered by social security. This helps ensure adequate coverage for specific treatments.

What are the advantages of mutual insurance for cross-border workers? Cross-border workers have specific contracts which supplement Luxembourg social security reimbursements, thus guaranteeing complete coverage for care provided in Luxembourg.

How to choose the right mutual health insurance in Luxembourg? To choose the right mutual insurance, it is important to assess your personal health needs, compare the available offers and take advantage of guidance tools to identify suitable options.

What criteria should be taken into account for a health insurance contract? It is crucial to consider the reimbursement levels, the types of care covered, the waiting periods and the prices of the different mutual insurance companies before making a choice.

Are there any treatments not covered by mutual insurance? Yes, certain services such as alternative medicine or certain costs related to aesthetic treatments may not be covered by the mutual insurance company. It is therefore necessary to check the conditions of the contract.

How do I know if my mutual insurance company reimburses my care correctly? To check if your mutual reimburses correctly, consult the reimbursement tables in your contract and compare them to the invoices for the care received.

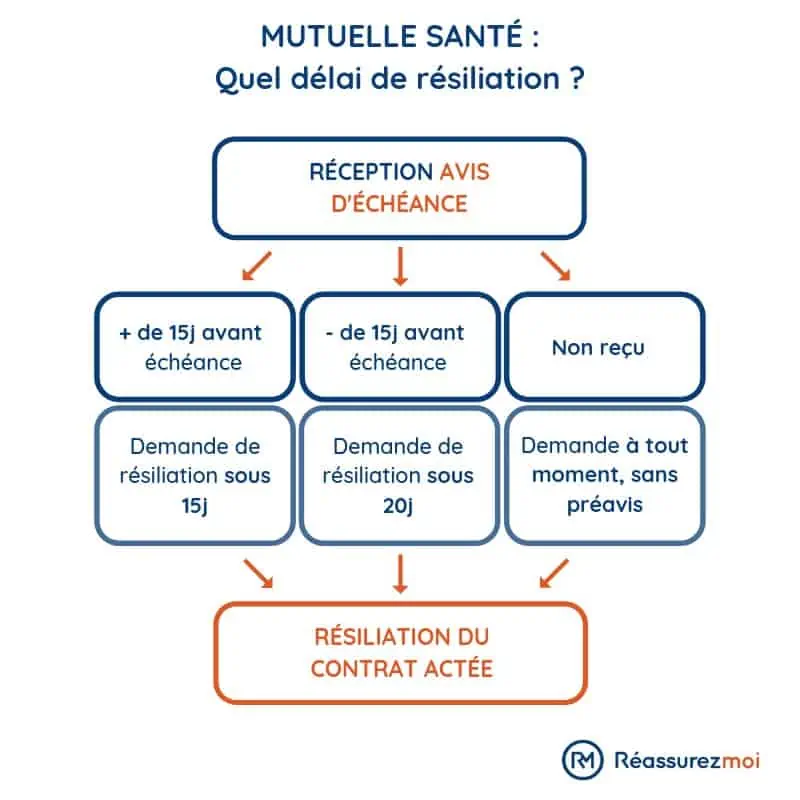

Is it possible to change mutual insurance? Yes, it is possible to change mutual insurance. However, it is recommended to carefully analyze the new offers and take into account the termination deadlines set by your current contract.