|

IN BRIEF

|

Private insurance plays an essential role in the financial protection of consumers, by offering solutions tailored to their specific needs. Faced with a constantly evolving sector, it is crucial toidentify the issues such as the enrichment of customer data, the new expectations of policyholders, and the need to promote sustainable initiatives. The benefits of private insurance, such as flexibility contracts and tax benefits, make it an attractive option for many individuals. Understanding these issues and benefits allows consumers to make informed choices and better defend their interests in this complex area.

In an economic context where financial security is essential, theprivate insurance emerges as a viable solution to protect your property and your health. This article aims to examine the challenges and the benefits that private insurance can offer consumers, while exploring areas that require particular attention.

Benefits

The advantages of private insurance are numerous and can considerably improve your peace of mind. First of all, it allows a best coverage specific consumer needs. Unlike public insurance, which is often limited, private contracts offer tailor-made options adapted to each personal situation.

In addition, private insurance provides reactivity and improved customer service. Many companies are in fact committed to offering personalized follow-up and rapid assistance in the event of a disaster, as highlighted in this study on customer relationship in the sector.

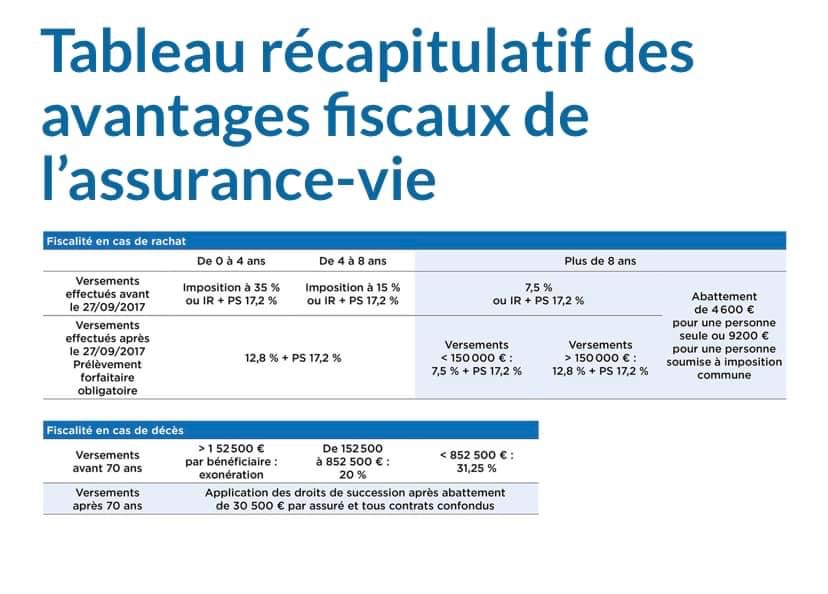

Another positive aspect is the tax advantages. Subscribe to a life insurance can offer tax reductions, while guaranteeing an optimized transfer of capital in the event of death. To learn more about the benefits of life insurance, see this link here.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many benefits, private insurance also has disadvantages which it is essential to consider. One of the main challenges is the cost bonuses. These can be higher than those of public insurance, which can represent a financial burden for some consumers.

In addition, the choice among the multitude of contracts offered may prove discouraging. The risk of misunderstandings, particularly regarding exclusions of guarantees, is present. This is why it is advisable to read the contract conditions carefully before committing.

Finally, the trust in the insurer is essential, and the choice of a quality service provider is essential. It is therefore essential to find out about the reputation of the insurance company and compare the offers available, as detailed in this article on the difference between mutual and private insurance.

Private insurance is an essential tool to protect yourself financially against various risks. It offers many benefits, particularly in terms of choice, services and coverage. However, it is crucial to understand its challenges to be able to get the most out of it. This article explores key aspects of private insurance, highlighting its challenges as well as its benefits for consumers.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The challenges of private insurance

The private insurance sector is constantly evolving. One of the main challenges is the relationship between insurers and policyholders. Companies must enrich their databases in order to better understand the needs and expectations of their customers. This involves adopting innovative technologies to facilitate this information collection while ensuring data security.

A changing market

The rise of InsurTech, for example, is transforming the insurance landscape. These innovations bring improvements in terms ofefficiency and cost reduction, thus offering consumers products more suited to their realities. Businesses must remain attentive to these changes to avoid being left behind.

Regulatory impacts

Another crucial challenge is the regulatory framework. Market participants must comply with increasingly strict requirements, which can sometimes limit their flexibility. Regulations aim to protect consumers while maintaining market integrity. It is therefore essential for policyholders to understand these regulations in order to make informed choices.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The advantages of private insurance

The benefits of private insurance are numerous and can meet a variety of financial needs. First of all, it allows you to benefit from a tailor-made cover, adapted to the specificities of each individual or family. Consumers can choose from a range of products that suit them, whether in terms of health, welfare or retirement.

Taxation and transfer of assets

Life insurance, for example, has advantages in terms of taxation, allowing a simplified and advantageous transfer of capital. By opting for life insurance, policyholders can protect and grow their assets while preparing for the future.

Addiction support

Another important advantage lies in the management of the risks linked to dependence. Many insurance companies offer specific solutions that guarantee financial support in the event of the need for extended care. This approach helps to strengthen the financial security policyholders facing life’s ups and downs.

By responding to these issues and taking advantage of the many advantages offered by private insurance, consumers can ensure increased financial protection. To find out more about the specifics of private health insurance in France, you can consult the following resources: Private health insurance in France And Health insurance for foreigners living in France.

Private insurance is a complex area that deserves special attention. Faced with market developments, it is crucial for consumers to understand the issues and benefits associated with them. This article explores the keys to navigating this sector, as well as the potential benefits of private insurance.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

The major challenges of private insurance

The private insurance sector faces many challenges. Among them, the increased competition between insurance companies implies a need to differentiate themselves through the quality of customer service. In addition, insurers must develop a in-depth knowledge of their customers to better meet their needs. Having reliable data makes it possible to enrich offers and offer appropriate services.

Another important concern is the regulation of the sector. Companies must navigate a complex legislative framework that can affect their business models. Understanding these aspects is essential for consumers to choose the coverage that best suits them.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

The advantages of private insurance

Private insurance has several significant advantages which can improve the quality of life of policyholders. First of all, it offers a advantageous taxation on premiums paid and benefits received, particularly in the case of life insurance. This results in better management of your assets.

Another strong point of private insurance is the transfer of capital which allows you to plan the future of your loved ones. For example, a life insurance policy can guarantee the financial security of your heirs after your death.

Health care

In terms of health, private insurance offers coverage that can go beyond that offered by the public system. It covers specific care, and in certain cases, reduced waiting times. This is particularly important for the care of long lasting. Consumers can thus choose insurance tailored to their needs, whether health or long-term care insurance.

To find out more

To deepen your understanding of private insurance, you can consult resources such as this complete guide to private health insurance or the presentation of the different types of insurance.

Finally, it is important to conduct a comparison of offers on the market in order to find the contract that best meets your expectations. Do not neglect the opinions of other customers to understand the strengths and weaknesses of the different insurers before making your choice.

| Issues | Advantages |

| Competitive pricing | Access to rates adapted to individual needs. |

| Sustainability of the insurer | Ensuring the financial solidity of the insurer. |

| Responsiveness to change | Possibility of rapid adjustment of contracts to new regulations. |

| Dematerialization of services | Simplified access to online services and contract management. |

| Personalization of offers | Tailor-made products that specifically meet customer needs. |

| Transparency of contracts | Better understanding of commitments and coverage. |

| Technological innovation | Use of digital solutions for efficient claims management. |

In a constantly changing financial world, it is essential to understand private insurance and its implications. Many consumers share their experience on the challenges they have encountered and the benefits they have gained from it. Making informed choices then becomes crucial to navigate this jungle of options.

Marie, a young professional, testifies: “When I started to consider private health insurance, I was lost in the face of the multitude of offers. I realized that choosing well was essential, not only for financial reasons, but also to have peace of mind in my healthcare choices. By taking the time to compare, I found insurance that perfectly suited my needs, with excellent value for money. »

François, for his part, addresses the challenges of customer relations: “My insurer was able to listen to me and direct me towards the insurance that truly met my expectations. Beyond the cost, I was able to benefit from personalized support. This gave me confidence in my choice, especially in the face of fears linked to variable premiums. »

For her part, Sandra talks about the importance of taxation : “Taking out life insurance allowed me to prepare for the future while benefiting from significant tax advantages. I discovered that by investing in the right insurance, you can both secure your assets and grow your capital. »

With the emergence of InsurTech, the procedures have become much simpler. Paul says: “I never thought the process of signing up for insurance could be so quick. Thanks to applications and digital innovations, I was able to finalize my contract in a few clicks, while having access to a multitude of options. It’s really to my advantage! »

Finally, Léa underlines the preponderant role of insurance in the face of unforeseen events: “I recently experienced an accident and I can say that my private insurance supported me perfectly. Reimbursements were quick and tailored to my needs. Without her, I would have been weighed down by medical expenses that I would never have been able to afford. This is where I realize the true value of good insurance. »

Private insurance is an area in which more and more consumers are interested, because it offers personalized solutions adapted to various needs. This article explores the major issues of private insurance and highlights the advantages it can bring to policyholders, guiding them through practical recommendations.

The challenges of private insurance

Faced with a constantly changing environment, the private insurance sector must adapt to numerous challenges. One of the main challenges lies in the customer relationship. Insurance companies aspire to enrich their databases to better understand their customers. A detailed understanding of consumer needs allows insurers to offer more relevant and personalized solutions.

The fight against climate change

Insurers have a fundamental role to play in dealing with the consequences of climate change. By integrating environmental criteria into their offers, they contribute to the energy transition and participate in building a sustainable future. Consumers can therefore join this movement by choosing insurers committed to responsible practices.

Consumer expectations

With a study on consumer preferences, it was revealed that customers are increasingly looking for more transparency and of simplicity in their insurance contracts. Companies must therefore ensure they meet these expectations through products that are clear, easily understandable and accessible. Consumers must be vigilant and choose companies that share their values.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

The advantages of private insurance

Private insurance offers many benefits which meet the specific needs of policyholders. Firstly, it allows personalized coverage and services tailored to individual requirements. Depending on their personal situation, consumers can choose contracts that fit their needs and their budget.

Advantageous taxation

One of the major attractions of life insurance, for example, is its reduced taxation. This option allows policyholders to grow their capital while benefiting from notable tax advantages, as part of preparing their heritage transfer. It is therefore wise to explore these products to optimize your financial situation in the long term.

Protection against the risk of dependence

Long-term care represents another crucial issue, where private insurance plays a fundamental role. By proposing solutions to protect against risk of dependence, it allows consumers to benefit from appropriate support when needed. This constitutes a real safety net for policyholders and their families.

Innovations in the insurance sector

Technological advances, such as those proposed by InsurTech, also constitute a significant advantage for consumers. These innovations aim to improve theefficiency and reduce costs for policyholders. By engaging with companies that leverage these new technologies, consumers can benefit from simplified processes and easier access to insurance solutions.

Ultimately, understanding the issues and benefits of private insurance allows consumers to make informed choices. Whether it is adapted coverage, tax advantages or responsible initiatives, private insurance is an area to be explored carefully and sparingly.

Private insurance represents a fundamental pillar in the financial protection of consumers. She responds to key issues in terms of security and foresight, allowing policyholders to face unforeseen events while ensuring a certain peace of mind. By integrating a private insurance contract into their protection strategy, consumers can benefit from more personalized coverage, tailored to their specific needs.

One of the major advantages of private insurance lies in its flexibility. Unlike public insurance systems, which are often rigid, private insurance allows consumers to choose the guarantees that best suit them. This personalization results in varied options, ranging from health risk coverage to retirement solutions and life insurance. These choices allow for better anticipation and management of the risks that everyone may face throughout their lives.

In order to get the most out of their insurance contracts, it is crucial for consumers to fully understand the challenges linked to this sector. This includes the need to assess the financial strength insurance companies, to familiarize themselves with the different types of policies available and to find out about the general conditions of contracts. By taking a proactive approach, consumers are better prepared to navigate the complex private insurance market.

Finally, private insurance is positioned as an essential tool for consumers concerned about their future and their well-being. By highlighting the issues and advantages, it becomes essential to adopt informed thinking when subscribing, in order to best benefit from the protections offered and build a peaceful future.

FAQs on private insurance: issues and benefits for consumers

What does private insurance mean? Private insurance is an insurance contract taken out with a private insurer, different from social security, which offers additional guarantees and often personalized services.

What are the main challenges of private insurance? The main issues include the need for better customer knowledge, adaptation to new consumer expectations, and management of the impacts of climate change.

How can private insurance help consumers? Private insurance offers personalized guarantees, a best coverage risks, as well as access to additional services such as financial assistance for health care.

What are the tax advantages of life insurance? Life insurance can offer interesting tax advantages, such as reduced taxation when transmitting capital to beneficiaries.

How is innovation in InsurTech influencing the sector? InsurTech innovations improve efficiency, reduce costs and simplify insurance processes, directly benefiting consumers.

What are the new expectations of customers in the insurance sector? Customers expect quality service, rapid responses to their needs and solutions adapted to their personal situations.

How do the consequences of climate change affect insurance? Insurers must take into account the risks linked to climate change to offer adequate coverage and thus encourage the energy transition.

Why is it important to compare private insurance contracts? Comparing contracts allows you to ensure that you are getting the best value for money and the guarantees best suited to your specific needs.

How is the opening of insurers’ resources, known as Open Insurance, beneficial? Open Insurance facilitates distribution, enriches offers and helps develop innovative solutions that benefit consumers.