|

IN BRIEF

|

Navigating the world of mutual insurance contracts can seem complex, especially when it comes to choosing the best option among the offers offered by Allianz. This comprehensive guide aims to provide you with the essential keys to better understand the specificities of contracts. complementary health. Whether you are considering a personalized health insurance or you need coverage through a group contract, we will explore each aspect that may influence your decision. With practical advice and clear information, you will be able to make an informed choice that will meet your health needs and those of your family.

Choosing complementary health insurance is a crucial decision to preserve your well-being and that of your family. The Allianz mutual offers various options through its contracts, which may complicate your choice. This article guides you through the advantages and disadvantages of Allianz mutual insurance contracts, to help you make the best choice according to your specific needs.

Benefits

There mutual Allianz stands out for several significant benefits that can meet your health expectations. First of all, its contracts offer personalized coverage that can adapt to your personal situation, whether you are employed, self-employed or with family.

Another major advantage is the possibility of benefit from rapid reimbursements in the event of health expenses. Allianz offers solutions that make it easier to manage your medical expenses, in particular by guaranteeing you total or partial reimbursement depending on the nature of the care. This is particularly useful during unexpected expenses.

In addition, thanks to its extensive network, Allianz provides access to numerous healthcare professionals, ensuring rapid and efficient care of your medical needs. This broad geographic coverage is a strong point for those who travel abroad or live far from medical centers.

Mondial Assistance reaches 1.5 billion euros in turnover in 2007 and prepares for future growth

In 2007, Mondial Assistance reached a historic milestone by reaching €1.5 billion in revenue. This milestone marked a turning point in the company’s expansion, and the company was already planning its future growth paths. In a sector where innovation is…

Disadvantages

Despite its many advantages, the mutual Allianz also has some disadvantages that should be considered. For example, the prices of its contracts may be higher than those of other mutual insurance companies. This can be a deterrent for people looking for a more economical option, especially if they are on a limited budget.

Another aspect to take into account is the complexity of the different formulas offered. Navigating the various options and coverages can be difficult, potentially leading to confusion when choosing the right coverage for you. For details on these contracts, you can consult the Allianz website.

Finally, some people reported sometimes long processing times for requests, which could cause additional stress during critical health-related moments. It is important to be well informed and to read the general conditions before committing.

In short, it is essential to carefully weigh the advantages and disadvantages of mutual Allianz to determine whether it meets your expectations and your personal situation. This will allow you to make an informed choice, which is essential for your safety and peace of mind.

When looking to subscribe to a mutual health insurance, it is essential to fully understand the different options available to us. The contract of mutual Allianz offers a multitude of guarantees adapted to various needs, but it can be complex. This guide aims to enlighten you on the specificities of these contracts, in order to help you make a wise choice adapted to your situation.

Choosing the right mutual insurance for expatriates in Asia

Embarking on an expat life in Asia is an exhilarating adventure, filled with cultural discoveries and professional opportunities. However, a crucial question quickly arises: how can you ensure adequate health coverage that protects both your well-being and your budget? Whether…

The basics of complementary health insurance

A complementary health, like that offered by Allianz, has the main mission of reimbursing the health costs which remain your responsibility after payment by thehealth insurance. This includes various treatments, medical consultations, hospitalization costs and other health expenses. To choose your contract carefully, it is essential to assess your specific needs, whether for routine care or more unforeseen situations such as hospitalization.

Boursorama Banque and Revolut: financial services duel in 2025

Boursorama Banque and Revolut are emerging as essential pillars of modern financial services. While Boursorama Banque perpetuates its heritage of reliability and French banking tradition, Revolut represents the breakthrough of a bold British neobank with innovative features. Their duel promises…

The different types of contracts

Allianz offers several formulas of mutual health insurance, ranging from individual contracts to collective solutions. Employees can benefit from the company health insurance, which is often mandatory and makes it possible to cover not only employees, but also their loved ones. This helps reduce their out-of-pocket health costs, a major advantage for everyone’s peace of mind.

Individual Supplementary Health Insurance

For those who opt for a personalized health insurance, the Allianz mutual offers individual contracts. These allow increased flexibility, offering you the choice of guarantees according to your needs. Reimbursement can be total or partial depending on the services chosen. To understand what is covered, read the general conditions is essential.

Discover LovExpat: the first dating app dedicated to French expats

Expat life is a unique adventure, marked by the challenges of adapting to a new culture, creating new social networks, and sometimes, finding a romantic connection. LovExpat, the app born from the vision of two French sisters, addresses this need.…

Choose the appropriate guarantees

When selecting your contract, it is important to look at the guarantees proposed. Allianz offers a table of guarantees which details the different options available, particularly for hospitalization costs, dental care, and alternative medicine. Carefully check the reimbursement limits and rates applied to choose the coverage that suits you best.

AgoraExpat – Your Reliable Ally for Expatriate Medical Coverage

Living in a foreign country is an enriching adventure, but it also comes with unique challenges, particularly when it comes to healthcare. Navigating a new healthcare system can be complex and worrying. Therefore, the need for reliable and comprehensive medical…

Compare prices

The cost of the Allianz mutual health insurance is a determining factor in your choice. The price varies depending on the guarantees selected and may be covered by subsidies, particularly for self-employed workers (TNS). Take the time to compare the prices of different plans and consult the offers to find the solution best suited to your budget. Do not hesitate to ask for a estimate to have a clear and detailed vision of costs.

Opinions of policyholders

It may be useful to consult the notice other policyholders to get an idea of customer satisfaction. Feedback can inform your choice and give you information on the quality of service, repayment times and the responsiveness of advisors. Visit comparison sites to get unbiased reviews.

Help and advice available

Finally, Allianz offers guides and health tips to help you in your approach. Do not hesitate to take advantage of these resources to better understand the subtleties and benefit from appropriate support. Taking the time to inform yourself ensures you make an informed choice and protect yourself effectively. For any questions, it is recommended to contact an Allianz advisor who will be able to provide you with precise answers to your questions.

There Allianz mutual health insurance stands out for its combination of personalized guarantees and of competitive rates. To make an informed choice, it is essential to understand the different aspects of this contract, from its coverage options to its general conditions. In this guide, we provide you with practical advice for deciphering your future contract and optimizing your health protection.

Understanding first euro health insurance in France

IN BRIEF Health insurance at 1st euro : international coverage for expatriates. Support for health costs from the first euro spent. Independent of the Fund for French people abroad (CFE). Reimbursement to 100% without excess (depending on the formula chosen).…

The different Allianz formulas

Allianz offers a varied range of mutual health insurance formulas adapted to different needs and budgets. Options are available, ranging from basic coverage to more comprehensive levels, incorporating specific health costs such as fee overruns or even the alternative medicine. It is useful to compare these formulas to choose the one that best meets your expectations.

Essential guarantees to consider

When you choose your mutual contract, certain elements should not be neglected. Among them, the coverage of hospitalization costs, reimbursement of doctor’s consultations and treatment of drugs. Also be sure to check if additional options, like optical or dental, are included in your choice.

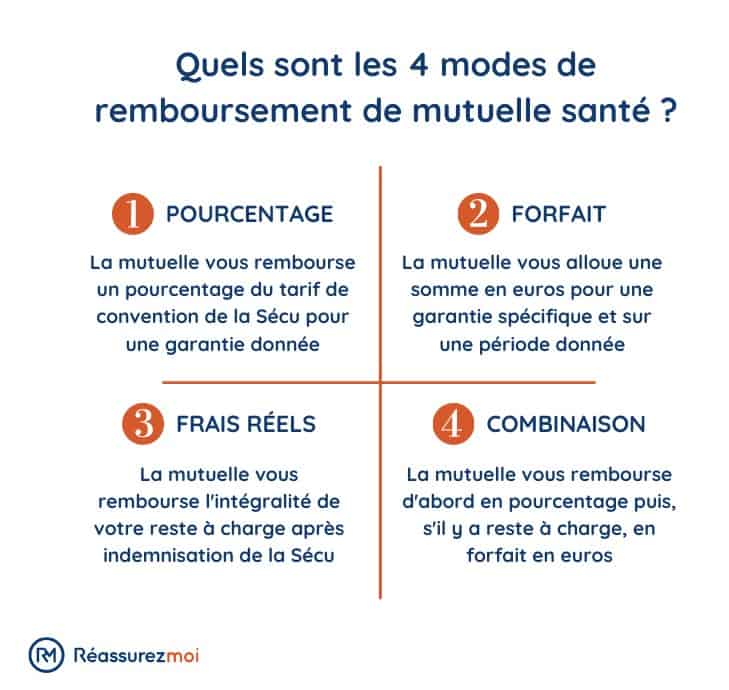

How reimbursement works

Understand how the reimbursement rate is crucial to avoid unpleasant surprises. Depending on the contract chosen, you will be able to benefit from a total or partial reimbursement of your health expenses after intervention by the social security. It is recommended to refer to the reimbursement rate displayed by Allianz to properly assess your future costs.

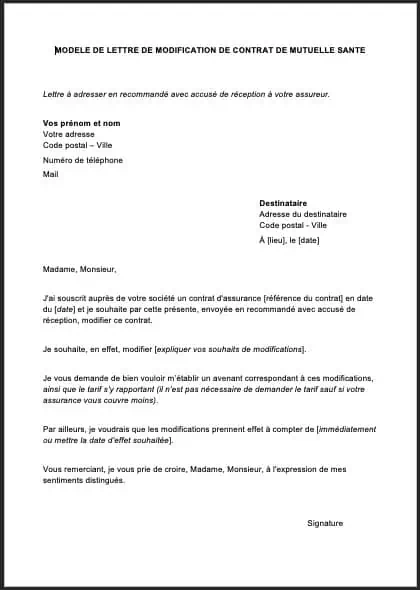

The steps to take out and terminate a contract

To take out a mutual insurance contract with Allianz, it is often enough to complete a quote form. Remember to carefully inform your needs to obtain an adequate proposal. Note that you can cancel your contract within 30 days of receipt if the terms do not suit you. This transparency allows you to make decisions without haste.

Check customer reviews

Before choosing Allianz as your mutual health insurance, it’s a good idea to check out customer reviews. These personal experiences will give you valuable insight into the quality of customer service and services offered by Allianz. Don’t hesitate to check forums or review sites to get a clear picture.

Resources at your disposal

Finally, Allianz provides you with a multitude of guides and of resources online to better understand the contracts. You can consult the Allianz official website for specific information and personalized advice on your health coverage.

Comparison of the Key Aspects of the Allianz Mutual Contract

| Appearance | Details |

| Refund | Partial or total depending on health expenses. |

| Blanket | Various options including geographic coverage area. |

| Prices | Different price levels depending on the guarantees chosen. |

| Collective contracts | Obligatory in companies, reduces the remainder payable by employees. |

| General conditions | Cancellation possible within 30 days of receipt. |

| Customer reviews | Known for responsive customer service and fast refunds. |

| Assistance | Access to prevention services and health advice including seniors. |

Testimonials on understanding the Allianz mutual insurance contract

When it comes to choosing a complementary health, the multitude of options can be overwhelming. Thanks to the complete guide to the contract of mutual Allianz, I was able to navigate through the different formulas and understand what best suited my needs. This guide is truly an asset for anyone wishing to make an informed choice.

As a self-employed person, I needed a health insurance which adapts to my financial capacities while providing adequate coverage. The table of guarantees offered by Allianz was a great help. I was able to easily compare the different options and choose the one that combined the best quality-price ratio.

The ability to personalize my contract was a real plus. I was able to choose the repayment options which suited my needs. The explanatory guide also allowed me to understand the differences between the coverage levels as well as the health expenses covered by mutual insurance.

What I particularly appreciate is the clarity of the information provided. All of the terms and conditions are explained in simple terms, which allowed me to avoid common pitfalls. Thanks to this guide, I now feel much more comfortable discussing the details of my contract with my advisor.

Have access to a glossary insurance terms was also a real asset. It allowed me to better understand technical terms that can be confusing to the uninitiated. This guide really makes the difference!

Finally, the section on termination is a valuable addition, because it informed me of my rights and the steps to follow if necessary. I now have peace of mind, knowing that I can make choices that suit my situation over time.

The choice of a complementary health is a crucial step to benefit from medical coverage adapted to your needs. This article offers you a complete guide to understanding contract contracts. mutual Allianz and helps you make an informed choice. Whether you are considering a group contract for your business or insurance complementary individual health, discover the keys to optimizing your health protection.

Why choose Allianz mutual insurance?

Allianz is a leader in the insurance market, offering a wide range of products that meet the varied needs of policyholders. The contracts of mutual health insurance Allianz stand out for their flexibility and customizable options, allowing them to adapt to each situation.

By opting for Allianz, you will benefit from optimal reimbursement health expenses, particularly in the event of illness, accident or during maternity. In addition, Allianz offers pricing in record time, allowing you to get quotes quickly and compare different options.

The main types of Allianz contracts

Corporate health insurance

For companies, the collective contract is a legal obligation. By choosing the company health insurance from Allianz, you will not only protect your employees, but you will also reduce their out-of-pocket costs for health care costs. This type of contract, which often includes guarantees adapted to the needs of the whole family, is an excellent way to improve working conditions while strengthening team cohesion.

Supplementary individual health

The guarantees of the complementary individual health at Allianz allow total or partial reimbursement of health costs, depending on the needs of the insured. Whether for routine care or for specific interventions, this contract is designed to adapt to the different levels of coverage desired, thus offering a tailor-made solution to everyone.

How to choose the right contract?

To choose the contract mutual health insurance what you need, several important keys must be taken into account:

- Assess your health needs : Take into account your state of health and that of your family, as well as the frequency of your medical consultations.

- Compare guarantees : Examine the different levels of cover and the options offered by Allianz to find the contract that will provide you with the most suitable solution.

- Consider the price : The financial aspect is essential. Take the time to compare the prices of the different plans while keeping in mind the guarantees offered.

- Check repayment times : Find out about the speed of reimbursement of expenses incurred to avoid unpleasant surprises.

- Consult the opinions of other policyholders : Reading feedback from other customers can help you understand the strengths and weaknesses of Allianz mutual insurance.

- Find out about cancellation options : It is essential to know the cancellation conditions, especially if you change your mind in the months following subscription.

The complementary health glossary

When you explore the world of mutual, it is also advisable to familiarize yourself with the specific vocabulary. For example, understanding the distinction between refunds health insurance and those of your complementary health insurance is essential to properly analyze your contracts.

Understanding the terms and conditions and different levels of coverage will make it easier for you to navigate insurance jargon and be an informed consumer.

The choice of your complementary health is a crucial step to guarantee your financial security in the face of medical expenses. Allianz, as a market leader, offers a multitude of options that adapt to the varied needs of its policyholders. To successfully navigate the complex world of health insurance contracts, it is essential to become familiar with the different benefits and levels of coverage.

In this guide, we have explored in detail the features Allianz mutual insurance contracts. By analyzing the different reimbursement levels, geographic areas of coverage, and options for self-employed workers, we have provided you with valuable tools to make an informed choice. Understanding the subtleties of each contract will allow you to minimize your remaining charges and optimize your reimbursements when it comes to medical, hospitalization or maternity care.

Each type of contract has its own advantages, whether it is a company health insurance or a supplementary individual health insurance. By taking into account your personal situation, your budget and your expectations for future care, you will be able to select the contract best suited to your needs. Do not hesitate to refer to the general conditions offers and to ask all your questions with Allianz advisors to clarify any gray areas.

Finally, insurance terminology can seem intimidating; that’s why we also included a glossary key terms. Whether you are already insured or are considering subscribing to a new mutual fund, this guide will support you in all your steps, for protected health and a controlled budget.

FAQ: Understanding the Allianz mutual insurance contract

What is the mission of complementary health insurance? The mission of complementary health insurance is to reimburse the portion of expenses that remains our responsibility after the intervention of health insurance, thus guaranteeing better access to care.

What is company health insurance? Company health insurance is a compulsory collective contract which protects employees and their families by reducing their out-of-pocket costs in terms of health costs.

What guarantees are offered by Allianz mutual insurance? The Allianz mutual offers different formulas with flexible guarantees, allowing you to choose the options that best meet each person’s needs.

How does the reimbursement of health expenses work with mutual insurance? Health expenses are reimbursed in full or in part, depending on the level of coverage subscribed to in the mutual insurance contract, whether for illness, accident or maternity.

How to choose the ideal complementary health insurance? To choose the ideal complementary health insurance, it is important to take into account your health needs, the price of the guarantees, as well as the services offered by the different contracts available.

What are the steps to terminate a mutual insurance contract? You can cancel your contract within 30 days of receiving your notification, whether for all insured persons or for one or more beneficiaries only.

Does Allianz offer specific contracts for self-employed workers? Yes, Allianz offers mutual health contracts specifically designed for self-employed workers, in order to offer them coverage adapted to their professional situation.

How do I know if my expenses are covered by my Allianz mutual insurance? To find out if your expenses are covered by your Allianz mutual insurance, it is essential to consult the table of guarantees, where the reimbursement conditions for each type of care are specified.